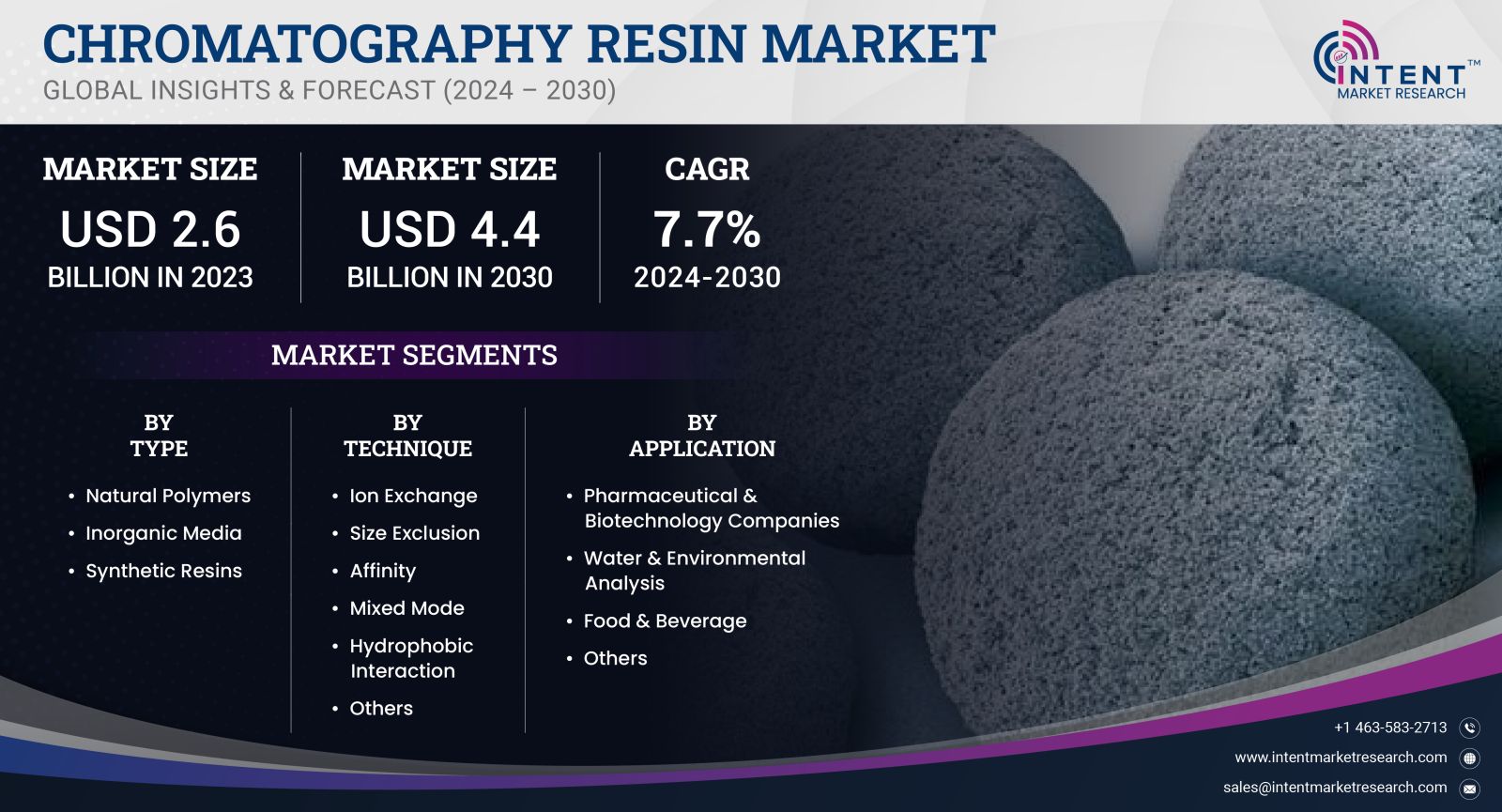

As per Intent Market Research, the Chromatography Resin Market was valued at USD 2.6 billion in 2023-e and will surpass USD 4.4 billion by 2030; growing at a CAGR of 7.7% during 2024 - 2030.

The global Chromatography Resin Market is experiencing significant growth, driven by the increasing demand for high-quality separation processes in various industries such as pharmaceuticals, biotechnology, and food and beverage. Chromatography resins are essential materials used in separation, purification, and analysis techniques, playing a pivotal role in the production of biologics, small molecules, and other complex mixtures. As regulatory requirements tighten and the need for efficient and reliable separation methods rises, the demand for chromatography resins is expected to surge. This growth is further fueled by advancements in resin technology and the increasing adoption of chromatography in research and industrial applications.

Product Type Segment: Ion Exchange Resins are the Largest Owing to Versatility

Within the product type segment, Ion Exchange Resins dominate the market, primarily due to their versatility and effectiveness in various applications. Ion exchange resins are widely used in the purification of proteins, peptides, and nucleic acids, making them invaluable in the pharmaceutical and biotechnology industries. Their ability to selectively remove impurities and separate charged biomolecules contributes to their extensive use in chromatographic techniques.

The growth of ion exchange resins can be attributed to the increasing focus on biopharmaceutical manufacturing and the need for high-purity products. As companies strive to improve the efficiency of their separation processes while adhering to stringent regulatory standards, the demand for ion exchange resins continues to rise. Additionally, ongoing innovations in resin formulations and applications enhance their performance and adaptability, solidifying ion exchange resins as the largest product type in the chromatography resin market.

Application Segment: Biopharmaceuticals is the Fastest Growing Owing to Rising Demand for Therapeutics

The Biopharmaceuticals application segment is the fastest growing in the chromatography resin market, driven by the surging demand for therapeutics, particularly biologics and biosimilars. The biopharmaceutical sector is characterized by a robust pipeline of new drug candidates, necessitating effective separation and purification techniques to ensure product quality and efficacy. Chromatography resins are essential in the downstream processing of biopharmaceuticals, facilitating the efficient purification of complex biomolecules.

As the biopharmaceutical industry expands, fueled by advancements in genetic engineering and monoclonal antibody development, the need for high-performance chromatography resins becomes critical. Companies are increasingly investing in optimized resin solutions that enhance yield and purity while minimizing processing times. This trend positions the biopharmaceuticals application segment as the fastest-growing area in the chromatography resin market, reflecting the industry's ongoing evolution and innovation.

End-User Segment: Pharmaceutical Industry is the Largest Owing to Strict Regulatory Standards

In the end-user segment, the Pharmaceutical Industry stands out as the largest subsegment, reflecting the critical demand for chromatography resins in drug development and manufacturing. The stringent regulatory landscape governing the pharmaceutical sector necessitates the use of high-quality separation technologies to ensure product safety and efficacy. Chromatography resins are integral to the purification processes employed in the production of active pharmaceutical ingredients (APIs) and finished drug formulations.

The growth of the pharmaceutical industry, driven by the increasing prevalence of chronic diseases and the need for innovative therapies, further supports the demand for chromatography resins. As pharmaceutical companies strive to meet regulatory requirements and enhance their manufacturing capabilities, the adoption of advanced chromatography technologies becomes paramount. This sustained focus on quality and compliance solidifies the pharmaceutical industry’s position as the largest end-user segment in the chromatography resin market.

Region Segment: North America is the Largest Owing to Strong Research and Development Infrastructure

North America is the largest region in the chromatography resin market, primarily due to its robust research and development infrastructure and the presence of key pharmaceutical and biotechnology companies. The region is home to a significant number of research institutions and laboratories engaged in cutting-edge studies, contributing to advancements in chromatography technologies. Additionally, the United States and Canada are at the forefront of biopharmaceutical research, driving the demand for high-quality chromatography resins.

The increasing focus on personalized medicine and the development of biologics in North America further enhance the demand for chromatography resins. Moreover, stringent regulatory standards in the region necessitate the use of effective separation technologies to ensure compliance. As North America continues to lead in innovation and investment in the life sciences sector, it is expected to maintain its status as the largest region in the chromatography resin market throughout the forecast period.

Competitive Landscape: Leading Companies Driving Innovation in the Chromatography Resin Market

The chromatography resin market is characterized by a competitive landscape featuring several prominent players committed to innovation and quality. The top 10 companies in this market include:

- Thermo Fisher Scientific Inc.

- Sartorius AG

- GE Healthcare (now part of Cytiva)

- Merck KGaA

- Purolite

- Novasep

- Repligen Corporation

- ABCR GmbH

- Jiangsu Jiecheng Chemical Co., Ltd.

- Bio-Rad Laboratories, Inc.

These companies are actively engaged in research and development to enhance the performance and application range of chromatography resins. For instance, Thermo Fisher Scientific and Merck KGaA are focusing on developing high-performance resin solutions tailored for specific biopharmaceutical applications. The competitive landscape also sees strategic partnerships and collaborations as companies aim to strengthen their market presence and leverage technological advancements.

As the demand for high-quality chromatography resins continues to rise across various industries, these leading companies are well-positioned to capitalize on emerging opportunities within the chromatography resin market. Their commitment to innovation, quality, and sustainability will drive growth and ensure they remain at the forefront of this evolving market landscape.

Report Objectives:

The report will help you answer some of the most critical questions in the Chromatography Resin Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the chromatography resin market?

- What is the size of the chromatography resin market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Middle East, and Rest of the World?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 2.6 billion |

|

Forecasted Value (2030) |

USD 4.4 billion |

|

CAGR (2024-2030) |

7.7% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Chromatography Resin Market By Type (Natural, Inorganic Media, Synthetic), By Technique (Ion Exchange, Hydrophobic Interaction, Affinity, Mixed Mode, Size Exclusion), By Application (Pharmaceutical & Biotechnology, Water & Environmental Analysis, Food & Beverage, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Chromatography Resin Market, by Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Natural Polymers |

|

4.2.Inorganic Media |

|

4.3.Synthetic Resins |

|

5.Chromatography Resin Market, by Technique (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Ion Exchange |

|

5.2.Size Exclusion |

|

5.3.Affinity |

|

5.4.Mixed Mode |

|

5.5.Hydrophobic Interaction |

|

5.6.Others |

|

6.Chromatography Resin Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Pharmaceutical & Biotechnology Companies |

|

6.2.Water & Environmental Analysis |

|

6.3.Food & Beverage |

|

6.4.Others |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Chromatography Resin Market, by Type |

|

7.2.7.North America Chromatography Resin Market, by Technique |

|

7.2.8.North America Chromatography Resin Market, by Application |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Chromatography Resin Market, by Type |

|

7.3.1.2.US Chromatography Resin Market, by Technique |

|

7.3.1.3.US Chromatography Resin Market, by Application |

|

7.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.Bio-Rad |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Bio-Works Technologies |

|

9.3.Tosoh Corporation |

|

9.4.Danaher |

|

9.5.Merck 9.6.Sartorius Stedim Biotech 9.7.Avanator 9.8.Purolite 9.9.Thermofisher Scientific 9.10.Novasep |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Chromatography Resin Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the chromatography resin Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the chromatography resin ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the chromatography resin market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA