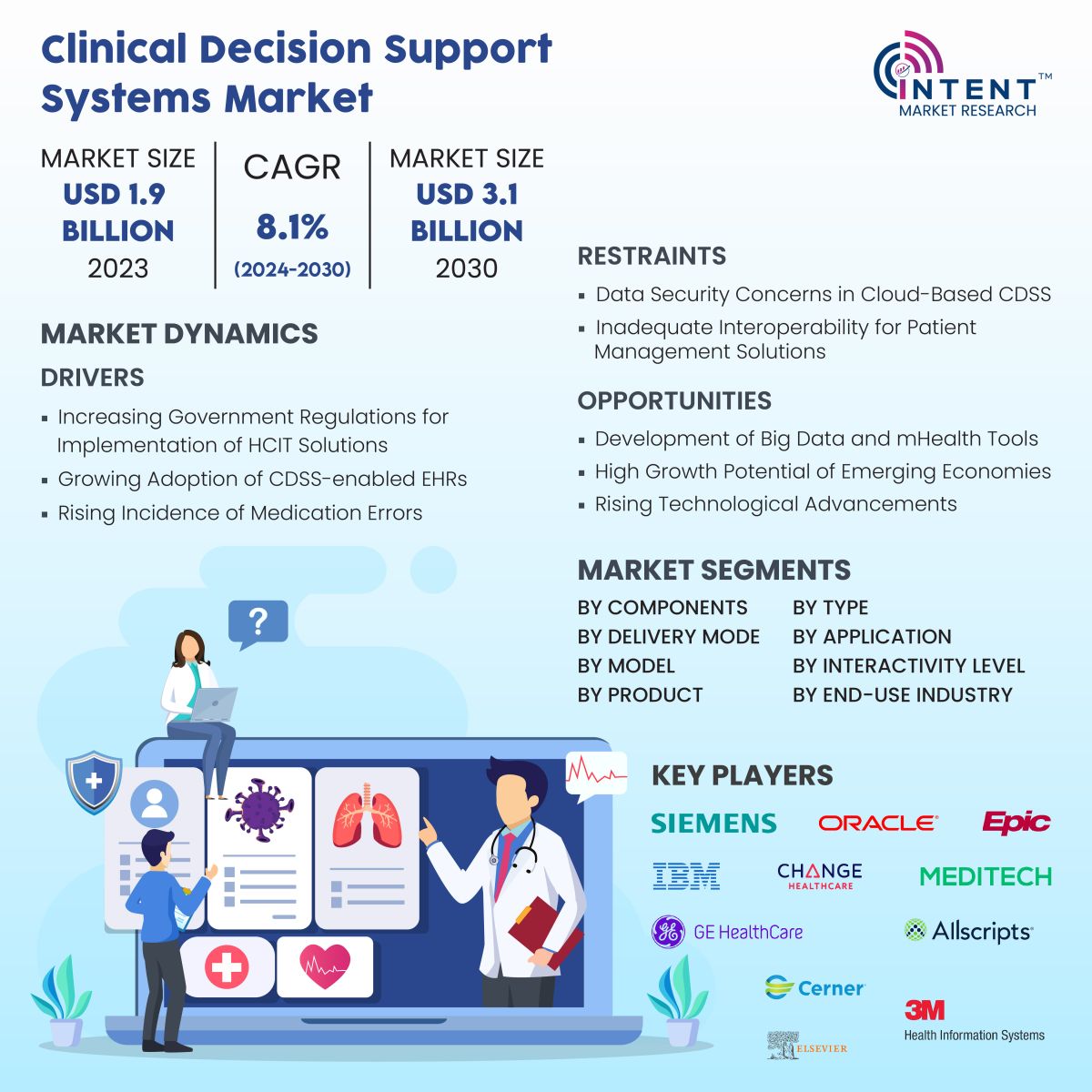

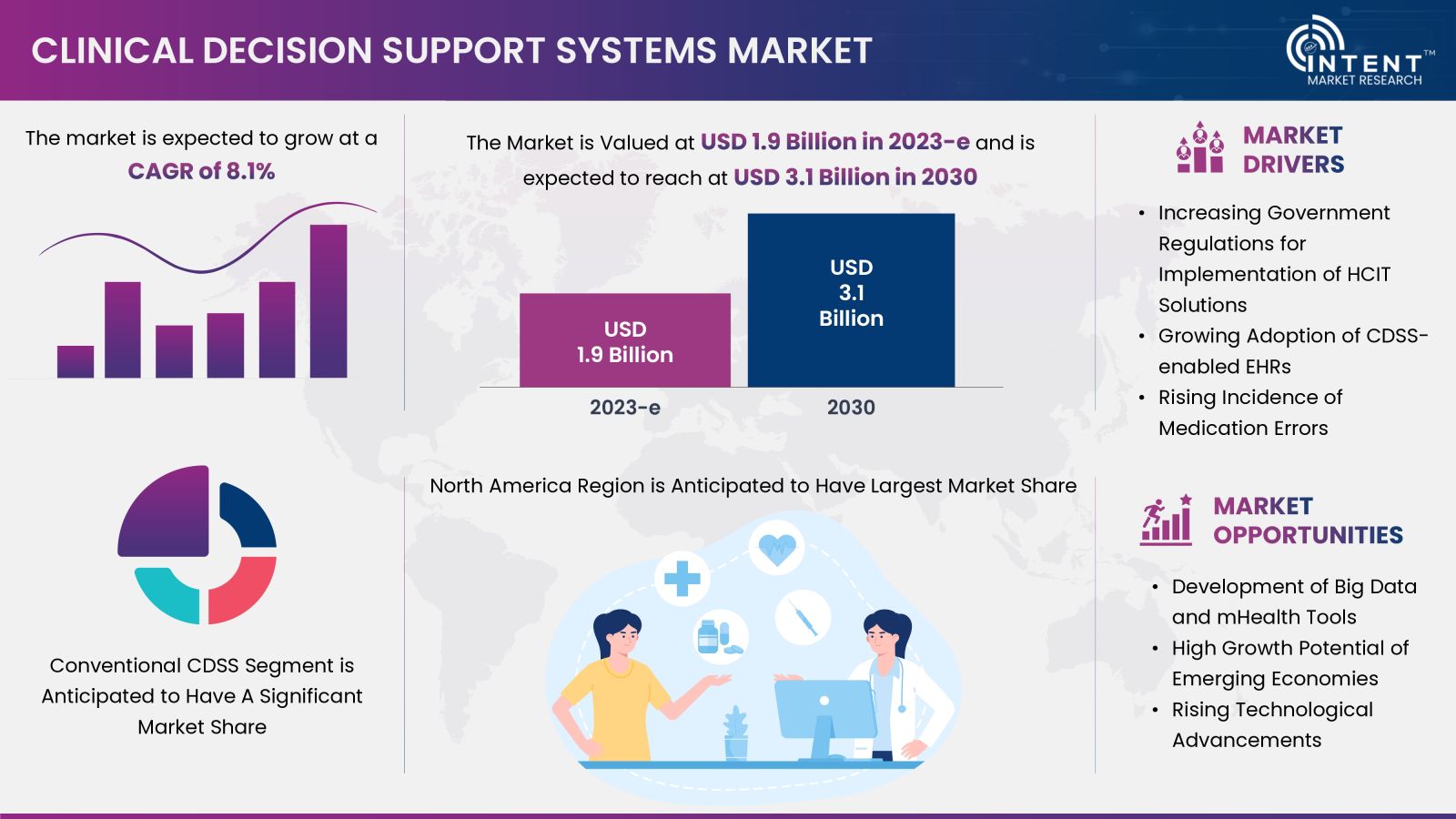

According to Intent Market Research, the Clinical Decision Support Systems Market is expected to grow from USD 1.9 billion in 2023-e at a CAGR of 8.1% to touch USD 3.1 billion by 2030. The clinical decision support systems market is competitive, the prominent players in the global market include 3M Health Information Systems, Allscripts, Cerner Corporation, Change Healthcare, Elsevier BV, Epic Systems, GE Healthcare, IBM Watson Health, McKesson Corporation, Meditech, NextGen Healthcare, Oracle, Philips Healthcare, Siemens Healthineers, and Wolters Kluwer Health.

During the COVID-19 pandemic, countries heavily relied on online services to sustain their health systems. Virtual consultations between healthcare professionals and patients became prevalent, primarily due to strict lockdown measures imposed by various governments in the early stages of the pandemic. The global impact of the COVID-19 outbreak underscored the crucial role played by clinical decision support systems in aiding patient resources and services.

The article published in the “Journal Plos One” in March 2021, they have emphasized the paramount importance of developing real-time clinical diagnosis decision support tools for COVID-19. These tools were instrumental in patient triage and resource allocation for individuals at risk. The widespread adoption of online services by several countries contributed to the market's growth.

Moreover, market players responded to the demand by introducing clinical decision support systems tailored for managing COVID-19 data and insights. For instance, in May 2022, Epocrates, a subsidiary of Athenahealth, announced its latest enhancements to the content within its decision support tool. These updates aim to equip clinicians with up-to-date information and expert guidance, empowering them with swift access to critical insights for evaluating and treating medical conditions. This ensures that clinicians can make well-informed decisions at the point of care, underscoring the importance of having timely and reliable information readily available.

Increasing Implementation of Government Regulations & Initiatives to Drive the Clinical Decision Support Systems Market

The CDSS market is expected to experience a significant boost due to the growing implementation of government regulations and initiatives. In May 2020, the Centers for Medicare & Medicaid Services made a notable decision to exercise enforcement discretion, refraining from taking action against specific payer-to-payer data exchange provisions, as indicated in a Federal Register Notice. The Biden administration emphasized the administration's commitment to enhance health data exchange and encouraging investments in interoperability through insights shared in a blog.

Furthermore, European Union Health Ministers collectively endorsed a statement in Europe with the aim of establishing an eHealth common area, facilitating the unrestricted movement of Electronic Health Records (EHR) across the continent. This statement also highlights the integration of eHealth into the Europe 2020 strategy. In support of advancing digital health, the UK government has pledged a significant investment of USD 347 million to promote research & development, fostering the creation of new pharmaceuticals, devices, and diagnostic tools.

These regulatory initiatives are anticipated to catalyze an increased adoption of Electronic Health Records (EHR). Consequently, this surge in EHR adoption is poised to influence and drive the widespread adoption of CDSS across major markets worldwide.

Big Data and mHealth Tools offers Opportunities for Market Growth

The development of CDSS is significantly influenced by the evolution of big data and mobile health (mHealth) tools. These technological advancements play a crucial role in enhancing the capabilities and effectiveness of CDSS. Big Data provides the infrastructure to handle and analyze vast amounts of healthcare data. CDSS can leverage advanced analytics to process diverse datasets, including EHRs, genomics, and real-time patient monitoring data. Mobile health tools offer clinicians and healthcare providers the ability to access CDSS from anywhere, facilitating point-of-care decision support thereby ensuring timely and informed decision-making.

Conventional CDSS Revolutionizes the Clinical Decision Support Systems Market

The conventional CDSS segment holds the largest share of the CDSS market. This dominance is primarily attributed to the widespread adoption of conventional decision support systems by clinicians at the point of care. These systems analyze patient data, medical history, and current information to provide real-time insights and evidence-based recommendations.

Conventional CDSS contributes to enhanced diagnostic accuracy, treatment planning, and overall patient care. Their integration fosters efficiency, reduces errors, and promotes adherence to best practices, thereby improving healthcare outcomes. In the clinical decision support systems market, these conventional systems continue to serve as foundational tools, ensuring the delivery of high-quality, evidence-driven healthcare.

The Surge of Integrated CDSS in Response to Cost Pressures and the Aging Population is aiding the Market Growth

The growth of the integrated CDSS segment is propelled by factors such as the mounting pressure to reduce healthcare costs, the increasing aging population, and a rising incidence of chronic disorders. Healthcare providers widely employ integrated CDSS to elevate the quality of care and health outcomes while simultaneously reducing medication errors. These systems integrate patient data, medical knowledge, and advanced algorithms to provide real-time, personalized recommendations to healthcare professionals.

North America Holds a Significant Market Share due to the High Government Spending in Healthcare Infrastructure

In 2023, North America is anticipated to lead in market share. This leadership position can be attributed to several factors, including the presence of key players in the region, significant investments in Healthcare Information Technology solutions, and a noticeable increase in medication errors in the US and Canada.

The increasing funding from the US government for supporting healthcare is an attributing factor for the market growth. For instance, the Congressional Budget Office, 2021, published that in the past few decades, federal funding for the National Institute of Health (NIH) has totaled over USD 700 billion.

Additionally, the increasingly advanced product launches in this region by various market players are also expected to contribute to the market growth. In August 2021, First Databank introduced FDB CDS Analytics; an innovative solution which empowers healthcare providers to effortlessly recognize, track, and tailor Clinical Decision Support (CDS) within their EHR. The overarching goal is to elevate clinician user experiences and amplify the impact of CDS across all care areas, ultimately contributing to the improvement of patient outcomes.

Moreover, in June 2021, Pathway, a clinical decision support platform raised USD1.3 million to scale its CDS platform. With this financing, the company aimed to enhance clinical decision support systems which eventually increase healthcare efficiency. These factors such as increasing investments, CDSS launches, and high funding for healthcare, fuel the growth of the CDSS market over the forecast period in North America.

The Key Players are Highly Competitive to Capture the Market Share

The market is characterized by intense competition due to the presence of numerous international and domestic players. The CDSS market, in particular, is dominated by key players such as 3M Health Information Systems, Allscripts, Cerner Corporation, Change Healthcare, Elsevier BV, Epic Systems, GE Healthcare, IBM Watson Health, McKesson Corporation, Meditech, NextGen Healthcare, Oracle, Philips Healthcare, Siemens Healthineers, and Wolters Kluwer Health, amongst others. Prominent players in the CDSS market are actively engaged in advancing their positions through the development and introduction of innovative CDSS devices.

Clinical Decision Support Systems Market Coverage

The report provides key insights into the clinical decision support systems market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyses key players and the competitive landscape within the market. The report offers the market size and forecasts for the clinical decision support systems market in value (USD billion) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.9 billion |

|

Forecast Revenue (2030) |

USD 3.1 billion |

|

CAGR (2024-2030) |

8.1% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

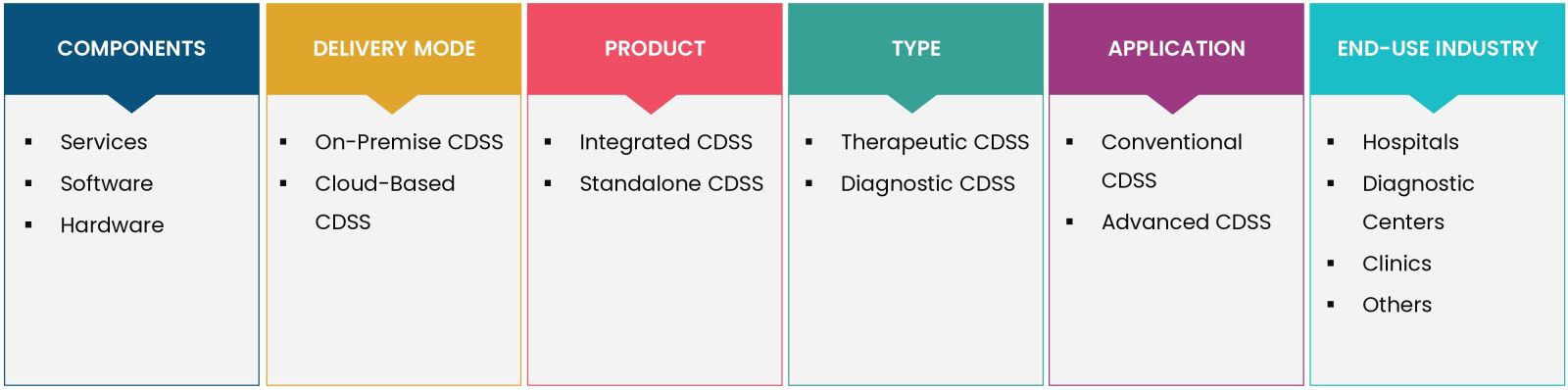

Segments Covered |

By Components (Software, Services, Hardware), By Delivery Mode (Cloud-Based CDSS, On-Premise CDSS), By Model (Knowledge-Based CDSS, Non-Knowledge Based CDSS (Genetic Algorithms, Artificial Neural Networks)), By Product (Integrated CDSS, Standalone CDSS), By Type (Therapeutic CDSS, Diagnostic CDSS), By Application (Conventional CDSS, Advanced CDSS), By Interactivity Level (Active CDSS, Passive CDSS), By End-use Industry (Hospitals, Diagnostic Centers, Clinics, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

3M Health Information Systems, Allscripts, Cerner Corporation, Change Healthcare, Elsevier BV, Epic Systems, GE Healthcare, IBM Watson Health, McKesson Corporation, Meditech, NextGen Healthcare, Oracle, Philips Healthcare, Siemens Healthineers, and Wolters Kluwer Health, among other |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|||||

|

1.1.Study Assumptions and Market Definition |

|||||

|

1.2.Scope of the Study |

|||||

|

2.Research Methodology |

|||||

|

3.Executive Summary |

|||||

|

4.Market Dynamics |

|||||

|

4.1.Market Growth Drivers |

|||||

|

4.1.1. Rapid advancements in the fields of biotechnology and bioinformatics |

|||||

|

4.1.2. Integration of cloud computing and interoperability platforms |

|||||

|

4.1.3. Integration with Electronic Health Records (EHR) |

|||||

|

4.2.Market Growth Restraints |

|||||

|

4.2.1.Delayed hardware & software upgrades |

|||||

|

4.2.2.High Capital Investments for CDSS Infrastructure |

|||||

|

4.3.Market Growth Opportunities |

|||||

|

4.3.1.Advancement in AI, Big Data and mHealth Tools |

|||||

|

4.3.2.High Growth & Adaptability Potential in Emerging Economies |

|||||

|

4.4.Pestle Analysis |

|||||

|

4.5.Porter’s Five Forces Analysis |

|||||

|

5.Market Outlook |

|||||

|

5.1. Overview (Industry Snapshot) |

|||||

|

5.2.Technology Analysis |

|||||

|

5.3.Supply Chain Analysis |

|||||

|

5.4.Value Chain Analysis |

|||||

|

5.5.Regulatory Analysis |

|||||

|

5.6.Reimbursement Analysis |

|||||

|

5.7.Pricing Analysis |

|||||

|

5.8.Patent Analysis |

|||||

|

5.9.Trade Analysis |

|||||

|

5.10. Business Models |

|||||

|

5.11. Unmet needs in the market |

|||||

|

5.12. Industry Trends |

|||||

|

5.13. Key Conference and Events |

|||||

|

6.Market Segment Outlook |

|||||

|

6.1.Segment Synopsis |

|||||

|

6.2.By Components (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

6.2.1.Software |

|||||

|

6.2.2.Hardware |

|||||

|

6.2.3.Services |

|||||

|

6.3.By Delivery Mode (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

6.3.1.Slow On-Premise CDSS |

|||||

|

6.3.2.Cloud-Based CDSS |

|||||

|

6.4.By Model (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

6.4.1.Knowledge-Based CDSS |

|||||

|

6.4.2.Non-Knowledge-Based CDSS |

|||||

|

6.4.2.1. Genetic Algorithms |

|||||

|

6.4.2.2. Artificial Neural Networks |

|||||

|

6.5.By Product (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

6.5.1.Integrated |

|||||

|

6.5.2.Standalone |

|||||

|

6.6.By Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

6.6.1.Therapeutic |

|||||

|

6.6.2.Diagnostic |

|||||

|

6.7.By Interactivity Level (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

6.7.1.Active |

|||||

|

6.7.2.Passive |

|||||

|

6.8.By End-use Industry (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

6.8.1.Hospitals |

|||||

|

6.8.2.Diagnostic Centers |

|||||

|

6.8.3.Clinics |

|||||

|

6.8.4.Others |

|||||

|

7.Regional Outlook |

|||||

|

7.1.Global Market Synopsis |

|||||

|

7.2.North America (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

7.2.1.North America Clinical Decision Support Systems Market Outlook |

|||||

|

7.2.1.1. US Clinical Decision Support Systems Market, By Components |

|||||

|

7.2.1.2. US Clinical Decision Support Systems Market, By Delivery Mode |

|||||

|

7.2.1.3. US Clinical Decision Support Systems Market, By Model |

|||||

|

7.2.1.4. US Clinical Decision Support Systems Market, By Product |

|||||

|

7.2.1.5. US Clinical Decision Support Systems Market, By Type |

|||||

|

7.2.1.6. US Clinical Decision Support Systems Market, By Interactivity Level |

|||||

|

7.2.1.7. US Clinical Decision Support Systems Market, By Application |

|||||

|

7.2.1.8. US Clinical Decision Support Systems Market, By End-use Industry |

|||||

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|||||

|

7.2.2.Canada |

|||||

|

7.3.Europe (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

7.3.1.Europe Clinical Decision Support Systems Market Outlook |

|||||

|

7.3.2.Germany |

|||||

|

7.3.3.UK |

|||||

|

7.3.4.France |

|||||

|

7.3.5.Spain |

|||||

|

7.3.6.Italy |

|||||

|

7.4.Asia-Pacific (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

7.4.1.Asia-Pacific Clinical Decision Support Systems Market Outlook |

|||||

|

7.4.2.China |

|||||

|

7.4.3.India |

|||||

|

7.4.4.Japan |

|||||

|

7.4.5.South Korea |

|||||

|

7.4.6.Australia |

|||||

|

7.5.Latin America (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

7.5.1.Latin America Clinical Decision Support Systems Market Outlook |

|||||

|

7.5.2.Mexico |

|||||

|

7.5.3.Brazil |

|||||

|

7.6.Middle East & Africa (Market Size & Forecast: USD Billion, 2024 – 2030) |

|||||

|

7.6.1.Middle East & Africa Clinical Decision Support Systems Market Outlook |

|||||

|

7.6.2.Saudi Arabia |

|||||

|

7.6.3.UAE

|

|||||

|

9.Company Profiles |

|||||

|

9.1.3M Health Information Systems |

|||||

|

9.1.1.Company Synopsis |

|||||

|

9.1.2.Company Financials |

|||||

|

9.1.3.Product/Service Portfolio |

|||||

|

9.1.4.Recent Developments |

|||||

|

9.1.5.Analyst Perception |

|||||

|

*Note: All the companies in section 9.1 will cover the same sub-chapters as above. |

|||||

|

9.2.Allscripts |

|||||

|

9.3.Cerner Corporation |

|||||

|

9.4.Elsevier BV |

|||||

|

9.5.Epic Systems |

|||||

|

9.6.GE Healthcare |

|||||

|

9.7.Hearst |

|||||

|

9.8.IBM Watson Health |

|||||

|

9.9.McKesson Corporation |

|||||

|

9.10. Meditech |

|||||

|

9.11. NextGen Healthcare |

|||||

|

9.12. Oracle |

|||||

|

9.13. Philips Healthcare |

|||||

|

9.14. Siemens Healthineers |

|||||

|

9.15. Wolters Kluwer Health |

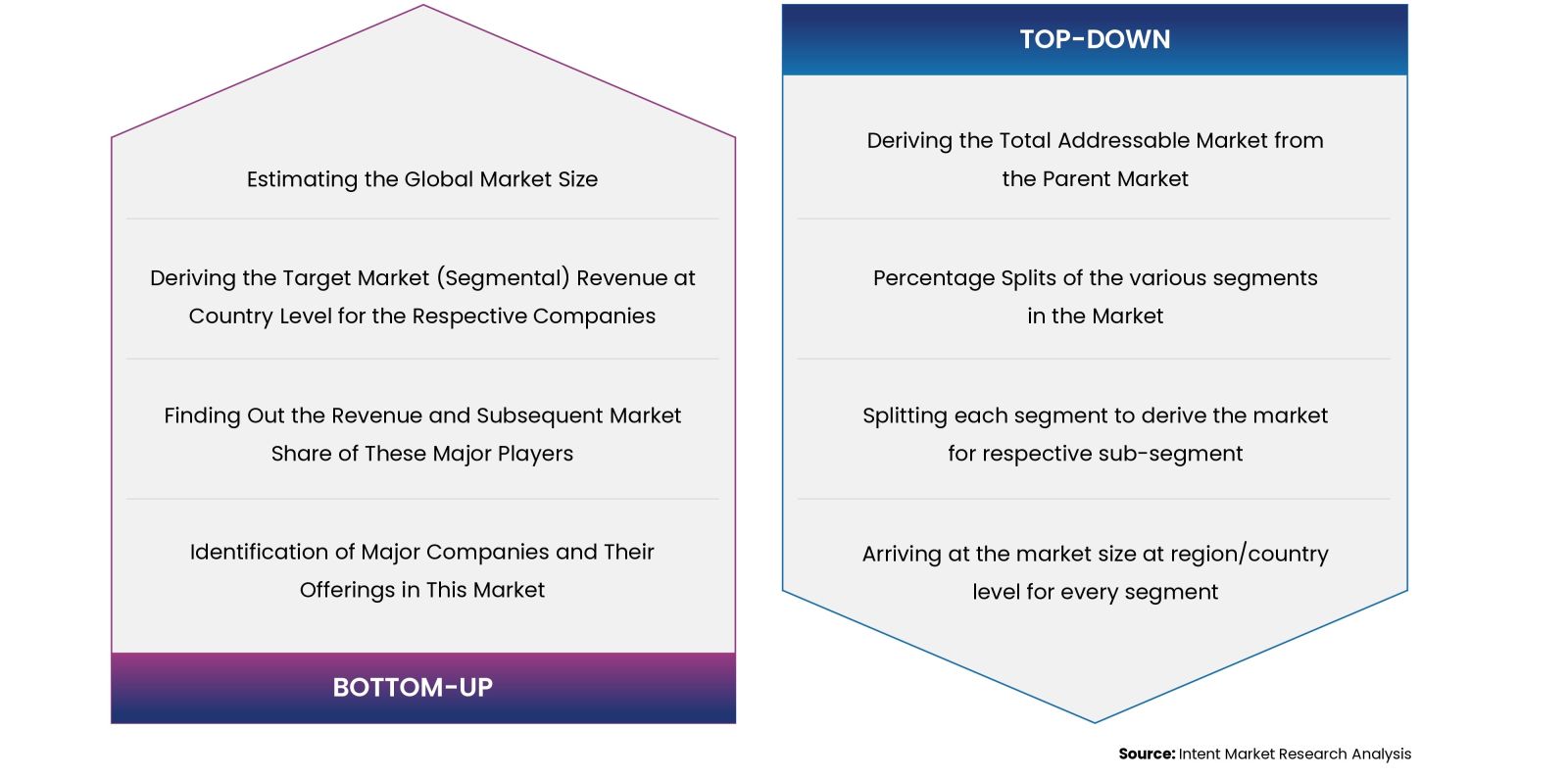

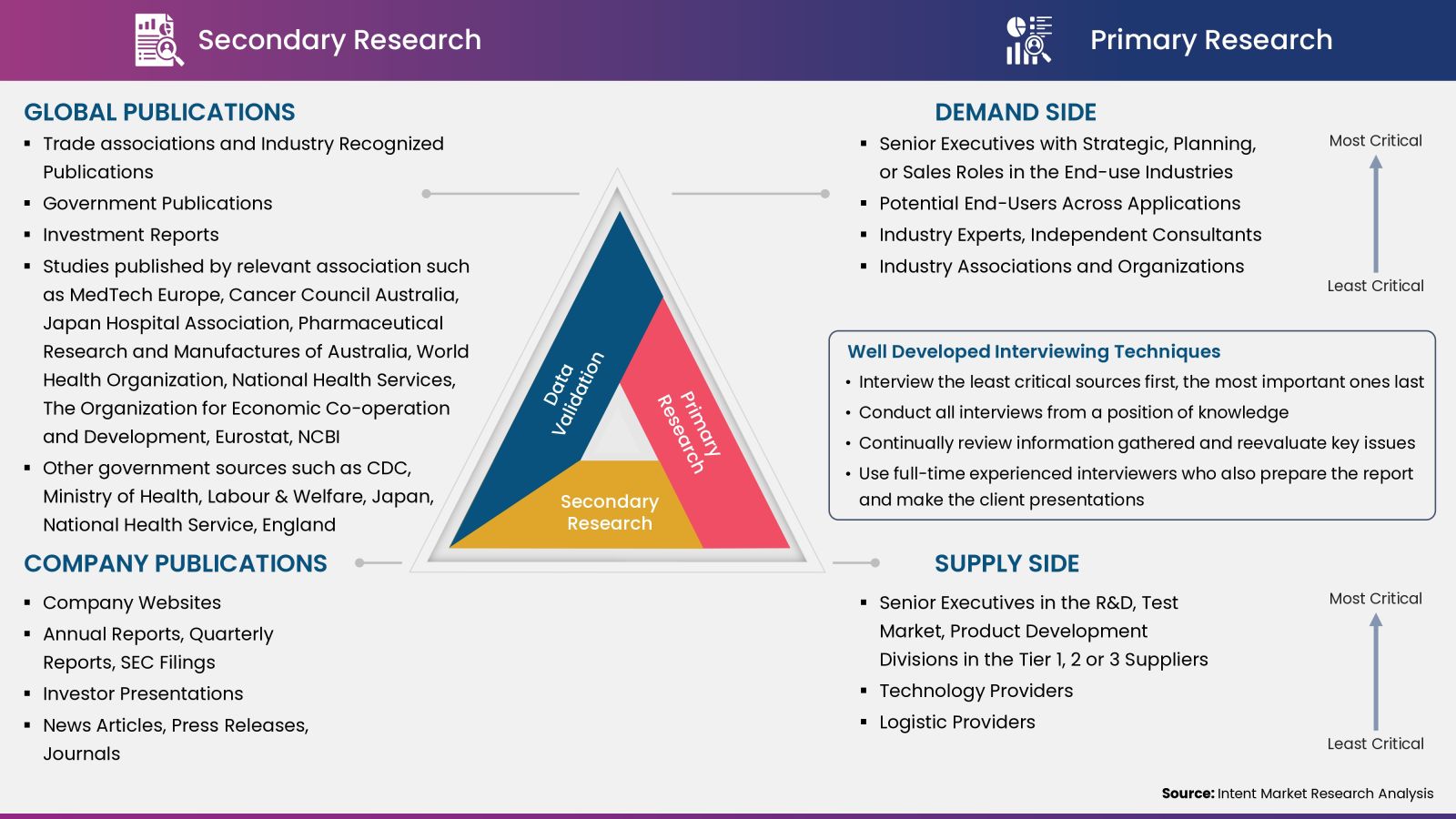

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.