As per Intent Market Research, the Data Center Equipment Market was valued at USD 61.1 billion in 2024-e and will surpass USD 213.9 billion by 2030; growing at a CAGR of 19.6% during 2025 - 2030.

The data center equipment market is expanding rapidly, driven by the increasing demand for data storage, cloud computing, and high-performance computing solutions across industries. As businesses and organizations generate and process enormous amounts of data, there is a growing need for reliable and efficient infrastructure to support these operations. Data centers, which house critical IT systems and infrastructure, require specialized equipment to ensure uptime, scalability, and optimal performance. This market includes various components such as servers, storage devices, network equipment, cooling systems, and power distribution units (PDUs), all of which are essential to maintaining the efficiency and reliability of data center operations.

The market is segmented by product type, end-user, and application, each contributing to the overall growth of the sector. Enterprises, cloud service providers, and hyperscale data centers are the primary end-users of data center equipment, all of which require robust infrastructure to meet the demands of modern computing. The rise of cloud computing, big data analytics, and disaster recovery services has further fueled the market, as these technologies require sophisticated data centers to manage vast volumes of data. The increasing reliance on digital platforms and the growing trend of remote work are expected to continue driving demand for data center equipment, positioning this market for sustained growth.

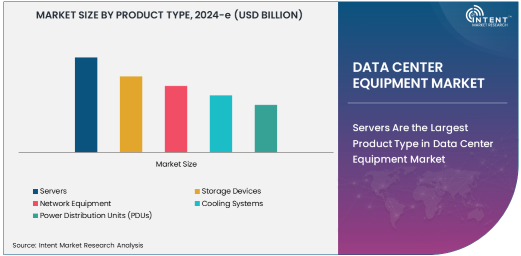

Servers Are the Largest Product Type in Data Center Equipment Market

Among the various product types in the data center equipment market, Servers are the largest and most critical component. Servers are the backbone of any data center, responsible for processing, managing, and storing data across various applications and services. They are used to support everything from cloud computing and data storage to big data analytics and disaster recovery. As enterprises and organizations continue to increase their digital operations, the demand for high-performance servers capable of handling large-scale computing tasks has surged.

Modern data centers require servers that can provide high processing power, scalability, and reliability to meet the growing demand for data-intensive applications. The shift towards virtualized environments and cloud computing has further intensified the need for robust server infrastructure. With emerging technologies such as artificial intelligence (AI), machine learning, and edge computing driving data processing requirements, servers remain the most vital and largest product type in the data center equipment market. The growing demand for cloud services and virtualized data environments is expected to continue fueling the market for servers in data centers.

Hyperscale Data Centers Are the Largest End-User Segment

In the end-user segment, Hyperscale Data Centers represent the largest and most significant category. Hyperscale data centers are large-scale facilities built to support massive cloud computing and big data applications, often operated by major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These data centers require substantial investments in infrastructure, including a variety of equipment such as servers, storage devices, cooling systems, and power distribution units (PDUs). As the demand for cloud services and digital storage continues to grow, hyperscale data centers are expanding rapidly to meet the needs of customers worldwide.

Hyperscale data centers are designed to provide high levels of scalability, redundancy, and efficiency, allowing operators to scale up or down based on demand. These centers are characterized by their ability to manage vast amounts of data with minimal latency, offering critical services such as cloud computing, content delivery, and disaster recovery. With cloud adoption increasing among businesses and consumers alike, hyperscale data centers will continue to be the largest and most important end-users of data center equipment in the foreseeable future.

Cloud Computing Drives Demand for Data Center Equipment

In the application segment, Cloud Computing is the largest and fastest-growing application driving the demand for data center equipment. Cloud computing allows organizations to store, manage, and process data remotely, providing scalability and flexibility that traditional on-premise data centers cannot match. As businesses increasingly migrate their operations to the cloud, the need for advanced data center infrastructure has risen dramatically. Cloud service providers require a combination of powerful servers, storage systems, and network equipment to offer services such as software-as-a-service (SaaS), platform-as-a-service (PaaS), and infrastructure-as-a-service (IaaS) to customers.

The rapid growth of cloud computing is directly fueling the demand for all types of data center equipment, including servers, storage devices, and network equipment. The shift to cloud-based services for businesses of all sizes, alongside the expansion of consumer-based applications and services, has made cloud computing the primary driver of the data center equipment market. As cloud services continue to evolve and expand, especially with the integration of artificial intelligence (AI) and machine learning, the demand for data center infrastructure is expected to continue growing.

North America Leads the Data Center Equipment Market

North America is the largest region in the data center equipment market, driven by the presence of major cloud service providers, technology companies, and large-scale enterprises. The region is home to a significant number of hyperscale data centers, particularly in the United States, where major players such as Amazon, Microsoft, and Google operate some of the largest data centers in the world. Additionally, the rapid digital transformation of industries in North America has accelerated the need for robust data center infrastructure to support the growing demand for cloud services, big data analytics, and high-performance computing.

The U.S. and Canada are well-positioned to maintain their dominance in the market, thanks to their advanced technological capabilities, strong infrastructure, and investments in the development of new data centers. Furthermore, the ongoing growth of digital platforms, the rise of artificial intelligence (AI), and the increasing reliance on cloud-based solutions are expected to further solidify North America's leadership in the global data center equipment market.

Competitive Landscape and Leading Companies

The data center equipment market is highly competitive, with several major players providing a wide range of products and services designed to meet the needs of enterprises, cloud service providers, and hyperscale data centers. Key companies in this market include Cisco Systems, Inc., Dell Technologies, Hewlett Packard Enterprise (HPE), IBM Corporation, and Schneider Electric. These companies offer a variety of data center solutions, including servers, storage devices, network equipment, and power distribution units (PDUs), aimed at providing high-performance, scalable, and energy-efficient infrastructure.

The competitive landscape is characterized by innovation and continuous product development, with companies focusing on creating energy-efficient, cost-effective, and high-performance solutions for modern data centers. Partnerships and collaborations are also common in this space, as companies seek to combine their expertise in hardware, software, and cloud technologies to address the growing demand for advanced data center solutions. As data center requirements continue to evolve with the rise of artificial intelligence, machine learning, and edge computing, leading companies are expected to remain at the forefront of the market, driving innovation and competition.

Recent Developments:

- In December 2024, Dell Technologies announced a new series of high-performance servers designed to meet the growing demand for data processing in AI and machine learning applications in large data centers.

- In November 2024, Hewlett Packard Enterprise (HPE) unveiled a new line of energy-efficient storage solutions aimed at reducing the carbon footprint of data centers while providing scalable storage options.

- In October 2024, Cisco Systems launched an updated version of its data center networking solutions, featuring improved performance and enhanced security capabilities to support cloud-based applications.

- In September 2024, Schneider Electric introduced an advanced cooling system that utilizes artificial intelligence for real-time energy optimization in data centers, helping companies reduce operational costs.

- In August 2024, Huawei Technologies secured a major contract to supply power distribution units (PDUs) and servers for a hyperscale data center in Southeast Asia, expected to support growing cloud services demand.

List of Leading Companies:

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Cisco Systems

- IBM Corporation

- Schneider Electric

- Huawei Technologies

- Hitachi Ltd.

- Vertiv Co.

- Pure Storage, Inc.

- Juniper Networks, Inc.

- Arista Networks, Inc.

- Lenovo Group Ltd.

- Eaton Corporation

- Intel Corporation

- Toshiba Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 61.1 Billion |

|

Forecasted Value (2030) |

USD 213.9 Billion |

|

CAGR (2025 – 2030) |

19.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Data Center Equipment Market by Product Type (Servers, Storage Devices, Network Equipment, Cooling Systems, Power Distribution Units (PDUs)), End-User (Enterprises, Cloud Service Providers, Colocation Data Centers, Hyperscale Data Centers), Application (Data Storage, Cloud Computing, Big Data and Analytics, Disaster Recovery and Backup) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, IBM Corporation, Schneider Electric, Huawei Technologies, Hitachi Ltd., Vertiv Co., Pure Storage, Inc., Juniper Networks, Inc., Arista Networks, Inc., Lenovo Group Ltd., Eaton Corporation, Intel Corporation, Toshiba Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Data Center Equipment Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Servers |

|

4.2. Storage Devices |

|

4.3. Network Equipment |

|

4.4. Cooling Systems |

|

4.5. Power Distribution Units (PDUs) |

|

5. Data Center Equipment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Enterprises |

|

5.2. Cloud Service Providers |

|

5.3. Colocation Data Centers |

|

5.4. Hyperscale Data Centers |

|

6. Data Center Equipment Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Data Storage |

|

6.2. Cloud Computing |

|

6.3. Big Data and Analytics |

|

6.4. Disaster Recovery and Backup |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Data Center Equipment Market, by Product Type |

|

7.2.7. North America Data Center Equipment Market, by End-User |

|

7.2.8. North America Data Center Equipment Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Data Center Equipment Market, by Product Type |

|

7.2.9.1.2. US Data Center Equipment Market, by End-User |

|

7.2.9.1.3. US Data Center Equipment Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Dell Technologies |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Hewlett Packard Enterprise (HPE) |

|

9.3. Cisco Systems |

|

9.4. IBM Corporation |

|

9.5. Schneider Electric |

|

9.6. Huawei Technologies |

|

9.7. Hitachi Ltd. |

|

9.8. Vertiv Co. |

|

9.9. Pure Storage, Inc. |

|

9.10. Juniper Networks, Inc. |

|

9.11. Arista Networks, Inc. |

|

9.12. Lenovo Group Ltd. |

|

9.13. Eaton Corporation |

|

9.14. Intel Corporation |

|

9.15. Toshiba Corporation |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Data Center Equipment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Data Center Equipment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Data Center Equipment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA