As per Intent Market Research, the Dental CAD/CAM Market was valued at USD 2.5 billion in 2024-e and will surpass USD 4.6 billion by 2030; growing at a CAGR of 10.2% during 2025 - 2030.

The dental CAD/CAM market is rapidly expanding, driven by the increasing adoption of digital workflows in dentistry and the growing demand for precision in restorative and orthodontic procedures. Computer-aided design (CAD) and computer-aided manufacturing (CAM) systems are transforming dental practices by streamlining processes, reducing turnaround times, and enhancing treatment outcomes.

The market's growth is fueled by technological advancements, such as the integration of AI in design software and the development of high-speed milling machines and 3D printers. The rising prevalence of dental disorders, coupled with the growing focus on aesthetics, further propels the adoption of CAD/CAM solutions across dental clinics, laboratories, and academic institutions.

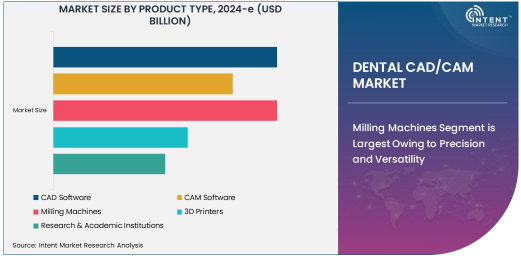

Milling Machines Segment is Largest Owing to Precision and Versatility

Milling machines dominate the product type segment, accounting for the largest share due to their precision and versatility in creating dental restorations. These machines are widely used for fabricating crowns, bridges, veneers, and implant abutments from various materials, such as ceramics and zirconia.

The segment's growth is supported by continuous innovations in milling technology, including multi-axis systems that deliver higher accuracy and finer details. Their ability to process complex designs with minimal manual intervention makes them an indispensable tool for dental laboratories and clinics aiming for high-quality restorations.

Additive Technology is Fastest Owing to Growth of 3D Printing

Additive technology, primarily driven by 3D printing, is the fastest-growing technology segment. This technology offers unmatched flexibility in creating intricate dental structures layer by layer, reducing material waste and enabling faster production.

Additive manufacturing is particularly gaining traction in orthodontics and implantology, where customization is key. The adoption of biocompatible materials and advancements in printing speed and resolution have further accelerated the growth of this segment, making it a game-changer for dental applications.

Zirconia Material Leads Owing to High Strength and Aesthetic Appeal

Zirconia materials hold the largest share in the material segment, attributed to their exceptional strength, durability, and natural tooth-like appearance. Zirconia is extensively used in creating crowns, bridges, and implant components, ensuring long-lasting restorations with minimal wear.

The material's popularity is further enhanced by advancements in translucent zirconia, which combines superior aesthetics with mechanical properties. Its biocompatibility and resistance to staining make it a preferred choice for both dental clinics and laboratories seeking reliable solutions for restorative dentistry.

Dental Laboratories Segment is Fastest Owing to Growing Outsourcing

Dental laboratories are the fastest-growing end-use segment, driven by the rising trend of outsourcing complex dental restorations. Laboratories leverage CAD/CAM systems to deliver high-precision and custom-made dental prosthetics tailored to individual patient needs.

This segment's growth is also fueled by advancements in digital workflows, enabling seamless collaboration between clinics and labs. By adopting CAD/CAM technologies, laboratories can achieve faster turnaround times, enhanced productivity, and superior quality, meeting the increasing demand for aesthetic and functional dental restorations.

North America is Largest Region Owing to High Adoption of Digital Dentistry

North America leads the dental CAD/CAM market, driven by the high adoption of digital dentistry and a well-established dental care infrastructure. The region's dominance is supported by a strong presence of leading market players, advanced technologies, and a growing preference for same-day restorations.

The increasing prevalence of dental disorders, coupled with significant investments in research and development, further boosts market growth in North America. Additionally, a high level of awareness among dental professionals and patients about the benefits of CAD/CAM systems contributes to the region's leadership in this market.

Competitive Landscape and Leading Companies

The dental CAD/CAM market is highly competitive, with major players focusing on innovation and expanding their product portfolios to gain a competitive edge. Companies like Dentsply Sirona, Planmeca, and Align Technology are at the forefront, offering comprehensive solutions that cater to various dental applications.

Emerging players are capitalizing on advancements in 3D printing and AI-driven design software to introduce cutting-edge products. The competitive landscape is characterized by strategic collaborations, acquisitions, and a strong emphasis on customer support and training, ensuring a seamless transition to digital workflows for dental professionals.

Recent Developments:

- In December 2024, 3Shape announced the launch of a new CAD software platform designed to streamline dental restoration workflows and improve patient outcomes.

- In November 2024, Sirona Dental Systems introduced an upgraded CAM milling machine offering enhanced precision and speed for dental laboratories.

- In October 2024, Dentsply Sirona launched an advanced 3D printer designed for more accurate and efficient dental restorations, targeting both clinics and labs.

- In September 2024, Planmeca unveiled its new ceramic material for CAD/CAM applications, aimed at improving the aesthetic outcomes of dental restorations.

- In August 2024, Roland DG Corporation released an updated CAD software solution featuring enhanced compatibility with other dental CAD/CAM systems and improved workflow integration.

List of Leading Companies:

- 3Shape

- Sirona Dental Systems

- Planmeca

- Straumann Group

- Dentsply Sirona

- Roland DG Corporation

- Mitsubishi Materials Corporation

- Exocad GmbH

- Henry Schein

- Ivoclar Vivadent

- KaVo Dental

- Shofu Dental

- Vatech

- Zimmer Biomet

- GC Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.5 billion |

|

Forecasted Value (2030) |

USD 4.6 billion |

|

CAGR (2025 – 2030) |

10.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Dental CAD/CAM Market By Product Type (CAD Software, CAM Software, Milling Machines, 3D Printers, Scanner Systems), By Technology (Subtractive Technology, Additive Technology, Hybrid Technology), By Application (Restorative Dentistry, Orthodontics, Implantology), By Material (Ceramic Materials, Resin Materials, Metallic Materials, Zirconia), By End-Use (Dental Clinics, Dental Laboratories, Research & Academic Institutions) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

3Shape, Sirona Dental Systems, Planmeca, Straumann Group, Dentsply Sirona, Roland DG Corporation, Mitsubishi Materials Corporation, Exocad GmbH, Henry Schein, Ivoclar Vivadent, KaVo Dental, Shofu Dental, Vatech, Zimmer Biomet, GC Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Dental CAD/CAM Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. CAD Software |

|

4.2. CAM Software |

|

4.3. Milling Machines |

|

4.4. 3D Printers |

|

4.5. Scanner Systems |

|

4.6. Others |

|

5. Dental CAD/CAM Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Subtractive Technology |

|

5.2. Additive Technology |

|

5.3. Hybrid Technology |

|

6. Dental CAD/CAM Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Restorative Dentistry |

|

6.2. Orthodontics |

|

6.3. Implantology |

|

6.4. Others |

|

7. Dental CAD/CAM Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Ceramic Materials |

|

7.2. Resin Materials |

|

7.3. Metallic Materials |

|

7.4. Zirconia |

|

7.5. Others |

|

8. Dental CAD/CAM Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Dental Clinics |

|

8.2. Dental Laboratories |

|

8.3. Research & Academic Institutions |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Dental CAD/CAM Market, by Product Type |

|

9.2.7. North America Dental CAD/CAM Market, by Technology |

|

9.2.8. North America Dental CAD/CAM Market, by Application |

|

9.2.9. North America Dental CAD/CAM Market, by Material |

|

9.2.10. North America Dental CAD/CAM Market, by End-Use |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Dental CAD/CAM Market, by Product Type |

|

9.2.11.1.2. US Dental CAD/CAM Market, by Technology |

|

9.2.11.1.3. US Dental CAD/CAM Market, by Application |

|

9.2.11.1.4. US Dental CAD/CAM Market, by Material |

|

9.2.11.1.5. US Dental CAD/CAM Market, by End-Use |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. 3Shape |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Sirona Dental Systems |

|

11.3. Planmeca |

|

11.4. Straumann Group |

|

11.5. Dentsply Sirona |

|

11.6. Roland DG Corporation |

|

11.7. Mitsubishi Materials Corporation |

|

11.8. Exocad GmbH |

|

11.9. Henry Schein |

|

11.10. Ivoclar Vivadent |

|

11.11. KaVo Dental |

|

11.12. Shofu Dental |

|

11.13. Vatech |

|

11.14. Zimmer Biomet |

|

11.15. GC Corporation |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Dental CAD/CAM Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Dental CAD/CAM Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Dental CAD/CAM Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA