As per Intent Market Research, the Biometric Vehicle Access Market was valued at USD 1.9 billion in 2023 and will surpass USD 3.9 billion by 2030; growing at a CAGR of 11.2% during 2024 - 2030.

The biometric vehicle access market is gaining significant traction, driven by the increasing need for enhanced vehicle security and personalized user experiences. With the integration of biometric technologies such as fingerprint, facial, and iris recognition, the automotive industry is transforming the way vehicles are accessed, operated, and secured. Biometrics offer a more secure and convenient alternative to traditional key fobs and PIN-based systems, enabling seamless entry, engine start, and anti-theft protection. As automotive manufacturers and fleet operators prioritize security, convenience, and user experience, biometric solutions are becoming a standard feature in modern vehicles.

Additionally, the growing trend of smart vehicles and the shift towards digitalization in the automotive industry are further propelling the adoption of biometric vehicle access systems. The market is expanding as vehicle manufacturers, fleet operators, and insurers embrace biometric technologies to provide an enhanced level of security, personalization, and fraud prevention. With increasing concerns about vehicle theft and unauthorized access, the biometric vehicle access market is poised for significant growth, offering innovative solutions for both consumer and commercial applications.

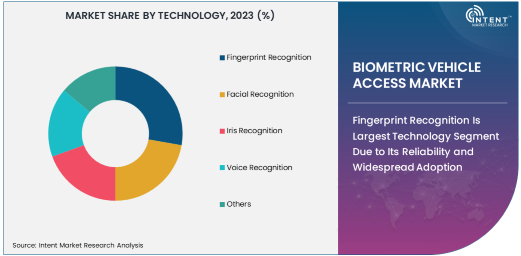

Fingerprint Recognition Is Largest Technology Segment Due to Its Reliability and Widespread Adoption

Fingerprint recognition is the largest technology segment in the biometric vehicle access market, owing to its proven reliability and ease of integration in automotive applications. Fingerprint recognition provides a secure and user-friendly method for vehicle entry and engine start, allowing authorized users to authenticate themselves quickly and accurately. This technology is already widely used in consumer electronics, and its adoption in vehicles is a natural extension, as drivers seek more secure and convenient alternatives to traditional keys and fobs.

Automotive OEMs and aftermarket companies are increasingly integrating fingerprint sensors into their vehicles, enabling users to unlock their vehicles, start the engine, and personalize vehicle settings, all with a simple touch of their finger. The reliability, speed, and relatively low cost of fingerprint recognition technology have made it the preferred choice for vehicle access systems. As the market for biometric vehicle access continues to grow, fingerprint recognition will remain the dominant technology in this space.

Active Access Is Fastest Growing Functionality Segment Driven by Demand for Seamless and Convenient Entry

Active access is the fastest growing functionality segment in the biometric vehicle access market, driven by the demand for seamless and touchless entry systems. Unlike traditional methods that require manual input, active access enables users to unlock and start their vehicle without the need to physically interact with a key or sensor. This functionality enhances convenience, especially for users who prefer contactless interaction with their vehicle, such as those carrying bags or groceries.

As biometric technologies such as facial recognition and voice recognition become more advanced, active access is gaining momentum in the automotive sector. Automakers are focusing on enhancing the user experience by integrating biometric sensors that automatically detect the driver’s identity, enabling effortless access to the vehicle. This trend is expected to accelerate as consumers increasingly value convenience and security in their automotive experiences, making active access the fastest growing functionality segment in the biometric vehicle access market.

Vehicle Entry & Exit Is Largest Application Segment Driven by Consumer Demand for Enhanced Security

Vehicle entry and exit is the largest application segment in the biometric vehicle access market, primarily driven by the growing consumer demand for secure and convenient access to their vehicles. Traditional keys and key fobs are being replaced by biometric systems that provide a more secure method of unlocking vehicles. Fingerprint recognition, facial recognition, and even voice recognition technologies are being integrated into modern vehicles to allow drivers to unlock their cars with just their biometric data, eliminating the need for physical keys.

The automotive industry is increasingly adopting biometric access systems to reduce the risk of theft, improve user convenience, and enhance overall security. With the rise in luxury and high-end vehicles incorporating biometric systems as a standard feature, the demand for secure vehicle entry systems is expected to increase. As consumers become more accustomed to the convenience of biometric access, vehicle entry and exit will remain the largest application segment in the biometric vehicle access market.

Automotive OEMs Is Largest End-Use Industry Segment Driven by Increasing Integration in New Vehicle Models

Automotive OEMs (Original Equipment Manufacturers) represent the largest end-use industry segment in the biometric vehicle access market, as they play a key role in the integration of biometric technologies into new vehicle models. The growing demand for advanced security features and personalized vehicle experiences has driven automotive OEMs to incorporate biometric systems into their vehicles' access and ignition systems. Biometric technologies offer a secure and innovative way to enhance the user experience, making them a key selling point for new vehicle models.

OEMs are increasingly partnering with biometric technology providers to integrate fingerprint, facial, and voice recognition systems into their vehicles. With the automotive industry focusing on the development of smart, connected, and secure vehicles, automotive OEMs are expected to continue leading the market by adopting advanced biometric vehicle access solutions. As the market evolves, automotive OEMs will remain the primary drivers of growth in this segment.

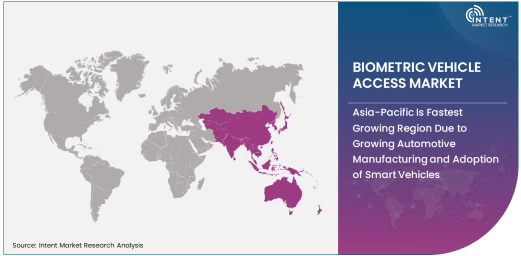

Asia-Pacific Is Fastest Growing Region Due to Growing Automotive Manufacturing and Adoption of Smart Vehicles

The Asia-Pacific region is the fastest growing in the biometric vehicle access market, driven by rapid advancements in automotive manufacturing, increasing vehicle production, and the adoption of smart vehicle technologies. The region is home to some of the largest automotive manufacturers, including Japan, South Korea, and China, which are at the forefront of adopting biometric vehicle access systems. With a strong emphasis on innovation and digital transformation, automotive companies in Asia-Pacific are integrating biometric technologies into their vehicles to offer enhanced security and user convenience.

In addition, the rising middle class in Asia-Pacific is driving demand for advanced vehicle features, including biometric access systems, as consumers seek more personalized and secure automotive experiences. As the automotive market in the region continues to grow, the demand for biometric vehicle access solutions is expected to increase, making Asia-Pacific the fastest growing region for biometric vehicle access systems.

Competitive Landscape and Leading Companies

The biometric vehicle access market is highly competitive, with several key players striving to gain a market share by offering innovative biometric solutions. Leading companies in this market include Fingerprint Cards AB, Gentex Corporation, Denso Corporation, and IDEMIA, which are at the forefront of developing and integrating biometric technologies into automotive applications. These companies are focusing on enhancing their product offerings through technological advancements, partnerships, and acquisitions to meet the growing demand for secure and user-friendly vehicle access systems.

The competitive landscape is characterized by strong collaborations between biometric technology providers and automotive manufacturers, with both parties working together to create seamless biometric access solutions for vehicles. As the market expands, these companies are expected to focus on improving the accuracy, reliability, and integration of biometric systems to maintain a competitive edge. The continued evolution of biometric vehicle access technologies, along with the growing emphasis on vehicle security and convenience, will drive intense competition in the market, making innovation and strategic partnerships key to success.

Recent Developments:

- In December 2024, Continental AG launched a new biometric access system for vehicles with integrated facial recognition technology.

- In November 2024, IDEMIA unveiled an advanced voice recognition-based vehicle access solution for premium automotive manufacturers.

- In October 2024, NXP Semiconductors introduced a fingerprint authentication system for keyless vehicle entry and engine start.

- In September 2024, ZF Friedrichshafen AG announced a partnership with a major automaker to develop biometric vehicle access solutions integrated with smart key technology.

- In August 2024, Bosch Mobility Solutions revealed a biometric security system that combines fingerprint and facial recognition for enhanced vehicle access control.

List of Leading Companies:

- Continental AG

- Bosch Mobility Solutions

- HID Global Corporation

- Panasonic Corporation

- NXP Semiconductors

- Synaptics Incorporated

- IDEMIA

- ZF Friedrichshafen AG

- Valeo S.A.

- Smart Key Technology Inc.

- Fingerprint Cards AB

- Aware, Inc.

- Toyota Industries Corporation

- Harman International (Samsung)

- Safran Identity & Security

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.9 billion |

|

Forecasted Value (2030) |

USD 3.9 billion |

|

CAGR (2024 – 2030) |

11.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Biometric Vehicle Access Market By Technology (Fingerprint Recognition, Facial Recognition, Iris Recognition, Voice Recognition), By Functionality (Passive Access, Active Access, Dual Authentication), By Application (Vehicle Entry & Exit, Engine Start/Stop, Fleet Management, Vehicle Security & Anti-Theft), By End-Use Industry (Automotive OEMs, Automotive Aftermarket, Fleet Operators, Insurance & Telematics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Continental AG, Bosch Mobility Solutions, HID Global Corporation, Panasonic Corporation, NXP Semiconductors, Synaptics Incorporated, IDEMIA, ZF Friedrichshafen AG, Valeo S.A., Smart Key Technology Inc., Fingerprint Cards AB, Aware, Inc., Toyota Industries Corporation, Harman International (Samsung), Safran Identity & Security |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Biometric Vehicle Access Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Fingerprint Recognition |

|

4.2. Facial Recognition |

|

4.3. Iris Recognition |

|

4.4. Voice Recognition |

|

4.5. Others |

|

5. Biometric Vehicle Access Market, by Functionality (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Passive Access |

|

5.2. Active Access |

|

5.3. Dual Authentication |

|

5.4. Others |

|

6. Biometric Vehicle Access Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Vehicle Entry & Exit |

|

6.2. Engine Start/Stop |

|

6.3. Fleet Management |

|

6.4. Vehicle Security & Anti-Theft |

|

6.5. Others |

|

7. Biometric Vehicle Access Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Automotive OEMs |

|

7.2. Automotive Aftermarket |

|

7.3. Fleet Operators |

|

7.4. Insurance & Telematics |

|

7.5. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Biometric Vehicle Access Market, by Technology |

|

8.2.7. North America Biometric Vehicle Access Market, by Functionality |

|

8.2.8. North America Biometric Vehicle Access Market, by Application |

|

8.2.9. North America Biometric Vehicle Access Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Biometric Vehicle Access Market, by Technology |

|

8.2.10.1.2. US Biometric Vehicle Access Market, by Functionality |

|

8.2.10.1.3. US Biometric Vehicle Access Market, by Application |

|

8.2.10.1.4. US Biometric Vehicle Access Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Continental AG |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Bosch Mobility Solutions |

|

10.3. HID Global Corporation |

|

10.4. Panasonic Corporation |

|

10.5. NXP Semiconductors |

|

10.6. Synaptics Incorporated |

|

10.7. IDEMIA |

|

10.8. ZF Friedrichshafen AG |

|

10.9. Valeo S.A. |

|

10.10. Smart Key Technology Inc. |

|

10.11. Fingerprint Cards AB |

|

10.12. Aware, Inc. |

|

10.13. Toyota Industries Corporation |

|

10.14. Harman International (Samsung) |

|

10.15. Safran Identity & Security |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Biometric Vehicle Access Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Biometric Vehicle Access Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Biometric Vehicle Access Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA