As per Intent Market Research, the Construction Estimating Software Market was valued at USD 2.6 Billion in 2024-e and will surpass USD 6.0 Billion by 2030; growing at a CAGR of 12.9% during 2025-2030.

The construction estimating software market has seen remarkable growth in recent years, driven by the increasing demand for accuracy and efficiency in project cost estimation across various sectors. Construction companies, large and small, are increasingly adopting digital tools to streamline their estimation processes, enhance budgeting precision, and reduce the risk of cost overruns. These software solutions allow businesses to calculate material costs, labor expenses, and other project-related expenses with a higher degree of accuracy, reducing time-consuming manual tasks. The market is expected to continue expanding as more players within the construction industry recognize the benefits of advanced software tools for improving project planning and management.

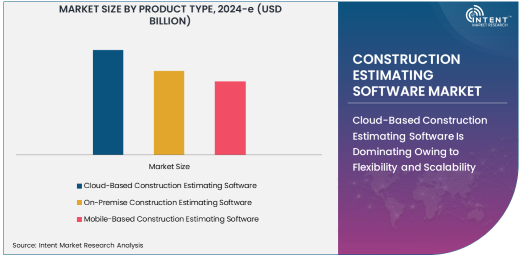

Cloud-Based Construction Estimating Software Is Dominating Owing to Flexibility and Scalability

Among the various product types, cloud-based construction estimating software is the largest segment in the market, largely due to its flexibility, scalability, and accessibility. Cloud solutions allow users to access their data from anywhere, making it ideal for project managers and teams that work in different locations. The ability to collaborate in real-time from any device has become crucial in the construction industry, where teams often operate on job sites and in the office simultaneously. Furthermore, cloud-based software eliminates the need for substantial infrastructure investments, as all data is hosted off-site, ensuring scalability for growing companies and projects.

As more construction firms transition to cloud-based systems, the demand for these solutions continues to grow. Cloud-based estimating software helps teams collaborate on cost estimates, provides a centralized data hub, and offers real-time updates on project progress. This integration with cloud services not only reduces the time spent on administrative tasks but also enables businesses to operate with greater agility and manage multiple projects concurrently. The trend toward cloud adoption is expected to remain strong, further cementing its position as the largest subsegment in the market.

Residential Construction Is the Largest End-User Industry Segment

In terms of end-user industries, residential construction is the largest segment in the market for construction estimating software. The residential sector is the backbone of the global construction industry, driven by ongoing urbanization, population growth, and the demand for housing. Estimating software plays a crucial role in residential construction, enabling companies to accurately forecast costs for materials, labor, and permits, thereby ensuring that projects stay on budget. As the demand for affordable housing and residential development increases, builders are turning to advanced software to streamline their estimating processes and reduce project delays caused by inaccurate cost assessments.

Residential construction projects often involve multiple stakeholders, including contractors, suppliers, and subcontractors, and effective cost management is essential for ensuring project success. Construction estimating software tailored for residential construction helps streamline collaboration between these stakeholders and ensures that resources are allocated efficiently. This segment's prominence in the market will continue as global housing markets expand and evolve, further driving the demand for efficient estimation tools in residential construction.

Cloud-Based Deployment Is Growing Rapidly with Increasing Preference for Accessibility

Cloud-based deployment is experiencing the fastest growth in the construction estimating software market, primarily due to the rising preference for accessible and scalable solutions. Cloud platforms offer construction firms the ability to store data remotely, with the added benefit of being able to access project information from anywhere, on any device. This flexibility is increasingly valuable as construction projects become more complex, involving numerous parties that need access to the same information in real time. The transition to cloud-based deployment reduces the need for on-site IT infrastructure, allowing companies to focus their resources on core business activities.

Moreover, cloud-based deployment often includes automatic updates and system maintenance, ensuring that software always functions at its highest capacity. This reduces downtime and IT support costs, making it an attractive option for construction companies looking to optimize operations. The shift toward cloud solutions has been a major driver of growth in the estimating software market, and this trend is expected to continue as companies seek more efficient ways to manage their estimating and project management processes.

Cost Estimation Application Is Fast-Growing as Companies Focus on Budget Control

The cost estimation application within construction estimating software is rapidly growing, as companies increasingly focus on staying within budget and avoiding cost overruns. The accurate estimation of material and labor costs is critical for the success of any construction project. With the rise of complex building requirements and the need for greater accuracy, construction companies are turning to advanced software to provide detailed and reliable cost projections. This application helps project managers predict costs more accurately, identify potential cost-saving opportunities, and avoid surprises during the project lifecycle.

Cost estimation tools help construction firms reduce errors in budgeting by automating the calculation process and providing accurate data insights. This not only saves time but also contributes to improved project profitability. As the construction industry continues to prioritize efficiency and cost control, the demand for robust cost estimation applications is expected to accelerate. This application will remain one of the fastest-growing in the construction estimating software market as companies seek to streamline their processes and maximize financial performance.

North America Leads the Market with High Adoption Rates

North America is the largest region for construction estimating software, largely due to the high adoption rates of advanced technologies in the construction industry. The U.S. and Canada are home to many of the world’s largest construction firms, and these companies are increasingly investing in digital solutions to improve their project management capabilities. The region's developed infrastructure and strong demand for residential, commercial, and industrial construction projects further support the need for accurate and efficient cost estimating tools. Additionally, the U.S. construction industry's large-scale infrastructure and government projects contribute to the growing demand for estimating software.

The adoption of cloud-based and mobile-based software solutions is particularly high in North America, as companies continue to embrace digital transformation to stay competitive. As technology continues to evolve, the region is likely to remain a major contributor to the global construction estimating software market. The high levels of investment in construction and infrastructure projects, combined with the push for technological integration, make North America the dominant region in this market.

Competitive Landscape and Leading Companies

The competitive landscape of the construction estimating software market is dynamic, with key players vying for market share through innovation, product development, and strategic partnerships. Leading companies in the market include Procore Technologies, Buildertrend, Sage Group, Viewpoint (Trimble), and PlanSwift. These companies are investing in cloud-based platforms, mobile solutions, and advanced analytics to provide users with more sophisticated tools for project estimation. Additionally, the presence of numerous small and medium-sized enterprises (SMEs) focused on niche markets has increased the overall competitiveness of the industry.

To maintain their leadership positions, these companies are continually upgrading their software solutions to offer greater functionalities and improve user experiences. In addition to organic growth, mergers and acquisitions are common in the sector as larger players seek to expand their offerings and integrate new technologies. The market is expected to witness increased consolidation as companies look to diversify their portfolios and meet the growing demand for integrated software solutions across construction projects.

Recent Developments:

- Procore Technologies introduced an upgraded version of their estimating software, providing enhanced features for cost management, material tracking, and bid management.

- Trimble acquired Viewpoint, adding advanced construction management software, including estimating and project control tools, to its portfolio.

- UDA Technologies entered a partnership with Sage Group to integrate their estimating software with Sage’s financial and accounting platforms for seamless data transfer.

- CoConstruct introduced a new mobile application with features tailored for homebuilders, enhancing field access for cost estimating and project tracking.

- Buildertrend expanded its market reach internationally, releasing updates to improve its cloud-based estimating and project management tools in European and Asian markets.

List of Leading Companies:

- Procore Technologies

- Buildertrend

- PlanSwift

- CoConstruct

- Viewpoint (Trimble)

- Sage Group

- ProEst

- BuilderEdge

- Foundation Software

- RedTeam Software

- UDA Technologies

- e-Builder (Trimble)

- B2W Software

- McCormick Systems

- Finalcad

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.6 Billion |

|

Forecasted Value (2030) |

USD 6.0 Billion |

|

CAGR (2025 – 2030) |

12.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Construction Estimating Software Market: Product Type (Cloud-Based Construction Estimating Software, On-Premise Construction Estimating Software, Mobile-Based Construction Estimating Software), End-User Industry (Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Projects, Government Projects), Deployment (On-Premise, Cloud-Based), Application (Residential Estimating, Commercial Estimating, Industrial Estimating, Project Bidding, Cost Estimation); |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Procore Technologies, Buildertrend, PlanSwift, CoConstruct, Viewpoint (Trimble), Sage Group, ProEst, BuilderEdge, Foundation Software, RedTeam Software, UDA Technologies, e-Builder (Trimble), B2W Software, McCormick Systems, Finalcad |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Construction Estimating Software Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Cloud-Based Construction Estimating Software |

|

4.2. On-Premise Construction Estimating Software |

|

4.3. Mobile-Based Construction Estimating Software |

|

5. Construction Estimating Software Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Residential Construction |

|

5.2. Commercial Construction |

|

5.3. Industrial Construction |

|

5.4. Infrastructure Projects |

|

5.5. Government Projects |

|

6. Construction Estimating Software Market, by Deployment (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. On-Premise |

|

6.2. Cloud-Based |

|

7. Construction Estimating Software Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Residential Estimating |

|

7.2. Commercial Estimating |

|

7.3. Industrial Estimating |

|

7.4. Project Bidding |

|

7.5. Cost Estimation |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Construction Estimating Software Market, by Product Type |

|

8.2.7. North America Construction Estimating Software Market, by End-User Industry |

|

8.2.8. North America Construction Estimating Software Market, by Deployment |

|

8.2.9. North America Construction Estimating Software Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Construction Estimating Software Market, by Product Type |

|

8.2.10.1.2. US Construction Estimating Software Market, by End-User Industry |

|

8.2.10.1.3. US Construction Estimating Software Market, by Deployment |

|

8.2.10.1.4. US Construction Estimating Software Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Procore Technologies |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Buildertrend |

|

10.3. PlanSwift |

|

10.4. CoConstruct |

|

10.5. Viewpoint (Trimble) |

|

10.6. Sage Group |

|

10.7. ProEst |

|

10.8. BuilderEdge |

|

10.9. Foundation Software |

|

10.10. RedTeam Software |

|

10.11. UDA Technologies |

|

10.12. e-Builder (Trimble) |

|

10.13. B2W Software |

|

10.14. McCormick Systems |

|

10.15. Finalcad |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Construction Estimating Software Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Construction Estimating Software Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Construction Estimating Software Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA