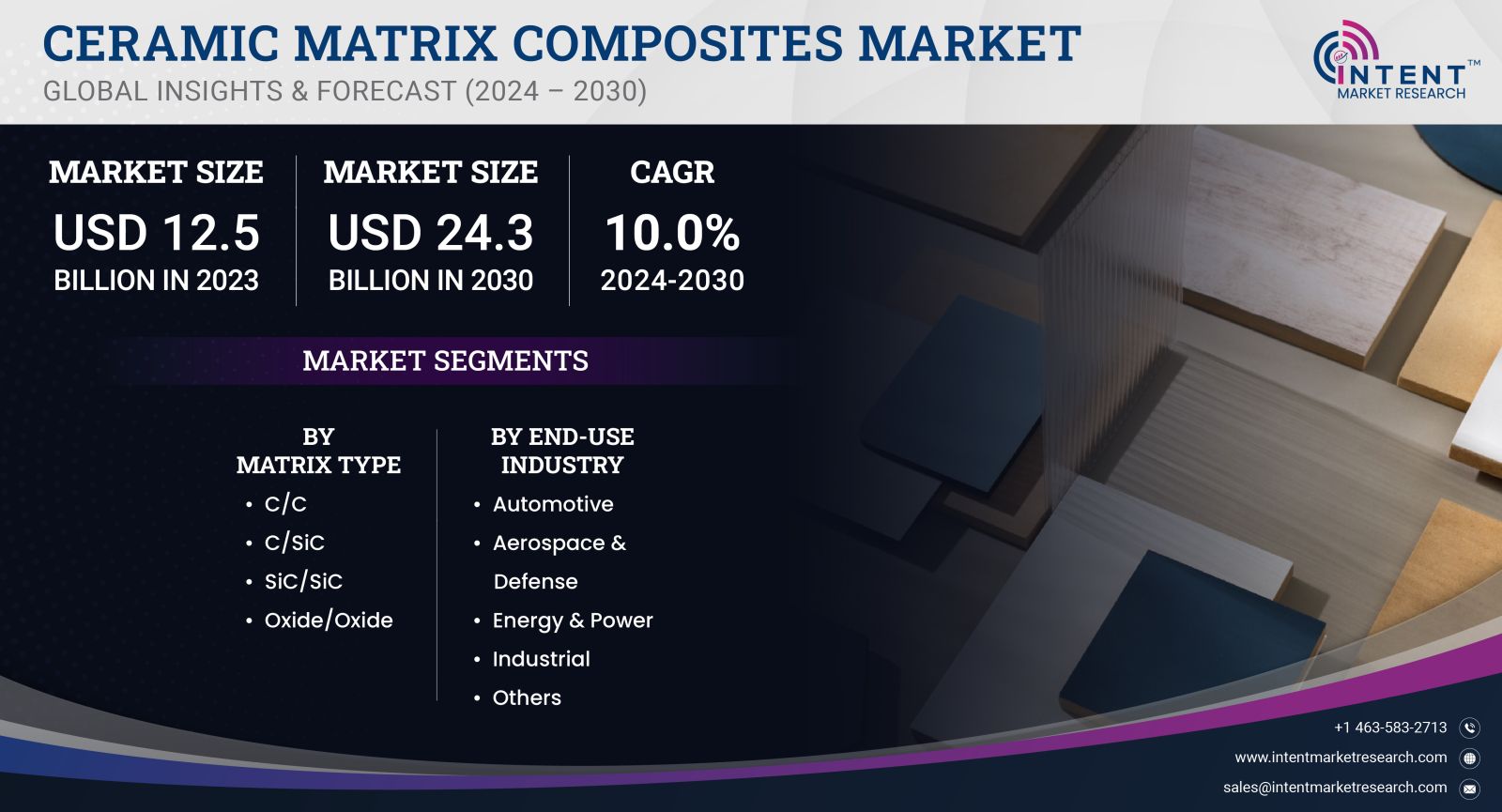

As per Intent Market Research, the Ceramic Matrix Composites Market was valued at USD 12.5 billion in 2023 and will surpass USD 24.3 billion by 2030; growing at a CAGR of 10.0% during 2024 - 2030.

The ceramic matrix composites (CMCs) market is on an upward trajectory, driven by the increasing demand for lightweight, high-strength materials across various industries, particularly aerospace, automotive, and energy. This growth is attributed to the rising need for advanced materials that can withstand extreme conditions, coupled with the growing focus on energy efficiency and sustainability in manufacturing processes.

Aerospace Segment is Largest Owing to Demand for Lightweight Materials

The aerospace segment is the largest within the ceramic matrix composites market, primarily due to the industry’s stringent requirements for lightweight and high-performance materials. The aerospace sector continuously seeks innovative solutions to reduce aircraft weight, thereby enhancing fuel efficiency and overall performance. CMCs are increasingly utilized in various applications, including turbine engines, heat shields, and structural components, thanks to their ability to withstand high temperatures and harsh environments.

Moreover, the aerospace industry is undergoing a significant transformation, with manufacturers striving to develop next-generation aircraft that prioritize sustainability and operational efficiency. The integration of CMCs into aerospace applications aligns with these objectives, as these materials provide a favorable strength-to-weight ratio and reduce the overall carbon footprint of aircraft. As advancements in aerospace technology continue to evolve, the demand for CMCs is expected to remain robust, solidifying the aerospace segment’s dominance in the ceramic matrix composites market.

Automotive Segment Fastest Growing Owing to Advancements in Electric Vehicles

The automotive segment is anticipated to be the fastest-growing segment in the ceramic matrix composites market, driven by advancements in electric vehicle (EV) technologies and the need for lightweight materials. With the automotive industry increasingly transitioning towards electrification, manufacturers are seeking ways to improve vehicle performance, battery efficiency, and range. CMCs play a crucial role in this transformation, as their lightweight and high-strength properties help reduce the overall weight of vehicles, leading to enhanced efficiency and performance.

Additionally, the growing emphasis on reducing greenhouse gas emissions and promoting sustainability in automotive manufacturing is propelling the adoption of CMCs. The use of ceramic matrix composites in brake systems, engine components, and other critical automotive parts supports these goals by providing durable and efficient solutions. As the demand for electric and hybrid vehicles continues to rise, the automotive segment is poised for significant growth, driving the overall expansion of the ceramic matrix composites market.

Energy Segment is Largest Owing to Increasing Focus on Renewable Energy

The energy segment is the largest in terms of applications within the ceramic matrix composites market, primarily due to the increasing focus on renewable energy sources and the need for efficient power generation. CMCs are widely used in the energy sector, particularly in applications related to gas turbines, nuclear reactors, and other high-temperature environments. Their ability to withstand extreme temperatures and corrosive environments makes them ideal for use in energy production, where reliability and efficiency are paramount.

Moreover, the ongoing global shift towards cleaner energy sources is driving innovation in energy technologies, creating opportunities for CMCs to enhance performance and efficiency. The increasing demand for energy-efficient solutions and the growing emphasis on reducing emissions further reinforce the need for advanced materials like CMCs. As the energy sector continues to evolve and adapt to sustainability goals, the energy segment is expected to remain a significant contributor to the ceramic matrix composites market.

Defense Segment Fastest Growing Owing to Enhanced Performance Requirements

The defense segment is projected to be the fastest-growing area within the ceramic matrix composites market, driven by the rising demand for advanced materials that meet stringent performance and durability requirements in military applications. CMCs are increasingly utilized in various defense applications, including armor systems, aerospace components, and missile systems, owing to their superior strength, lightweight characteristics, and resistance to high temperatures.

As military organizations around the world focus on modernization and enhancing operational capabilities, the demand for innovative materials that can withstand extreme conditions is growing. The integration of CMCs into defense applications not only improves performance but also enhances the safety and survivability of military personnel and equipment. As defense spending continues to increase globally, the demand for ceramic matrix composites in this sector is expected to witness substantial growth, contributing to the overall expansion of the market.

North America Region Largest Owing to Technological Advancements

The North America region is the largest market for ceramic matrix composites, driven by technological advancements and a strong focus on research and development. The aerospace and defense industries in the United States are significant consumers of CMCs, as they invest heavily in innovative materials to enhance the performance and efficiency of their products. Additionally, the presence of major manufacturers and suppliers in the region supports a competitive market environment that fosters innovation and growth.

Furthermore, the increasing demand for lightweight materials in the automotive sector, particularly with the rise of electric vehicles, is contributing to the growth of the CMC market in North America. As companies continue to prioritize sustainability and energy efficiency in their operations, the adoption of ceramic matrix composites is expected to expand. With ongoing investments in research and development, North America is likely to maintain its leadership position in the global ceramic matrix composites market throughout the forecast period.

Top Companies Leading the Competitive Landscape

The competitive landscape of the ceramic matrix composites market features several leading companies that are driving innovation and growth. The top 10 companies in this market include General Electric Company, Rolls-Royce Holdings PLC, Siemens AG, Safran S.A., 3M Company, United Technologies Corporation, Mitsubishi Heavy Industries, CoorsTek Inc., CeramTec GmbH, and NASA (National Aeronautics and Space Administration). These companies are recognized for their strong brand presence, diverse product portfolios, and commitment to quality and technological advancement in ceramic matrix composites.

Competition within the ceramic matrix composites market is intense, with companies focusing on product innovation, research and development, and strategic partnerships. Many leading manufacturers are investing significantly in R&D to enhance the performance and applicability of CMCs across various sectors. Additionally, strategic collaborations and joint ventures are becoming increasingly common as companies seek to expand their market reach and enhance their competitive advantage. With ongoing trends towards lightweight and high-performance materials, leading players are well-positioned to capitalize on the growing opportunities within the ceramic matrix composites market, ensuring their continued relevance and success in the industry.

Report Objectives:

The report will help you answer some of the most critical questions in the Ceramic Matrix Composites Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the ceramic matrix composites market?

- What is the size of the ceramic matrix composites market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 12.5 billion |

|

Forecasted Value (2030) |

USD 24.3 billion |

|

CAGR (2024-2030) |

10.0% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Ceramic Matrix Composites Market By Matrix Type (C/C, C/Sic, Sic/Sic, Oxide/Oxide), By Fiber Type (Continuous, Woven), By End-use Industry (Automotive, Aerospace and Defense, Energy and Power, Industrial) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Ceramic Matrix Composites Market, by Fiber Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Continuous |

|

4.2.Woven |

|

4.3.Others (Felt/Mat, Chopped, Twill, Braided, Ropes & Belts) |

|

5.Ceramic Matrix Composites Market, by Matrix Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.C/C |

|

5.2.C/SiC |

|

5.3.SiC/SiC |

|

5.4.Oxide/Oxide |

|

6.Ceramic Matrix Composites Market, by End-use Industry (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Automotive |

|

6.2.Aerospace & Defense |

|

6.3.Energy & Power |

|

6.4.Industrial |

|

6.5.Others (Other Includes Electrical & Electronics, Biomedical, And Marine) |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.5.1.Existing & Future Technologies Disrupting the Market |

|

7.2.5.2.Use Case Analysis |

|

7.2.5.3.Company Innovations |

|

7.2.5.4.Pricing Analysis |

|

7.2.5.5.Regulatory Landscape |

|

7.2.6.North America Ceramic Matrix Composites Market, by Fiber Type |

|

7.2.7.North America Ceramic Matrix Composites Market, by Matrix Type |

|

7.2.8.North America Ceramic Matrix Composites Market, by End-use Industry |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Ceramic Matrix Composites Market, by Fiber Type |

|

7.3.1.2.US Ceramic Matrix Composites Market, by Matrix Type |

|

7.3.1.3.US Ceramic Matrix Composites Market, by End-use Industry |

|

7.3.2.Canada |

|

7.3.3.Mexico |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.General Electric |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Lancer Systems |

|

9.3.CoorsTek |

|

9.4.RTX Corporation |

|

9.5.COI Ceramics |

|

9.6.Rolls-Royce |

|

9.7.SGL Carbon |

|

9.8.Composites Horizons, LLC |

|

9.9.Axiom Materials |

|

9.10.Pyromeral Systems |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Ceramic Matrix Composites Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the ceramic matrix composites Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the ceramic matrix composites ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the ceramic matrix composites market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA