As per Intent Market Research, the Cyber Knife Market was valued at USD 1.9 Billion in 2024-e and will surpass USD 3.2 Billion by 2030; growing at a CAGR of 8.9% during 2025 - 2030.

The Cyber Knife market is an essential segment within the medical devices industry, offering advanced solutions for non-invasive cancer treatment. Cyber Knife technology, also known as robotic radiosurgery, is used to treat tumors in the body with high precision using radiation. Unlike traditional surgery, Cyber Knife systems are capable of delivering precise radiation directly to tumors without the need for incisions, making them a preferred option for patients who are inoperable or wish to avoid conventional surgery. The growing prevalence of cancer worldwide, combined with technological advancements in medical imaging and radiosurgery, is driving the growth of the Cyber Knife market.

The increasing adoption of Cyber Knife systems is driven by their ability to treat tumors in difficult-to-reach areas, such as the spine, brain, and lungs, with minimal risk of damage to surrounding healthy tissue. This technology is revolutionizing cancer treatment, offering patients an alternative to traditional radiation therapy and surgery. As healthcare providers continue to adopt more advanced, minimally invasive treatment options, the demand for Cyber Knife systems is expected to rise, making it one of the most innovative and rapidly growing segments within cancer care.

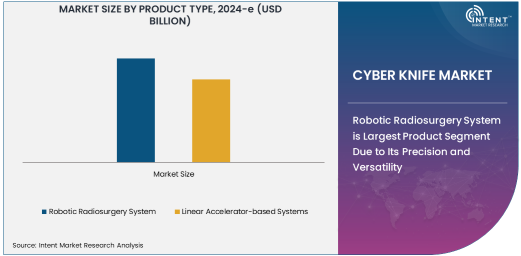

Robotic Radiosurgery System is Largest Product Segment Due to Its Precision and Versatility

The Robotic Radiosurgery System is the largest product segment in the Cyber Knife market, largely due to its superior precision and versatility in treating tumors. This system uses a robotic arm to deliver highly targeted radiation to tumors, offering a non-invasive treatment option with minimal discomfort for patients. The precision of the robotic system enables oncologists to treat tumors with high accuracy, even in areas that are difficult to reach with traditional surgery or other radiation therapies.

Robotic radiosurgery systems can be used for a wide variety of conditions, including brain, spine, liver, lung, and prostate cancers, which makes them extremely versatile in clinical settings. The ability to track and adjust to patient movement during treatment further enhances the effectiveness of this system, making it the preferred choice in the market. As technological advancements continue to improve the functionality of robotic radiosurgery systems, the demand for these systems is expected to continue rising, solidifying their position as the largest segment in the Cyber Knife market.

Image-guided Radiosurgery is Fastest Growing Technology Due to Enhanced Accuracy in Tumor Treatment

Image-guided radiosurgery is the fastest-growing technology within the Cyber Knife market, primarily due to its ability to improve the accuracy of radiation delivery. This technology allows for real-time imaging of the tumor and surrounding tissues during treatment, enabling healthcare providers to target the tumor with unmatched precision. Image-guided radiosurgery is particularly beneficial in treating tumors located in complex or sensitive areas of the body, such as the brain or near vital organs.

The real-time imaging feature enhances the effectiveness of radiation treatment by compensating for patient movement during the procedure. This reduces the potential for damage to healthy tissue and ensures that the tumor receives the appropriate radiation dose. As advancements in medical imaging continue to evolve, the integration of image-guided radiosurgery with robotic radiosurgery systems will drive the growth of this technology, making it the fastest-growing segment in the Cyber Knife market.

Hospitals are Largest End-Use Application Segment Due to High Demand for Advanced Cancer Treatment

Hospitals are the largest end-use application segment in the Cyber Knife market, driven by the high demand for advanced cancer treatment solutions. Hospitals play a central role in providing comprehensive healthcare services, including cancer diagnosis and treatment, which makes them the primary setting for the installation and use of Cyber Knife systems. The increasing adoption of minimally invasive, precision-based treatments in hospitals has led to a growing preference for robotic radiosurgery systems in oncology departments.

Hospitals are equipped with the necessary infrastructure and specialized medical staff to operate sophisticated technologies like Cyber Knife systems. Additionally, the ability to offer advanced treatment options to cancer patients, including those with tumors that are otherwise difficult to treat, makes hospitals the largest consumers of Cyber Knife systems. As cancer incidence rates continue to rise globally, hospitals will remain the key end-users of these advanced treatment technologies, ensuring the dominance of this segment in the market.

North America is Largest Region Owing to Well-Established Healthcare Infrastructure

North America is the largest region in the Cyber Knife market, driven by the well-established healthcare infrastructure, high cancer prevalence, and increasing adoption of advanced cancer treatment technologies. The United States, in particular, is a major market for Cyber Knife systems, with numerous hospitals and cancer treatment centers adopting these systems for the treatment of a variety of cancers. The region is known for its advanced medical technologies and high healthcare spending, which supports the rapid growth of the Cyber Knife market.

In addition to the strong healthcare infrastructure, North America benefits from continuous investments in cancer research and treatment innovation. This has led to a growing demand for non-invasive treatment options, including Cyber Knife systems. As the market for advanced cancer treatment continues to expand, North America is expected to maintain its leadership position, further driving the growth of the Cyber Knife market.

Competitive Landscape and Key Players

The Cyber Knife market is highly competitive, with several leading companies offering advanced systems for radiosurgery and cancer treatment. Prominent players in this market include Accuray Incorporated, the developer of the CyberKnife system, Varian Medical Systems, Elekta AB, and ViewRay, Inc. These companies are at the forefront of innovation, constantly improving their product offerings to meet the growing demand for precise and minimally invasive cancer treatment solutions.

The competitive landscape is characterized by continuous technological advancements, with companies focusing on enhancing the precision, usability, and integration of Cyber Knife systems. Strategic partnerships, mergers, and acquisitions are also common in the market as companies seek to expand their product portfolios and strengthen their market presence. As the market evolves, these key players will continue to drive innovation and shape the future of radiosurgery in cancer treatment.

Recent Developments:

- Accuray Inc. introduced an upgraded version of its CyberKnife system, featuring enhanced imaging capabilities and improved tumor tracking for greater precision in treatment.

- Varian Medical Systems announced a partnership with several leading cancer treatment centers to integrate its CyberKnife systems with advanced AI-based analytics for improved patient outcomes.

- Siemens Healthineers launched a new robotic radiosurgery solution aimed at offering more personalized cancer treatment, with enhanced real-time imaging and treatment customization.

- Elekta AB received regulatory approval for its new stereotactic radiosurgery platform, offering higher precision and reduced treatment time compared to traditional methods.

- GE Healthcare expanded its cyber knife product portfolio by incorporating advanced imaging technologies to support both diagnostic and therapeutic radiotherapy procedures in oncology.

List of Leading Companies:

- Accuray Inc.

- Elekta AB

- Varian Medical Systems

- Siemens Healthineers

- Koninklijke Philips N.V.

- GE Healthcare

- Panasonic Healthcare

- Hitachi Ltd.

- Brainlab AG

- Medtronic PLC

- Toshiba Medical Systems Corporation

- Samsung Medison Co., Ltd.

- Cancer Treatment Services International

- Shandong Sinocare, Inc.

- United Imaging Healthcare Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.9 Billion |

|

Forecasted Value (2030) |

USD 3.2 Billion |

|

CAGR (2025 – 2030) |

8.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Cyber Knife Market by Product Type (Robotic Radiosurgery System, Linear Accelerator-based Systems), Technology (Image-guided Radiosurgery, Stereotactic Radiosurgery), End-Use Application (Hospitals, Specialty Clinics, Cancer Treatment Centers) and By Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Accuray Inc., Elekta AB, Varian Medical Systems, Siemens Healthineers, Koninklijke Philips N.V., GE Healthcare, Hitachi Ltd., Brainlab AG, Medtronic PLC, Toshiba Medical Systems Corporation, Samsung Medison Co., Ltd., Cancer Treatment Services International, United Imaging Healthcare Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Cyber Knife Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Robotic Radiosurgery System |

|

4.2. Linear Accelerator-based Systems |

|

5. Cyber Knife Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Image-guided Radiosurgery |

|

5.2. Stereotactic Radiosurgery |

|

6. Cyber Knife Market, by End-Use Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Specialty Clinics |

|

6.3. Cancer Treatment Centers |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Cyber Knife Market, by Product Type |

|

7.2.7. North America Cyber Knife Market, by Technology |

|

7.2.8. North America Cyber Knife Market, by End-Use Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Cyber Knife Market, by Product Type |

|

7.2.9.1.2. US Cyber Knife Market, by Technology |

|

7.2.9.1.3. US Cyber Knife Market, by End-Use Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Accuray Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Elekta AB |

|

9.3. Varian Medical Systems |

|

9.4. Siemens Healthineers |

|

9.5. Koninklijke Philips N.V. |

|

9.6. GE Healthcare |

|

9.7. Panasonic Healthcare |

|

9.8. Hitachi Ltd. |

|

9.9. Brainlab AG |

|

9.10. Medtronic PLC |

|

9.11. Toshiba Medical Systems Corporation |

|

9.12. Samsung Medison Co., Ltd. |

|

9.13. Cancer Treatment Services International |

|

9.14. Shandong Sinocare, Inc. |

|

9.15. United Imaging Healthcare Co., Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Cyber Knife Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Cyber Knife Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Cyber Knife Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA