As per Intent Market Research, the Dental Articulators Market was valued at USD 314.3 million in 2024-e and will surpass USD 573.3 million by 2030; growing at a CAGR of 10.5% during 2025 - 2030.

The dental articulators market is experiencing steady growth as a result of advancements in dental technology, increased adoption of dental devices, and a growing demand for precise dental prosthetics. Dental articulators play a critical role in simulating jaw movement and the relationship between the teeth, providing dental professionals with a valuable tool for diagnosing and planning treatments. This market is also being driven by the increasing prevalence of dental disorders, the aging population, and the rise in cosmetic dental procedures.

As dental technology continues to evolve, articulators have become more sophisticated, with improvements in materials and designs offering enhanced accuracy and durability. The market is also benefiting from the rising awareness of dental care and the increasing availability of dental services worldwide.

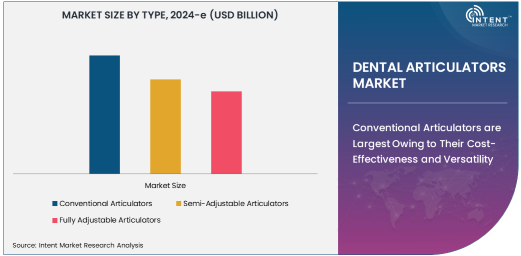

Conventional Articulators are Largest Owing to Their Cost-Effectiveness and Versatility

Conventional articulators dominate the dental articulators market, primarily due to their cost-effectiveness and wide range of applications. These devices offer basic functionality, allowing dental professionals to simulate jaw movements and create accurate prosthetic devices for patients. Conventional articulators are particularly popular in smaller dental clinics and practices, where budget constraints are an important factor.

Their simplicity, ease of use, and lower price point make them the preferred choice for many dental professionals, particularly when complex adjustments or detailed jaw movement simulations are not required. Despite the rise in more advanced articulators, the conventional type continues to be a staple in dental settings worldwide.

Fully Adjustable Articulators are Fastest Growing Due to Their Advanced Features and Precision

Fully adjustable articulators are the fastest-growing segment in the dental articulators market, driven by their advanced features and enhanced precision in simulating jaw movements. These articulators allow for more precise adjustments, enabling dental professionals to replicate complex jaw movements with greater accuracy. This makes them ideal for use in restorative and prosthodontic procedures, where a higher degree of customization and fit is essential.

The increasing demand for customized dental treatments and the rise of high-quality prosthetics are fueling the growth of fully adjustable articulators. Additionally, advancements in design and material technologies have made these devices more accessible, contributing to their growing popularity in the market.

Dental Clinics are Largest End-User Due to High Volume of Routine Procedures

Dental clinics represent the largest end-user segment in the dental articulators market, accounting for a significant portion of the market share. These clinics perform a wide variety of dental procedures, including restorative, orthodontic, and cosmetic treatments, all of which require the use of articulators for accurate diagnosis and treatment planning. The high volume of routine dental treatments, coupled with the increasing number of patients seeking dental prosthetics and implants, contributes to the dominance of dental clinics as the primary users of articulators.

The ongoing trend toward personalized and aesthetic dental solutions, along with the growing emphasis on precise prosthetic fitting, ensures the continued reliance on dental articulators in these settings.

North America is Largest Region Owing to High Adoption of Advanced Dental Technologies

North America is the largest region in the dental articulators market, supported by the high adoption rate of advanced dental technologies, significant investments in dental healthcare, and a well-established healthcare infrastructure. The United States, in particular, is a key market player, with numerous dental clinics and hospitals incorporating advanced dental devices, including articulators, in their daily operations.

The increasing demand for cosmetic and restorative dental procedures, along with the presence of leading dental equipment manufacturers in the region, contributes to North America's dominance in the dental articulators market. Furthermore, growing awareness of dental health and a rising geriatric population are expected to sustain market growth in this region.

Leading Companies and Competitive Landscape

The dental articulators market is competitive, with several key players such as Whip Mix, KaVo Dental, and A-dec leading the market. These companies are focused on innovation, producing articulators with advanced features, improved materials, and better ergonomic designs to cater to the evolving needs of dental professionals.

Competition in the market is driven by product differentiation, with companies introducing new features such as enhanced adjustability, improved durability, and superior accuracy in jaw movement simulation. Collaborations between manufacturers and dental professionals, along with increased research and development efforts, are also contributing to the market's growth.

Recent Developments:

- In December 2024, Ivoclar Vivadent AG launched an innovative semi-adjustable dental articulator, designed to improve precision in orthodontic treatments.

- In November 2024, KaVo Dental expanded its range of fully adjustable articulators, offering enhanced user control and customization for dental professionals.

- In October 2024, 3M Health Care introduced a new line of metal-based dental articulators, offering better durability and performance for long-term use in dental clinics.

- In September 2024, Zimmer Biomet entered a partnership with a major dental research institute to enhance dental articulator technology for more accurate restorative procedures.

- In August 2024, Straumann Group unveiled a new digital dental articulator, aimed at improving efficiency and accuracy in dental lab settings.

List of Leading Companies:

- Ivoclar Vivadent AG

- Dentsply Sirona Inc.

- Apex Dental Milling

- KaVo Dental

- 3M Health Care

- Straumann Group

- Sam Dental

- Micerium S.p.A.

- Dentium Co., Ltd.

- Modern Dental Group

- Vatech

- Ormco Corporation

- GC Corporation

- Kuraray Noritake Dental Inc.

- Zimmer Biomet

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 314.3 million |

|

Forecasted Value (2030) |

USD 573.3 million |

|

CAGR (2025 – 2030) |

10.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Dental Articulators Market By Type (Conventional Articulators, Semi-Adjustable Articulators, Fully Adjustable Articulators), By Material (Metal Articulators, Plastic Articulators, Ceramic Articulators), By Design (Single-Arch Articulators, Dual-Arch Articulators), By End-Use (Dental Clinics, Hospitals, Orthodontic Clinics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Ivoclar Vivadent AG, Dentsply Sirona Inc., Apex Dental Milling, KaVo Dental, 3M Health Care, Straumann Group, Sam Dental, Micerium S.p.A., Dentium Co., Ltd., Modern Dental Group, Vatech, Ormco Corporation, GC Corporation, Kuraray Noritake Dental Inc., Zimmer Biomet |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Dental Articulators Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Conventional Articulators |

|

4.2. Semi-Adjustable Articulators |

|

4.3. Fully Adjustable Articulators |

|

5. Dental Articulators Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Metal Articulators |

|

5.2. Plastic Articulators |

|

5.3. Ceramic Articulators |

|

6. Dental Articulators Market, by Design (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Single-Arch Articulators |

|

6.2. Dual-Arch Articulators |

|

7. Dental Articulators Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Dental Clinics |

|

7.2. Hospitals |

|

7.3. Orthodontic Clinics |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Dental Articulators Market, by Type |

|

8.2.7. North America Dental Articulators Market, by Material |

|

8.2.8. North America Dental Articulators Market, by Design |

|

8.2.9. North America Dental Articulators Market, by End-Use |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Dental Articulators Market, by Type |

|

8.2.10.1.2. US Dental Articulators Market, by Material |

|

8.2.10.1.3. US Dental Articulators Market, by Design |

|

8.2.10.1.4. US Dental Articulators Market, by End-Use |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Ivoclar Vivadent AG |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Dentsply Sirona Inc. |

|

10.3. Apex Dental Milling |

|

10.4. KaVo Dental |

|

10.5. 3M Health Care |

|

10.6. Straumann Group |

|

10.7. Sam Dental |

|

10.8. Micerium S.p.A. |

|

10.9. Dentium Co., Ltd. |

|

10.10. Modern Dental Group |

|

10.11. Vatech |

|

10.12. Ormco Corporation |

|

10.13. GC Corporation |

|

10.14. Kuraray Noritake Dental Inc. |

|

10.15. Zimmer Biomet |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Dental Articulators Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Dental Articulators Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Dental Articulators Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA