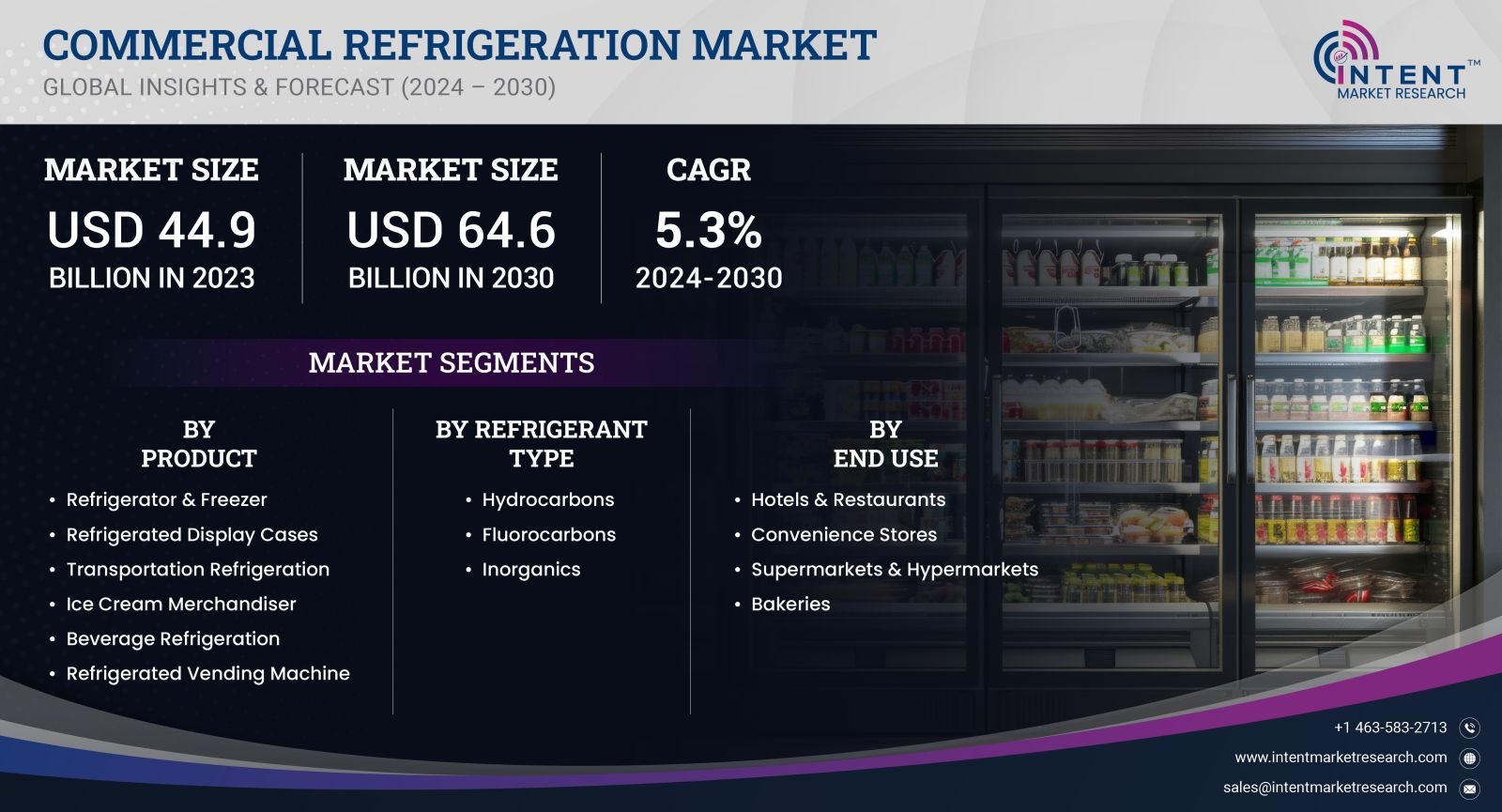

As per Intent Market Research, the Commercial Refrigeration Market was valued at USD 44.9 billion in 2023-e and will surpass USD 64.6 billion by 2030; growing at a CAGR of 5.3% during 2024 - 2030.

The global Commercial Refrigeration Market is experiencing significant growth, driven by increasing demand for refrigeration solutions across various sectors, including food and beverage, hospitality, healthcare, and retail. With the rising emphasis on food safety, energy efficiency, and the preservation of perishables, commercial refrigeration systems are becoming indispensable. These systems include refrigeration units, display cases, walk-in coolers, and industrial refrigeration solutions, catering to a wide array of applications.. Factors such as technological advancements, evolving consumer preferences, and stringent regulatory standards concerning energy efficiency are expected to propel this market forward.

Equipment Type Segment: Display Cases are the Largest Owing to Versatile Applications

Within the equipment type segment, Display Cases represent the largest subsegment, owing to their versatile applications in retail and food service environments. Display cases are crucial for showcasing perishable products, including dairy items, meats, beverages, and desserts, thereby enhancing product visibility and attracting consumer interest. Their ability to maintain optimal temperatures while providing an appealing presentation is a significant advantage in various commercial settings.

The growth of the display case subsegment can be attributed to the increasing number of supermarkets, convenience stores, and restaurants that prioritize food safety and quality. As retailers strive to provide fresh and visually appealing products, the demand for advanced display cases featuring innovative technologies—such as energy-efficient refrigeration and smart temperature controls—continues to rise. This trend solidifies display cases as the largest equipment type in the commercial refrigeration market, reflecting their importance in driving sales and enhancing customer experience.

Application Segment: Food and Beverage is the Fastest Growing Owing to Rising Consumer Demand

The Food and Beverage application segment is the fastest growing in the commercial refrigeration market, driven by the rising consumer demand for fresh and high-quality food products. With increasing urbanization and changing lifestyles, consumers are gravitating toward convenience and ready-to-eat food options, leading to a surge in the need for efficient refrigeration systems to preserve food quality and safety. The food and beverage sector relies heavily on commercial refrigeration to store, display, and distribute products, making it a critical area of focus.

Furthermore, the growth of the online grocery delivery and food service industries is amplifying the demand for reliable refrigeration solutions. As restaurants, cafes, and grocery stores enhance their operational efficiency, they increasingly invest in advanced refrigeration technologies that meet stringent food safety standards. This shift towards high-performance refrigeration systems within the food and beverage sector positions it as the fastest-growing application segment in the commercial refrigeration market.

End-User Segment: Retail Sector is the Largest Owing to Increased Consumer Interaction

In the end-user segment, the Retail Sector stands out as the largest subsegment, reflecting the critical demand for commercial refrigeration solutions in supermarkets, convenience stores, and specialty food shops. Retail establishments require effective refrigeration systems to maintain the freshness of food products while attracting customers with appealing displays. The competitive nature of the retail market necessitates the use of high-quality refrigeration solutions to enhance customer experience and drive sales.

The growth of the retail sector is further supported by the expanding trend of e-commerce and online grocery shopping. As consumers increasingly seek convenience in their shopping experiences, retail establishments must invest in modern refrigeration solutions to ensure that products remain fresh during transportation and storage. This ongoing focus on quality and accessibility solidifies the retail sector's position as the largest end-user segment in the commercial refrigeration market.

Region Segment: North America is the Largest Owing to Strong Regulatory Frameworks and Consumer Preferences

North America is the largest region in the commercial refrigeration market, primarily due to its strong regulatory frameworks and evolving consumer preferences regarding food safety and quality. The United States and Canada have established stringent regulations governing the storage and transportation of food products, driving the demand for efficient and reliable refrigeration systems. Moreover, the growing awareness of the importance of energy-efficient refrigeration technologies is leading to increased investments in advanced systems.

The North American market also benefits from a robust food and beverage industry and a well-developed retail sector. As consumers continue to prioritize fresh and high-quality products, retailers are compelled to upgrade their refrigeration systems to meet these expectations. The combination of regulatory requirements, consumer trends, and industrial growth positions North America as the largest region in the commercial refrigeration market during the forecast period.

Competitive Landscape: Leading Companies Driving Innovation in the Commercial Refrigeration Market

The commercial refrigeration market is characterized by a competitive landscape featuring several key players committed to innovation, sustainability, and quality. The top 10 companies in this market include:

- Carrier Global Corporation

- Emerson Electric Co.

- Danfoss A/S

- Thermo King Corporation

- Haier Group Corporation

- Liebherr Group

- True Manufacturing Co., Inc.

- Nor-Lake, Inc.

- Standex International Corporation

- Hoshizaki Corporation

These companies are actively engaged in research and development to enhance the efficiency and performance of commercial refrigeration systems. For instance, Carrier and Emerson Electric are focusing on developing eco-friendly refrigeration solutions that comply with environmental regulations while meeting customer demands for energy efficiency. The competitive landscape also sees strategic partnerships, acquisitions, and collaborations as companies aim to strengthen their market presence and leverage technological advancements.

As the demand for advanced commercial refrigeration solutions continues to rise across various industries, these leading companies are well-positioned to capitalize on emerging opportunities within the market. Their commitment to innovation and sustainability will drive growth and ensure they remain at the forefront of this evolving landscape.

Report Objectives

The report will help you answer some of the most critical questions in the Commercial Refrigeration Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the commercial refrigeration market?

- What is the size of the commercial refrigeration market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 44.9 billion |

|

Forecasted Value (2030) |

USD 64.6 billion |

|

CAGR (2024-2030) |

5.3% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Commercial Refrigeration Market By Product Type (Refrigerator & Freezer, Refrigerated Display Cases, Transportation Refrigeration), By Refrigerant Type (Hydrocarbons, Fluorocarbons, Inorganics), By End-use (Supermarkets & Hypermarkets, Hotels & Restaurants, Bakeries) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Commercial Refrigeration Market, by Product Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Refrigerator & Freezer |

|

4.2.Refrigerated Display Cases |

|

4.3.Transportation Refrigeration |

|

4.4.Ice Cream Merchandiser |

|

4.5.Beverage Refrigeration |

|

4.6.Refrigerated Vending Machine |

|

5.Commercial Refrigeration Market, by Refrigerant Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Hydrocarbons |

|

5.2.Fluorocarbons |

|

5.3.Inorganics |

|

6.Commercial Refrigeration Market, by End-Use (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Hotels & Restaurants |

|

6.2.Convenience Stores |

|

6.3.Supermarkets & Hypermarkets |

|

6.4.Bakeries |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Commercial Refrigeration Market, by Product Type |

|

7.2.7.North America Commercial Refrigeration Market, by Refrigerant Type |

|

7.2.8.North America Commercial Refrigeration Market, by End-Use |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Commercial Refrigeration Market, by Product Type |

|

7.3.1.2.US Commercial Refrigeration Market, by Refrigerant Type |

|

7.3.1.3.US Commercial Refrigeration Market, by End-Use |

|

7.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.Carrier |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Emerson Electric |

|

9.3.Daikin |

|

9.4.Danfoss |

|

9.5.GEA Group |

|

9.6.Johnson Controls |

|

9.7.Voltas |

|

9.8.DE Rigo Refrigeration |

|

9.9.Blue Star |

|

9.10.SCM Frigo |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Commercial Refrigeration Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the commercial refrigeration Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the commercial refrigeration ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the commercial refrigeration market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA

.jpg)