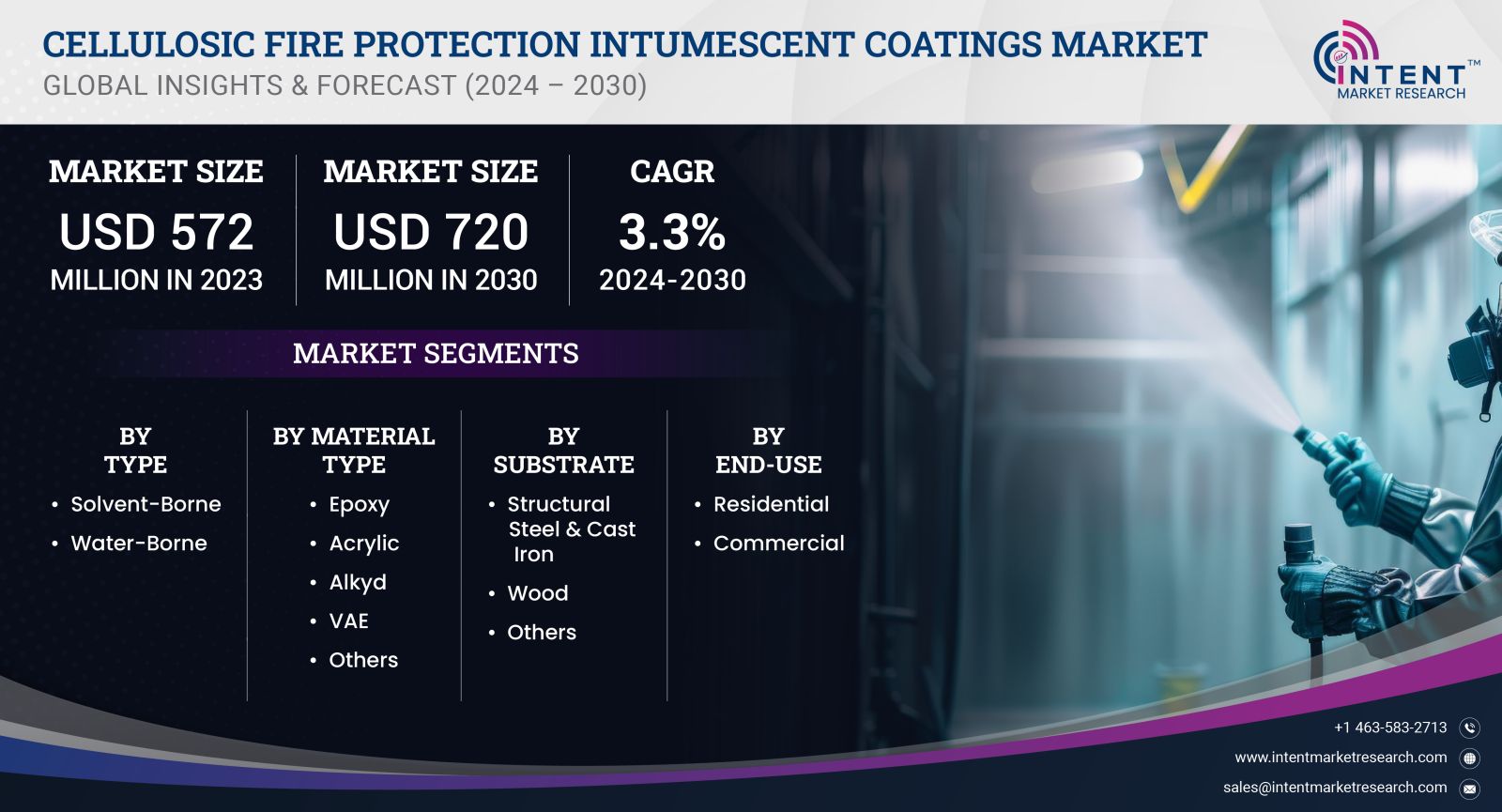

As per Intent Market Research, the Cellulosic Fire Protection Intumescent Coatings Market was valued at USD 572 million in 2023-e and will surpass USD 720 million by 2030; growing at a CAGR of 3.3% during 2024 - 2030.

The global Cellulosic Fire Protection Intumescent Coatings Market is on a promising trajectory, driven by the growing need for enhanced fire safety measures in construction and various industrial applications. Intumescent coatings are a vital component in passive fire protection systems, as they swell and form an insulating char layer when exposed to high temperatures, thereby protecting structural elements from fire damage. These coatings are particularly effective for cellulosic materials, which are prevalent in many construction applications. This growth is influenced by increasing regulatory requirements and rising awareness regarding fire safety in residential, commercial, and industrial sectors.

Product Type Segment: Water-based Intumescent Coatings are the Largest Owing to Eco-Friendliness

Within the product type segment, Water-based Intumescent Coatings dominate the market, primarily due to their eco-friendly properties and ease of application. These coatings offer significant advantages over solvent-based options, including lower volatile organic compounds (VOCs), which align with stringent environmental regulations and sustainability initiatives. The growing emphasis on green building practices and the need for safer application methods in occupied spaces are driving the demand for water-based intumescent coatings.

Furthermore, water-based formulations exhibit excellent adhesion properties and can be applied to a variety of substrates, including wood and steel. The versatility and performance of water-based coatings make them the preferred choice among architects, contractors, and building owners looking to meet fire safety standards without compromising environmental integrity. As the market shifts towards sustainable solutions, water-based intumescent coatings are expected to maintain their status as the largest subsegment in the cellulosic fire protection intumescent coatings market.

End-Use Segment: Commercial Construction is the Fastest Growing Owing to Urbanization Trends

The Commercial Construction sector is the fastest-growing subsegment in the end-use category, propelled by rapid urbanization and increasing investments in infrastructure development. As cities expand and new commercial properties are constructed, there is a rising demand for effective fire protection solutions to ensure the safety of occupants and assets. Intumescent coatings play a crucial role in this context, providing essential fire resistance for structural components in office buildings, shopping centers, and other commercial facilities.

Additionally, the growing awareness of fire safety regulations and building codes has led to increased compliance requirements for commercial construction projects. Builders and developers are increasingly adopting intumescent coatings as part of their fire protection strategies, recognizing their effectiveness in enhancing safety and minimizing damage during fire incidents. As urbanization trends continue to drive construction activities, the commercial construction sector is expected to remain a significant growth driver for the cellulosic fire protection intumescent coatings market.

Application Segment: Structural Steel Protection is the Largest Owing to Regulatory Compliance

In the application segment, Structural Steel Protection emerges as the largest subsegment, reflecting the critical need for fire protection in buildings and infrastructure. Steel is a widely used construction material, but it can lose its structural integrity under high temperatures. Intumescent coatings are extensively applied to structural steel elements to provide necessary fire resistance, ensuring that buildings meet regulatory compliance standards for fire safety.

The demand for structural steel protection is further amplified by the ongoing construction of high-rise buildings and industrial facilities, where the stakes for fire safety are significantly higher. Regulatory agencies worldwide are enforcing stringent fire safety codes, compelling builders to incorporate intumescent coatings into their projects. As the focus on safety in construction intensifies, structural steel protection is poised to maintain its position as the largest application segment in the cellulosic fire protection intumescent coatings market.

Region Segment: North America is the Largest Owing to Stringent Safety Regulations

North America is the largest region in the cellulosic fire protection intumescent coatings market, largely attributed to stringent fire safety regulations and a well-established construction industry. The United States and Canada have implemented comprehensive fire safety codes that necessitate the use of fire-resistant materials in both commercial and residential construction. This regulatory landscape has fostered a strong demand for intumescent coatings, particularly in high-rise buildings, industrial facilities, and infrastructure projects.

Furthermore, the increasing focus on safety and sustainability in construction practices is driving the adoption of intumescent coatings in North America. The region's commitment to innovation and the development of advanced fire protection solutions ensures that it remains a key player in the global market. As construction activities continue to rise, particularly in urban areas, North America is expected to sustain its leadership position in the cellulosic fire protection intumescent coatings market.

Competitive Landscape: Leading Companies Driving Growth in the Cellulosic Fire Protection Intumescent Coatings Market

The cellulosic fire protection intumescent coatings market is characterized by a competitive landscape featuring several key players who are continuously innovating and expanding their offerings. The top 10 companies in this market include:

- AkzoNobel N.V.

- PPG Industries, Inc.

- Sherwin-Williams Company

- BASF SE

- Rpm International Inc.

- Sika AG

- Albi Protective Coatings

- Dulux Group (part of AkzoNobel)

- Jotun A/S

- Hempel A/S

These companies are at the forefront of developing advanced intumescent coatings that meet evolving fire safety standards and customer needs. For instance, AkzoNobel and PPG Industries are focusing on formulating high-performance water-based intumescent coatings that align with sustainability goals while providing exceptional fire protection. The competitive landscape is also marked by strategic partnerships, collaborations, and acquisitions as companies seek to enhance their market presence and expand their product portfolios.

As the demand for effective fire protection solutions continues to rise, these leading companies are well-positioned to capitalize on emerging opportunities in the cellulosic fire protection intumescent coatings market. Their commitment to innovation, quality, and sustainability will drive growth and ensure their relevance in this dynamic market landscape.

Report Objectives:

The report will help you answer some of the most critical questions in the Cellulosic Fire Protection Intumescent Coatings Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the cellulosic fire protection intumescent coatings market?

- What is the size of the cellulosic fire protection intumescent coatings market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 572 million |

|

Forecasted Value (2030) |

USD 720 million |

|

CAGR (2024-2030) |

3.3% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Cellulosic Fire Protection Intumescent Coatings Market By Material Type (Acrylic, Alkyd, Epoxy, VAE), By Type (Solvent-borne, Water-borne), By Substrate Type (Structural Steel & Cast Iron, Wood), By End-Use (Residential, Commercial) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Cellulosic Fire Protection Intumescent Coatings Market, by Type (Market Size & Forecast: USD Million, 2024 – 2030) |

|

4.1.Solvent-Borne |

|

4.2.Water-Borne |

|

5.Cellulosic Fire Protection Intumescent Coatings Market, by Material Type (Market Size & Forecast: USD Million, 2024 – 2030) |

|

5.1.Epoxy |

|

5.2.Acrylic |

|

5.3.Alkyd |

|

5.4.VAE |

|

5.5.Others |

|

6.Cellulosic Fire Protection Intumescent Coatings Market, by Substrate (Market Size & Forecast: USD Million, 2024 – 2030) |

|

6.1.Structural Steel & Cast Iron |

|

6.2.Wood |

|

6.3.Others |

|

7.Cellulosic Fire Protection Intumescent Coatings Market, by End-Use (Market Size & Forecast: USD Million, 2024 – 2030) |

|

7.1.Residential |

|

7.2.Commercial |

|

8.Regional Analysis (Market Size & Forecast: USD Million, 2024 – 2030) |

|

8.1.Regional Overview |

|

8.2.North America |

|

8.2.1.Regional Trends & Growth Drivers |

|

8.2.2.Barriers & Challenges |

|

8.2.3.Opportunities |

|

8.2.4.Factor Impact Analysis |

|

8.2.5.Technology Trends |

|

8.2.6.North America Cellulosic Fire Protection Intumescent Coatings Market, by Type |

|

8.2.7.North America Cellulosic Fire Protection Intumescent Coatings Market, by Material Type |

|

8.2.8.North America Cellulosic Fire Protection Intumescent Coatings Market, by Substrate |

|

8.2.9.North America Cellulosic Fire Protection Intumescent Coatings Market, by End-Use |

|

*Similar segmentation will be provided at each regional level |

|

8.3.By Country |

|

8.3.1.US |

|

8.3.1.1.US Cellulosic Fire Protection Intumescent Coatings Market, by Type |

|

8.3.1.2.US Cellulosic Fire Protection Intumescent Coatings Market, by Material Type |

|

8.3.1.3.US Cellulosic Fire Protection Intumescent Coatings Market, by Substrate |

|

8.3.1.4.US Cellulosic Fire Protection Intumescent Coatings Market, by End-Use |

|

8.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

8.4.Europe |

|

8.5.APAC |

|

8.6.Latin America |

|

8.7.Middle East & Africa |

|

9.Competitive Landscape |

|

9.1.Overview of the Key Players |

|

9.2.Competitive Ecosystem |

|

9.2.1.Platform Manufacturers |

|

9.2.2.Subsystem Manufacturers |

|

9.2.3.Service Providers |

|

9.2.4.Software Providers |

|

9.3.Company Share Analysis |

|

9.4.Company Benchmarking Matrix |

|

9.4.1.Strategic Overview |

|

9.4.2.Product Innovations |

|

9.5.Start-up Ecosystem |

|

9.6.Strategic Competitive Insights/ Customer Imperatives |

|

9.7.ESG Matrix/ Sustainability Matrix |

|

9.8.Manufacturing Network |

|

9.8.1.Locations |

|

9.8.2.Supply Chain and Logistics |

|

9.8.3.Product Flexibility/Customization |

|

9.8.4.Digital Transformation and Connectivity |

|

9.8.5.Environmental and Regulatory Compliance |

|

9.9.Technology Readiness Level Matrix |

|

9.10.Technology Maturity Curve |

|

9.11.Buying Criteria |

|

10.Company Profiles |

|

10.1.ETEX Group |

|

10.1.1.Company Overview |

|

10.1.2.Company Financials |

|

10.1.3.Product/Service Portfolio |

|

10.1.4.Recent Developments |

|

10.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2.Kansai Paints |

|

10.3.RPM International |

|

10.4.Sika |

|

10.5.The Sherwin-Williams Company |

|

10.6.PPG Industries |

|

10.7.Hempel |

|

10.8.Akzonobel |

|

10.9.Contego International |

|

10.10.JF Amonn |

|

11.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the cellulosic fire protection intumescent coatings market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the cellulosic fire protection intumescent coatings Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the cellulosic fire protection intumescent coatings ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the cellulosic fire protection intumescent coatings market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA

.jpg)