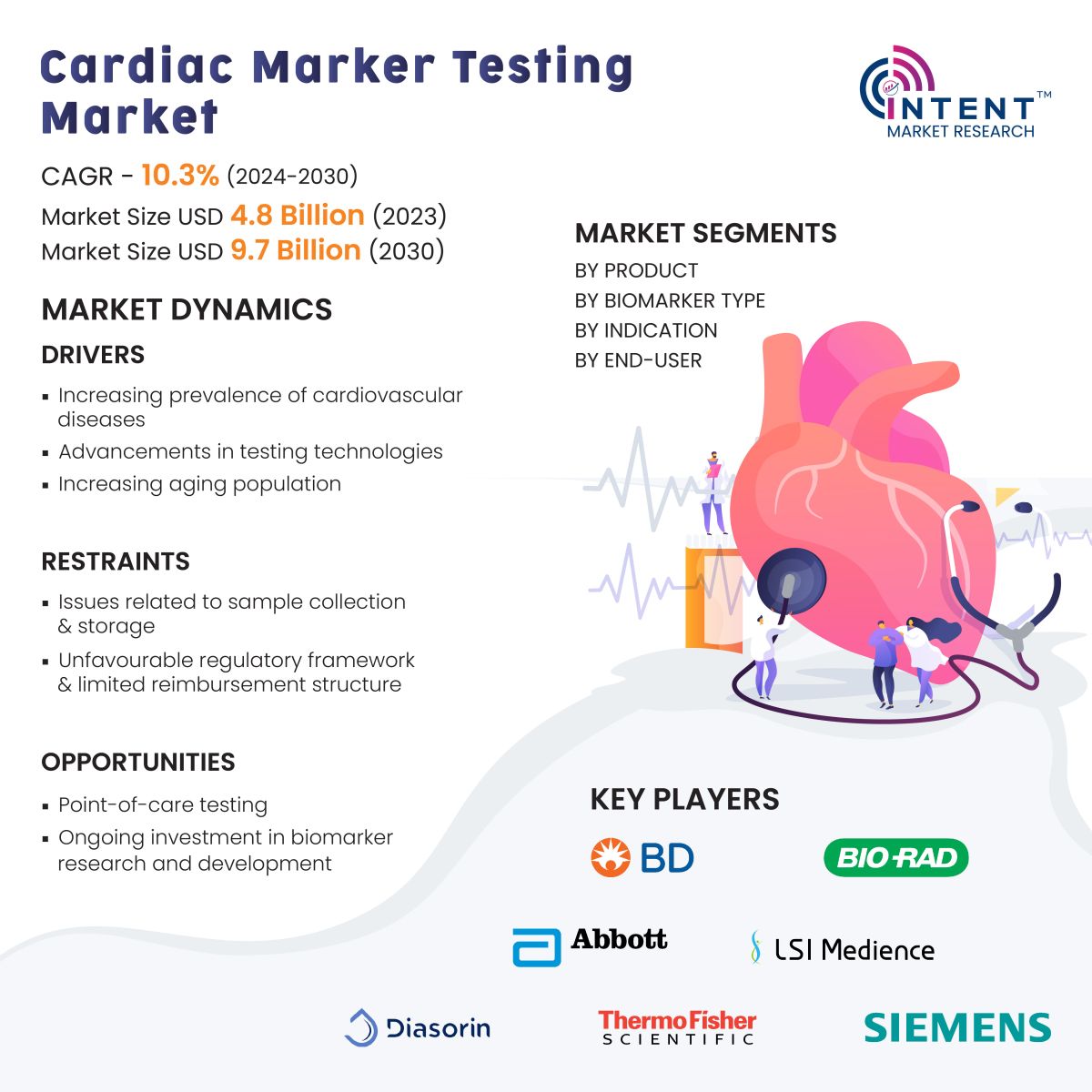

According to Intent Market Research, the Cardiac Marker Testing Market is expected to grow from USD 4.8 billion in 2023-e at a CAGR of 10.3% to touch USD 9.7 billion by 2030. The cardiac marker testing is a competitive market, the prominent players in the global market include Abbott, BD, bioMérieux, Bio-Rad, Danaher, DiaSorin, LSI Medience, PerkinElmer, Quidel, Roche, Siemens, Thermo Fisher Scientific, and Tosoh. The market is thriving due to factors such as the increasing prevalence of cardiovascular diseases.

Cardiac marker testing involves the measurement of specific substances in the blood that are released when the heart is damaged or stressed. It involves the analysis of specific proteins released during heart damage. Troponins, BNP, and CK-MB are among the key biomarkers assessed to diagnose conditions such as heart attacks and heart failure. These tests, performed through blood samples, aid in determining the extent of cardiac injury, and guide treatment decisions. From high-sensitivity assays to point-of-care testing, this field is continually evolving, providing critical insights for timely intervention and personalized patient care.

Increasing Prevalence of Cardiovascular Diseases to Drive the Market

The escalating prevalence of cardiovascular diseases propels the imperative for advanced diagnostic tools. High-profile public awareness campaigns, coupled with targeted health initiatives, become vital. Such efforts aim to educate communities, emphasizing prevention, early detection, and lifestyle modifications.

According to "World Health Fedration" deaths from cardiovascular disease (CVD) rises globally to 20.5 million in 2021. CVD emerged as the predominant cause of death worldwide in 2021, with four out of every five CVD-related deaths occurring in low- and middle-income countries (LMICs). Globally, sedentary lifestyles, poor diets, and an aging population contribute to rising cardiovascular diseases. The increasing incidence underscores the need for effective diagnostic tools, with cardiac biomarker testing playing a crucial role in the prompt identification and management of cardiovascular conditions in contemporary healthcare.

Revolutionizing Cardiovascular Care with AI, Telemedicine, and Remote Monitoring Synergy

AI and cardiac biomarker testing revolutionize healthcare by swiftly and accurately deciphering data, identifying patterns, predicting risks, and tailoring treatments. This fusion offers efficient, data-driven solutions for cardiovascular disease management. Telemedicine and remote monitoring reshape healthcare, allowing patient access to professionals and proactive interventions based on biomarker data. This convergence signifies a patient-centric shift, optimizing diagnostics, and facilitating timely interventions in remote cardiovascular care.

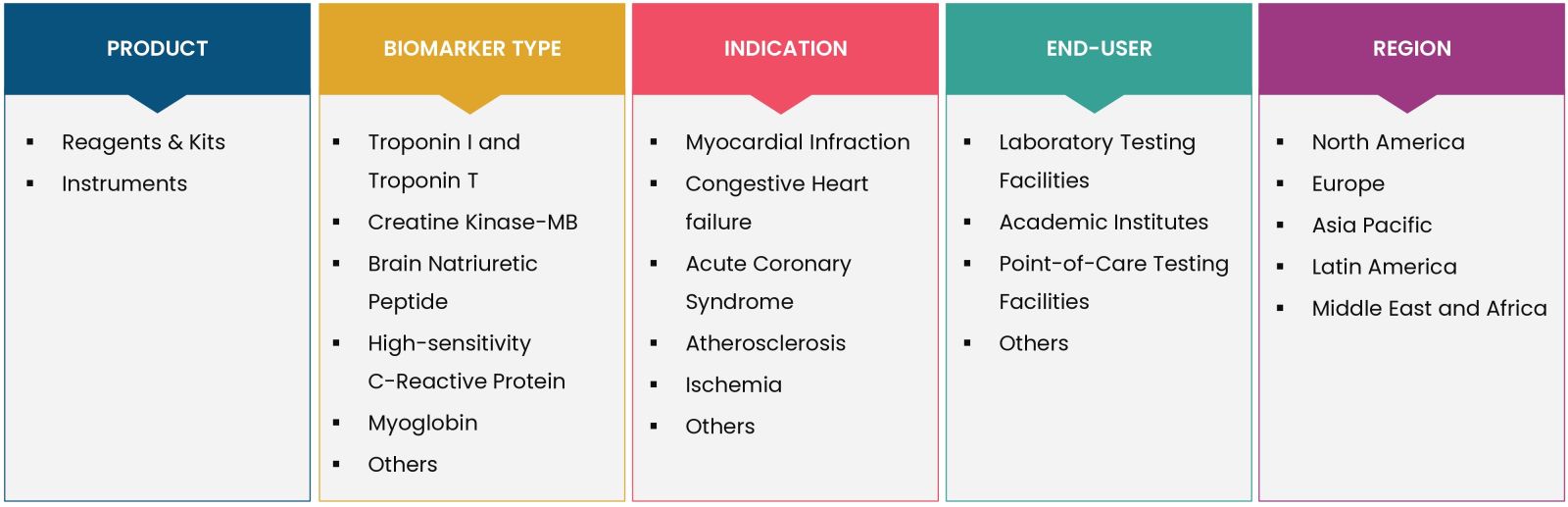

Reagents and Kits Plays Crucial Role in Laboratories to Optimize Cardiac Health Assessments

Reagents and kits dominate the cardiac marker testing market, due to their pivotal role in diagnosing cardiovascular conditions. Reagents and kits facilitates the identification of biomolecules such as proteins or nucleic acids, these reagents and kits contribute significantly to diagnostic and research processes. In cardiac marker studies, they enable the precise assessment of substances indicative of heart conditions, aiding healthcare professionals and researchers in making informed decisions for patient care, prognosis, and advancing the understanding of cardiovascular diseases.

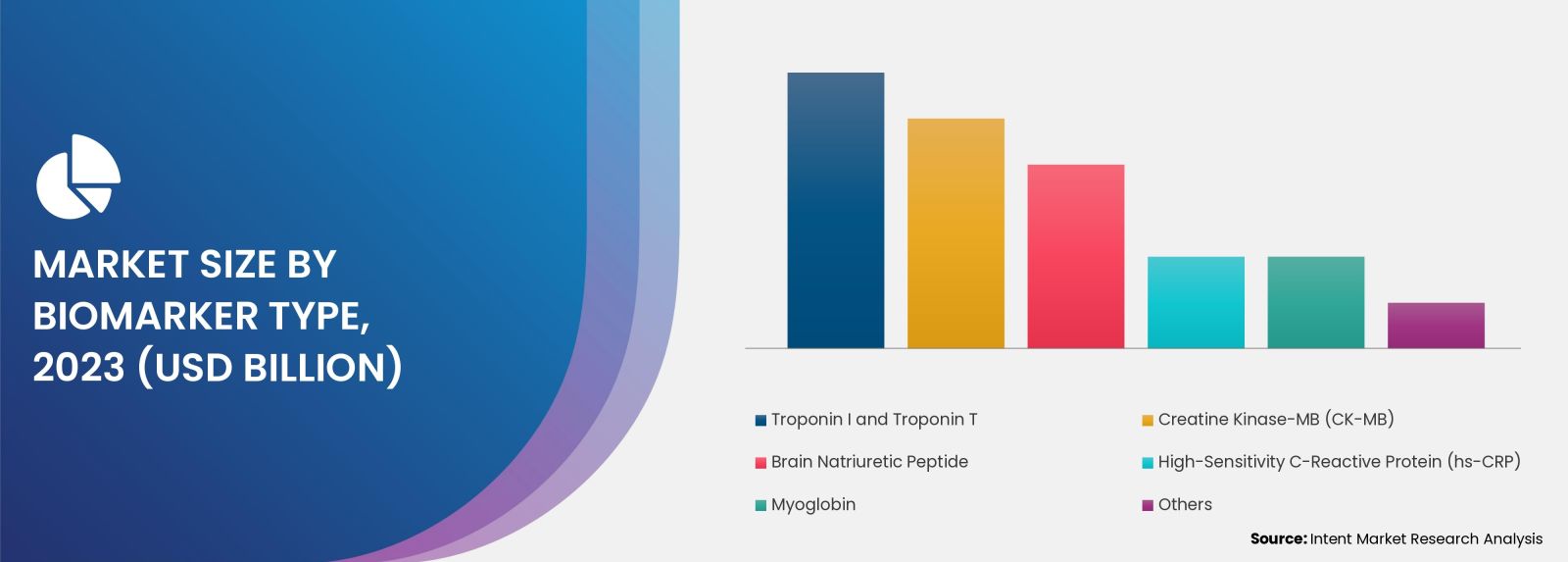

Troponins' Pivotal Role in Diagnosing and Treating Myocardial Injury

Troponins, specifically troponin I and troponin T, are highly specific markers for myocardial injury, making them crucial in diagnosing acute myocardial infarction. The widespread prevalence of heart-related conditions, coupled with the diagnostic significance of troponins, drives their consistent use in clinical settings. Additionally, the guidelines recommend troponin testing for acute coronary syndromes. The continuous advancements in troponin testing technologies and their central role in cardiovascular diagnostics contribute to their dominant position within the cardiac marker testing market.

Precise and Sensitive Detection of Cardiac Marker in Myocardial Infarction

Myocardial infarction held the largest share in cardiac marker testing market by indication due to its critical importance in diagnosing heart attacks. Troponins are primary markers released during myocardial infarction, making this indication a key driver for cardiac biomarker testing. The precise and sensitive detection of these biomarkers enables rapid diagnosis, aiding timely interventions.

The Cardiac Marker Testing Market is Thriving due to Rise in Laboratory Testing

The laboratory testing segment held the largest share in the cardiac marker testing market in 2023. This was attributed to healthcare infrastructure reforms, heightened healthcare spending, increased disposable incomes, and governmental initiatives to prevent heart disorders. Common cardiac markers include Troponins, Creatine Kinase-MB, Myoglobin, B-type Natriuretic Peptide, and others. Laboratories utilize various testing methods, such as immunoassays and enzyme-linked immunosorbent assay, to measure these biomarkers accurately.

Major Industry Players are Enhancing their Positions by actively Developing Cardiac Maker Testing Platforms

The market is characterized by intense competition due to the presence of numerous international and domestic players. The cardiac marker testing market, in particular, is dominated by key players such as Abbott, BD, bioMérieux, Bio-Rad, Danaher, DiaSorin, LSI Medience, PerkinElmer, Quidel, Roche, Siemens, Thermo Fisher Scientific, and Tosoh amongst others. These industry leaders primarily focus on acquiring smaller players and innovating their product lines to cater to changing consumer preferences and needs. The success of market players is heavily dependent on their ability to adapt to changing market trends and consumer preferences.

- In 2023, BD obtained FDA approval for its BD Vacutainer Troponin I Ultra test, marking it as the inaugural FDA-approved point-of-care troponin test for acute myocardial infarction (AMI)

- In 2023, Bio-Rad introduced the Bio-Plex 2300 Troponin I Assay in 2023, a high-sensitivity test capable of earlier detection of cardiac damage compared to other troponin tests

Cardiac Marker Testing Market: Scope of the Report

The report provides key insights into the cardiac marker testing market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyses key players and the competitive landscape within the market. The report offers the market size and forecasts for the cardiac marker testing market in value (USD billion) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 4.8 billion |

|

Forecast Revenue (2030) |

USD 9.7 billion |

|

CAGR (2024-2030) |

10.3% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Product (Reagents & Kits, Instruments), By Indication (Myocardial Infraction, Congestive Heart Failure, Acute Coronary Syndrome, Atherosclerosis, Ischemia, Others), By Biomarker Type (Troponin I and Troponin T, Creatine Kinase-MB, Brain Natriuretic Peptide, High-sensitivity C-reactive Protein, Myoglobin, Others), By End-user (Laboratory Testing Facilities, Academic Institutes, Point-of-Care Testing Facilities, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

Abbott, BD, bioMérieux, Bio-Rad, Danaher, DiaSorin, LSI Medience, PerkinElmer, Quidel, Roche, Siemens, Thermo Fisher Scientific, and Tosoh |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Increasing Prevalence of Cardiovascular Diseases |

|

4.1.2.Advancements in Testing Technologies |

|

4.1.3.Increase in Research & Innovation Activities |

|

4.2.Market Growth Restraints |

|

4.2.1.Sample Collection & Storage Issues |

|

4.2.2.Unfavorable Regulatory Framework |

|

4.2.3.Limited Reimbursement Policies |

|

4.3.Market Growth Opportunities |

|

4.3.1.Advancing Point-of-Care Testing Facilities |

|

4.3.2.Ongoing Investment in Biomarker Research and Development |

|

4.4.Pestle Analysis |

|

4.5.Porter’s Five Forces Analysis |

|

5.Market Outlook |

|

5.1.Overview (Industry Snapshot) |

|

5.2.Technology Analysis |

|

5.3.Supply Chain Analysis |

|

5.4.Value Chain Analysis |

|

5.5.Regulatory Analysis |

|

5.6.Reimbursement Analysis |

|

5.7.Pricing Analysis |

|

5.8.Patent Analysis |

|

5.9.Trade Analysis |

|

5.10. Unmet needs in the market |

|

5.11. Trends/Disruptions Impacting Customers Businesses |

|

5.12. Key Conference and Events |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Segment Synopsis |

|

6.2. By Product |

|

6.2.1.Reagents & Kits |

|

6.2.2.Instruments |

|

6.3.By Indication |

|

6.3.1.Congestive Heart failure |

|

6.3.2.Mycocardial Infraction |

|

6.3.3.Atherosclerosis |

|

6.3.4.Acute Coronary Syndrome |

|

6.3.5.Ischemia |

|

6.3.6.Others |

|

6.4.By Biomarker Type |

|

6.4.1.Troponin I and Troponin T |

|

6.4.2.Creatine Kinase-MB (CK-MB) |

|

6.4.3.Brain Natriuretic Peptide |

|

6.4.4.High-Sensitivity C-reactive Protein (hs-CRP) |

|

6.4.5.Myoglobin |

|

6.4.6.Others |

|

6.5.By End-Use |

|

6.5.1.Laboratories |

|

6.5.2.Academic & Research Institutes |

|

6.5.3.Point-of-Care Testing Facilities |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America Cardiac Marker Testing Market Outlook |

|

7.2.1.1.US Cardiac Marker Testing Market, By Mobility |

|

7.2.1.2.US Cardiac Marker Testing Market, By Patient Type |

|

7.2.1.3.US Cardiac Marker Testing Market, By Interface |

|

7.2.1.4.US Cardiac Marker Testing Market, By Mode-of-Verification |

|

7.2.1.5.US Cardiac Marker Testing Market, By Indication |

|

7.2.1.6.US Cardiac Marker Testing Market, By End-Use Industry |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.2.Canada |

|

7.3.Europe |

|

7.3.1.Europe Cardiac Marker Testing Market Outlook |

|

7.3.1.1.Germany |

|

7.3.1.2.UK |

|

7.3.1.3.France |

|

7.3.1.4.Spain |

|

7.3.1.5.Italy |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific Cardiac Marker Testing Market Outlook |

|

7.4.1.1.China |

|

7.4.1.2.India |

|

7.4.1.3.Japan |

|

7.4.1.4.South Korea |

|

7.4.1.5.Australia |

|

7.5.Latin America |

|

7.5.1.Latin America Cardiac Marker Testing Market Outlook |

|

7.5.1.1.Mexico |

|

7.5.1.2.Brazil |

|

7.6.Middle East & Africa |

|

7.6.1.Middle East & Africa Cardiac Marker Testing Market Outlook |

|

7.6.1.1.Saudi Arabia |

|

7.6.1.2.UAE |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Volume Output Analysis |

|

8.3.Company Strategy Analysis |

|

8.4.Competitive Matrix |

|

9.Company Profiles |

|

9.1. Abbott |

|

9.1.1.Company Synopsis |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.Analyst Perception |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.2.Becton, Dickinson and Company |

|

9.3.bioMérieux |

|

9.4.Bio-Rad |

|

9.5.Danaher Corporation |

|

9.6.DiaSorin |

|

9.7.LSI Medience |

|

9.8.PerkinElmer |

|

9.9.Quidel Corporation |

|

9.10.Roche |

|

9.11.Siemens |

|

9.12.Thermo Fisher Scientific |

|

9.13.Tosoh Corporation |

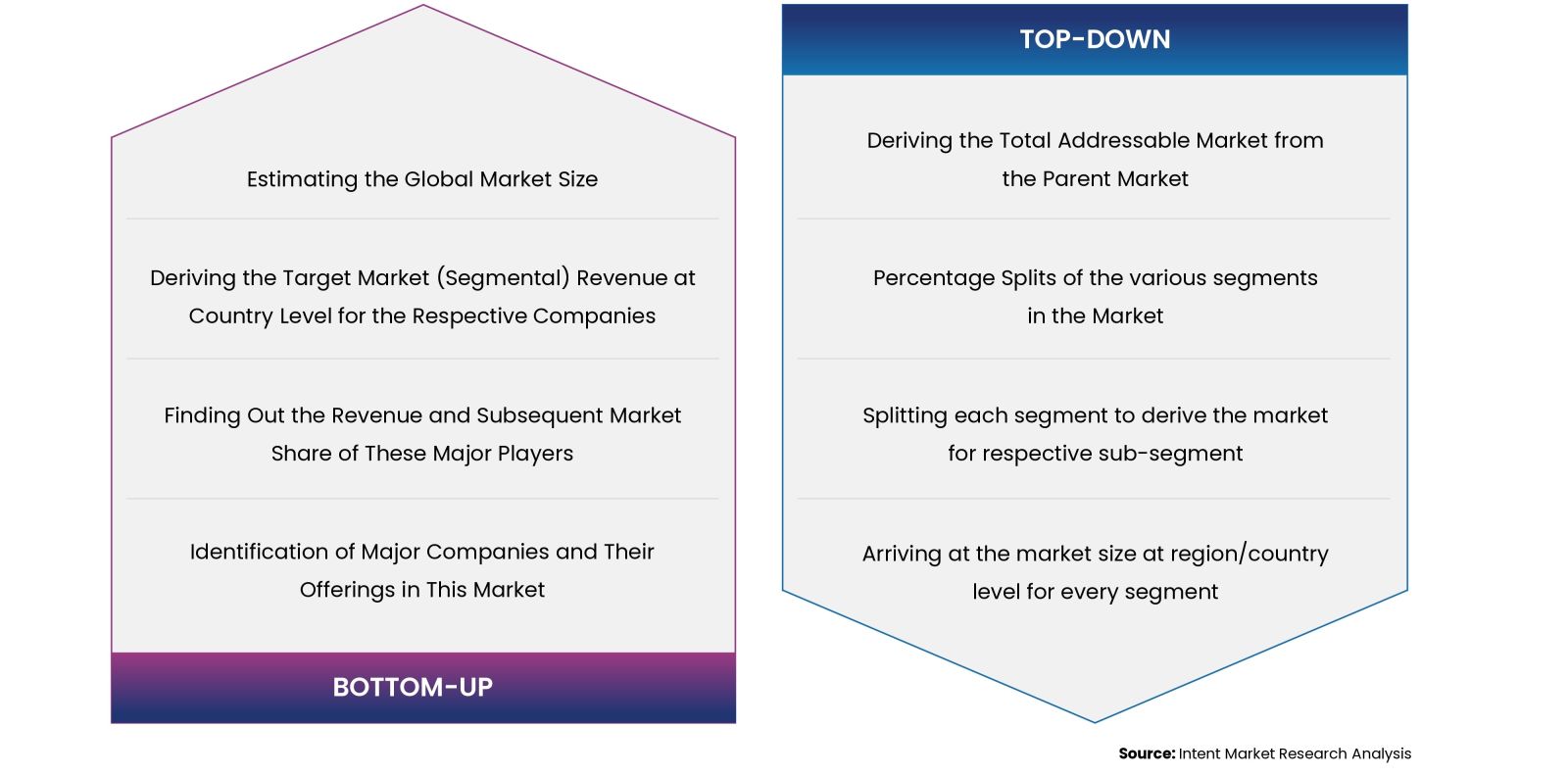

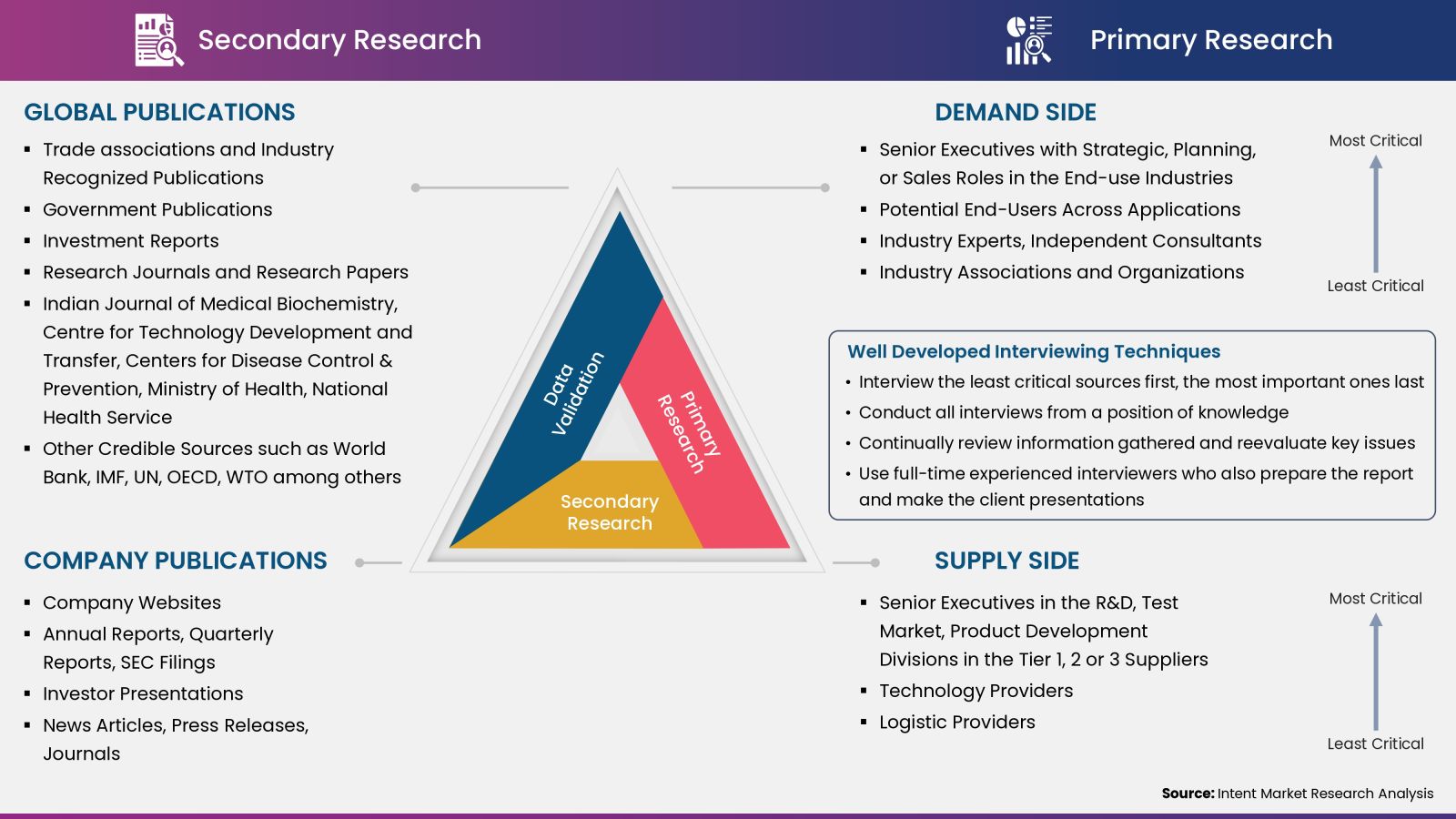

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.

`