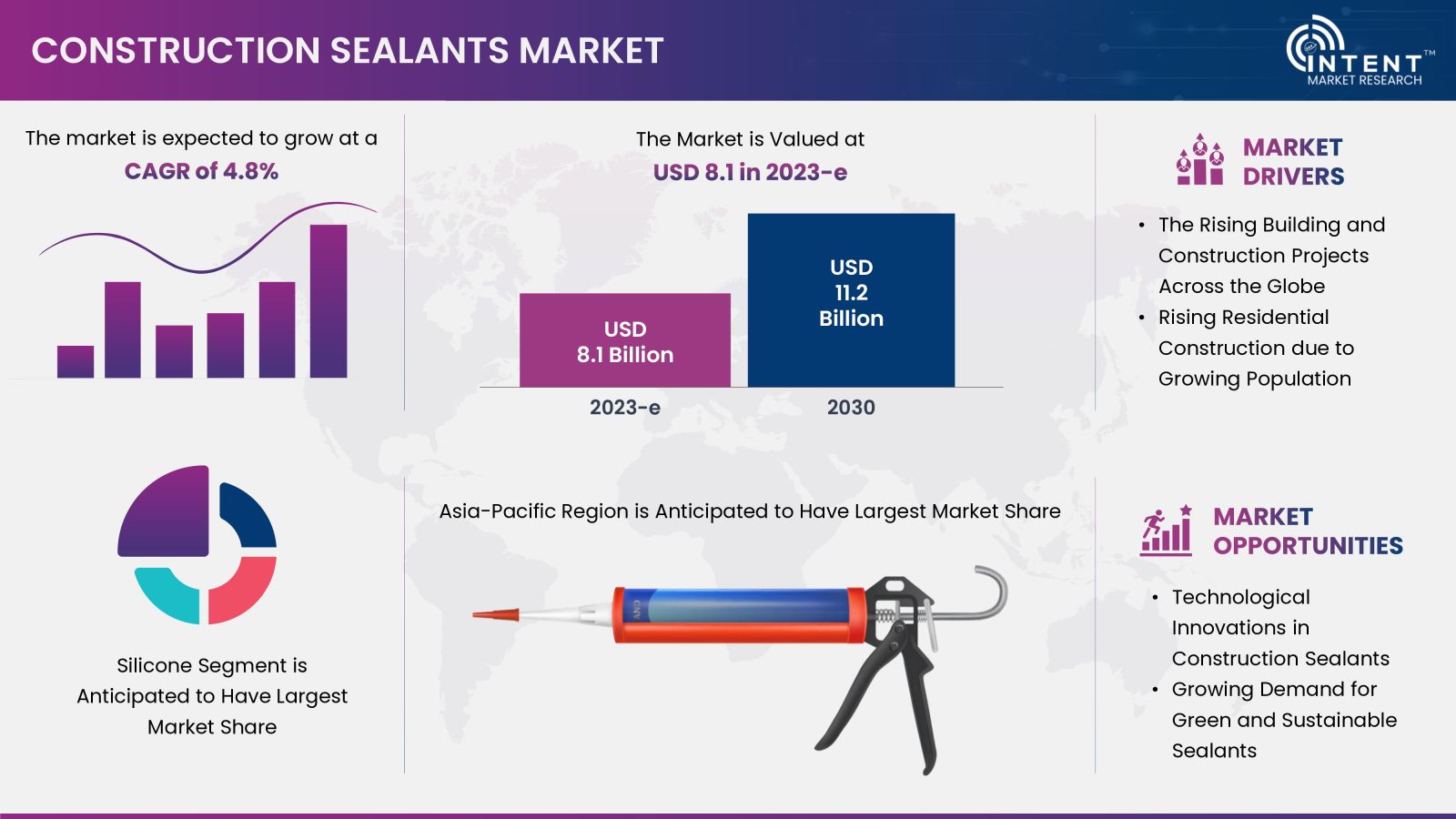

As per Intent Market Research, the Construction Sealants Market size is expected to grow from USD 8.1 billion in 2023 to USD 11.2 billion by 2030, at a CAGR of 4.8% during the forecast period (2024-2030). The construction sealants market is moderately competitive, with numerous manufacturers vying for a significant share. Prominent players include 3M, Arkema, BASF, Dow, DuPont, Evonik, GE Sealants, H.B. Fuller, Henkel, PPG, Sika, Titebond, Tremco, and Wacker among others. The rising building and construction projects across the globe is driving the market growth.

The construction sealants market is expected to grow significantly over the forecast period due to their benefits such as thermal stability, humidity and moisture resistance, weather condition resistance, and insulation. Construction sealants are developed to provide excellent resistance to chemicals and other weather conditions and high strength to the joints.

Construction sealants are the specialized compounds used in the building and construction sector to fill and seal seams, joints, gaps, and fractures in a variety of constructions. These sealants are intended to improve the general performance and longevity of buildings by preventing the intrusion of air, water, dust, or other environmental components. The demand for construction sealants continues to grow as industries recognize the potential for improved stability and resistance, thereby driving ongoing research & development in construction sealant materials.

Construction Sealants Market Dynamics

The Rising Building and Construction Projects Across the Globe are Expected To Drive the Market

Construction sealants are primarily used to seal gaps and cracks in structures to provide a barrier that prevents problems such as water leaks, air penetration, and the entry of contaminants. Sealants are essential for maintaining the durability and long-term efficacy of buildings, particularly in locations where several building materials converge or where settling and movement may take place. For instance, in 2023, according to Associated General Contractors of America, a US-based trade association, the construction sector plays a significant role in the U.S. economy, with over 919,000 construction establishments in the US. This industry provides employment for 8.0 million workers and contributes to the creation of structures valued at nearly $2.1 trillion annually.

Stringent Environmental Regulations Associated with the Construction Sealants May Hinder the Market Growth

The stringent laws and guidelines governing construction sealants market due to the toxicity of sealants produced using solvent-borne technologies. Solvent-based sealants are mainly responsible for the emission of volatile organic substances during evaporation after application. Volatile organic compounds (VOCs) are precursor pollutants that help to create fine particulate matter and ground-level ozone, both of which creates smog.

Construction Sealants Market Segment Insights

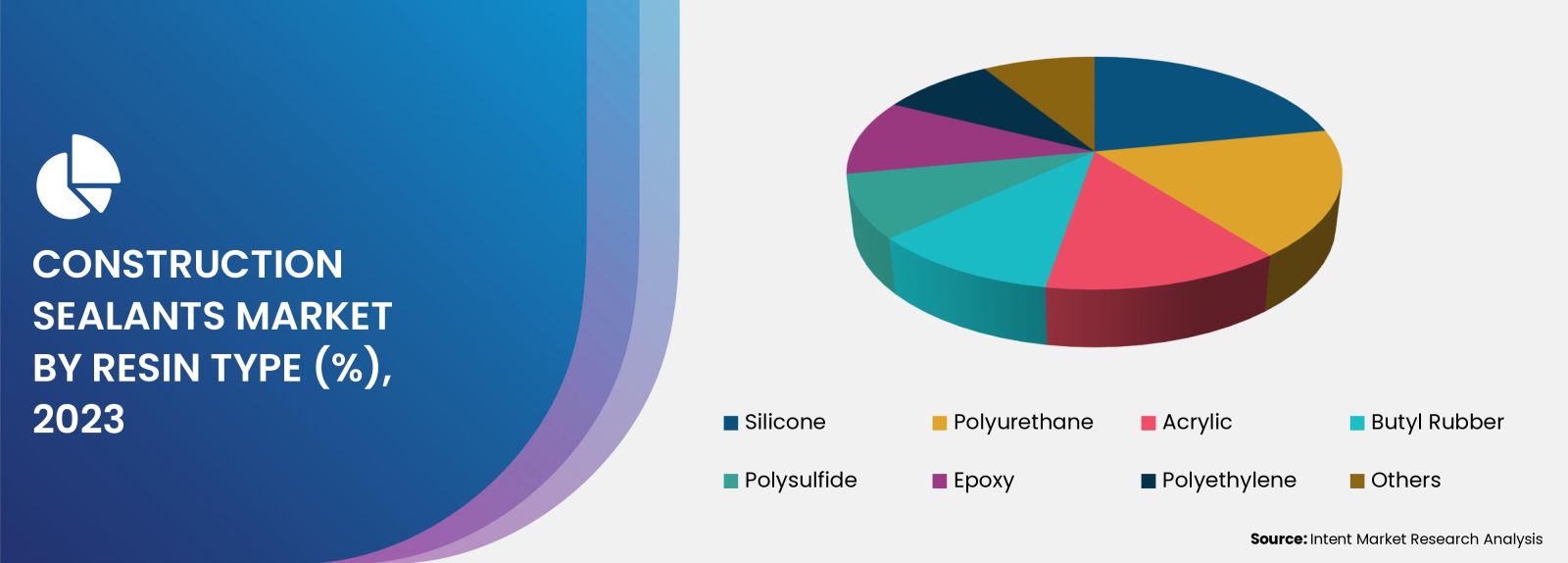

The Silicone Segment Holds the Largest Market Share

The silicone segment has the largest market share due to various advantages it offers such as flexibility along with adhesion to the joint, exhibit durability by providing enough strength, chemical and weather resistance and non-corrosive nature. These benefits allow the material to be used with any metal in construction.

Major market players are involved in development of innovative silicone-based sealants from bio-based raw materials to reduce environmental emissions and offer superior stability to the surface. For instance, in December 2020, Wacker Chemie a Germany-based chemical company launched bio-based silicone sealants ELASTOSIL for construction applications. Sealants are widely employed in professional construction applications due to their extended shelf life.

Wacker Chemie maintains a commitment to traceability, ensuring transparency regarding the origins of renewable raw materials throughout the complete production cycle. This process encompasses the initial upstream stages through to the preparation of the final silicone sealant with longer shelf life.

Water-Based Sealants is Expected to Grow Significantly During the Forecast Period

The water-based construction sealant segment is expected to grow significantly owing to its simplicity of application, Low Volatile Organic Compound (VOC) content, and environmental friendliness. In theconstruction industry, water-based sealants are formulations that, rather than conventional solvents such as petroleum-based chemicals, employ water as the main solvent or carrier, which is gaining popularity.

For instance, in 2019, GE Sealants launched its new range of silicone acrylic latex caulks and sealants, which consists of nine solutions that provide paint projects with enduring protection both inside and outdoors. These water-based acrylic latex sealants are designed for a variety of applications, including kitchens and baths, windows and doors, and seals and paints, to provide durability and weather resistance.

Glazing Segment Held the Major Share in Construction Sealants Market

The glazing segment is expected to hold the major market share due to the extensive use of construction sealants in the fitting of glass windows, where sealants are used to seal joints between glass and window frames. In construction, glazing sealants are essential, especially for installing windows, glass panels, and other glazed components. The purpose of these sealants is to maintain the integrity of the building envelope by offering a strong and weather-resistant seal between glass and different types of frame materials.

For instance, in September 2022, Saint-Gobain, a France-based company, launched ORAE, which is a low-carbon glass developed to reduce greenhouse gas emissions from buildings. This glass is designed to promote sustainability and reduce the carbon footprint generated by construction buildings.

Residential End-users Holds the Largest Market Share in the Construction Sealants Market

The residential sector holds the largest market share, driven by its numerous advantages in residential buildings. These benefits encompass preventing water infiltration through joints in various building materials, preserving the structural integrity of residential structures, and enhancing the visual appeal of buildings by providing a neat and polished appearance.

These advantages have significantly contributed to the upsurge in residential construction spending in recent years. For instance, as of April 2023, a report indicated that the total residential construction spending in the US reached USD 852 billion in 2022, with USD 368 billion allocated to single-unit housing and USD 123 billion to multi-family units. Consequently, the escalating expenditure on residential construction is anticipated to propel market growth.

Asia-Pacific is Poised to Dominate in Market Growth in the Forecast Period

Asia-Pacific is expected to dominate the market due to the rapidly growing construction industry in developing countries along with the increasing number of ongoing construction projects. The major factors contributing to the growth of this region are the rising demand for bio-based sealants and infrastructure development, foreign investments attracted by low labor costs and readily available raw materials, government initiatives to boost manufacturing, and the increasing number of end-use industries.

For instance, in 2023, Sika AG established a new, cutting-edge technology center in Suzhou, China, and has greatly increased its research & development capabilities throughout the Asia-Pacific area. This center's main objective is to create high-performance, sustainable technologies that will enable Sika to significantly impact the transformation of the automotive and construction sectors. To fully realize market potential throughout the Asia-Pacific region, the new center of excellence will be crucial.

Major Industry Players are Enhancing their Market Positions By Actively Developing Construction Sealants Products

The market is characterized by intense competition due to the presence of numerous international and domestic players. The construction sealants market, in particular, is dominated by key players such as 3M, Arkema, BASF, Dow, DuPont, Evonik, GE Sealants, H.B. Fuller, Henkel, PPG, Sika, Titebond, Tremco and Wacker among others. These industry leaders are primarily focused on acquiring smaller players and innovating their product lines to promote innovation to reduce carbon emissions and enhance stability in the bio-economy. The success of market players is heavily dependent on their ability to adapt to changing market trends and consumer preferences.

- In June 2022, Evonik Industries, a Germany-based chemical company launched a sustainable liquid polybutadienes construction sealant with POLYVEST. It has been demonstrated that using sustainably generated butadiene in the production of this cutting-edge product line may minimize the usage of fossil raw materials by as much as 99.9% supporting bio-economy.

- In September 2023, IMERYS announced their strategic collaboration with VINCI Construction to develop sustainable construction solutions. Through this collaboration, both companies are working together to develop sustainable production used in construction to reduce greenhouse emissions.

Construction Sealants Market Coverage

The report provides key insights into the construction sealants market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market. The report offers the market size and forecasts for the construction sealants market in value (USD billion) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 8.1 billion |

|

Forecast Revenue (2030) |

USD 11.2 billion |

|

CAGR (2024-2030) |

4.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

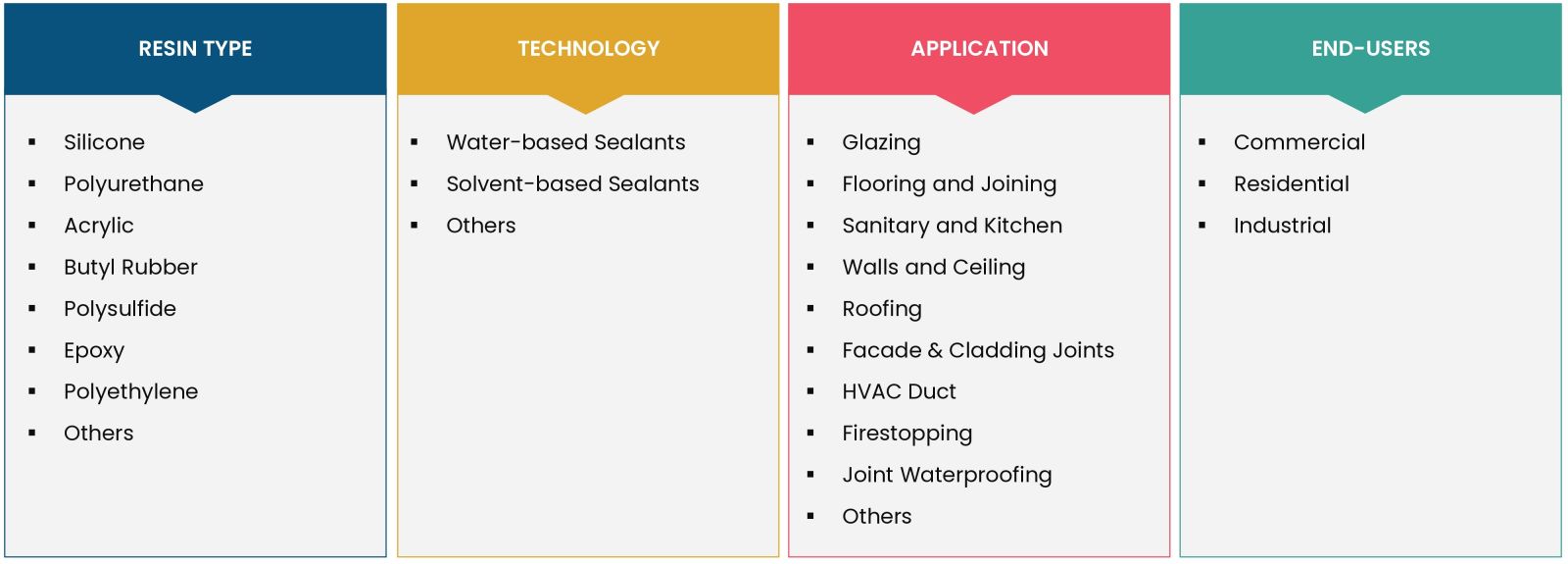

Segments Covered |

By Resin Type (Silicone, Polyurethane, Acrylic, Butyl Rubber, Polysulfide, Epoxy, Polyethylene, Others), By Technology (Water-Based Sealants, Solvent-Based Sealants, Others), By Application (Glazing, Flooring and Joining, Sanitary and Kitchen, Walls and Ceiling, Roofing, Facade and Cladding Joints, HVAC Duct, Firestopping, Joint Waterproofing, Others), By End-users (Commercial, Residential, Industrial, Infrastructural) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

3M, Arkema, BASF, Dow, DuPont, Evonik, GE Sealants, H.B. Fuller, Henkel, PPG, Sika, Titebond, Tremco, Wacker |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Rising Building and Construction Projects Across the Globe |

|

4.1.2.Rising Residential Construction Due to Growing Population |

|

4.1.3.Technological Innovation in Construction Sealants |

|

4.2.Market Growth Restraints |

|

4.2.1.Stringent Environmental Regulations Associated with Construction Sealants |

|

4.3.Market Growth Opportunities |

|

4.3.1.Growing Demand for Green and Sustainable Sealants |

|

5.Market Outlook |

|

5.1.Supply Chain Analysis |

|

5.2.Technology Trends |

|

5.3.Patent Analysis |

|

6.Market Segment Outlook (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

6.1.Segment Synopsis |

|

6.2.By Resin Type |

|

6.2.1.Silicone |

|

6.2.2.Polyurethane |

|

6.2.3.Acrylic |

|

6.2.4.Butyl Rubber |

|

6.2.5.Polysulfide |

|

6.2.6.Epoxy |

|

6.2.7.Polyethylene |

|

6.2.8.Others |

|

6.3.By Technology |

|

6.3.1.Water-based Sealants |

|

6.3.2.Solvent-based Sealants |

|

6.4.By Application |

|

6.4.1.Glazing |

|

6.4.2.Flooring and Joining |

|

6.4.3.Sanitary and Kitchen |

|

6.4.4.Walls and Ceiling |

|

6.4.5.Roofing |

|

6.4.6.Façade and Cladding Joints |

|

6.4.7.HVAC Duct |

|

6.4.8.Firestopping |

|

6.4.9.Joint Waterproofing |

|

6.4.10. Others |

|

6.5.By End-use |

|

6.5.1.Commercial |

|

6.5.2.Residential |

|

6.5.3.Industrial |

|

6.5.4.Infrastructural |

|

7.Regional Outlook (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America Construction Sealants Market Outlook |

|

7.2.2.US |

|

7.2.2.1.US Construction Sealants Market, By Resin Type |

|

7.2.2.2.US Construction Sealants Market, By Technology |

|

7.2.2.3.US Construction Sealants Market, By Application |

|

7.2.2.4.US Construction Sealants Market, By End-users |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3.Canada |

|

7.2.4.Mexico |

|

7.3.Europe |

|

7.3.1.Europe Construction Sealants Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Spain |

|

7.3.6.Italy |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific Construction Sealants Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Latin America |

|

7.5.1.Latin America Construction Sealants Market Outlook |

|

7.5.2.Brazil |

|

7.5.3.Argentina |

|

7.6.Middle East & Africa |

|

7.6.1.Middle East & Africa Construction Sealants Market Outlook |

|

7.6.2.Saudi Arabia |

|

7.6.3.UAE |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Company Strategy Analysis |

|

8.3.Competitive Matrix |

|

9.Company Profiles |

|

9.1.Construction Sealants Companies (Supply-Side) |

|

9.1.1.3M |

|

9.1.1.1. Company Synopsis |

|

9.1.1.2. Company Financials |

|

9.1.1.3. Product/Service Portfolio |

|

9.1.1.4. Recent Developments |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.1.2.Arkema |

|

9.1.3.BASF |

|

9.1.4.Dow |

|

9.1.5.DuPont |

|

9.1.6.Evonik |

|

9.1.7.GE Sealants |

|

9.1.8.H.B. Fuller |

|

9.1.9.PPG |

|

9.1.10.Sika |

|

9.1.11.Titebond |

|

9.1.12.Tremco |

|

9.1.13.Wacker |

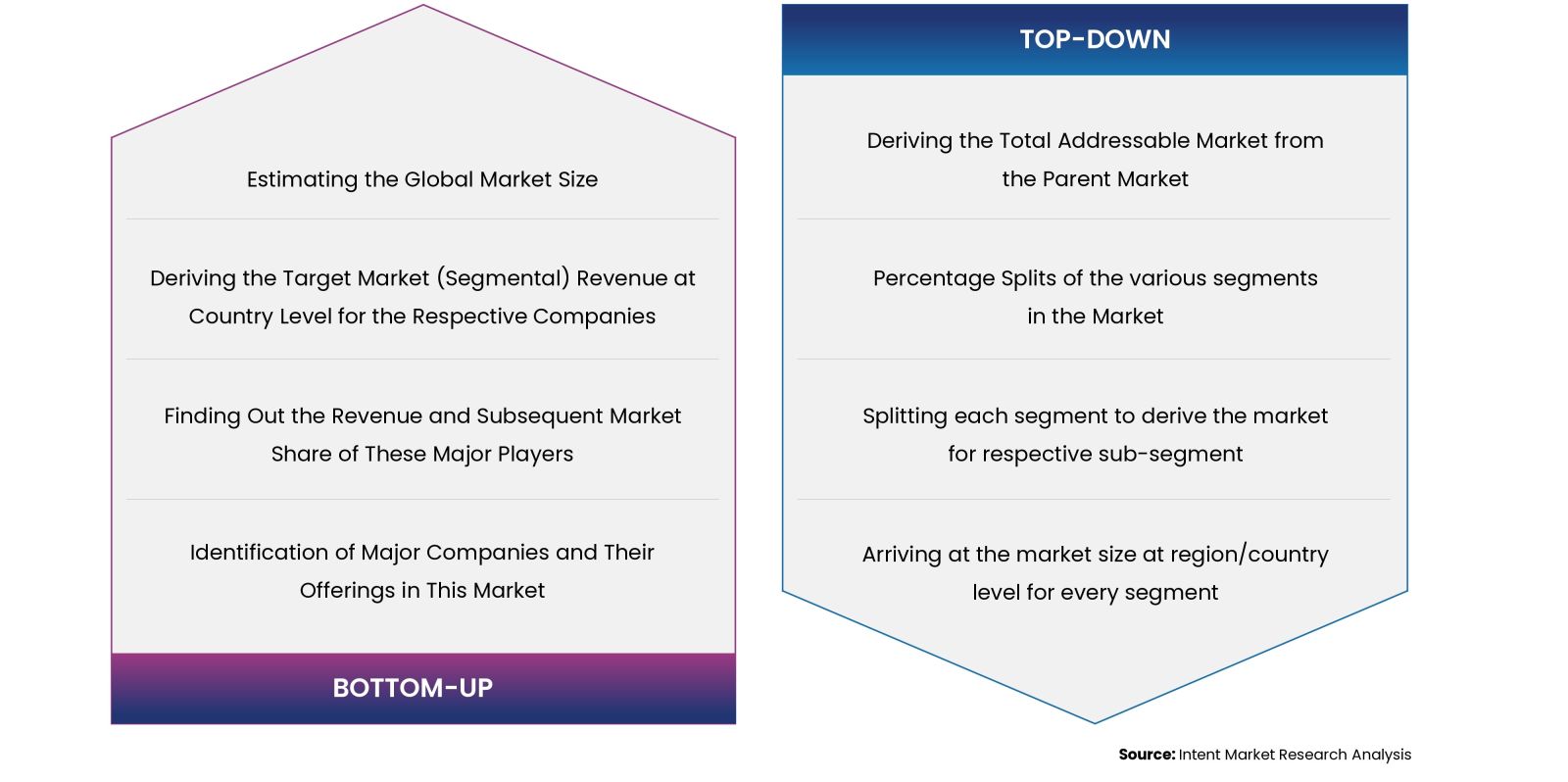

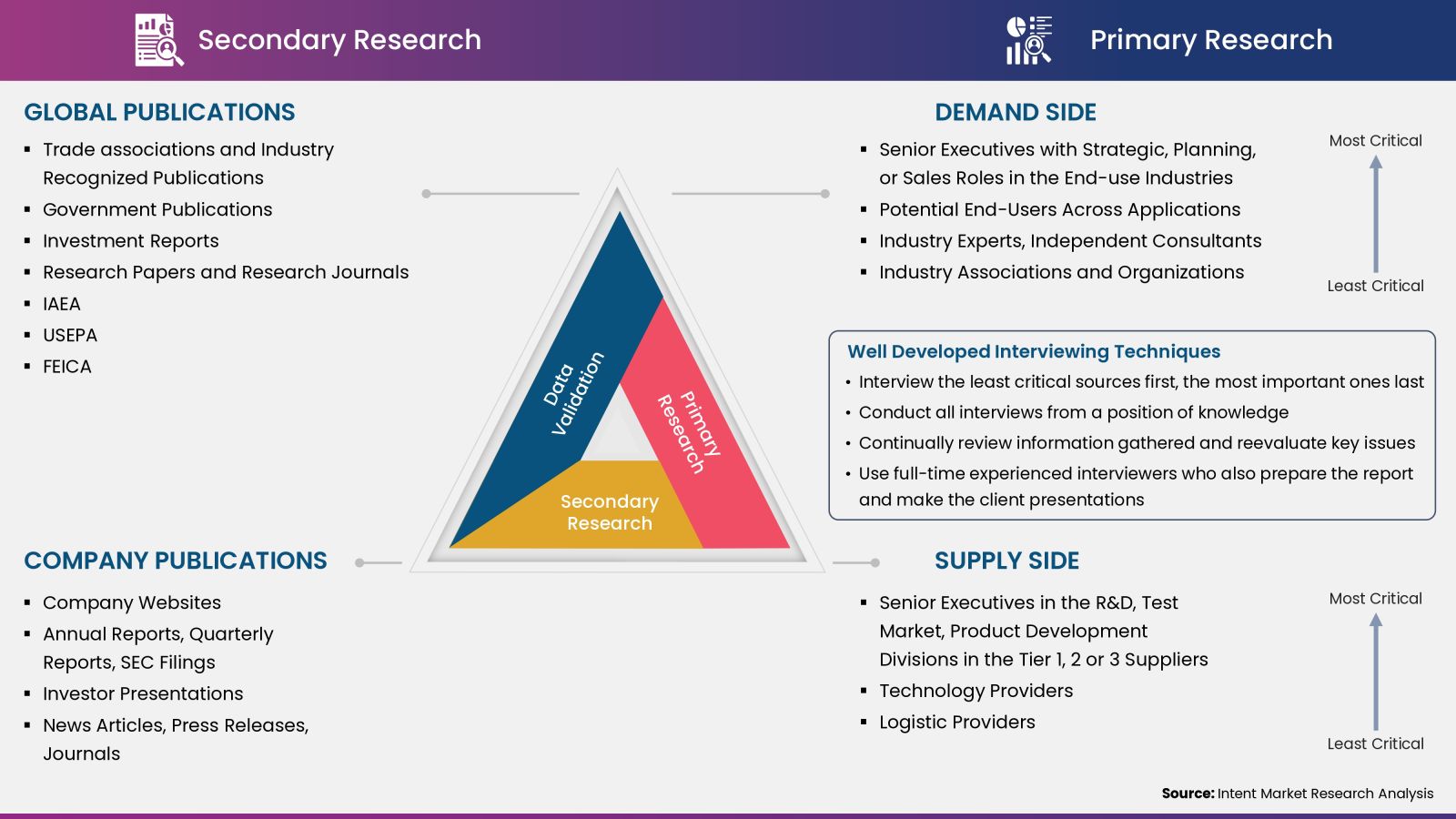

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.