As per Intent Market Research, the Dental Bone Grafts Substitutes Market was valued at USD 723.2 million in 2024-e and will surpass USD 1,253.7 million by 2030; growing at a CAGR of 9.6% during 2025 - 2030.

The dental bone graft substitutes market is experiencing significant growth, driven by the rising prevalence of dental disorders and the increasing number of dental implant procedures. Bone graft substitutes play a crucial role in enhancing bone regeneration, particularly in cases of periodontal disease, tooth loss, and jaw deformities.

Advancements in biomaterials, coupled with the growing adoption of minimally invasive techniques, have propelled the demand for innovative bone graft solutions. Additionally, the aging population and an increasing focus on aesthetic dentistry have contributed to the rising need for effective bone augmentation procedures worldwide.

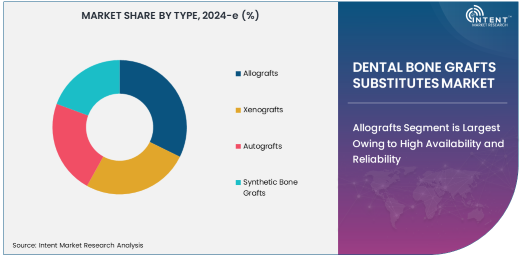

Allografts Segment is Largest Owing to High Availability and Reliability

Allografts lead the market in the type segment, attributed to their widespread availability and consistent performance in bone regeneration procedures. Derived from human donors, allografts eliminate the need for a secondary surgical site, reducing patient morbidity and recovery time.

The segment's growth is bolstered by advancements in sterilization and preservation techniques, ensuring the safety and efficacy of allograft materials. Their versatility in various dental applications, such as implant dentistry and periodontal bone grafting, further underscores their dominance in the market.

Implant Dentistry is Fastest Owing to Rising Demand for Dental Implants

Implant dentistry represents the fastest-growing application segment, driven by the increasing demand for dental implants as a long-term solution for tooth replacement. Bone graft substitutes are essential in implant dentistry, particularly for patients with insufficient bone density to support implants.

The segment's growth is fueled by the rising prevalence of edentulism, advancements in implant technologies, and an increasing focus on dental aesthetics. Bone graft substitutes, such as synthetic grafts and bioactive glass, are gaining traction for their ability to enhance osseointegration and improve implant success rates.

Granules Form Leads Owing to Ease of Application

Granules dominate the form segment, primarily due to their ease of application and adaptability to irregular bone defects. Granular bone graft substitutes are commonly used in periodontal bone grafting and implant dentistry, offering excellent handling properties and optimal bone regeneration outcomes.

The segment's popularity is further supported by advancements in material composition, such as bioactive granules, which promote faster healing and integration. Their ability to be mixed with other graft materials and tailored to specific clinical needs makes granules a preferred choice among dental professionals.

Dental Clinics Segment is Fastest Owing to Rising Patient Visits

Dental clinics are the fastest-growing end-user segment, driven by the increasing number of patients seeking bone grafting procedures. Clinics often serve as the first point of contact for dental care, catering to a wide range of periodontal and implant dentistry needs.

The segment's growth is attributed to the rising number of private dental practitioners and the expansion of clinic networks in both urban and rural areas. Clinics increasingly adopt advanced bone graft substitutes and technologies to enhance patient outcomes and build trust among patients seeking specialized care.

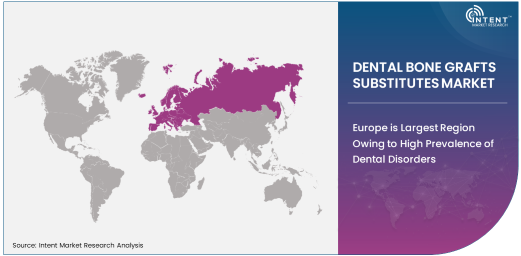

Europe is Largest Region Owing to High Prevalence of Dental Disorders

Europe holds the largest share in the dental bone graft substitutes market, owing to the high prevalence of dental disorders and a well-established dental care infrastructure. Countries like Germany, the UK, and France are at the forefront, driven by an aging population and increasing awareness about dental health.

The region benefits from significant advancements in dental biomaterials and the presence of leading market players. Additionally, government support for oral healthcare and the availability of skilled dental professionals contribute to Europe's dominance in this market.

Competitive Landscape and Leading Companies

The dental bone graft substitutes market is highly competitive, with key players focusing on product innovation and strategic partnerships. Companies such as Geistlich Pharma, Zimmer Biomet, and Dentsply Sirona lead the market with their comprehensive portfolios and strong global presence.

Emerging players are leveraging advancements in biomaterials to introduce novel products, such as bioactive and collagen-based grafts, catering to the growing demand for effective and sustainable solutions. The competitive landscape is characterized by continuous research and development efforts aimed at improving the efficacy, safety, and handling of bone graft substitutes.

Recent Developments:

- In December 2024, Zimmer Biomet launched a new collagen-based dental bone graft substitute, which enhances bone regeneration and supports faster healing in dental implant procedures.

- In November 2024, Dentsply Sirona introduced a synthetic bone graft product, combining bioactive materials for improved integration with natural bone in dental applications.

- In October 2024, Medtronic expanded its line of bone graft substitutes by adding a new tricalcium phosphate-based solution, designed for use in periodontal and implant surgeries.

- In September 2024, Straumann Group launched a bioactive glass-based bone graft substitute, offering enhanced osteointegration for dental implants.

- In August 2024, Kerr Corporation announced the release of a new putty-style bone graft product, specifically designed for use in maxillofacial surgery and periodontal procedures.

List of Leading Companies:

- Zimmer Biomet

- Dentsply Sirona

- Straumann Group

- Medtronic

- Kerr Corporation

- Henry Schein

- Smith & Nephew

- Stryker Corporation

- Regeneron Pharmaceuticals

- Biosurgery

- Osstem Implant

- DePuy Synthes

- Mölnlycke Health Care

- Biomet

- Collagen Matrix

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 723.2 million |

|

Forecasted Value (2030) |

USD 1,253.7 million |

|

CAGR (2025 – 2030) |

9.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Dental Bone Grafts Substitutes Market By Type (Allografts, Xenografts, Autografts, Synthetic Bone Grafts), By Material (Hydroxyapatite, Tricalcium Phosphate, Collagen-based Bone Grafts, Bioactive Glass), By Form (Granules, Putty, Blocks), By Application (Periodontal Bone Grafting, Implant Dentistry, Maxillofacial Surgery), By End-User (Dental Clinics, Dental Hospitals, Dental Laboratories) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Zimmer Biomet, Dentsply Sirona, Straumann Group, Medtronic, Kerr Corporation, Henry Schein, Smith & Nephew, Stryker Corporation, Regeneron Pharmaceuticals, Biosurgery, Osstem Implant, DePuy Synthes, Mölnlycke Health Care, Biomet, Collagen Matrix |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Dental Bone Grafts Substitutes Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Allografts |

|

4.2. Xenografts |

|

4.3. Autografts |

|

4.4. Synthetic Bone Grafts |

|

5. Dental Bone Grafts Substitutes Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Hydroxyapatite |

|

5.2. Tricalcium Phosphate |

|

5.3. Collagen-based Bone Grafts |

|

5.4. Bioactive Glass |

|

6. Dental Bone Grafts Substitutes Market, by Form (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Granules |

|

6.2. Putty |

|

6.3. Blocks |

|

7. Dental Bone Grafts Substitutes Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Periodontal Bone Grafting |

|

7.2. Implant Dentistry |

|

7.3. Maxillofacial Surgery |

|

8. Dental Bone Grafts Substitutes Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Dental Clinics |

|

8.2. Dental Hospitals |

|

8.3. Dental Laboratories |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Dental Bone Grafts Substitutes Market, by Type |

|

9.2.7. North America Dental Bone Grafts Substitutes Market, by Material |

|

9.2.8. North America Dental Bone Grafts Substitutes Market, by Form |

|

9.2.9. North America Dental Bone Grafts Substitutes Market, by Application |

|

9.2.10. By Country |

|

9.2.10.1. US |

|

9.2.10.1.1. US Dental Bone Grafts Substitutes Market, by Type |

|

9.2.10.1.2. US Dental Bone Grafts Substitutes Market, by Material |

|

9.2.10.1.3. US Dental Bone Grafts Substitutes Market, by Form |

|

9.2.10.1.4. US Dental Bone Grafts Substitutes Market, by Application |

|

9.2.10.2. Canada |

|

9.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Zimmer Biomet |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Dentsply Sirona |

|

11.3. Straumann Group |

|

11.4. Medtronic |

|

11.5. Kerr Corporation |

|

11.6. Henry Schein |

|

11.7. Smith & Nephew |

|

11.8. Stryker Corporation |

|

11.9. Regeneron Pharmaceuticals |

|

11.10. Biosurgery |

|

11.11. Osstem Implant |

|

11.12. DePuy Synthes |

|

11.13. Mölnlycke Health Care |

|

11.14. Biomet |

|

11.15. Collagen Matrix |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Dental Bone Grafts Substitutes Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Dental Bone Grafts Substitutes Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Dental Bone Grafts Substitutes Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA