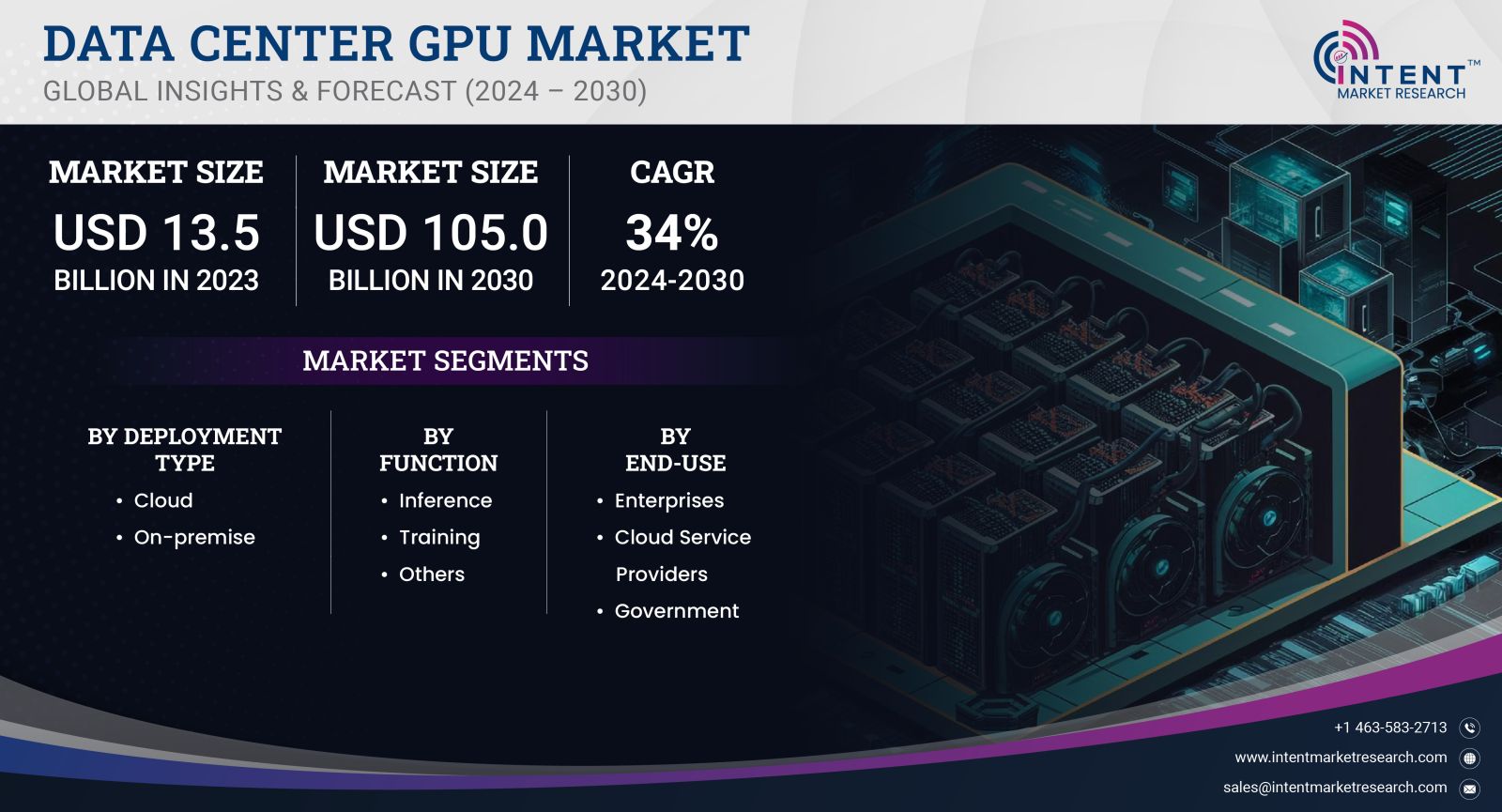

As per Intent Market Research, the Data Center GPU Market was valued at USD 13.5 billion in 2023 and will surpass USD 105.0 billion by 2030; growing at a CAGR of 34% during 2024 - 2030.

The Data Center GPU market is a critical component of the rapidly evolving cloud computing and artificial intelligence (AI) sectors. With the increasing demand for high-performance computing (HPC) and the growing adoption of machine learning applications, GPUs have emerged as essential hardware in data centers. These units are designed to handle parallel processing tasks, enabling organizations to process vast amounts of data more efficiently than traditional CPUs. The market is projected to witness significant growth, driven by the rising need for advanced computing solutions and the escalating importance of data analytics across various industries.

The base year for this forecast is 2024, with substantial investments from key players, technological advancements, and increasing applications across industries such as automotive, healthcare, and finance. As businesses strive to enhance their operational efficiency and leverage data-driven insights, the demand for GPUs in data centers is poised to expand, contributing to a dynamic competitive landscape.

AI Workload Segment is Fastest Growing Owing to Increased AI Adoption

Among the various segments of the Data Center GPU market, the AI workload segment is the fastest growing, driven primarily by the exponential rise in artificial intelligence applications across diverse industries. Companies are increasingly investing in AI-driven solutions for tasks ranging from data analysis to natural language processing, necessitating robust computational power. As organizations seek to implement advanced AI technologies, the demand for high-performance GPUs capable of handling AI workloads efficiently has surged.

The integration of AI into various business processes has created a substantial market for data center GPUs tailored for AI workloads. The capability of GPUs to perform parallel processing allows them to tackle complex algorithms and datasets, leading to faster and more efficient outcomes. Furthermore, the proliferation of machine learning frameworks and tools has made it easier for organizations to adopt AI solutions, thereby boosting the demand for specialized GPU resources. With the continued growth of AI technologies, this segment is expected to maintain its momentum, creating substantial opportunities for vendors in the market.

Cloud Gaming Segment is Largest Owing to Rising Popularity

The cloud gaming segment stands out as the largest in the Data Center GPU market, primarily due to the increasing popularity of gaming-as-a-service platforms. As gaming enthusiasts demand high-quality graphics and seamless experiences, companies are increasingly investing in cloud gaming solutions that leverage the power of GPUs in data centers. The ability to stream games in real-time without the need for high-end gaming hardware at the user’s end has transformed how games are consumed and played.

Cloud gaming relies heavily on advanced GPUs to render graphics and deliver immersive gaming experiences to users. This segment's growth is fueled by the rise of subscription-based gaming services and the proliferation of high-speed internet connectivity. Additionally, the emergence of 5G technology is expected to further enhance the cloud gaming experience, making it more accessible to a broader audience. As a result, the cloud gaming segment is poised for continued expansion, driven by evolving consumer preferences and advancements in gaming technology.

High-Performance Computing (HPC) Segment is Largest Owing to Research Demands

The High-Performance Computing (HPC) segment represents the largest share of the Data Center GPU market, primarily driven by the growing demands from research institutions and industries requiring complex simulations and data analysis. HPC applications span various sectors, including aerospace, automotive, and scientific research, where vast computational power is essential for achieving accurate results. As the complexity of research and simulations continues to increase, the need for powerful GPUs in data centers is paramount.

The HPC segment's expansion is fueled by the ongoing evolution of scientific computing and big data analytics. Researchers and organizations are leveraging advanced GPU architectures to expedite their computational tasks, resulting in quicker insights and breakthroughs. Furthermore, the increasing trend towards collaborative research and shared resources in data centers is expected to bolster the adoption of HPC solutions. As industries continue to recognize the value of high-performance computing, this segment is set to maintain its leadership position within the Data Center GPU market.

Virtual Desktop Infrastructure (VDI) Segment is Fastest Growing Owing to Remote Work Trends

The Virtual Desktop Infrastructure (VDI) segment is the fastest growing in the Data Center GPU market, reflecting the surge in remote work and the need for flexible computing solutions. Organizations are increasingly adopting VDI to provide employees with access to centralized resources and applications, enabling seamless collaboration and productivity regardless of location. As remote work becomes a permanent fixture in many organizations, the demand for VDI solutions powered by high-performance GPUs has escalated.

VDI solutions benefit significantly from GPU acceleration, as it enhances user experiences by providing smooth graphics rendering and faster application performance. The rise of hybrid work models has further accelerated the need for scalable and efficient VDI solutions, driving investments in data center GPUs. As companies continue to seek ways to optimize their remote work strategies, the VDI segment is anticipated to experience robust growth, contributing to the overall expansion of the Data Center GPU market.

Telecommunications Segment is Largest Owing to 5G Expansion

Within the Data Center GPU market, the telecommunications segment is the largest, primarily due to the ongoing expansion of 5G technology. As telecommunications providers deploy 5G networks, there is a growing need for advanced computing resources to manage the massive amounts of data generated by these networks. GPUs play a critical role in processing and analyzing this data, ensuring optimal performance and efficiency in telecommunications operations.

The deployment of 5G technology has led to increased demand for data centers equipped with powerful GPUs capable of supporting advanced applications such as IoT, smart cities, and autonomous vehicles. As telecommunication companies look to enhance their infrastructure and services, the adoption of GPUs in data centers is expected to rise significantly. This trend will not only drive growth in the telecommunications segment but also create synergies with other sectors, further reinforcing the Data Center GPU market's trajectory.

North America is the Largest Region Owing to Technological Advancements

North America is the largest region in the Data Center GPU market, driven by rapid technological advancements and a strong presence of key industry players. The region boasts a well-established infrastructure for data centers, coupled with significant investments in research and development, leading to innovative GPU solutions. Additionally, the increasing adoption of cloud computing, AI, and big data analytics across various sectors has fueled the demand for high-performance GPUs in North American data centers.

The presence of major technology companies and startups in the region has created a highly competitive landscape, further propelling market growth. The increasing trend toward hybrid and multi-cloud strategies among enterprises has also necessitated the deployment of advanced GPU resources to support diverse workloads. As North America continues to lead in technology adoption and innovation, it is expected to maintain its dominance in the Data Center GPU market.

Competitive Landscape of the Data Center GPU Market

The competitive landscape of the Data Center GPU market is characterized by the presence of several key players vying for market share through innovation and strategic partnerships. The top ten companies in the market include NVIDIA, AMD, Intel, Google, Amazon Web Services (AWS), Microsoft Azure, IBM, Huawei, Dell Technologies, and Alibaba Cloud. These companies are focused on enhancing their product offerings, expanding their geographic reach, and developing advanced technologies to meet the growing demands of various sectors.

NVIDIA stands out as a leader in the Data Center GPU market, primarily due to its pioneering work in GPU architectures and AI solutions. The company has consistently innovated its product line to cater to the evolving needs of data centers, establishing itself as a preferred choice for organizations seeking high-performance computing solutions. Meanwhile, AMD and Intel are also gaining traction by introducing competitive offerings and enhancing their GPU capabilities. The competitive dynamics in the Data Center GPU market are expected to intensify, driven by technological advancements, collaborations, and the increasing demand for high-performance computing solutions across industries.

Report Objectives:

The report will help you answer some of the most critical questions in the Data Center GPU Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Data Center GPU market?

- What is the size of the Data Center GPU market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 13.5 billion |

|

Forecasted Value (2030) |

USD 105.0 billion |

|

CAGR (2024 – 2030) |

34.0% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Data Center GPU Market By Function (Training, Inference), By Deployment Type (Cloud, On-premise), By End-Use (Cloud Service Providers, Enterprises, Government) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and Rest of Asia Pacific), Latin America (Brazil, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Data Center GPU Market, by Deployment Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1.Cloud |

|

4.2.On-premise |

|

5.Data Center GPU Market, by Function (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1.Inference |

|

5.2.Training |

|

5.3.Others |

|

6.Data Center GPU Market, by End-Use (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1.Enterprises |

|

6.2.Cloud Service Providers |

|

6.3.Government |

|

7.Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Data Center GPU Market, by Deployment Type |

|

7.2.7.North America Data Center GPU Market, by Function |

|

7.2.8.North America Data Center GPU Market, by End-Use |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Data Center GPU Market, by Deployment Type |

|

7.3.1.2.US Data Center GPU Market, by Function |

|

7.3.1.3.US Data Center GPU Market, by End-Use |

|

7.3.2.Canada |

|

7.3.3.Mexico |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.Micron Technology |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Alphabet |

|

9.3.Advanced Micro Devices, Inc. (AMD) |

|

9.4.NVIDIA |

|

9.5.IBM |

|

9.6.Intel |

|

9.7.Microsoft |

|

9.8.Qualcomm |

|

9.9.Samsung |

|

9.10.Apple |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Data Center GPU Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to measure the impact of them on the Data Center GPU Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Data Center GPU ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the Data Center GPU market. These methods were also employed to estimate the size of various sub-segments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA