As per Intent Market Research, the Botulinum Toxin in Urology Market was valued at USD 0.9 Billion in 2024-e and will surpass USD 1.4 Billion by 2030; growing at a CAGR of 7.6% during 2025-2030.

The botulinum toxin in urology market has witnessed significant growth due to its increasing use in treating various bladder-related conditions. Botulinum toxin, particularly Type A, is used for its ability to block nerve signals that cause involuntary muscle contractions, making it a viable option for treating disorders such as overactive bladder (OAB), neurogenic bladder dysfunction, and bladder spasms. The market is expanding due to the growing prevalence of these conditions and the rising awareness of botulinum toxin's effectiveness. The global market is poised for further growth, driven by innovations in product development and a greater focus on minimally invasive treatments.

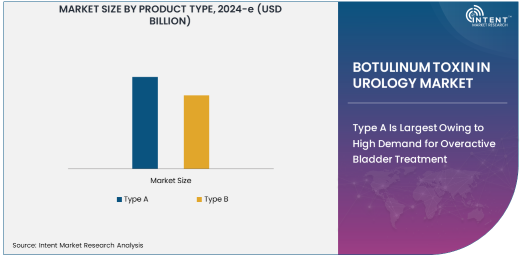

Type A Is Largest Owing to High Demand for Overactive Bladder Treatment

Type A botulinum toxin is the most widely used form in the urology market. It has gained popularity due to its proven efficacy in treating conditions like overactive bladder (OAB) and neurogenic bladder dysfunction. The injectable formulation of Type A botulinum toxin, such as Botox, has been FDA-approved and is widely utilized in clinical practice. Its ability to reduce the frequency of bladder contractions in patients with OAB is a key factor driving its dominance in the market. The product's safety profile and effective outcomes in improving patients' quality of life have further fueled its widespread adoption.

Type A botulinum toxin is also associated with long-lasting results, typically providing relief for several months. This longer duration of action compared to other treatments, such as oral medications, has made it a preferred choice for patients and healthcare providers. As the global incidence of OAB continues to rise, the demand for Type A botulinum toxin is expected to grow substantially, cementing its position as the largest subsegment in the botulinum toxin in urology market.

Overactive Bladder (OAB) Application is Largest Owing to High Prevalence

Overactive bladder (OAB) is the largest application segment in the botulinum toxin in urology market. OAB affects millions of people worldwide and is characterized by symptoms such as frequent urination, urgency, and nocturia. It can significantly impact a patient's quality of life, leading to frustration and embarrassment. Treatment with botulinum toxin Type A has emerged as a highly effective solution, particularly for patients who do not respond to oral medications or behavioral therapies.

The growing prevalence of OAB, along with its associated risk factors such as aging populations and increasing rates of obesity, is driving the demand for botulinum toxin-based treatments. Additionally, as healthcare providers increasingly recognize the efficacy of botulinum toxin in managing OAB symptoms, more patients are opting for this minimally invasive treatment. As a result, OAB remains the largest application for botulinum toxin in urology, contributing significantly to the market's overall growth.

Hospitals End-User Segment is Largest Owing to Comprehensive Treatment Availability

Hospitals remain the largest end-user segment in the botulinum toxin in urology market. Hospitals provide comprehensive care for patients with complex urological conditions, including OAB, neurogenic bladder dysfunction, and bladder spasms. The availability of advanced diagnostic tools, specialized care teams, and access to cutting-edge treatments makes hospitals the primary setting for botulinum toxin injections.

Patients seeking botulinum toxin treatment for urological conditions often prefer hospitals due to the presence of specialized urologists and the ability to manage potential side effects and complications. Moreover, hospitals are equipped to handle severe cases of OAB or bladder dysfunction, where botulinum toxin treatments are deemed necessary. As the demand for botulinum toxin continues to rise, hospitals are expected to remain the dominant end-user segment, driving the market forward.

North America is Largest Region Owing to High Adoption and Established Healthcare Infrastructure

North America is the largest region in the botulinum toxin in urology market. The region benefits from a well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and a growing aging population, all contributing to the increased use of botulinum toxin in treating urological conditions. The U.S. is particularly prominent in the market, with a high number of healthcare providers offering botulinum toxin injections for OAB and other bladder disorders.

In addition, North America has witnessed significant advancements in regulatory approvals, with the FDA approving botulinum toxin for various urological applications. The region's healthcare system is also characterized by a large number of specialized urology clinics and hospitals, further driving the demand for botulinum toxin treatments. As awareness about the benefits of botulinum toxin continues to spread, North America is expected to maintain its dominant position in the market throughout the forecast period.

Competitive Landscape and Leading Companies

The botulinum toxin in urology market is highly competitive, with several key players leading the market. Allergan (now part of AbbVie Inc.) is one of the most prominent companies, with its Botox product being the most widely used botulinum toxin in urology. Other significant players include Ipsen, Medytox, Revance Therapeutics, and Merz Pharmaceuticals, all of which are advancing their portfolios to address the growing demand for botulinum toxin treatments in urology. These companies are focused on expanding their product offerings, conducting clinical trials, and gaining regulatory approvals to further penetrate the market.

The competitive landscape is characterized by ongoing product innovations, strategic partnerships, and mergers and acquisitions. For instance, companies are exploring new indications for botulinum toxin in urology, such as bladder spasms and interstitial cystitis, to broaden their market share. With the increasing demand for minimally invasive procedures, these leading companies are expected

Recent Developments:

- Revance Therapeutics announced the successful completion of clinical trials for its botulinum toxin product, DaxibotulinumtoxinA, in treating overactive bladder, with regulatory filings expected in 2025.

- Allergan (AbbVie Inc.) expanded its portfolio in the urology market by receiving approval for Botox for the treatment of neurogenic detrusor overactivity in patients with spinal cord injury.

- Ipsen received approval from the European Medicines Agency for its botulinum toxin product, Dysport, for treatment of bladder dysfunction in patients with neurogenic bladder.

- Medytox entered a strategic partnership with a leading urology clinic chain in the U.S. to conduct phase IV clinical trials of botulinum toxin for urinary incontinence treatment.

- Evolus announced a new clinical trial initiative aimed at evaluating the efficacy and safety of its botulinum toxin in treating bladder spasms, with results expected to be released in 2025.

List of Leading Companies:

- Allergan (AbbVie Inc.)

- Ipsen

- Medytox

- Revance Therapeutics

- Hugel

- Evolus

- Merz Pharmaceuticals

- Daewoong Pharmaceutical

- Wockhardt

- Botulax

- Toxin Corporation of America

- Shenzhen Qianhai Yilimei Biotech

- Lanzhou Institute of Biological Products

- Hangzhou Medical Vaccine Co., Ltd.

- Beijing Tianyao Pharmaceutical Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.9 Billion |

|

Forecasted Value (2030) |

USD 1.4 Billion |

|

CAGR (2025 – 2030) |

7.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Botulinum Toxin in Urology Market By Product Type (Type A, Type B), By Application (Overactive Bladder, Neurogenic Bladder Dysfunction, Bladder Spasms, Interstitial Cystitis/Painful Bladder Syndrome), By End-User (Hospitals, Urology Clinics, Ambulatory Surgical Centers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Allergan (AbbVie Inc.), Ipsen, Medytox, Revance Therapeutics, Hugel, Evolus, Merz Pharmaceuticals, Daewoong Pharmaceutical, Wockhardt, Botulax, Toxin Corporation of America, Shenzhen Qianhai Yilimei Biotech, Lanzhou Institute of Biological Products, Hangzhou Medical Vaccine Co., Ltd., Beijing Tianyao Pharmaceutical Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Botulinum Toxin in Urology Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Type A |

|

4.2. Type B |

|

5. Botulinum Toxin in Urology Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Overactive Bladder (OAB) |

|

5.2. Neurogenic Bladder Dysfunction |

|

5.3. Bladder Spasms |

|

5.4. Interstitial Cystitis/Painful Bladder Syndrome (IC/PBS) |

|

5.5. Others |

|

6. Botulinum Toxin in Urology Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Urology Clinics |

|

6.3. Ambulatory Surgical Centers (ASCs) |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Botulinum Toxin in Urology Market, by Product Type |

|

7.2.7. North America Botulinum Toxin in Urology Market, by Application |

|

7.2.8. North America Botulinum Toxin in Urology Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Botulinum Toxin in Urology Market, by Product Type |

|

7.2.9.1.2. US Botulinum Toxin in Urology Market, by Application |

|

7.2.9.1.3. US Botulinum Toxin in Urology Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Allergan (AbbVie Inc.) |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Ipsen |

|

9.3. Medytox |

|

9.4. Revance Therapeutics |

|

9.5. Hugel |

|

9.6. Evolus |

|

9.7. Merz Pharmaceuticals |

|

9.8. Daewoong Pharmaceutical |

|

9.9. Wockhardt |

|

9.10. Botulax |

|

9.11. Toxin Corporation of America |

|

9.12. Shenzhen Qianhai Yilimei Biotech |

|

9.13. Lanzhou Institute of Biological Products |

|

9.14. Hangzhou Medical Vaccine Co., Ltd. |

|

9.15. Beijing Tianyao Pharmaceutical Co., Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Botulinum Toxin in Urology Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Botulinum Toxin in Urology Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Botulinum Toxin in Urology Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA