As per Intent Market Research, the Collagen Market was valued at USD 4.6 billion in 2023 and will surpass USD 6.6 billion by 2030; growing at a CAGR of 5.2% during 2024 - 2030.

The collagen market has witnessed significant growth due to its increasing demand across various industries such as food and beverages, pharmaceuticals, cosmetics, and healthcare. Collagen, a vital protein found in the human body, has gained immense popularity for its multiple benefits, including promoting skin elasticity, improving joint health, and boosting bone strength. As consumers increasingly focus on health and wellness, the market for collagen products is expanding rapidly, with various forms and sources of collagen being developed to meet the diverse needs of consumers worldwide.

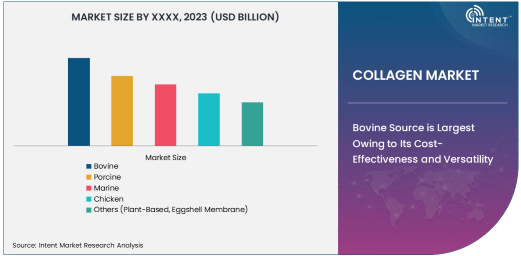

Bovine Source is Largest Owing to Its Cost-Effectiveness and Versatility

Bovine collagen remains the largest source in the global collagen market. Derived from cattle, bovine collagen is widely used due to its cost-effectiveness and the abundant availability of bovine-derived raw materials. It is primarily used in Type I and Type III collagen production, which are ideal for supporting skin, bones, and joint health. Bovine collagen also has a broad range of applications in food and beverages, pharmaceuticals, and cosmetics, making it a preferred choice among manufacturers. The increasing demand for dietary supplements, functional foods, and skin care products has driven the widespread use of bovine collagen, contributing to its dominant market share.

Type I Collagen is Leading Owing to Its Abundance and Application Versatility

Among the various collagen types, Type I collagen holds the largest market share. Type I collagen is found abundantly in the skin, tendons, ligaments, and bones, making it highly sought after in both the beauty and health sectors. It is commonly used in anti-aging products, bone health supplements, and joint health formulations, making it indispensable in the growing wellness market. The demand for Type I collagen is expected to continue rising due to its versatility and the increasing awareness of its role in promoting skin elasticity, improving bone density, and enhancing overall joint function. This collagen type’s widespread use in the food and beverage industry, particularly in supplements and functional foods, has also driven its growth.

Hydrolyzed Collagen is Fastest Growing Owing to Its High Bioavailability

Hydrolyzed collagen, which refers to collagen that has been broken down into smaller peptides, is the fastest-growing form of collagen in the market. The hydrolyzation process makes the collagen peptides easier for the body to absorb, leading to a higher bioavailability compared to other forms like gelatin or native collagen. This feature has made hydrolyzed collagen a preferred choice in dietary supplements and functional foods. Consumers seeking effective solutions for joint pain, skin aging, and bone health are increasingly turning to hydrolyzed collagen products, fueling its rapid growth in the market. The ease of incorporation into powders, drinks, and capsules further enhances its appeal.

Food & Beverages Application is Largest Due to Increased Consumer Awareness

The food and beverages segment is the largest application area for collagen, as it benefits from the growing consumer interest in functional foods that support health. Collagen-enriched products such as protein bars, beverages, and dietary supplements are in high demand. Collagen in food products is primarily used to enhance skin health, promote joint mobility, and improve digestive health, aligning with the increasing focus on preventive health measures. As awareness about the benefits of collagen continues to grow, more manufacturers are incorporating collagen into a variety of food and beverage products, further driving the expansion of this segment.

Online Sales Channel is Fastest Growing Due to E-Commerce Trends

The online sales channel is the fastest-growing distribution channel for collagen products. E-commerce platforms have seen a significant rise in the purchase of health and wellness products, including collagen supplements, due to convenience, greater product variety, and often better pricing. The availability of collagen on online platforms like Amazon, eBay, and specialized health supplement websites has made it easier for consumers to access collagen products from anywhere in the world. As consumers become more tech-savvy and prefer online shopping for health products, the online sales channel is expected to continue its rapid expansion in the coming years.

Asia Pacific is Fastest Growing Region Driven by Health Trends

The Asia Pacific region is the fastest-growing market for collagen products, driven by rising health consciousness, an aging population, and an expanding middle class. Countries like China, Japan, and India are witnessing a significant surge in demand for collagen-based health supplements, skincare products, and functional foods. This growth is also fueled by the increasing awareness of collagen’s role in anti-aging and joint health, especially in countries with large elderly populations. The popularity of collagen-infused beauty products and the increasing incorporation of collagen in traditional foods are also contributing to the growth of the market in this region.

Leading Companies and Competitive Landscape

The collagen market is highly competitive, with several leading players striving to maintain their market position through product innovation, mergers, and strategic partnerships. Companies such as Gelita AG, Collagen Solutions Plc, DSM Nutritional Products, Harbin Haorui Biological Engineering Co. Ltd., and Vital Proteins are among the market leaders. These companies have been expanding their portfolios through the development of new collagen-based products, catering to the growing demand for plant-based collagen alternatives, and forming strategic alliances to tap into new geographical markets. As the market continues to grow, companies are increasingly focusing on product diversification, enhanced distribution channels, and research into sustainable sourcing to strengthen their competitive position.

The overall competitive landscape is expected to remain dynamic, with both established players and emerging startups introducing innovative solutions to meet consumer demands for collagen-based products. As the focus on health and wellness continues to rise, the competition will likely intensify, with companies increasingly emphasizing quality, sustainability, and innovation to stay ahead in the market.

List of Leading Companies:

- Gelita AG

- Collagen Solutions Plc

- DSM Nutritional Products

- Harbin Haorui Biological Engineering Co., Ltd.

- Nitta Gelatin Inc.

- Tessenderlo Group

- Amicogen Inc.

- Rousselot (A Darling Ingredients Inc. Brand)

- Vital Proteins

- Neocell (A Unilever Brand)

- BASF SE

- Evolva Holding SA

- Cargill Inc.

- Kewpie Corporation

- China National Petroleum Corporation

Recent Developments:

- Gelita has recently launched a new line of vegan-friendly collagen peptides designed to cater to the growing demand for plant-based products in the health and wellness market.

- Rousselot announced an expansion in its marine collagen production facilities in response to increased consumer demand for marine-based collagen products in cosmetics and supplements.

- Vital Proteins has signed a partnership agreement with a major retail chain to expand its presence in the global retail market, enhancing its consumer base for collagen-based beauty and wellness products.

- Tessenderlo has been actively investing in research to develop collagen-based materials for the medical devices market, with applications in wound healing and regenerative medicine.

- DSM has launched an innovative collagen peptide ingredient specifically formulated to support skin elasticity and reduce wrinkles, focusing on the growing anti-aging market segment

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 4.6 Billion |

|

Forecasted Value (2030) |

USD 6.6 Billion |

|

CAGR (2024 – 2030) |

5.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Collagen Market By Source (Bovine, Porcine, Marine, Chicken), By Type (Type I, Type II, Type III, Type IV, Type V, Type X), By Form (Hydrolyzed Collagen, Collagen Peptides, Gelatin, Native Collagen, Collagen Powder), By Application (Food & Beverages, Pharmaceuticals & Nutraceuticals, Cosmetics & Personal Care, Healthcare & Medical Devices, Bone & Joint Health, Skin Care), and By Distribution Channel (Online Sales, Offline Sales) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Gelita AG, Collagen Solutions Plc, DSM Nutritional Products, Harbin Haorui Biological Engineering Co., Ltd., Nitta Gelatin Inc., Tessenderlo Group, Amicogen Inc., Rousselot (A Darling Ingredients Inc. Brand), Vital Proteins, Neocell (A Unilever Brand), BASF SE, Evolva Holding SA, Cargill Inc., Kewpie Corporation, China National Petroleum Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Collagen Market, by Source (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Bovine |

|

4.2. Porcine |

|

4.3. Marine |

|

4.4. Chicken |

|

4.5. Others |

|

5. Collagen Market, by By Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Type I |

|

5.2. Type II |

|

5.3. Type III |

|

5.4. Type IV |

|

5.5. Type V |

|

5.6. Type X |

|

6. Collagen Market, by By Form (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Hydrolyzed Collagen |

|

6.2. Collagen Peptides |

|

6.3. Gelatin |

|

6.4. Native Collagen |

|

6.5. Collagen Powder |

|

7. Collagen Market, by By Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Food & Beverages |

|

7.2. Pharmaceuticals & Nutraceuticals |

|

7.3. Cosmetics & Personal Care |

|

7.4. Healthcare & Medical Devices |

|

7.5. Bone & Joint Health |

|

7.6. Skin Care |

|

7.7. Others |

|

8. Collagen Market, by By Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Online Sales |

|

8.2. Offline Sales |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Collagen Market, by Source |

|

9.2.7. North America Collagen Market, by By Type |

|

9.2.8. North America Collagen Market, by By Form |

|

9.2.9. North America Collagen Market, by By Application |

|

9.2.10. North America Collagen Market, by By Distribution Channel |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Collagen Market, by Source |

|

9.2.11.1.2. US Collagen Market, by By Type |

|

9.2.11.1.3. US Collagen Market, by By Form |

|

9.2.11.1.4. US Collagen Market, by By Application |

|

9.2.11.1.5. US Collagen Market, by By Distribution Channel |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Gelita AG |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Collagen Solutions Plc |

|

11.3. DSM Nutritional Products |

|

11.4. Harbin Haorui Biological Engineering Co., Ltd. |

|

11.5. Nitta Gelatin Inc. |

|

11.6. Tessenderlo Group |

|

11.7. Amicogen Inc. |

|

11.8. Rousselot (A Darling Ingredients Inc. Brand) |

|

11.9. Vital Proteins |

|

11.10. Neocell (A Unilever Brand) |

|

11.11. BASF SE |

|

11.12. Evolva Holding SA |

|

11.13. Cargill Inc. |

|

11.14. Kewpie Corporation |

|

11.15. China National Petroleum Corporation |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Collagen Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Collagen Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Collagen Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA