As per Intent Market Research, the Dental Caries Treatment Market was valued at USD 1.0 billion in 2024-e and will surpass USD 1.9 billion by 2030; growing at a CAGR of 10.3% during 2025 - 2030.

The dental caries treatment market is driven by the increasing prevalence of dental caries (cavities) and growing awareness about oral health across various demographics. Dental caries, which is one of the most common chronic diseases worldwide, leads to significant dental damage if not treated promptly. This has spurred the demand for effective dental treatments, including restorative fillings, fluoride treatments, sealants, and crown and bridge restorations. The ongoing advancements in dental materials and technologies are further enhancing the efficacy of treatments for dental caries.

Moreover, as the population ages and dental care awareness improves globally, the demand for dental caries treatment solutions continues to rise, particularly in developed regions where preventive care is emphasized. Additionally, the market is seeing a shift toward more minimally invasive and non-invasive treatment options, driven by both patient preferences and advancements in dental technology.

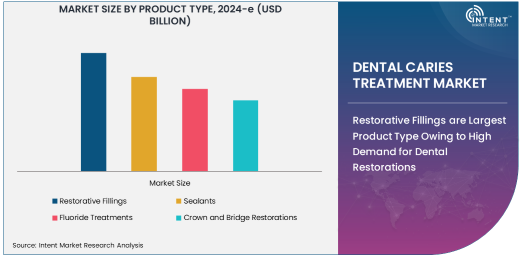

Restorative Fillings are Largest Product Type Owing to High Demand for Dental Restorations

Restorative fillings are the largest product type in the dental caries treatment market, driven by their high demand in addressing cavities. These fillings, which can be made from a variety of materials such as composites, amalgam, or ceramics, are essential for restoring teeth affected by dental caries. The rising incidence of cavities across both pediatric and adult populations contributes significantly to the growth of this segment.

Restorative fillings are particularly in demand for adults who experience caries due to factors like diet, poor oral hygiene, and age-related dental wear. With technological advancements in dental filling materials that offer better durability, aesthetics, and patient comfort, restorative fillings are expected to remain the dominant product in the market.

Minimally Invasive Treatments are Fastest Growing Treatment Type Due to Preference for Patient Comfort

Minimally invasive treatments are the fastest-growing segment in the dental caries treatment market, as both patients and dental professionals increasingly favor procedures that preserve healthy tooth structure while achieving effective results. This treatment approach includes methods such as air abrasion, laser therapy, and micro- or minimal cavity preparations that allow for smaller, less invasive fillings. The shift toward minimally invasive treatments is fueled by patient preferences for reduced pain, faster recovery, and lower risk of complications, alongside the increasing availability of advanced dental technologies.

The growing awareness of the benefits of preserving natural tooth structure and the advancements in diagnostic tools, such as early-stage cavity detection, are likely to further accelerate the adoption of minimally invasive treatments in dental clinics.

Pediatric Age Group is Largest Due to Higher Prevalence of Dental Caries in Children

The pediatric age group is the largest in the dental caries treatment market due to the higher prevalence of dental caries among children. Early intervention is crucial in preventing the progression of cavities, and pediatric dentistry has been focusing on preventive measures such as fluoride treatments and dental sealants, in addition to restorative treatments like fillings. Additionally, children's preference for sugary foods and drinks contributes to the higher incidence of caries in this age group.

Furthermore, many countries have launched initiatives to improve children's oral health, driving the demand for dental treatments tailored to younger patients. As awareness and preventive care grow, the pediatric segment is expected to continue dominating the dental caries treatment market.

Dental Clinics are Largest End-User Due to High Volume of Routine Treatments

Dental clinics are the largest end-user segment in the dental caries treatment market, as they perform a significant number of routine treatments for cavities. With an increasing focus on preventive care, dental clinics serve as primary locations for services such as fluoride treatments, sealants, and restorative fillings. The wide availability of advanced diagnostic tools in these clinics has further contributed to their dominance in the market, enabling early detection of dental caries and effective treatment.

Additionally, the convenience and accessibility of dental clinics make them the preferred choice for patients seeking regular dental check-ups and treatments, further driving the demand for caries treatment solutions.

North America is Largest Region Owing to Advanced Healthcare Infrastructure and High Awareness

North America is the largest region in the dental caries treatment market due to its advanced healthcare infrastructure, high levels of dental care awareness, and widespread access to dental professionals. The United States and Canada exhibit a high demand for dental treatments, particularly for pediatric and adult populations, where caries are prevalent. Furthermore, the adoption of advanced diagnostic tools and innovative treatment options in the region is driving the growth of the market.

The high spending power, coupled with an emphasis on preventive dental care, contributes to North America's dominance. The increasing availability of advanced minimally invasive treatments in the region is also contributing to the market's expansion.

Leading Companies and Competitive Landscape

Key players in the dental caries treatment market include Dentsply Sirona, 3M, Colgate-Palmolive, Ivoclar Vivadent, and Zimmer Biomet. These companies are leading the market with a broad range of products for treating dental caries, including restorative fillings, fluoride treatments, sealants, and crowns. They continue to innovate by developing new materials and technologies that enhance treatment outcomes and patient comfort.

The competitive landscape is characterized by strategic partnerships, mergers, and new product launches. Companies are also focusing on expanding their product portfolios to address the growing demand for non-invasive and minimally invasive treatment options. As patient expectations evolve, these companies are investing in research and development to stay at the forefront of the dental caries treatment market.

Recent Developments:

- In December 2024, Dentsply Sirona launched a new line of restorative fillings aimed at providing durable and aesthetically pleasing solutions for dental caries treatment.

- In November 2024, 3M introduced a fluoride varnish to improve prevention and treatment of early-stage dental caries.

- In October 2024, Henry Schein partnered with leading dental clinics to provide advanced caries treatment solutions, including minimally invasive options.

- In September 2024, Ivoclar Vivadent announced a new line of dental sealants that provide longer-lasting protection against dental caries, targeting both pediatric and adult patients.

- In August 2024, P&G released an updated version of its fluoride treatment product aimed at improving the remineralization process in early dental caries.

List of Leading Companies:

- 3M

- Dentsply Sirona

- Henry Schein

- Ivoclar Vivadent

- Colgate-Palmolive

- P&G

- Septodont

- GC Corporation

- Danaher Corporation

- Kavo Kerr

- Ultradent Products, Inc.

- Voco GmbH

- Shofu Dental Corporation

- Micerium S.p.A.

- Royal Dental Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.0 billion |

|

Forecasted Value (2030) |

USD 1.9 billion |

|

CAGR (2025 – 2030) |

10.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Dental Caries Treatment Market By Product Type (Restorative Fillings, Sealants, Fluoride Treatments, Crown and Bridge Restorations), By Treatment Type (Non-invasive Treatments, Minimally Invasive Treatments, Invasive Treatments), By Age Group (Pediatric, Adult, Geriatric), By End-Use (Dental Clinics, Hospitals) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

3M, Dentsply Sirona, Henry Schein, Ivoclar Vivadent, Colgate-Palmolive, P&G, Septodont, GC Corporation, Danaher Corporation, Kavo Kerr, Ultradent Products, Inc., Voco GmbH, Shofu Dental Corporation, Micerium S.p.A., Royal Dental Group |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Dental Caries Treatment Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Restorative Fillings |

|

4.2. Sealants |

|

4.3. Fluoride Treatments |

|

4.4. Crown and Bridge Restorations |

|

5. Dental Caries Treatment Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Non-invasive Treatments |

|

5.2. Minimally Invasive Treatments |

|

5.3. Invasive Treatments |

|

6. Dental Caries Treatment Market, by Age Group (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Pediatric |

|

6.2. Adult |

|

6.3. Geriatric |

|

7. Dental Caries Treatment Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Dental Clinics |

|

7.2. Hospitals |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Dental Caries Treatment Market, by Product Type |

|

8.2.7. North America Dental Caries Treatment Market, by Treatment Type |

|

8.2.8. North America Dental Caries Treatment Market, by Age Group |

|

8.2.9. North America Dental Caries Treatment Market, by End-Use |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Dental Caries Treatment Market, by Product Type |

|

8.2.10.1.2. US Dental Caries Treatment Market, by Treatment Type |

|

8.2.10.1.3. US Dental Caries Treatment Market, by Age Group |

|

8.2.10.1.4. US Dental Caries Treatment Market, by End-Use |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. 3M |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Dentsply Sirona |

|

10.3. Henry Schein |

|

10.4. Ivoclar Vivadent |

|

10.5. Colgate-Palmolive |

|

10.6. P&G |

|

10.7. Septodont |

|

10.8. GC Corporation |

|

10.9. Danaher Corporation |

|

10.10. Kavo Kerr |

|

10.11. Ultradent Products, Inc. |

|

10.12. Voco GmbH |

|

10.13. Shofu Dental Corporation |

|

10.14. Micerium S.p.A. |

|

10.15. Royal Dental Group |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Dental Caries Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Dental Caries Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Dental Caries Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA