As per Intent Market Research, the Dental Anesthesia Market was valued at USD 2.1 billion in 2024-e and will surpass USD 3.5 billion by 2030; growing at a CAGR of 8.3% during 2025 - 2030.

The dental anesthesia market is expanding rapidly, driven by the increasing number of dental procedures, ranging from routine treatments to complex oral surgeries. The demand for anesthesia in dental care is essential for ensuring patient comfort, pain management, and the successful completion of various procedures. As dental professionals adopt more advanced techniques to enhance patient experiences and minimize pain, the market for dental anesthesia continues to grow. Rising awareness about dental health, coupled with the aging population requiring more dental care, is further fueling the market's growth.

Technological advancements in anesthetic agents, delivery systems, and safety measures are contributing to the increasing adoption of anesthesia in dental practices. Additionally, growing consumer expectations for pain-free dental treatments are promoting the use of anesthesia across various procedures, making it a standard practice in dental clinics and hospitals.

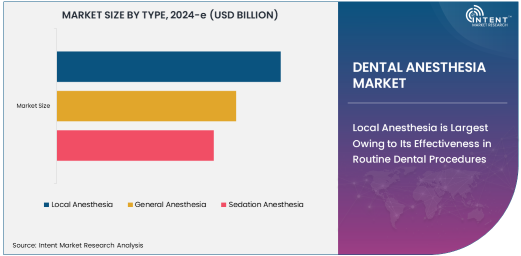

Local Anesthesia is Largest Owing to Its Effectiveness in Routine Dental Procedures

Local anesthesia is the largest segment in the dental anesthesia market due to its widespread use in routine dental procedures. This anesthesia type is applied to a specific area of the mouth to block sensation, ensuring that patients do not experience pain during procedures such as fillings, cleanings, and root canal treatments. The simplicity, quick onset of action, and minimal side effects of local anesthesia make it the preferred choice for both patients and dental professionals.

Local anesthesia's popularity is further supported by the ease of administration, cost-effectiveness, and low risk of complications, which make it ideal for routine dental procedures. The ongoing improvement in local anesthetic agents, such as lidocaine and articaine, has enhanced the effectiveness and duration of anesthesia, further driving the growth of this segment.

Injectable Anesthesia is Fastest Growing Due to Its Precision and Control in Anesthesia Delivery

Injectable anesthesia is the fastest-growing segment in the dental anesthesia market due to its precise control over the dosage and targeted delivery of anesthetic agents. This method allows for more accurate and effective pain management during dental procedures, particularly in complex surgeries and treatments that require deep anesthesia. Injectable anesthesia is increasingly preferred for procedures such as extractions, root canals, and other invasive oral surgeries, as it provides localized pain relief with fewer risks.

Advancements in injectable anesthesia technology, such as computer-controlled delivery systems, have improved the precision and comfort of injections, contributing to the growth of this segment. Additionally, the availability of various anesthetic agents, including lidocaine and articaine, that can be delivered via injection is driving the demand for injectable anesthesia in dental practices.

Dental Clinics are Largest End-User Owing to High Volume of Dental Procedures Performed

Dental clinics are the largest end-users in the dental anesthesia market due to the high volume of routine and specialized procedures performed in these settings. From cleanings and fillings to complex oral surgeries, dental clinics are at the forefront of administering anesthesia to ensure patient comfort and safety. With the increasing number of individuals seeking dental care and the growing emphasis on pain-free treatments, dental clinics continue to dominate the market for dental anesthesia.

The demand for advanced anesthetic agents and delivery systems in dental clinics is expected to continue rising, as more patients opt for treatments that require anesthesia. Moreover, the growing trend of cosmetic and orthodontic dental procedures, which often require anesthesia, is also contributing to the dominance of dental clinics in the market.

North America is Largest Region Owing to High Healthcare Standards and Adoption of Advanced Anesthesia Techniques

North America is the largest region in the dental anesthesia market, driven by the region's advanced healthcare infrastructure, high adoption of dental technologies, and the widespread use of anesthesia in dental treatments. The United States and Canada lead the market, with a large number of dental clinics and hospitals offering state-of-the-art anesthesia techniques for various dental procedures. High disposable incomes, a strong focus on patient comfort, and an increasing demand for cosmetic dentistry further contribute to North America's market leadership.

Additionally, the presence of major dental anesthesia manufacturers and continuous advancements in anesthetic agents and delivery systems support the region's dominance. North America is expected to maintain its position as the leading market for dental anesthesia in the coming years.

Leading Companies and Competitive Landscape

The dental anesthesia market is competitive, with key players including Dentsply Sirona Inc., Septodont, and the American Dental Association (ADA), which offer a range of dental anesthetic products. Companies are increasingly focusing on product innovation, with a growing emphasis on improving the efficacy and safety of anesthetic agents. Many of the leading players are also investing in research and development to create new, more effective anesthetics with fewer side effects, further expanding the market.

The competitive landscape is characterized by partnerships between dental clinics, hospitals, and anesthesia product manufacturers, aimed at improving the delivery of anesthesia and enhancing patient safety. Moreover, regulatory approvals and market expansion into emerging regions are key strategies for growth in this dynamic market.

Recent Developments:

- In November 2024, Dentsply Sirona Inc. launched a new line of dental anesthesia products, focusing on more precise dosages to enhance patient safety during procedures.

- In October 2024, Becton Dickinson and Company introduced a new automated injection system, designed to improve the administration process for dental anesthesiologists.

- In September 2024, Septodont expanded its anesthetic agent offerings, introducing a new formulation of articaine designed for longer-lasting pain relief during oral surgeries.

- In August 2024, Zimmer Biomet partnered with a leading dental research institution to develop new sedation techniques for high-risk dental patients, enhancing safety and comfort.

- In July 2024, Patterson Dental Supply announced the launch of a new anesthesia delivery system, aimed at reducing the likelihood of adverse reactions and improving procedural efficiency.

List of Leading Companies:

- Dentsply Sirona Inc.

- Midmark Corporation

- Zimmer Biomet

- Becton Dickinson and Company

- Danaher Corporation

- Septodont

- Patterson Dental Supply, Inc.

- Ansell Ltd.

- 3M Health Care

- Carestream Health, Inc.

- Parker Hannifin Corporation

- Lincare Holdings Inc.

- Ipsen S.A.

- Merz North America, Inc.

- Fresenius Kabi

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.1 billion |

|

Forecasted Value (2030) |

USD 3.5 billion |

|

CAGR (2025 – 2030) |

8.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Dental Anesthesia Market By Type (Local Anesthesia, General Anesthesia, Sedation Anesthesia), By Administration Mode (Injectable Anesthesia, Topical Anesthesia), By Anesthetic Agents (Lidocaine, Articaine, Bupivacaine, Mepivacaine, Other Anesthetic Agents), By End-Use Industry (Dental Clinics, Hospitals, Ambulatory Surgical Centers), By Procedure Type (Routine Dental Procedures, Oral Surgeries, Cosmetic Dental Procedures, Orthodontic Treatments) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Dentsply Sirona Inc., Midmark Corporation, Zimmer Biomet, Becton Dickinson and Company, Danaher Corporation, Septodont, Patterson Dental Supply, Inc., Ansell Ltd., 3M Health Care, Carestream Health, Inc., Parker Hannifin Corporation, Lincare Holdings Inc., Ipsen S.A., Merz North America, Inc., Fresenius Kabi |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Dental Anesthesia Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Local Anesthesia |

|

4.2. General Anesthesia |

|

4.3. Sedation Anesthesia |

|

5. Dental Anesthesia Market, by Administration Mode (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Injectable Anesthesia |

|

5.2. Topical Anesthesia |

|

6. Dental Anesthesia Market, by Anesthetic Agents (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Lidocaine |

|

6.2. Articaine |

|

6.3. Bupivacaine |

|

6.4. Mepivacaine |

|

6.5. Others |

|

7. Dental Anesthesia Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Dental Clinics |

|

7.2. Hospitals |

|

7.3. Ambulatory Surgical Centers |

|

8. Dental Anesthesia Market, by Procedure Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Routine Dental Procedures |

|

8.2. Oral Surgeries |

|

8.3. Cosmetic Dental Procedures |

|

8.4. Orthodontic Treatments |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Dental Anesthesia Market, by Type |

|

9.2.7. North America Dental Anesthesia Market, by Administration Mode |

|

9.2.8. North America Dental Anesthesia Market, by Anesthetic Agents |

|

9.2.9. North America Dental Anesthesia Market, by End-Use Industry |

|

9.2.10. North America Dental Anesthesia Market, by Procedure Type |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Dental Anesthesia Market, by Type |

|

9.2.11.1.2. US Dental Anesthesia Market, by Administration Mode |

|

9.2.11.1.3. US Dental Anesthesia Market, by Anesthetic Agents |

|

9.2.11.1.4. US Dental Anesthesia Market, by End-Use Industry |

|

9.2.11.1.5. US Dental Anesthesia Market, by Procedure Type |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Dentsply Sirona Inc. |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Midmark Corporation |

|

11.3. Zimmer Biomet |

|

11.4. Becton Dickinson and Company |

|

11.5. Danaher Corporation |

|

11.6. Septodont |

|

11.7. Patterson Dental Supply, Inc. |

|

11.8. Ansell Ltd. |

|

11.9. 3M Health Care |

|

11.10. Carestream Health, Inc. |

|

11.11. Parker Hannifin Corporation |

|

11.12. Lincare Holdings Inc. |

|

11.13. Ipsen S.A. |

|

11.14. Merz North America, Inc. |

|

11.15. Fresenius Kabi |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Dental Anesthesia Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Dental Anesthesia Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Dental Anesthesia Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA