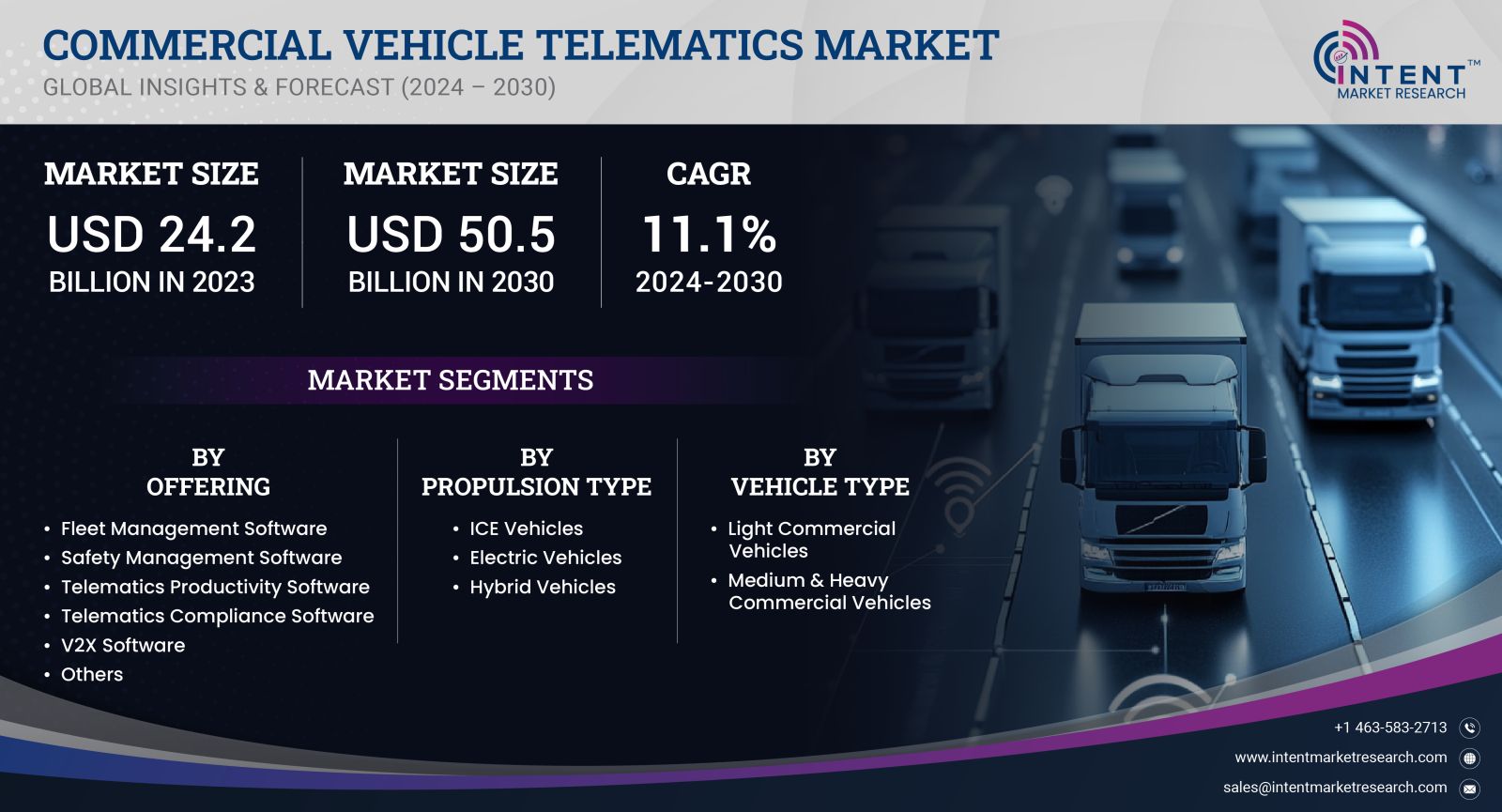

As per Intent Market Research, the Commercial Vehicle Telematics Market was valued at USD 24.2 billion in 2023 and will surpass USD 50.5 billion by 2030; growing at a CAGR of 11.1% during 2024 - 2030.

The Commercial Vehicle Telematics Market has been experiencing rapid growth driven by the increasing demand for fleet management solutions, enhanced vehicle safety, and the need for operational efficiency in the logistics and transportation sectors. Telematics involves the integration of telecommunications and informatics, enabling real-time vehicle tracking, diagnostics, and data communication between commercial vehicles and central systems. As businesses adopt more sophisticated technologies for monitoring and managing their fleets, the market for commercial vehicle telematics has become a key enabler for efficient and cost-effective operations.

Solutions segment is the largest due to high demand for fleet management systems

The solutions segment dominates the Commercial Vehicle Telematics Market due to the high demand for fleet management systems, which help companies optimize their vehicle usage, reduce fuel consumption, and improve driver behavior. Fleet management solutions offer various capabilities, such as vehicle tracking, maintenance alerts, and route optimization, making them essential tools for businesses with large fleets. These solutions enable fleet operators to make data-driven decisions, increasing efficiency and reducing operational costs.

Within this segment, fleet management systems stand out as the largest subsegment, driven by the increasing need for real-time vehicle monitoring and route optimization. Fleet operators can track their vehicles' locations, monitor fuel consumption, and receive maintenance alerts, all of which contribute to cost savings and improved efficiency. The integration of AI and machine learning in fleet management solutions is further enhancing their capabilities, allowing for predictive maintenance and better risk management.

Embedded telematics segment is the fastest growing due to rising OEM integration

The embedded telematics segment is witnessing the fastest growth in the Commercial Vehicle Telematics Market, as more original equipment manufacturers (OEMs) integrate telematics systems directly into their vehicles. Embedded telematics systems are pre-installed by vehicle manufacturers, allowing seamless connectivity and providing fleet operators with a reliable, factory-installed solution. This trend is driven by the growing demand for built-in connectivity solutions, which offer better data accuracy and eliminate the need for aftermarket installations.

The embedded systems subsegment is growing rapidly due to OEMs recognizing the value of providing vehicles that are "connected" right from the factory. These systems offer enhanced data collection and analytics capabilities, enabling real-time monitoring of vehicle performance and driving patterns. With the increasing popularity of electric vehicles (EVs) and autonomous driving technologies, embedded telematics systems are expected to become the standard in commercial vehicles, contributing significantly to the market's growth over the forecast period.

Government regulations driving the largest growth in the Safety and Security segment

Safety and security solutions are critical components of the Commercial Vehicle Telematics Market, as they help ensure driver safety and vehicle security. Governments worldwide are implementing stringent regulations to enhance road safety and reduce accidents, particularly in the commercial vehicle sector. This has led to increased demand for telematics-based safety solutions, such as collision avoidance systems, lane departure warnings, and emergency response systems.

The collision avoidance system subsegment is the largest within the safety and security segment, driven by regulatory requirements and the growing focus on reducing road accidents. These systems use sensors and cameras to detect potential collisions and automatically apply the brakes if necessary. With regulatory bodies across regions mandating the installation of advanced safety systems in commercial vehicles, the adoption of collision avoidance systems is set to grow significantly in the coming years.

Real-time communications boosting the fastest growth in the Vehicle-to-Everything (V2X) communication segment

Vehicle-to-Everything (V2X) communication is rapidly gaining importance in the Commercial Vehicle Telematics Market, enabling vehicles to communicate with each other, infrastructure, pedestrians, and cloud networks. The growing need for real-time data sharing between vehicles and their surroundings to enhance safety, optimize traffic flow, and improve operational efficiency is driving this segment's growth.

Within the V2X communication segment, the vehicle-to-infrastructure (V2I) communication subsegment is the fastest growing, fueled by the increasing adoption of smart city initiatives and connected infrastructure. V2I communication allows commercial vehicles to receive real-time information about traffic lights, road conditions, and speed limits, improving route planning and reducing congestion. The rise of autonomous driving technologies is also expected to boost the demand for V2I communication in the commercial vehicle sector, as vehicles will require constant communication with surrounding infrastructure to operate safely.

Asia-Pacific region is the largest market owing to strong industrial growth

The Asia-Pacific region holds the largest share of the Commercial Vehicle Telematics Market, primarily due to the region's strong industrial growth, booming logistics sector, and increasing adoption of telematics solutions in commercial vehicles. Countries like China, India, and Japan are witnessing rapid urbanization and industrialization, which are driving the demand for efficient fleet management and telematics solutions. Additionally, government initiatives promoting road safety and smart transportation systems are further fueling the growth of telematics in the region.

China, in particular, has emerged as a major player in the global telematics market, with a large number of commercial vehicle operators adopting telematics systems to enhance fleet efficiency and comply with government regulations. The increasing penetration of electric vehicles in the region is also contributing to the growth of the telematics market, as EVs rely heavily on telematics for battery monitoring, charging optimization, and route planning. Over the forecast period, Asia-Pacific is expected to continue leading the market, with strong demand for telematics solutions from both established fleet operators and new entrants.

Leading companies driving innovation and competition

The Commercial Vehicle Telematics Market is highly competitive, with numerous players vying for market share through product innovation, strategic partnerships, and mergers and acquisitions. Leading companies in this market are focusing on expanding their product portfolios, enhancing their technological capabilities, and entering new geographic markets to maintain a competitive edge.

Some of the top players in the market include Geotab, Trimble, Verizon Connect, Omnitracs, Teletrac Navman, MiX Telematics, Zonar Systems, TomTom Telematics, ACTIA Group, and Continental AG. These companies are investing heavily in research and development to introduce advanced telematics solutions that cater to the evolving needs of fleet operators. Additionally, many of these firms are entering into partnerships with OEMs to offer embedded telematics systems, further driving market growth. The competitive landscape is expected to remain dynamic, with continuous innovation and technological advancements shaping the future of the industry.

Report Objectives:

The report will help you answer some of the most critical questions in the Commercial Vehicle Telematics Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Commercial Vehicle Telematics Market?

- What is the size of the Commercial Vehicle Telematics Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 24.2 billion |

|

Forecasted Value (2030) |

USD 50.5 billion |

|

CAGR (2024 – 2030) |

11.1% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Commercial Vehicle Telematics Market By Offering (Fleet Management Software, Safety Management Software, Telematics Productivity Software, Telematics Compliance Software, V2X Software), By Propulsion Type (ICE Vehicles, Electric Vehicles, Hybrid Vehicles), By Vehicle Type (Light Commercial Vehicles, Medium & Heavy Commercial Vehicles) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and Rest of Asia Pacific), Latin America (Brazil, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Commercial Vehicle Telematics Market, by Offering (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1.Fleet Management Software |

|

4.2.Safety Management Software |

|

4.3.Telematics Productivity Software |

|

4.4.Telematics Compliance Software |

|

4.5.V2X Software |

|

4.6.Others |

|

5.Commercial Vehicle Telematics Market, by Propulsion Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1.ICE Vehicles |

|

5.2.Electric Vehicles |

|

5.3.Hybrid Vehicles |

|

6.Commercial Vehicle Telematics Market, by Vehicle Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1.Light Commercial Vehicles |

|

6.2.Medium & Heavy Commercial Vehicles |

|

7.Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Commercial Vehicle Telematics Market, by Offering |

|

7.2.7.North America Commercial Vehicle Telematics Market, by Propulsion Type |

|

7.2.8.North America Commercial Vehicle Telematics Market, by Vehicle Type |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Commercial Vehicle Telematics Market, by Offering |

|

7.3.1.2.US Commercial Vehicle Telematics Market, by Propulsion Type |

|

7.3.1.3.US Commercial Vehicle Telematics Market, by Vehicle Type |

|

7.3.2.Canada |

|

7.3.3.Mexico |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.Geotab |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.GreenRoad Technologies |

|

9.3.Inseego Corporation |

|

9.4.Lytx, Inc. |

|

9.5.Masternaut Limited |

|

9.6.Microlise |

|

9.7.Octo Telematics |

|

9.8.Trimble |

|

9.9.Verizon Connect |

|

9.10.Zonar Systems |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Commercial Vehicle Telematics Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to measure the impact of them on the Commercial Vehicle Telematics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Commercial Vehicle Telematics ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the Commercial Vehicle Telematics Market. These methods were also employed to estimate the size of various sub segments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg) Data Triangulation

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA