As per Intent Market Research, the Botulinum Neurotoxin Market was valued at USD 7.2 billion in 2024-e and will surpass USD 12.3 billion by 2030; growing at a CAGR of 9.3% during 2025 - 2030.

The botulinum neurotoxin market is expanding rapidly due to its increasing use in both cosmetic and medical applications. Botulinum toxins, particularly Types A and B, are gaining popularity for their ability to treat various conditions such as wrinkles, chronic migraines, excessive sweating, and muscle spasticity. The market is being driven by the growing demand for minimally invasive cosmetic treatments, which offer effective results with minimal downtime. Additionally, medical applications are also contributing to market growth as botulinum neurotoxins are used to treat various medical conditions that involve muscle dysfunction.

Advances in the formulation of botulinum toxins, including improved injectables and topicals, have increased the range of applications for these neurotoxins. As new therapeutic uses are discovered, the market for botulinum neurotoxin is expected to continue growing in both the aesthetic and medical sectors.

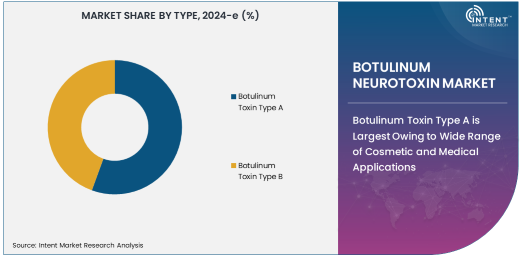

Botulinum Toxin Type A is Largest Owing to Wide Range of Cosmetic and Medical Applications

Botulinum Toxin Type A is the largest segment in the botulinum neurotoxin market, owing to its broad range of applications in both cosmetic and medical fields. Type A is the most commonly used botulinum toxin for aesthetic procedures, such as wrinkle reduction and facial rejuvenation, making it a leading product in the cosmetic applications segment. Additionally, Type A is used in medical treatments, including chronic migraine relief, overactive bladder treatment, and muscle spasticity management.

The versatility of Botulinum Toxin Type A across a wide spectrum of indications, coupled with its well-established safety and efficacy profile, has solidified its position as the leading neurotoxin in the market. This broad applicability across diverse therapeutic areas continues to drive the demand for Type A botulinum toxin.

Injectables are Largest Product Form Owing to High Patient Demand for Non-Invasive Procedures

Injectables are the largest product form segment in the botulinum neurotoxin market, primarily due to their widespread use in both aesthetic and medical applications. Injectable botulinum toxins, especially Type A, are favored in cosmetic treatments for reducing facial wrinkles and fine lines. Injectables are also the preferred method for various medical applications such as treating muscle spasticity, chronic migraines, and hyperhidrosis.

The growing preference for non-invasive procedures that offer minimal recovery time has fueled the dominance of injectables in the botulinum neurotoxin market. As the demand for quick, effective, and minimally invasive treatments increases, injectables are expected to remain the dominant product form.

Hospitals are Largest End-User Owing to Broad Range of Medical Applications and Specialized Care

Hospitals are the largest end-user in the botulinum neurotoxin market, owing to the broad range of medical applications and the specialized care provided in these settings. Botulinum toxins are widely used in hospitals to treat medical conditions such as chronic migraines, muscle spasticity, and overactive bladder. Hospitals also provide a higher level of expertise, with specialized medical professionals who can administer botulinum neurotoxin injections for both medical and cosmetic purposes.

As the medical uses of botulinum neurotoxins expand, including applications in pediatric and neurological treatments, hospitals continue to be the leading end-user. The comprehensive care available in hospital settings, combined with growing medical adoption, positions hospitals as the largest end-user segment in the botulinum neurotoxin market.

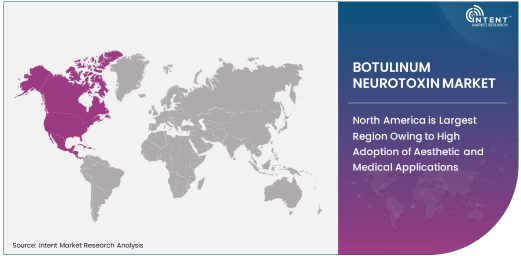

North America is Largest Region Owing to High Adoption of Aesthetic and Medical Applications

North America is the largest region in the botulinum neurotoxin market, driven by the high adoption of botulinum toxins for both cosmetic and medical applications. The United States, in particular, is the largest market for botulinum neurotoxin, as there is a strong demand for minimally invasive aesthetic procedures and a growing acceptance of botulinum neurotoxin for medical uses such as chronic migraine treatment and muscle spasticity management.

North America's advanced healthcare infrastructure, high disposable income, and the growing preference for non-invasive treatments contribute to the region’s dominance in the market. As consumer awareness and demand for botulinum neurotoxin treatments continue to rise, North America is expected to maintain its leadership position in the global market.

Leading Companies and Competitive Landscape

The botulinum neurotoxin market is highly competitive, with leading companies such as Allergan (AbbVie), Ipsen, and Medytox dominating the space. These companies offer various botulinum toxin products, including Botox (Type A), Dysport (Type A), and Xeomin (Type A), with a strong focus on both cosmetic and medical applications.

The competitive landscape is marked by innovation, with companies continuously working on improving the safety, efficacy, and formulations of botulinum neurotoxin products. Strategic partnerships, new product launches, and regulatory approvals play a significant role in expanding market share. As demand for botulinum neurotoxin products continues to grow, leading companies are focusing on both expanding their product offerings and increasing their presence in emerging markets.

Recent Developments:

- In December 2024, AbbVie announced the launch of a new formulation of Botox for migraine treatment. This new version aims to reduce treatment times and improve patient comfort.

- In November 2024, Ipsen expanded its partnership with healthcare providers to increase access to Dysport in key markets. The goal is to provide more patients with affordable treatments for muscle spasticity.

- In October 2024, Revance Therapeutics received FDA approval for their new botulinum toxin injection for the treatment of crow’s feet. The approval marks a significant step forward in their cosmetic portfolio.

- In September 2024, Medytox reported positive results from a clinical trial on its new botulinum toxin product. The product is expected to be more effective than existing treatments for wrinkles.

- In August 2024, Merz Pharmaceuticals launched a new botulinum toxin product targeting excess sweating. The product is now available in select European markets, expanding Merz’s offerings in the aesthetic and therapeutic segments.

List of Leading Companies:

- AbbVie (Allergan)

- Ipsen

- Medytox

- Revance Therapeutics

- Hugel

- Botulax

- United Pharmacies

- JHP Pharmaceuticals

- Merz Pharmaceuticals

- Daewoong Pharmaceutical

- China National Pharmaceutical Group (Sinopharm)

- Lanzhou Institute of Biological Products

- Toxins Inc.

- Biopharm Engineering

- Biogen

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 7.2 billion |

|

Forecasted Value (2030) |

USD 12.3 billion |

|

CAGR (2025 – 2030) |

9.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Botulinum Neurotoxin Market By Type (Botulinum Toxin Type A, Botulinum Toxin Type B), By Application (Cosmetic Applications, Medical Applications), By Product Form (Injectables, Topicals), By End-User (Hospitals, Dermatology Clinics, Home Care) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

AbbVie (Allergan), Ipsen, Medytox, Revance Therapeutics, Hugel, Botulax, United Pharmacies, JHP Pharmaceuticals, Merz Pharmaceuticals, Daewoong Pharmaceutical, China National Pharmaceutical Group (Sinopharm), Lanzhou Institute of Biological Products, Toxins Inc., Biopharm Engineering, Biogen |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Botulinum Neurotoxin Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Botulinum Toxin Type A |

|

4.2. Botulinum Toxin Type B |

|

5. Botulinum Neurotoxin Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Cosmetic Applications |

|

5.2. Medical Applications |

|

6. Botulinum Neurotoxin Market, by Product Form (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Injectables |

|

6.2. Topicals |

|

7. Botulinum Neurotoxin Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Dermatology Clinics |

|

7.3. Home Care |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Botulinum Neurotoxin Market, by Type |

|

8.2.7. North America Botulinum Neurotoxin Market, by Application |

|

8.2.8. North America Botulinum Neurotoxin Market, by Product Form |

|

8.2.9. North America Botulinum Neurotoxin Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Botulinum Neurotoxin Market, by Type |

|

8.2.10.1.2. US Botulinum Neurotoxin Market, by Application |

|

8.2.10.1.3. US Botulinum Neurotoxin Market, by Product Form |

|

8.2.10.1.4. US Botulinum Neurotoxin Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. AbbVie (Allergan) |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Ipsen |

|

10.3. Medytox |

|

10.4. Revance Therapeutics |

|

10.5. Hugel |

|

10.6. Botulax |

|

10.7. United Pharmacies |

|

10.8. JHP Pharmaceuticals |

|

10.9. Merz Pharmaceuticals |

|

10.10. Daewoong Pharmaceutical |

|

10.11. China National Pharmaceutical Group (Sinopharm) |

|

10.12. Lanzhou Institute of Biological Products |

|

10.13. Toxins Inc. |

|

10.14. Biopharm Engineering |

|

10.15. Biogen |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Botulinum Neurotoxin Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Botulinum Neurotoxin Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Botulinum Neurotoxin Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA