sales@intentmarketresearch.com

+1 463-583-2713

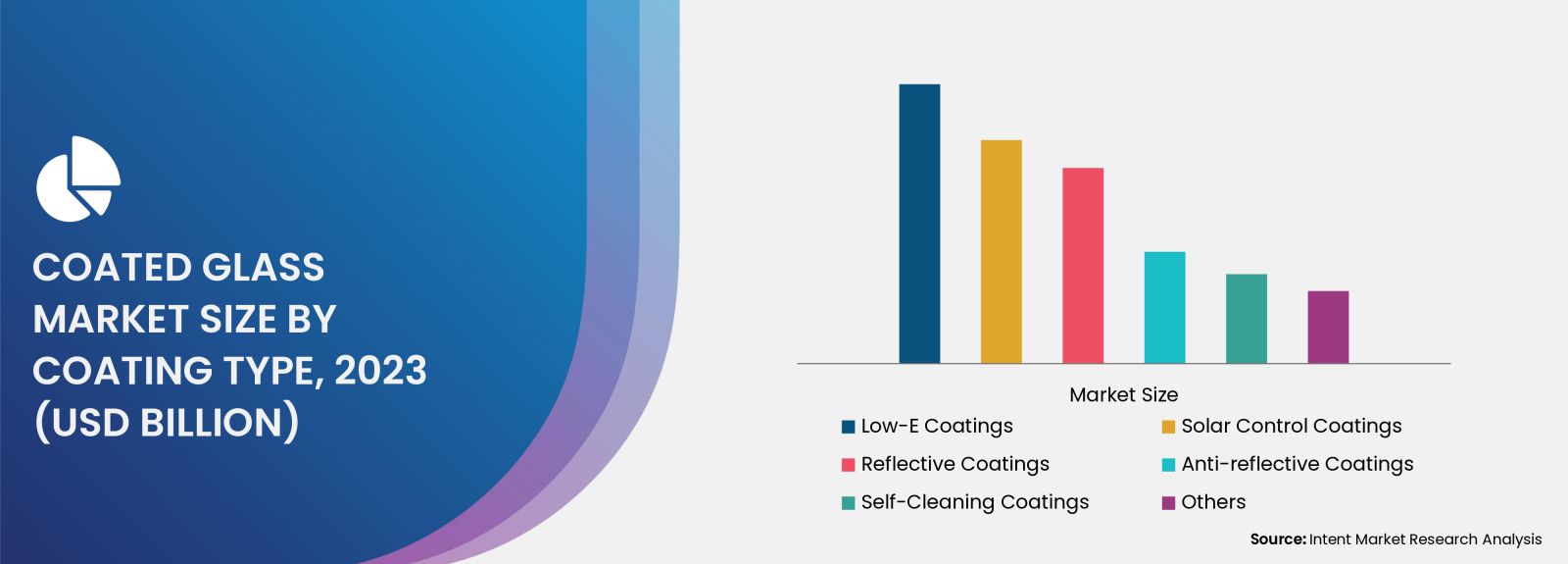

Coated Glass Market By Coating Type (Low-E Coatings, Solar Control Coatings, Reflective Coatings, Anti-Reflective Coatings, Self-Cleaning Coatings), By Glass Type (Tempered Glass, Laminated Glass, Insulated Glass, Annealed Glass), By Application (Construction, Automotive, Solar Panels, Electronics & Displays), and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Coated Glass Market was valued at USD 34.4 billion in 2023 and will surpass USD 48.9 billion by 2030; growing at a CAGR of 5.2% during 2024 - 2030.

The Coated Glass Market is anticipated to experience robust growth between 2024 and 2030, driven by the increasing demand for high-performance glass solutions across industries such as construction, automotive, electronics, and solar energy. Coated glass refers to glass that has been treated with a layer of material to enhance its properties, such as improving its durability, energy efficiency, and aesthetic appeal. These coatings are typically used to enhance surface functionality, such as anti-reflective coatings, UV protection, thermal insulation, and scratch resistance.The market's expansion is influenced by the growing need for energy-efficient building materials, eco-friendly products, and advanced technologies in sectors like construction and automotive As consumers and industries alike prioritize sustainability and innovation, the coated glass market is expected to witness a strong CAGR during the forecast period. This report examines key market segments, including types of coatings, end-use industries, and regional trends, offering insights into the market's growth trajectory through 2030.

Architectural Glass Segment is Largest Owing to Rising Demand for Energy-Efficient Buildings

The Architectural Glass segment is the largest in the coated glass market, primarily due to the growing emphasis on energy efficiency and sustainability in modern construction projects. Coated architectural glass is used in a wide range of applications, including windows, facades, and curtain walls, to improve energy performance by reducing heat gain or loss. With an increasing number of countries adopting stringent regulations on energy efficiency in buildings, the demand for coated glass that offers thermal insulation and UV protection has soared.

Architectural coatings like Low-E (low emissivity) and solar control coatings not only help reduce energy consumption by enhancing insulation but also improve the overall comfort of building occupants. Furthermore, advancements in coatings technology have allowed for the development of glass that can manage both thermal and light transmission, making it highly attractive for commercial and residential buildings alike. This growing adoption of energy-efficient glass solutions positions the architectural segment as the largest subsegment within the coated glass market, with continued demand driven by green building initiatives and government mandates.

Automotive Glass Segment is Fastest Growing Owing to Advances in Smart Glass Technology

The Automotive Glass segment is the fastest growing within the coated glass market, driven by innovations in smart glass technology and the increasing demand for safety and comfort features in vehicles. Coated automotive glass is used to enhance vehicle windows and windshields, offering benefits such as better heat insulation, glare reduction, and improved durability. Moreover, the rise of electric vehicles (EVs) and autonomous vehicles is driving the need for advanced automotive glass solutions with functional coatings, such as electrochromic or photochromic coatings, that allow the glass to adjust to varying light conditions.

The integration of smart glass in vehicles enables energy savings by reducing the need for air conditioning and improving cabin comfort. Coatings that provide anti-fog, anti-reflective, and scratch-resistant properties are increasingly popular in high-end automotive designs. As the automotive industry focuses on innovation to meet consumer demands for more efficient, safer, and visually appealing vehicles, the automotive glass segment is expected to see substantial growth, particularly in the electric vehicle sector where energy-efficient solutions are crucial.

Solar Glass Segment is Fastest Growing Owing to Increasing Solar Energy Applications

The Solar Glass segment is witnessing significant growth, driven by the increasing adoption of solar energy solutions. Coated glass used in solar panels, particularly those with anti-reflective coatings, is critical for improving the efficiency of solar energy systems by allowing more sunlight to be absorbed. As the global demand for renewable energy grows, the need for solar panels and related components is expanding rapidly, positioning the solar glass segment as one of the fastest-growing areas within the coated glass market.

Solar glass coatings enhance the performance of photovoltaic cells by reducing surface reflection and increasing light absorption. Moreover, the development of transparent solar glass for building-integrated photovoltaics (BIPV) and the growing use of solar glass in various energy-efficient applications further contribute to the market’s expansion. As governments, businesses, and consumers invest more in renewable energy sources, the solar glass segment is expected to see continued growth, driven by technological innovations and environmental sustainability goals.

Asia Pacific Region is Fastest Growing Owing to Rapid Industrialization and Construction Boom

The Asia Pacific (APAC) region is the fastest-growing market for coated glass, owing to rapid industrialization, urbanization, and an expanding construction industry. Countries such as China, India, Japan, and South Korea are experiencing booming demand for energy-efficient and sustainable building materials, which is driving the adoption of coated glass in the region. Additionally, the automotive and solar energy sectors in APAC are also growing rapidly, further contributing to the increased demand for coated glass solutions.

In China, the world’s largest construction market, there is a strong focus on green building initiatives, with both government policies and consumer preferences pushing for more energy-efficient buildings. The demand for coated glass in architecture is significant, with the trend of smart cities and eco-friendly infrastructure projects gaining momentum. Similarly, the rise of electric vehicles in China and India is fueling the demand for advanced automotive glass, particularly in high-performance vehicles. The APAC region’s robust economic growth, technological advancements, and environmental policies make it the fastest-growing region in the coated glass market.

North America Region is Largest Owing to Strong Demand from Construction and Automotive Industries

North America is the largest regional market for coated glass, driven by strong demand from the construction and automotive industries, particularly in the United States and Canada. The region’s emphasis on energy-efficient buildings, along with stringent regulations regarding energy consumption in both commercial and residential buildings, has created a robust market for coated architectural glass. Coated glass solutions, such as Low-E coatings, are widely used in windows and facades to reduce energy consumption, helping to meet the region’s sustainability goals.

In the automotive sector, North America remains a key market for coated glass, with automakers continuously adopting advanced glazing technologies to enhance vehicle performance, comfort, and safety. Furthermore, the growing popularity of electric and autonomous vehicles in the region is boosting demand for smart automotive glass. The region’s well-established infrastructure, technological innovations, and focus on renewable energy solutions position North America as the largest market for coated glass, with steady growth projected in the coming years.

Leading Companies and Competitive Landscape

The Coated Glass Market is highly competitive, with key players focusing on technological innovation, product development, and strategic partnerships to strengthen their market positions. Leading companies include Saint-Gobain, Guardian Industries, Pilkington (NSG Group), Asahi Glass Co. (AGC), and Cardinal Glass Industries. These companies dominate the market by offering a wide range of coated glass products for various applications, including architectural, automotive, and solar glass.

The competitive landscape is characterized by ongoing R&D activities aimed at developing new coating technologies that offer enhanced performance, durability, and sustainability. Companies are also expanding their global presence through acquisitions, collaborations, and partnerships, particularly in the rapidly growing markets of Asia Pacific and Latin America. The growing trend of energy-efficient and sustainable products, along with regulatory pressures to reduce carbon footprints, is pushing manufacturers to innovate and adapt to the evolving demands of the market. As the demand for coated glass in industries such as construction, automotive, and renewable energy rises, competition in the market is expected to intensify, with leading players striving to maintain technological leadership and capture emerging opportunities.

The report focuses on estimating the current market potential in terms of the total addressable market for all the segments, sub-segments, and regions. In the process, all the high-growth and upcoming technologies were identified and analyzed to measure their impact on the current and future market. The report also identifies the key stakeholders, their business gaps, and their purchasing behavior. This information is essential for developing effective marketing strategies and creating products or services that meet the needs of the target market. The report also covers a detailed analysis of the competitive landscape which includes major players, their recent developments, growth strategies, product benchmarking, and manufacturing operations among others. Also, brief insights on start-up ecosystem and emerging companies is also included as part of this report.

Report Objectives:

The report will help you answer some of the most critical questions in the Coated Glass Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Coated Glass Market?

- What is the size of the Coated Glass Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 34.4 billion |

|

Forecasted Value (2030) |

USD 48.9 billion |

|

CAGR (2024 – 2030) |

5.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Coated Glass Market By Coating Type (Low-E Coatings, Solar Control Coatings, Reflective Coatings, Anti-Reflective Coatings, Self-Cleaning Coatings), By Glass Type (Tempered Glass, Laminated Glass, Insulated Glass, Annealed Glass), By Application (Construction, Automotive, Solar Panels, Electronics & Displays) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Coated Glass Market, by Coating Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Low-E Coatings |

|

4.2. Solar Control Coatings |

|

4.3. Reflective Coatings |

|

4.4. Anti-Reflective Coatings |

|

4.5. Self-Cleaning Coatings |

|

4.6. Others |

|

5. Coated Glass Market, by Glass Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Tempered Glass |

|

5.2. Laminated Glass |

|

5.3. Insulated Glass |

|

5.4. Annealed Glass |

|

5.5. Others |

|

6. Coated Glass Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Construction |

|

6.1.1. Residential |

|

6.1.2. Commercial |

|

6.2. Automotive |

|

6.3. Solar Panels |

|

6.4. Electronics & Displays |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Coated Glass Market, by Coating Type |

|

7.2.7. North America Coated Glass Market, by Glass Type |

|

7.2.8. North America Coated Glass Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Coated Glass Market, by Coating Type |

|

7.2.9.1.2. US Coated Glass Market, by Glass Type |

|

7.2.9.1.3. US Coated Glass Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. AGC Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Cardinal Glass |

|

9.3. Central Glass |

|

9.4. Corning Incorporated |

|

9.5. Fenzi Group |

|

9.6. Fuyao Group |

|

9.7. Guardian Industries |

|

9.8. NSG Group |

|

9.9. PPG Industries |

|

9.10. Saint-Gobain |

|

9.11. Schott |

|

9.12. Şişecam Group |

|

9.13. Taiwan Glass |

|

9.14. Vitro Architectural Glass |

|

9.15. Xinyi Glass |

|

10. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Coated Glass Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Coated Glass Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Coated Glass ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Coated Glass Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats