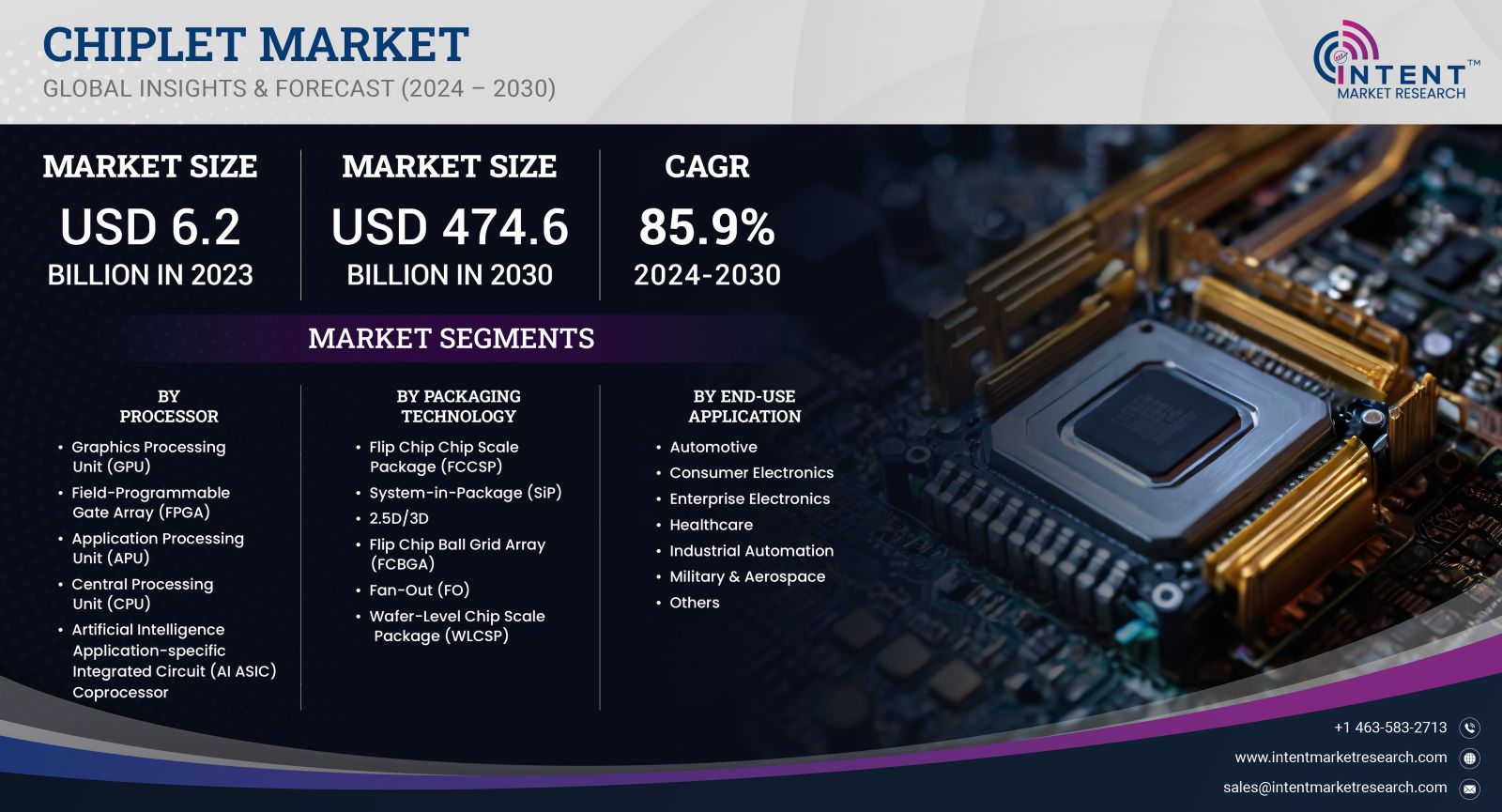

As per Intent Market Research, the Chiplet Market was valued at USD 6.2 billion in 2023-e and will surpass USD 474.6 billion by 2030; growing at a CAGR of 85.9% during 2024 - 2030.

The Chiplet Market has emerged as a transformative force within the semiconductor industry, driven by the growing demand for smaller, faster, and more efficient integrated circuits. Chiplets represent a shift from traditional monolithic system-on-chip (SoC) designs, enabling designers to combine multiple smaller chips into a single package. This modular approach provides enhanced scalability, reduced costs, and improved performance, making it an attractive solution for applications in high-performance computing, telecommunications, and artificial intelligence (AI).

Processor Segment is Largest Owing to Rising Demand in High-Performance Computing

Within the chiplet market, the processor segment holds the largest market share. This dominance is primarily driven by the increasing need for high-performance computing (HPC) applications, especially in industries such as data centers, AI, and cloud computing. Processor chiplets enable companies to combine multiple processing cores from different vendors or technologies into a single package, significantly enhancing processing power while reducing development time and costs.

As technology scales continue to shrink, manufacturers are leveraging chiplets to break the barriers of traditional monolithic chip design. The rise of AI workloads, large-scale data processing, and machine learning models has spurred the adoption of chiplet-based processors. This subsegment is particularly popular among companies focusing on next-generation data center architectures and high-performance cloud infrastructure, positioning the processor chiplet subsegment as a crucial driver of growth in the overall market.

Memory Segment is Fastest Growing Due to Advanced AI and ML Applications

The memory segment is expected to witness the fastest growth within the chiplet market during the forecast period. The growing demand for high-bandwidth memory (HBM) in advanced computing applications such as AI, machine learning (ML), and autonomous vehicles is fueling this rapid expansion. Memory chiplets offer a flexible solution for increasing memory bandwidth without the need for larger monolithic memory designs, making them an ideal choice for memory-intensive workloads.

In particular, HBM chiplets are gaining traction as they allow for greater data throughput and improved energy efficiency, which are essential for modern AI and ML applications. As these technologies continue to evolve, the need for faster and more efficient memory solutions will accelerate, driving the growth of the memory chiplet market at an impressive CAGR during the forecast period.

Interconnect Segment is Largest Owing to Need for Efficient Communication Between Chiplets

The interconnect segment also holds a significant share of the chiplet market. Efficient communication between chiplets is critical to the overall performance of a chiplet-based system, and advancements in interconnect technologies are playing a pivotal role in facilitating this communication. Interconnect chiplets allow for high-speed data transfer between individual chiplets within a package, reducing latency and power consumption.

As the complexity of chiplet systems increases, so does the need for robust and scalable interconnect solutions. The rise of advanced packaging technologies, such as 2.5D and 3D integration, has led to the development of innovative interconnect solutions that improve overall chip performance and efficiency. This segment's growth is further fueled by the increasing deployment of chiplets in high-performance computing and data-intensive applications.

Graphics Processing Unit (GPU) Segment is Fastest Growing Due to Expanding Gaming and AI Markets

The Graphics Processing Unit (GPU) segment is expected to register the fastest growth in the chiplet market over the forecast period. The booming gaming industry, coupled with the increasing adoption of GPUs for AI workloads, is driving this rapid expansion. GPUs are inherently parallel in nature, making them highly suitable for tasks such as image and video rendering, deep learning, and scientific simulations.

Chiplet-based GPU architectures allow manufacturers to scale performance by integrating multiple GPU cores in a single package, without the design limitations of a traditional monolithic GPU. This flexibility is attracting significant interest from both the gaming and AI industries, where performance demands continue to soar. As a result, the GPU segment is poised to see a robust CAGR during the forecast period, driven by the growing popularity of immersive gaming experiences and AI-based applications.

Fastest Growing Region: Asia-Pacific is Leading Due to Manufacturing Hub and Rising Technological Adoption

The Asia-Pacific region is projected to be the fastest-growing market for chiplets from 2024 to 2030. This growth is primarily attributed to the region's dominance in semiconductor manufacturing, especially in countries such as China, Taiwan, and South Korea. Additionally, the rising adoption of advanced technologies such as AI, 5G, and IoT in the region is creating a high demand for chiplet-based solutions.

The presence of leading foundries, including TSMC and Samsung, coupled with strong government support for domestic semiconductor industries, has positioned the Asia-Pacific region at the forefront of chiplet innovation. Moreover, the region's large consumer electronics and automotive markets are further driving the demand for high-performance and efficient chiplet solutions, resulting in a rapidly expanding market.

Leading Companies and Competitive Landscape

The competitive landscape of the chiplet market is characterized by a mix of established semiconductor giants and innovative startups. Leading companies are investing heavily in research and development to stay ahead in this rapidly evolving space. Some of the top players in the market include:

- Advanced Micro Devices (AMD) – A pioneer in chiplet architecture with its Ryzen and EPYC processors, AMD is a key player driving innovation in high-performance computing.

- Intel Corporation – Leveraging its hybrid architectures and integrated solutions, Intel is aggressively advancing its chiplet technology across multiple applications.

- Taiwan Semiconductor Manufacturing Company (TSMC) – As one of the leading foundries, TSMC plays a crucial role in manufacturing chiplets for major semiconductor companies.

- Samsung Electronics – With its advancements in memory chiplets and 3D packaging, Samsung is a significant player in the chiplet market.

- NVIDIA Corporation – A leader in GPU chiplets, NVIDIA is pushing the boundaries of performance in gaming and AI workloads.

- Broadcom Inc. – Known for its communication and networking chiplets, Broadcom is integral to the development of interconnect solutions.

- Marvell Technology – Specializing in infrastructure solutions, Marvell is leveraging chiplets to offer high-performance networking and data center solutions.

- Qualcomm Technologies – Qualcomm is focusing on chiplet integration for mobile and AI-driven applications, particularly in 5G and IoT.

- Xilinx (acquired by AMD) – A leader in programmable logic devices, Xilinx is integrating chiplet technology into its FPGA offerings.

- Apple Inc. – While relatively new to the chiplet market, Apple's innovative M-series chips have set benchmarks for performance and efficiency.

The competitive landscape is characterized by strategic partnerships, mergers, and acquisitions, as companies seek to expand their product portfolios and enhance their capabilities in chiplet technology. The market is expected to see further consolidation as the adoption of chiplets becomes mainstream across various industries.

Report Objectives

The report will help you answer some of the most critical questions in the Chiplet Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the chiplet market?

- What is the size of the chiplet market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 6.2 billion |

|

Forecasted Value (2030) |

USD 474.6 billion |

|

CAGR (2024-2030) |

85.9% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Chiplet Market By Processor (APU, AI ASIC Co-Processor, Field-Programmable Gate Array (FPGA), Central Processing Unit (CPU), Graphics Processing Unit (GPU)), By Packaging Technology (2.5D/3D, FCCSP, FCBGA, SiP, WLCSP, Fan-Out), By End-use Application (Automotive, Electronics, Industrial Automation, Healthcare) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Chiplet Market, by Processor (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Graphics Processing Unit (GPU) |

|

4.2.Field-Programmable Gate Array (FPGA) |

|

4.3.Application Processing Unit (APU) |

|

4.4.Central Processing Unit (CPU) |

|

4.5.Artificial Intelligence Application-specific Integrated Circuit (AI ASIC) Coprocessor |

|

5.Chiplet Market, by Packaging Technology (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Flip Chip Chip Scale Package (FCCSP) |

|

5.2.System-in-Package (SiP) |

|

5.3.2.5D/3D |

|

5.4.Flip Chip Ball Grid Array (FCBGA) |

|

5.5.Fan-Out (FO) |

|

5.6.Wafer-Level Chip Scale Package (WLCSP) |

|

6.Chiplet Market, by End-use Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Automotive |

|

6.2.Consumer Electronics |

|

6.3.Enterprise Electronics |

|

6.4.Healthcare |

|

6.5.Industrial Automation |

|

6.6.Military & Aerospace |

|

6.7.Others |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Chiplet Market, by Processor |

|

7.2.7.North America Chiplet Market, by Packaging Technology |

|

7.2.8.North America Chiplet Market, by End-use Application |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Chiplet Market, by Processor |

|

7.3.1.2.US Chiplet Market, by Packaging Technology |

|

7.3.1.3.US Chiplet Market, by End-use Application |

|

7.3.2.Canada |

|

Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.Apple |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Advanced Micro Devices |

|

9.3.Intel |

|

9.4.Marvell |

|

9.5.Achronix Semiconductor Corporation |

|

9.6.NVIDIA |

|

9.7.Mediatek |

|

9.8.Ranovus |

|

9.9.IBM |

|

9.10.Cadence Design Systems |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the chiplet market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the chiplet Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the chiplet ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the chiplet market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA

.jpg)