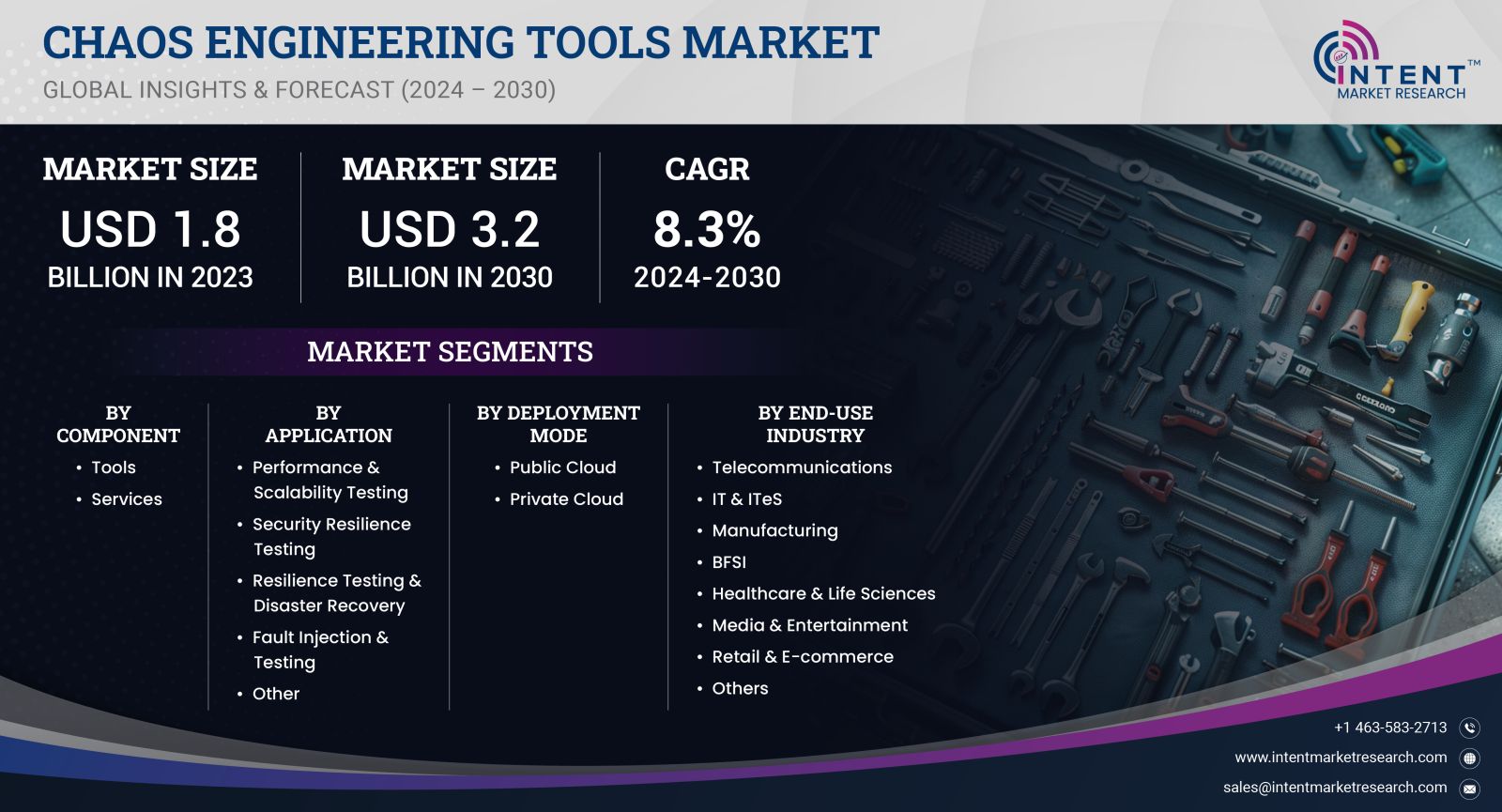

As per Intent Market Research, the Chaos Engineering Tools Market was valued at USD 1.8 billion in 2023-e and will surpass USD 3.2 billion by 2030; growing at a CAGR of 8.3% during 2024 - 2030.

The Chaos Engineering Tools market is gaining prominence as organizations increasingly adopt a proactive approach to enhance system resilience and reliability. Chaos engineering involves deliberately injecting faults and disruptions into systems to identify vulnerabilities and improve performance under adverse conditions. This practice is essential for companies operating in today's complex IT environments, where uptime and reliability are paramount.

The adoption of chaos engineering tools is being driven by the increasing complexity of cloud-based environments and microservices architecture, which can introduce new failure points that traditional testing methods may overlook. As businesses strive to enhance user experience and maintain competitive advantage, the focus on chaos engineering becomes vital. Various segments within this market, including tools for cloud infrastructure, microservices, and site reliability engineering (SRE), are gaining traction. By exploring the key segments and their sub-segments, stakeholders can better understand the dynamics influencing market growth and the opportunities that lie ahead.

Cloud Infrastructure Tools Segment is Fastest Growing Owing to

The cloud infrastructure tools segment of the chaos engineering market is experiencing rapid growth due to the widespread adoption of cloud computing across industries. Organizations are increasingly migrating their workloads to cloud platforms, enabling greater flexibility and scalability. This shift necessitates the implementation of chaos engineering practices to ensure system robustness in the face of potential cloud service failures. The surge in remote work, accelerated by the pandemic, has further emphasized the need for reliable cloud infrastructure, leading to a greater focus on testing resilience in these environments. The cloud infrastructure chaos engineering tools market is projected to witness a CAGR of around 28% from 2024 to 2030.

Key players in this segment are continuously innovating to provide advanced features, such as automated failure simulations and real-time monitoring. The integration of machine learning algorithms to predict and mitigate potential failures is also gaining traction. As organizations prioritize uptime and user satisfaction, the adoption of cloud infrastructure chaos engineering tools is expected to become an integral part of their operational strategy. Consequently, this sub-segment is anticipated to significantly contribute to the overall growth of the chaos engineering tools market in the coming years.

Microservices Tools Segment is Largest Owing to

The microservices tools segment is currently the largest within the chaos engineering tools market, driven by the growing trend of microservices architecture among organizations. Microservices enable businesses to develop and deploy applications in a modular fashion, improving agility and scalability. However, this architecture also introduces challenges in terms of service dependencies and potential points of failure. Chaos engineering tools designed for microservices allow organizations to simulate failures and validate the resilience of each component, ensuring that the entire system can withstand disruptions. This segment is expected to maintain its leadership, with a market share of approximately 45% throughout the forecast period.

The need for continuous testing and validation in microservices environments is prompting companies to invest heavily in chaos engineering solutions. As more organizations adopt microservices to drive digital transformation, the demand for specialized tools to manage and test these architectures is set to rise. Leading players in this segment are focusing on providing comprehensive solutions that integrate seamlessly with existing CI/CD pipelines, making it easier for teams to incorporate chaos engineering into their workflows. The microservices tools segment is thus positioned for sustained growth, reflecting its crucial role in enhancing the reliability of modern software applications.

Site Reliability Engineering (SRE) Tools Segment is Fastest Growing Owing to

The site reliability engineering (SRE) tools segment is the fastest growing within the chaos engineering tools market, as organizations increasingly recognize the importance of reliability in software systems. SRE combines software engineering practices with IT operations, ensuring that services are not only built but also maintained effectively. Chaos engineering plays a vital role in this discipline by proactively identifying weaknesses and potential failure points in systems. This segment is projected to grow at a remarkable CAGR of 30% from 2024 to 2030, driven by the expanding adoption of SRE practices across various industries.

SRE teams are responsible for maintaining system reliability, availability, and performance, which aligns perfectly with the objectives of chaos engineering. The increasing complexity of distributed systems necessitates a shift towards more robust testing methods, including chaos engineering simulations. As organizations strive to deliver seamless user experiences, the integration of chaos engineering tools into SRE practices is expected to rise. Companies are focusing on enhancing collaboration between development and operations teams, resulting in improved efficiency and responsiveness. As such, the SRE tools segment is poised for significant growth, reflecting the broader trend of prioritizing reliability in software development.

Leading Region is North America Owing to

North America emerges as the leading region in the chaos engineering tools market, driven by the concentration of technology companies and the early adoption of innovative practices. The United States, in particular, has been at the forefront of chaos engineering, with numerous organizations leveraging these tools to enhance system resilience. The region's robust IT infrastructure, coupled with a culture of continuous innovation, facilitates the rapid adoption of chaos engineering practices across various sectors, including finance, healthcare, and retail. North America is expected to maintain its dominance throughout the forecast period, capturing approximately 40% of the market share.

The increasing complexity of software systems and the rising demand for high availability are key factors propelling the growth of chaos engineering in North America. Companies in the region are investing significantly in research and development to enhance their chaos engineering capabilities, ensuring that they remain competitive in an evolving digital landscape. Furthermore, the presence of leading chaos engineering tool providers in North America fosters a conducive environment for market growth. As businesses continue to recognize the value of proactive testing, the region is set to play a pivotal role in shaping the future of the chaos engineering tools market.

Competitive Landscape

The competitive landscape of the chaos engineering tools market is characterized by the presence of several prominent players who are continually innovating to enhance their offerings. The top ten companies dominating this space include:

- Gremlin - A pioneer in chaos engineering, Gremlin provides a comprehensive platform for conducting chaos experiments and improving system reliability.

- Chaos Monkey (Part of Netflix) - A well-known tool in the chaos engineering community, Chaos Monkey helps organizations identify and mitigate weaknesses in cloud environments.

- Azure Chaos Studio (Microsoft) - Microsoft’s Azure Chaos Studio offers built-in capabilities for chaos engineering, enabling developers to test the resilience of their applications on Azure.

- AWS Fault Injection Simulator - Amazon Web Services (AWS) provides this service to help customers simulate various failure scenarios in their applications to enhance reliability.

- LitmusChaos - An open-source chaos engineering framework that allows users to orchestrate chaos experiments across cloud-native applications.

- ChaosIQ - Offers solutions designed for enterprises looking to incorporate chaos engineering into their software development processes.

- Gremlin - Provides robust chaos engineering solutions that empower teams to test and improve system resilience effectively.

- Blameless - This platform focuses on SRE and incident management, integrating chaos engineering practices to enhance overall system reliability.

- Instana - A monitoring and observability platform that integrates chaos engineering to help organizations ensure application reliability.

- SRE Academy - Offers educational resources and tools that enable organizations to adopt chaos engineering as part of their SRE practices.

Report Objectives:

The report will help you answer some of the most critical questions in the Chaos Engineering Tools Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Chaos Engineering Tools market?

- What is the size of the Chaos Engineering Tools market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.8 billion |

|

Forecasted Value (2030) |

USD 3.2 billion |

|

CAGR (2024-2030) |

8.3% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Chaos Engineering Tools Market By Component (Tools, Services), By Deployment Mode (Public, Private), By Application (Performance & Scalability Testing, Security Resilience Testing, Resilience Testing & Disaster Recovery), By End-use Industry (BFSI, IT & ITeS, Telecommunications, Media & Entertainment, Fault Injection & Testing) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Chaos Engineering Tools Market, by Component (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Tools |

|

4.2.Services |

|

5.Chaos Engineering Tools Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Performance & Scalability Testing |

|

5.2.Security Resilience Testing |

|

5.3.Resilience Testing & Disaster Recovery |

|

5.4.Fault Injection & Testing |

|

5.5.Other |

|

6.Chaos Engineering Tools Market, by Deployment Mode (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Public Cloud |

|

6.2.Private Cloud |

|

7.Chaos Engineering Tools Market, by End-use Industry (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Telecommunications |

|

7.2.IT & ITeS |

|

7.3.Manufacturing |

|

7.4.BFSI |

|

7.5.Healthcare & Life Sciences |

|

7.6.Media & Entertainment |

|

7.7.Retail & E-commerce |

|

7.8.Others |

|

8.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Regional Overview |

|

8.2.North America |

|

8.2.1.Regional Trends & Growth Drivers |

|

8.2.2.Barriers & Challenges |

|

8.2.3.Opportunities |

|

8.2.4.Factor Impact Analysis |

|

8.2.5.Technology Trends |

|

8.2.6.North America Chaos Engineering Tools Market, by Component |

|

8.2.7.North America Chaos Engineering Tools Market, by Application |

|

8.2.8.North America Chaos Engineering Tools Market, by Deployment Mode |

|

8.2.9.North America Chaos Engineering Tools Market, by End-use Industry |

|

*Similar segmentation will be provided at each regional level |

|

8.3.By Country |

|

8.3.1.US |

|

8.3.1.1.US Chaos Engineering Tools Market, by Component |

|

8.3.1.2.US Chaos Engineering Tools Market, by Application |

|

8.3.1.3.US Chaos Engineering Tools Market, by Deployment Mode |

|

8.3.1.4.US Chaos Engineering Tools Market, by End-use Industry |

|

8.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

8.4.Europe |

|

8.5.APAC |

|

8.6.Latin America |

|

8.7.Middle East & Africa |

|

9.Competitive Landscape |

|

9.1.Overview of the Key Players |

|

9.2.Competitive Ecosystem |

|

9.2.1.Platform Manufacturers |

|

9.2.2.Subsystem Manufacturers |

|

9.2.3.Service Providers |

|

9.2.4.Software Providers |

|

9.3.Company Share Analysis |

|

9.4.Company Benchmarking Matrix |

|

9.4.1.Strategic Overview |

|

9.4.2.Product Innovations |

|

9.5.Start-up Ecosystem |

|

9.6.Strategic Competitive Insights/ Customer Imperatives |

|

9.7.ESG Matrix/ Sustainability Matrix |

|

9.8.Manufacturing Network |

|

9.8.1.Locations |

|

9.8.2.Supply Chain and Logistics |

|

9.8.3.Product Flexibility/Customization |

|

9.8.4.Digital Transformation and Connectivity |

|

9.8.5.Environmental and Regulatory Compliance |

|

9.9.Technology Readiness Level Matrix |

|

9.10.Technology Maturity Curve |

|

9.11.Buying Criteria |

|

10.Company Profiles |

|

10.1.OpenText |

|

10.1.1.Company Overview |

|

10.1.2.Company Financials |

|

10.1.3.Product/Service Portfolio |

|

10.1.4.Recent Developments |

|

10.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2.Harness |

|

10.3.Tricentis |

|

10.4.Nagarro |

|

10.5.Microsoft |

|

10.6.Cavission |

|

10.7.Virtusa |

|

10.8.Speedscale |

|

10.9.Wiremock |

|

10.10.Chaossearch |

|

11.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Chaos Engineering Tools Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the Chaos Engineering Tools Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Chaos Engineering Tools ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the Chaos Engineering Tools market. These methods were also employed to estimate the size of various sub-segments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA

.jpg)