As per Intent Market Research, the Building Acoustic Insulation Market was valued at USD 7.8 billion in 2024-e and will surpass USD 12.1 billion by 2030; growing at a CAGR of 7.6% during 2024 - 2030.

The building acoustic insulation market is witnessing significant growth, driven by the increasing demand for noise control in residential, commercial, and industrial buildings. With urbanization on the rise and buildings becoming more densely populated, the need for effective soundproofing solutions has never been greater. Acoustic insulation materials are crucial in reducing the transmission of sound, providing a quieter and more comfortable living and working environment. These materials are being widely used in various applications, such as walls, floors, ceilings, doors, and windows, to reduce noise pollution and enhance acoustic performance. Additionally, the growing awareness of the importance of noise pollution control and its impact on mental and physical health is expected to fuel market demand.

As noise control regulations become stricter and energy efficiency standards evolve, the market for building acoustic insulation is expected to continue expanding. The application of acoustic insulation is no longer limited to just residential buildings but extends across various sectors such as commercial offices, healthcare facilities, educational institutions, and industrial buildings. The growing trend of green building construction, combined with the increased focus on sustainability and environmental responsibility, is also influencing the adoption of eco-friendly and high-performance acoustic insulation materials.

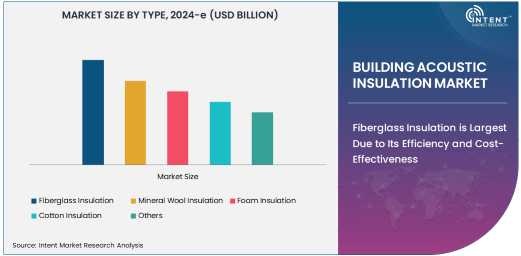

Fiberglass Insulation is Largest Due to Its Efficiency and Cost-Effectiveness

Fiberglass insulation remains the largest segment in the building acoustic insulation market due to its superior sound absorption properties and cost-effectiveness. It is widely used in both residential and commercial applications for soundproofing purposes. Fiberglass insulation is known for its ability to reduce sound transmission across various surfaces, particularly in walls, ceilings, and floors, making it an ideal choice for buildings that require efficient noise control. The material is also lightweight and easy to install, contributing to its widespread adoption.

Furthermore, fiberglass insulation provides excellent thermal insulation in addition to its acoustic properties, making it a dual-purpose solution for energy-efficient buildings. This combination of thermal and acoustic performance, along with its affordability, ensures that fiberglass insulation continues to dominate the market. As building codes and standards evolve, the demand for high-performing insulation materials that meet both noise and energy requirements will further drive the growth of the fiberglass segment.

Foam Insulation Gaining Traction Due to Superior Acoustic Performance and Versatility

Foam insulation is rapidly becoming one of the fastest-growing segments in the building acoustic insulation market, thanks to its superior acoustic performance and versatility. Foam-based products, such as spray foam and rigid foam boards, offer excellent soundproofing capabilities, particularly in spaces where noise control is critical, such as recording studios, offices, and residential properties located near busy roads or industrial areas. Foam insulation materials are capable of reducing sound transmission across walls, ceilings, and floors while also providing additional benefits like moisture resistance and enhanced thermal insulation.

The versatility of foam insulation materials makes them suitable for a wide range of applications, from small residential buildings to large commercial complexes. Moreover, the growing demand for high-performance, easy-to-install soundproofing materials is driving the growth of the foam insulation market. As building designs become more complex, foam insulation offers a flexible solution that can be applied to various surfaces and configurations, making it an attractive option for architects and contractors looking for customized acoustic solutions.

Commercial Segment Leads in Acoustic Insulation Adoption

The commercial segment is the largest end-user of building acoustic insulation, reflecting the significant emphasis placed on noise control in offices, retail spaces, hotels, and other commercial establishments. With the increase in open-plan office layouts and collaborative workspaces, the demand for effective acoustic insulation has surged. These environments require high-quality soundproofing materials to ensure privacy, reduce distractions, and enhance productivity. Commercial spaces such as hotels, restaurants, and conference centers also benefit from acoustic insulation to provide a quieter and more comfortable atmosphere for guests.

In addition to office and hospitality spaces, commercial buildings in sectors like healthcare and education are also driving demand for building acoustic insulation. For example, hospitals require quiet environments for patient recovery, and schools must ensure that classrooms are conducive to learning. As urbanization and commercial construction continue to grow globally, the commercial segment is expected to remain the largest contributor to the building acoustic insulation market.

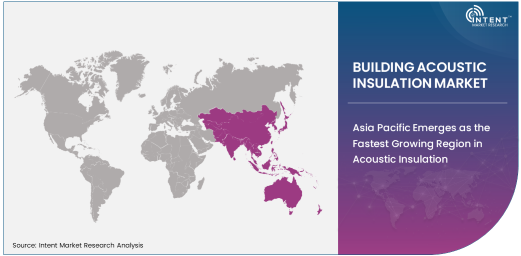

Asia Pacific Emerges as the Fastest Growing Region in Acoustic Insulation

The Asia Pacific region is emerging as the fastest-growing market for building acoustic insulation, driven by rapid urbanization, infrastructure development, and the increasing construction of commercial and residential buildings. Countries like China, India, and Japan are witnessing a surge in demand for effective noise control solutions as population densities increase and urban areas expand. As the construction industry in this region grows, there is a heightened focus on providing better living and working environments, which is accelerating the adoption of building acoustic insulation.

The growth in this region is also influenced by the expanding middle class and the rise in disposable incomes, leading to higher demand for quality living spaces and commercial properties. Additionally, governments in Asia Pacific countries are implementing stricter building regulations related to soundproofing and energy efficiency, which further fuels the need for advanced acoustic insulation materials. The region’s rapid infrastructure development and increasing awareness of noise pollution are expected to contribute to the continued growth of the building acoustic insulation market in Asia Pacific.

Competitive Landscape Highlights Key Players and Market Strategies

The building acoustic insulation market is highly competitive, with key players such as Owens Corning, Saint-Gobain, Rockwool International, Knauf Insulation, and Johns Manville leading the industry. These companies are focused on expanding their product portfolios, improving the performance of their insulation materials, and incorporating sustainable manufacturing practices to meet the growing demand for environmentally friendly solutions.

In addition to product innovation, leading players in the market are pursuing strategic partnerships, acquisitions, and collaborations to strengthen their position in the market. Companies are also focusing on geographic expansion, particularly in emerging markets like Asia Pacific, where demand for building acoustic insulation is rapidly increasing. As regulations around energy efficiency and noise control continue to evolve, competition in the market is expected to intensify, with players continually adapting their strategies to meet changing customer needs and industry standards.

Recent Developments:

- Saint-Gobain launched a new range of sustainable, high-performance acoustic insulation materials for residential and commercial buildings.

- Owens Corning introduced an advanced soundproofing solution designed for urban residential applications.

- Rockwool International A/S expanded its product portfolio with new noise-reducing insulation materials for the industrial sector.

- Knauf Insulation unveiled a new eco-friendly insulation material aimed at improving both thermal and acoustic performance in buildings.

- BASF SE collaborated with leading architecture firms to provide tailored acoustic insulation solutions for large-scale commercial projects.

List of Leading Companies:

- Saint-Gobain

- Owens Corning

- Rockwool International A/S

- Johns Manville (Berkshire Hathaway)

- Knauf Insulation

- BASF SE

- Armacell International S.A.

- Kingspan Group

- Uralita S.A.

- Morgan Advanced Materials

- Fletcher Insulation

- Isover (Saint-Gobain Group)

- Thermafiber (Owens Corning)

- Sound Seal, Inc.

- Acoustical Surfaces, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 7.8 billion |

|

Forecasted Value (2030) |

USD 12.1 billion |

|

CAGR (2025 – 2030) |

7.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Building Acoustic Insulation Market By Type (Fiberglass Insulation, Mineral Wool Insulation, Foam Insulation, Cotton Insulation), By Application (Walls, Floors, Ceilings, Doors, Windows), By End-User (Residential, Commercial, Industrial, Institutional) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Saint-Gobain, Owens Corning, Rockwool International A/S, Johns Manville (Berkshire Hathaway), Knauf Insulation, BASF SE, Armacell International S.A., Kingspan Group, Uralita S.A., Morgan Advanced Materials, Fletcher Insulation, Isover (Saint-Gobain Group), Thermafiber (Owens Corning), Sound Seal, Inc., Acoustical Surfaces, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Building Acoustic Insulation Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Fiberglass Insulation |

|

4.2. Mineral Wool Insulation |

|

4.3. Foam Insulation |

|

4.4. Cotton Insulation |

|

4.5. Others |

|

5. Building Acoustic Insulation Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Walls |

|

5.2. Floors |

|

5.3. Ceilings |

|

5.4. Doors |

|

5.5. Windows |

|

5.6. Others |

|

6. Building Acoustic Insulation Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Residential |

|

6.2. Commercial |

|

6.3. Industrial |

|

6.4. Institutional |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Building Acoustic Insulation Market, by Type |

|

7.2.7. North America Building Acoustic Insulation Market, by Application |

|

7.2.8. North America Building Acoustic Insulation Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Building Acoustic Insulation Market, by Type |

|

7.2.9.1.2. US Building Acoustic Insulation Market, by Application |

|

7.2.9.1.3. US Building Acoustic Insulation Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Saint-Gobain |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Owens Corning |

|

9.3. Rockwool International A/S |

|

9.4. Johns Manville (Berkshire Hathaway) |

|

9.5. Knauf Insulation |

|

9.6. BASF SE |

|

9.7. Armacell International S.A. |

|

9.8. Kingspan Group |

|

9.9. Uralita S.A. |

|

9.10. Morgan Advanced Materials |

|

9.11. Fletcher Insulation |

|

9.12. Isover (Saint-Gobain Group) |

|

9.13. Thermafiber (Owens Corning) |

|

9.14. Sound Seal, Inc. |

|

9.15. Acoustical Surfaces, Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Building Acoustic Insulation Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Building Acoustic Insulation Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Building Acoustic Insulation Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA