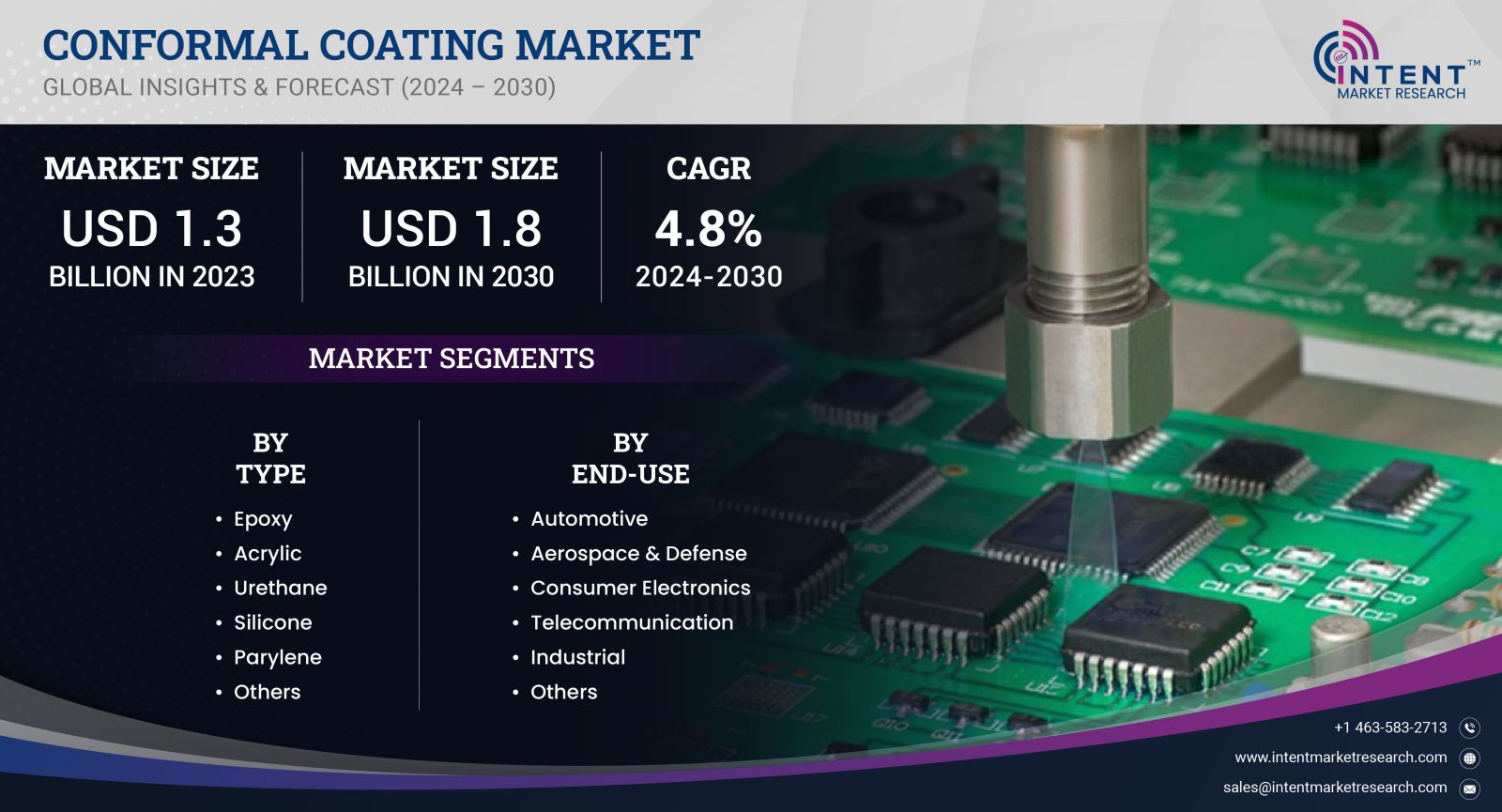

As per Intent Market Research, the Conformal Coating Market was valued at USD 1.3 billion in 2023-e and will surpass USD 1.8 billion by 2030; growing at a CAGR of 4.8% during 2024 - 2030.

The conformal coating market is experiencing robust growth, driven by the increasing demand for reliable and efficient protection of electronic components from environmental factors such as moisture, dust, and chemicals. Conformal coatings are thin layers of protective material applied to circuit boards and electronic assemblies to enhance their durability and longevity. Key factors fueling this growth include the expansion of the electronics industry, advancements in coating technologies, and a heightened focus on product reliability in consumer electronics, automotive, and industrial applications.

Acrylic Segment is Largest Owing to Versatile Applications and Ease of Use

The acrylic segment is the largest within the conformal coating market, primarily due to its versatility and ease of application. Acrylic coatings are widely used for protecting electronic components in various applications, from consumer electronics to automotive systems. Their excellent adhesion, transparency, and resistance to moisture make them an ideal choice for a variety of electronic devices. The acrylic segment's prominence can be attributed to its widespread acceptance and proven performance across different industries, allowing manufacturers to ensure the reliability of their products.

The growth of the acrylic segment is also fueled by advancements in coating formulations that enhance performance characteristics, such as chemical resistance and flexibility. As industries increasingly prioritize lightweight and durable solutions, acrylic conformal coatings are becoming the material of choice for many manufacturers. This trend solidifies the acrylic segment's position as the largest within the conformal coating market, highlighting its critical role in the protection of electronic components.

Silicone Segment Fastest Growing Owing to Superior Protection in Harsh Environments

The silicone segment is anticipated to be the fastest-growing area within the conformal coating market, driven by its superior performance in extreme conditions. Silicone coatings are known for their exceptional thermal stability, flexibility, and resistance to harsh chemicals and UV exposure. As industries such as automotive, aerospace, and renewable energy increasingly demand high-performance coatings that can withstand challenging environments, the silicone segment is gaining traction.

Moreover, the growing trend towards electric vehicles and advanced electronics, which often operate in high-temperature and high-humidity conditions, is fueling the demand for silicone conformal coatings. The ability of silicone coatings to maintain their protective qualities under extreme conditions makes them increasingly attractive to manufacturers seeking to enhance the reliability and lifespan of their electronic products. This unique combination of properties positions the silicone segment as the fastest-growing area within the conformal coating market.

Polyurethane Segment is Largest Owing to Enhanced Durability and Protection

The polyurethane segment is the largest in the conformal coating market, primarily due to its enhanced durability and excellent protective properties. Polyurethane coatings offer superior resistance to abrasion, chemicals, and moisture, making them suitable for applications in demanding environments such as automotive and industrial sectors. The versatility of polyurethane formulations allows for customization in terms of viscosity, drying time, and hardness, making them a preferred choice for many manufacturers.

The increasing focus on product quality and longevity drives the demand for polyurethane conformal coatings across various applications. As manufacturers continue to seek materials that provide lasting protection for electronic components, polyurethane coatings are positioned as a key player in the conformal coating market. The ongoing innovations in polyurethane technologies are further enhancing their performance, solidifying the segment's position as the largest in the market.

Asia-Pacific Region Fastest Growing Owing to Rapid Industrialization and Electronics Demand

The Asia-Pacific region is projected to be the fastest-growing market for conformal coatings, driven by rapid industrialization, a booming electronics sector, and increasing investments in manufacturing. Countries such as China, Japan, and South Korea are at the forefront of electronics production, leading to heightened demand for effective conformal coatings to protect electronic components. The expansion of the automotive and renewable energy sectors in the region also contributes to the growing need for reliable coating solutions.

The region's focus on technological advancements and innovation further propels the conformal coating market's growth. As manufacturers increasingly prioritize product reliability and performance, the demand for high-quality conformal coatings is expected to surge. This trend positions the Asia-Pacific region as a pivotal area for the growth of the conformal coating market, reflecting its increasing significance in the global landscape.

Top Companies Leading the Competitive Landscape

The competitive landscape of the conformal coating market features several leading companies that are driving innovation and growth. The top 10 companies in this market include Henkel AG & Co. KGaA, Dow Inc., 3M Company, HumiSeal, Electrolube, Chase Corporation, PPG Industries, KISCO Ltd., Conformal Coating, Inc., and Aremco Products, Inc. These companies are recognized for their strong brand presence, extensive product portfolios, and commitment to quality and sustainability in conformal coatings.

Competition within the conformal coating market is intense, with companies focusing on product innovation, research and development, and strategic partnerships. Many leading manufacturers are investing significantly in R&D to enhance the performance and applicability of conformal coatings across various sectors. Additionally, strategic collaborations and joint ventures are becoming increasingly common as companies seek to expand their market reach and enhance their competitive advantage. With ongoing trends toward sustainability and high-performance materials, leading players are well-positioned to capitalize on the growing opportunities within the conformal coating market, ensuring their continued relevance and success in the industry.

Report Objectives

The report will help you answer some of the most critical questions in the Conformal Coating Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the conformal coating market?

- What is the size of the conformal coating market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.3 billion |

|

Forecasted Value (2030) |

USD 1.8 billion |

|

CAGR (2024-2030) |

4.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Conformal Coating Market By Type (Epoxy, Acrylic, Urethane, Silicone), By End-use (Automotive, Aerospace & Defense, Consumer Electronics, Telecommunication, Industrial) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Conformal Coating Market, by Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Epoxy |

|

4.2.Acrylic |

|

4.3.Urethane |

|

4.4.Silicone |

|

4.5.Parylene |

|

4.6.Others |

|

5.Conformal Coating Market, by End-Use (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Automotive |

|

5.2.Aerospace & Defense |

|

5.3.Consumer Electronics |

|

5.4.Telecommunication |

|

5.5.Industrial |

|

5.6.Others |

|

6.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Regional Overview |

|

6.2.North America |

|

6.2.1.Regional Trends & Growth Drivers |

|

6.2.2.Barriers & Challenges |

|

6.2.3.Opportunities |

|

6.2.4.Factor Impact Analysis |

|

6.2.5.Technology Trends |

|

6.2.6.North America Conformal Coating Market, by Type |

|

6.2.7.North America Conformal Coating Market, by End-Use |

|

*Similar segmentation will be provided at each regional level |

|

6.3.By Country |

|

6.3.1.US |

|

6.3.1.1.US Conformal Coating Market, by Type |

|

6.3.1.2.US Conformal Coating Market, by End-Use |

|

6.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

6.4.Europe |

|

6.5.APAC |

|

6.6.Latin America |

|

6.7.Middle East & Africa |

|

7.Competitive Landscape |

|

7.1.Overview of the Key Players |

|

7.2.Competitive Ecosystem |

|

7.2.1.Platform Manufacturers |

|

7.2.2.Subsystem Manufacturers |

|

7.2.3.Service Providers |

|

7.2.4.Software Providers |

|

7.3.Company Share Analysis |

|

7.4.Company Benchmarking Matrix |

|

7.4.1.Strategic Overview |

|

7.4.2.Product Innovations |

|

7.5.Start-up Ecosystem |

|

7.6.Strategic Competitive Insights/ Customer Imperatives |

|

7.7.ESG Matrix/ Sustainability Matrix |

|

7.8.Manufacturing Network |

|

7.8.1.Locations |

|

7.8.2.Supply Chain and Logistics |

|

7.8.3.Product Flexibility/Customization |

|

7.8.4.Digital Transformation and Connectivity |

|

7.8.5.Environmental and Regulatory Compliance |

|

7.9.Technology Readiness Level Matrix |

|

7.10.Technology Maturity Curve |

|

7.11.Buying Criteria |

|

8.Company Profiles |

|

8.1.Shin-Etsu Chemical |

|

8.1.1.Company Overview |

|

8.1.2.Company Financials |

|

8.1.3.Product/Service Portfolio |

|

8.1.4.Recent Developments |

|

8.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2.Illinois Tool Works |

|

8.3.Dymax |

|

8.4.Chase Corporation |

|

8.5.Dow |

|

8.6.Electrolube |

|

8.7.H.B. Fuller |

|

8.8.Henkel |

|

8.9.Specialty Coating Systems, Inc. |

|

8.10.Altana AG |

|

9.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Conformal Coating Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the conformal coating Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the conformal coating ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the conformal coating market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA

.jpg)