As per Intent Market Research, the Civil Engineering Market was valued at USD 1151.6 Billion in 2024-e and will surpass USD 1965.6 Billion by 2030; growing at a CAGR of 7.9% during 2025-2030.

The civil engineering market plays a pivotal role in the development and maintenance of infrastructure across the globe. This sector encompasses a broad spectrum of services, ranging from the design and construction of roads and bridges to urban planning and water resource management. With the growing demand for robust infrastructure in both developed and emerging economies, civil engineering continues to evolve, driven by advancements in technology and innovation. The sector is vital for enabling economic development, improving living standards, and addressing challenges such as urbanization, environmental sustainability, and population growth.

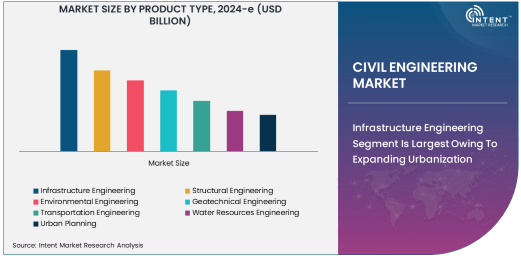

Infrastructure Engineering Segment Is Largest Owing To Expanding Urbanization

Infrastructure engineering holds the largest share in the civil engineering market due to its essential role in facilitating the development of essential public infrastructure. The increasing need for roads, highways, bridges, and airports, especially in rapidly urbanizing regions, has propelled the demand for infrastructure engineering services. Additionally, the rise of smart cities, powered by IoT and AI technologies, has further increased the demand for integrated infrastructure solutions. Major cities across the world are constantly evolving, requiring extensive investment in infrastructure projects to accommodate growing populations, making infrastructure engineering a central element of the civil engineering sector.

The largest projects, such as the construction of large transportation networks and energy infrastructure, are driving the growth of this subsegment. With governments worldwide investing in infrastructure to support economic growth and development, infrastructure engineering continues to dominate the civil engineering landscape. The rise in public-private partnerships (PPPs) has also provided opportunities for firms involved in infrastructure engineering to secure significant contracts globally.

Residential Construction Segment Is Largest Owing To Housing Demands

The residential construction segment is the largest end-user industry within civil engineering, primarily driven by the continuous demand for housing. As urbanization accelerates, the need for residential complexes, affordable housing, and urban developments has surged. This demand is particularly evident in rapidly growing economies where population growth and migration to cities are creating an urgent need for housing. With millennials and young families driving demand, the residential construction sector remains a robust market in civil engineering.

Residential construction includes the development of high-rise buildings, housing societies, and mixed-use projects, which are often tied to urban planning and infrastructure development. Additionally, sustainability in construction practices, such as green buildings and energy-efficient homes, is becoming an integral focus in residential projects. Builders are incorporating smart home technologies and renewable energy sources to meet consumer demand for eco-friendly living solutions, further boosting the growth of this segment.

BIM Technology Is Fastest Growing Owing To Technological Advancements

Among the various technologies in civil engineering, BIM (Building Information Modeling) has emerged as the fastest-growing subsegment, revolutionizing how construction projects are planned and executed. BIM allows for the creation of detailed 3D models of buildings and infrastructure, enabling engineers, architects, and contractors to collaborate more effectively. The adoption of BIM reduces errors, enhances project efficiency, and minimizes construction costs by providing accurate visualization and facilitating better decision-making.

The rise of BIM is driven by its ability to streamline the entire project lifecycle, from planning and design to construction and maintenance. The technology is gaining traction in both public and private projects, with many governments mandating the use of BIM for large-scale infrastructure projects. As more stakeholders in the construction process embrace BIM for its efficiency and cost-effectiveness, the technology is set to continue growing rapidly in the coming years.

Public Projects Segment Is Largest Owing To Government Investments

Public projects remain the largest segment within civil engineering due to significant investments made by governments worldwide in the development of infrastructure. These projects typically include roads, bridges, utilities, airports, and public transportation systems, which are vital for the functioning of modern economies. Government initiatives aimed at improving infrastructure in urban and rural areas, such as smart cities and sustainability-focused development projects, have led to increased demand for civil engineering services in the public sector.

Public projects are typically characterized by large-scale budgets and long-term timelines, making them highly lucrative for civil engineering firms. With government-backed funding, public projects are less susceptible to market volatility, providing a steady stream of work for companies in this segment. Moreover, public-private partnerships (PPPs) are further fueling the expansion of public sector projects, offering new opportunities for civil engineering firms to engage in large-scale infrastructure development.

North America Is Largest Region Owing To Established Infrastructure

North America stands as the largest region in the civil engineering market, primarily due to its well-established infrastructure and the ongoing need for maintenance, repair, and modernization. The United States and Canada are leaders in infrastructure development, with substantial investments being directed toward the upgrade of aging infrastructure, such as highways, bridges, and public transportation systems. Additionally, the adoption of advanced technologies in construction, such as AI and BIM, has further contributed to the region’s dominance in the civil engineering market.

In North America, both the private and public sectors are heavily involved in civil engineering projects, with significant contributions from government initiatives to improve infrastructure. The region's continued focus on sustainability, smart cities, and green building technologies also aligns with global trends, making North America a key player in the civil engineering market.

Leading Companies and Competitive Landscape

The civil engineering market is highly competitive, with numerous global players offering a wide range of services across different sectors. Some of the leading companies in this market include Bechtel Corporation, Vinci S.A., Skanska AB, AECOM, and China State Construction Engineering Corporation (CSCEC). These companies are involved in large-scale infrastructure projects and have a strong presence in key markets worldwide.

The competitive landscape is characterized by the increasing use of advanced technologies, such as BIM, drones, and AI, to enhance operational efficiency and project delivery. As construction projects become more complex, firms are seeking to differentiate themselves through technological innovation, sustainability, and project management expertise. Additionally, mergers and acquisitions (M&A) activities are common in this sector as companies aim to expand their service offerings and geographical reach. With growing demand for infrastructure, the competitive environment is expected to remain dynamic and fast-paced, requiring companies to stay agile and adapt to changing market conditions.

Recent Developments:

- Bechtel was awarded a major contract to design and build a sustainable energy project in the Middle East, marking a significant step towards expanding its energy sector footprint.

- AECOM announced the acquisition of a technology-driven infrastructure solutions firm to enhance its capabilities in the smart cities sector and leverage AI and automation.

- Vinci secured a new contract for the construction of a major highway system in Europe, reinforcing its position as a leading player in transportation infrastructure.

- Skanska launched a new initiative focusing on reducing carbon emissions across its global projects, investing in green building solutions to meet sustainability targets.

- Turner Construction expanded its operations by acquiring a regional construction firm specializing in mixed-use developments, increasing its presence in urban construction

List of Leading Companies:

- Bechtel Corporation

- China State Construction Engineering Corporation (CSCEC)

- Fluor Corporation

- Kiewit Corporation

- Turner Construction Company

- Vinci S.A.

- Skanska AB

- Lendlease Group

- Jacobs Engineering Group

- Balfour Beatty

- McDermott International, Inc.

- AECOM

- Parsons Corporation

- CB&I

- Hochtief AG

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1,151.6 Billion |

|

Forecasted Value (2030) |

USD 1,965.6 Billion |

|

CAGR (2025 – 2030) |

7.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Civil Engineering Market By Product Type (Infrastructure Engineering, Structural Engineering, Environmental Engineering, Geotechnical Engineering, Transportation Engineering, Water Resources Engineering, Urban Planning), By End-User Industry (Residential Construction, Commercial Construction, Industrial Construction, Transportation, Energy, Utilities, Government Projects), By Technology (BIM (Building Information Modeling), Drones and UAVs, AI & Machine Learning, Robotics, 3D Printing, Smart Infrastructure), By Project Type (Public Projects, Private Projects, Mixed-use Projects), and By Distribution Channel (Direct Sales, Online Platforms, Retail & Wholesale, Contractors & Subcontractors); |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Bechtel Corporation, China State Construction Engineering Corporation (CSCEC), Fluor Corporation, Kiewit Corporation, Turner Construction Company, Vinci S.A., Skanska AB, Lendlease Group, Jacobs Engineering Group, Balfour Beatty, McDermott International, Inc., AECOM, Parsons Corporation, CB&I, Hochtief AG |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Civil Engineering Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Infrastructure Engineering |

|

4.2. Structural Engineering |

|

4.3. Environmental Engineering |

|

4.4. Geotechnical Engineering |

|

4.5. Transportation Engineering |

|

4.6. Water Resources Engineering |

|

4.7. Urban Planning |

|

5. Civil Engineering Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Residential Construction |

|

5.2. Commercial Construction |

|

5.3. Industrial Construction |

|

5.4. Transportation |

|

5.5. Energy |

|

5.6. Utilities |

|

5.7. Government Projects |

|

6. Civil Engineering Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. BIM (Building Information Modeling) |

|

6.2. Drones and UAVs |

|

6.3. AI & Machine Learning |

|

6.4. Robotics |

|

6.5. 3D Printing |

|

6.6. Smart Infrastructure |

|

7. Civil Engineering Market, by Project Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Public Projects |

|

7.2. Private Projects |

|

7.3. Mixed-use Projects |

|

8. Civil Engineering Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Direct Sales |

|

8.2. Online Platforms |

|

8.3. Retail & Wholesale |

|

8.4. Contractors & Subcontractors |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Civil Engineering Market, by Product Type |

|

9.2.7. North America Civil Engineering Market, by End-User Industry |

|

9.2.8. North America Civil Engineering Market, by Technology |

|

9.2.9. North America Civil Engineering Market, by Project Type |

|

9.2.10. North America Civil Engineering Market, by Distribution Channel |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Civil Engineering Market, by Product Type |

|

9.2.11.1.2. US Civil Engineering Market, by End-User Industry |

|

9.2.11.1.3. US Civil Engineering Market, by Technology |

|

9.2.11.1.4. US Civil Engineering Market, by Project Type |

|

9.2.11.1.5. US Civil Engineering Market, by Distribution Channel |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Bechtel Corporation |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. China State Construction Engineering Corporation (CSCEC) |

|

11.3. Fluor Corporation |

|

11.4. Kiewit Corporation |

|

11.5. Turner Construction Company |

|

11.6. Vinci S.A. |

|

11.7. Skanska AB |

|

11.8. Lendlease Group |

|

11.9. Jacobs Engineering Group |

|

11.10. Balfour Beatty |

|

11.11. McDermott International, Inc. |

|

11.12. AECOM |

|

11.13. Parsons Corporation |

|

11.14. CB&I |

|

11.15. Hochtief AG |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Civil Engineering Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Civil Engineering Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Civil Engineering Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA