As per Intent Market Research, the Dental Charting Software Market was valued at USD 452.3 million in 2024-e and will surpass USD 773.1 million by 2030; growing at a CAGR of 9.3% during 2025 - 2030.

The dental charting software market is witnessing significant growth as dental practices increasingly adopt digital solutions to streamline operations and enhance patient care. These software tools are designed to record, manage, and update patient information, particularly for dental examinations and treatments. The shift toward digital healthcare solutions, fueled by advancements in technology and the growing demand for efficient, paperless workflows, has accelerated the adoption of dental charting software across dental clinics and private practices.

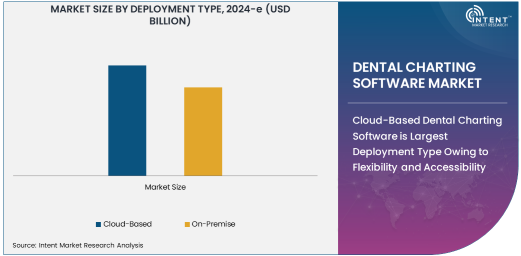

Cloud-based dental charting software is particularly popular due to its scalability, accessibility, and cost-effectiveness, while on-premise solutions offer data security and control for organizations with specific privacy requirements. As more dental practitioners seek integrated solutions that enhance operational efficiency, the demand for sophisticated charting software continues to rise.

Cloud-Based Dental Charting Software is Largest Deployment Type Owing to Flexibility and Accessibility

Cloud-based dental charting software is the largest deployment type, primarily due to its flexibility, ease of access, and lower upfront costs compared to on-premise solutions. Cloud-based platforms allow dental professionals to access patient records securely from any location, facilitating better communication, remote consultations, and improved patient management. The ability to store large amounts of data securely and scale up according to the needs of the practice makes cloud-based software an attractive choice for dental clinics and private practices alike.

Additionally, cloud-based solutions offer seamless integration with other healthcare systems, allowing for comprehensive patient data management. The convenience, reduced IT maintenance requirements, and cost-effectiveness of cloud-based dental charting software make it the preferred choice for most dental practices.

Advanced Charting with Integration is Largest Functionality Due to Enhanced Efficiency and Data Access

Advanced charting features with integration are the largest functionality in the dental charting software market due to their ability to streamline dental practice operations and improve patient care. These advanced solutions provide comprehensive patient profiles, including treatment histories, diagnostic imaging, and other essential medical information, all integrated within a single platform. This integration allows dental professionals to easily track patient progress and make informed decisions.

Moreover, advanced charting software often includes features such as appointment scheduling, billing, and integration with dental imaging and radiology systems, providing a one-stop solution for managing all aspects of patient care. As dental practices continue to seek more efficient and cohesive solutions, the demand for advanced charting software with integration is expected to grow.

Dental Clinics are Largest End-User Due to High Adoption Rate of Digital Solutions

Dental clinics are the largest end-user of dental charting software, driven by the need for efficient and accurate patient data management. The increasing adoption of digital solutions in dental practices, coupled with the need for better patient care and streamlined operations, has resulted in high demand for dental charting software among dental clinics.

Furthermore, dental clinics often require specialized features, such as integration with patient management systems, electronic health records (EHR), and scheduling tools, which are readily available in advanced charting software. As the dental industry continues to embrace digital transformation, dental clinics remain the dominant end-user for dental charting software.

North America is Largest Region Owing to Advanced Healthcare Infrastructure and Adoption Rates

North America is the largest region in the dental charting software market, driven by its highly developed healthcare infrastructure and the widespread adoption of digital healthcare solutions. The United States, in particular, is home to numerous dental clinics and private practices that are increasingly adopting cloud-based and integrated charting solutions to improve efficiency and enhance patient outcomes.

The presence of key market players, along with significant investments in healthcare technology, further supports the growth of the dental charting software market in North America. With a growing focus on data security, regulatory compliance, and improved patient care, North America continues to lead the global market for dental charting software.

Leading Companies and Competitive Landscape

Key players in the dental charting software market include Dentrix, Eaglesoft, Open Dental, Curve Dental, and Practice-Web, among others. These companies dominate the market by offering comprehensive solutions that integrate advanced charting features, patient management tools, and customizable options for dental professionals.

The competitive landscape is characterized by continuous innovation, with companies focusing on improving usability, expanding integration capabilities, and ensuring compliance with healthcare regulations. As the market evolves, there is also a growing trend toward AI-powered features and mobile accessibility, which will further intensify competition among market leaders.

Recent Developments:

- In December 2024, Dentrix unveiled a major update to its dental charting software, integrating AI-powered diagnostic tools for better treatment planning.

- In November 2024, Curve Dental launched a new cloud-based dental charting feature that allows seamless access to patient records from anywhere, even on mobile devices.

- In October 2024, Carestream Dental introduced a new version of its charting software with enhanced image integration and real-time collaboration tools for dental professionals.

- In September 2024, EagleSoft added new features to its dental charting software, including customizable charting templates and automatic updates to patient records.

- In August 2024, Planet DDS expanded its cloud-based offerings with improved charting tools, making it easier for dental teams to access and update patient information.

List of Leading Companies:

- Dentrix (Henry Schein)

- EagleSoft (Patterson Dental)

- Open Dental

- Carestream Dental

- Curve Dental

- SoftDent (Carestream Dental)

- ABELDent

- XLDent

- Practicesoft

- MOGO Dental Software

- DentiMax

- Planet DDS

- Ortho2

- OrthoTrac

- DocuSign (for electronic signatures integration)

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 452.3 million |

|

Forecasted Value (2030) |

USD 773.1 million |

|

CAGR (2025 – 2030) |

9.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Dental Charting Software Market By Deployment Type (Cloud-Based, On-Premise), By Functionality (Basic Charting Features, Advanced Charting with Integration), By End-Use Industry (Dental Clinics, Hospitals, Private Practices) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Dentrix (Henry Schein), EagleSoft (Patterson Dental), Open Dental, Carestream Dental, Curve Dental, SoftDent (Carestream Dental), ABELDent, XLDent, Practicesoft, MOGO Dental Software, DentiMax, Planet DDS, Ortho2, OrthoTrac, DocuSign (for electronic signatures integration) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Dental Charting Software Market, by Deployment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Cloud-Based |

|

4.2. On-Premise |

|

5. Dental Charting Software Market, by Functionality (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Basic Charting Features |

|

5.2. Advanced Charting with Integration |

|

6. Dental Charting Software Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Dental Clinics |

|

6.2. Hospitals |

|

6.3. Private Practices |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Dental Charting Software Market, by Deployment Type |

|

7.2.7. North America Dental Charting Software Market, by Functionality |

|

7.2.8. North America Dental Charting Software Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Dental Charting Software Market, by Deployment Type |

|

7.2.9.1.2. US Dental Charting Software Market, by Functionality |

|

7.2.9.1.3. US Dental Charting Software Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Dentrix (Henry Schein) |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. EagleSoft (Patterson Dental) |

|

9.3. Open Dental |

|

9.4. Carestream Dental |

|

9.5. Curve Dental |

|

9.6. SoftDent (Carestream Dental) |

|

9.7. ABELDent |

|

9.8. XLDent |

|

9.9. Practicesoft |

|

9.10. MOGO Dental Software |

|

9.11. DentiMax |

|

9.12. Planet DDS |

|

9.13. Ortho2 |

|

9.14. OrthoTrac |

|

9.15. DocuSign (for electronic signatures integration) |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Dental Charting Software Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Dental Charting Software Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Dental Charting Software Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA