As per Intent Market Research, the Bio-Based Paints and Coatings Market is expected to grow from USD 2.5 billion in 2023 at a CAGR of 8.0% to touch USD 4.3 billion by 2030.

The bio-based paints and coatings market is experiencing significant growth as industries increasingly prioritize sustainability and environmental impact reduction. Traditional paints and coatings, often made from petroleum-based chemicals, are being replaced by bio-based alternatives, which are derived from renewable resources. This shift is largely driven by growing consumer awareness of environmental issues, stricter regulations on volatile organic compound (VOC) emissions, and the increasing demand for sustainable building materials. Bio-based paints and coatings offer a more eco-friendly solution by using raw materials such as plant-based oils, natural resins, and bio-based pigments, contributing to reduced carbon footprints and improved air quality.

As a result, bio-based paints and coatings are becoming more prevalent across various industries, including construction, automotive, and furniture. Innovations in raw materials, along with advancements in production technologies, are making bio-based paints and coatings more commercially viable and cost-competitive. The market's expansion is also fueled by government regulations that incentivize the use of environmentally friendly products, as well as growing demand from consumers and businesses for products that align with sustainability goals. The bio-based paints and coatings market is expected to continue its upward trajectory, driven by innovations and regulatory support for eco-friendly alternatives.

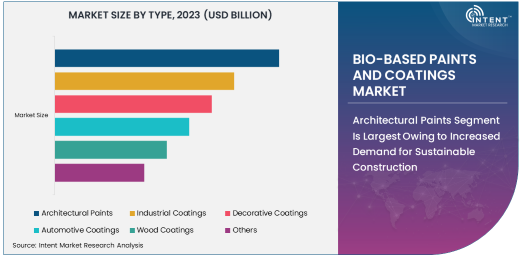

Architectural Paints Segment Is Largest Owing to Increased Demand for Sustainable Construction

The architectural paints segment is the largest in the bio-based paints and coatings market, primarily due to the increasing demand for eco-friendly and sustainable materials in the construction industry. As green building certifications such as LEED (Leadership in Energy and Environmental Design) gain traction, the use of bio-based architectural paints has become a key component of sustainable building practices. These paints, made from renewable raw materials like plant-based oils and natural resins, provide an environmentally friendly alternative to traditional paints, which often contain harmful chemicals and high levels of VOCs.

The demand for bio-based architectural paints is being driven by both residential and commercial building projects that aim to reduce their environmental footprint. Consumers and builders are more focused on using products that meet sustainability standards, which is propelling the growth of bio-based architectural paints. Moreover, advancements in bio-based paint formulations are improving performance characteristics such as durability, coverage, and finish, making them an attractive choice for modern construction projects.

Water-Based Solvents Raw Material Is Fastest Growing Owing to Low Environmental Impact

Water-based solvents are the fastest-growing raw material in the bio-based paints and coatings market, owing to their low environmental impact and regulatory advantages. Water-based paints have significantly lower levels of VOCs compared to solvent-based paints, making them a preferred choice in regions with stringent environmental regulations, particularly in Europe and North America. The increasing adoption of water-based solvents in the production of bio-based paints is driven by the need for eco-friendly solutions that do not compromise on quality or performance.

The shift towards water-based solvents is also being supported by technological advancements that enhance the performance of water-based paints. These paints are now available in a wide range of colors and finishes, making them suitable for various applications in both residential and commercial sectors. As the demand for sustainable building materials continues to rise, the use of water-based solvents in bio-based paints is expected to grow rapidly, driven by consumer preferences for low-toxicity and environmentally friendly products.

Residential Buildings Application Is Largest Due to Increased Focus on Sustainable Living

The residential buildings application is the largest segment in the bio-based paints and coatings market, driven by the growing consumer demand for sustainable living spaces. Homeowners and builders are increasingly choosing eco-friendly paints for their residential projects to reduce the environmental impact of their homes. Bio-based paints, which are free from harmful chemicals, are gaining popularity as a safer alternative for home interiors and exteriors. These paints provide the benefits of sustainability without sacrificing aesthetics or performance, making them an attractive choice for residential construction.

In addition to the growing consumer awareness around sustainable living, government incentives and building codes are encouraging the use of bio-based paints in residential projects. Bio-based paints are seen as a critical component of energy-efficient and environmentally responsible homes, contributing to healthier indoor air quality and reducing the overall carbon footprint of residential buildings. As the market for eco-friendly residential construction expands, the demand for bio-based paints in the residential buildings sector is expected to continue to rise.

North America Region Is Largest Market Owing to Strict Environmental Regulations and Sustainability Trends

North America is the largest market for bio-based paints and coatings, driven by stringent environmental regulations and a strong emphasis on sustainability. The U.S. and Canada have adopted strict environmental standards for paints and coatings, which has led to a surge in the demand for low-VOC, water-based, and bio-based alternatives. Both countries have introduced regulations to limit the use of harmful chemicals in paints, and this is pushing manufacturers to develop more eco-friendly solutions. Additionally, the growing trend of green building and sustainable construction in North America has significantly contributed to the market's expansion.

The North American market is also supported by increasing consumer preference for eco-friendly products, particularly in residential and commercial construction. As green building initiatives gain momentum, the adoption of bio-based paints and coatings is expected to continue to rise. With significant investments in research and development, North American companies are leading the way in the production of high-performance bio-based paints, solidifying the region's position as the largest market for this segment.

Competitive Landscape

The bio-based paints and coatings market is highly competitive, with key players focusing on innovation and sustainability to capture market share. Major companies such as BASF, AkzoNobel, Sherwin-Williams, and PPG Industries are investing in the development of eco-friendly paint formulations made from renewable raw materials. These companies are leveraging their strong R&D capabilities to create products that meet environmental regulations while offering superior performance.

In addition to large multinational companies, several smaller firms are entering the market with specialized bio-based products, further intensifying the competition. Many companies are forming strategic partnerships and collaborations to enhance their technological capabilities and expand their product offerings. As consumer demand for sustainable products grows, competition in the bio-based paints and coatings market is expected to intensify, with companies focusing on improving product quality, reducing costs, and differentiating their offerings through innovative formulations and eco-friendly credentials.

Recent Developments:

- In November 2024, AkzoNobel N.V. launched a new line of bio-based architectural paints, made from renewable plant-based oils and resins.

- In October 2024, BASF SE expanded its bio-based coating solutions portfolio, focusing on water-based technologies for automotive applications.

- In September 2024, PPG Industries introduced a new sustainable industrial coating that uses bio-based resins to reduce environmental impact.

- In August 2024, Sherwin-Williams Company unveiled a new range of eco-friendly paints using renewable raw materials, aimed at reducing VOC emissions.

- In July 2024, Dow Chemical Company entered a partnership to develop bio-based pigments for sustainable coatings in the furniture industry.

List of Leading Companies:

- AkzoNobel N.V.

- BASF SE

- PPG Industries, Inc.

- Sherwin-Williams Company

- Dow Chemical Company

- Henkel AG & Co. KGaA

- Jotun Group

- Kansai Paint Co., Ltd.

- Valspar Corporation (Acquired by Sherwin-Williams)

- RPM International Inc.

- Hempel A/S

- Axalta Coating Systems

- Clariant International Ltd.

- Benjamin Moore & Co.

- Berger Paints India Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 2.5 billion |

|

Forecasted Value (2030) |

USD 4.3 billion |

|

CAGR (2024 – 2030) |

8.0% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Bio-Based Paints and Coatings Market By Type (Architectural Paints, Industrial Coatings, Decorative Coatings, Automotive Coatings, Wood Coatings), By Raw Material (Plant-Based Oils, Natural Resins, Water-Based Solvents, Bio-Based Pigments), By Form (Liquid, Powder, Paste), By Application (Residential Buildings, Commercial Buildings, Industrial Facilities, Automotive Industry, Wood Industry) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

AkzoNobel N.V., BASF SE, PPG Industries, Inc., Sherwin-Williams Company, Dow Chemical Company, Henkel AG & Co. KGaA, Jotun Group, Kansai Paint Co., Ltd., Valspar Corporation (Acquired by Sherwin-Williams), RPM International Inc., Hempel A/S, Axalta Coating Systems, Clariant International Ltd., Benjamin Moore & Co., Berger Paints India Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Bio-Based Paints and Coatings Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Architectural Paints |

|

4.2. Industrial Coatings |

|

4.3. Decorative Coatings |

|

4.4. Automotive Coatings |

|

4.5. Wood Coatings |

|

4.6. Others |

|

5. Bio-Based Paints and Coatings Market, by Raw Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Plant-Based Oils |

|

5.2. Natural Resins |

|

5.3. Water-Based Solvents |

|

5.4. Bio-Based Pigments |

|

5.5. Others |

|

6. Bio-Based Paints and Coatings Market, by Form (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Liquid |

|

6.2. Powder |

|

6.3. Paste |

|

7. Bio-Based Paints and Coatings Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Residential Buildings |

|

7.2. Commercial Buildings |

|

7.3. Industrial Facilities |

|

7.4. Automotive Industry |

|

7.5. Wood Industry |

|

7.6. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Bio-Based Paints and Coatings Market, by Type |

|

8.2.7. North America Bio-Based Paints and Coatings Market, by Raw Material |

|

8.2.8. North America Bio-Based Paints and Coatings Market, by Form |

|

8.2.9. North America Bio-Based Paints and Coatings Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Bio-Based Paints and Coatings Market, by Type |

|

8.2.10.1.2. US Bio-Based Paints and Coatings Market, by Raw Material |

|

8.2.10.1.3. US Bio-Based Paints and Coatings Market, by Form |

|

8.2.10.1.4. US Bio-Based Paints and Coatings Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. AkzoNobel N.V. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. BASF SE |

|

10.3. PPG Industries, Inc. |

|

10.4. Sherwin-Williams Company |

|

10.5. Dow Chemical Company |

|

10.6. Henkel AG & Co. KGaA |

|

10.7. Jotun Group |

|

10.8. Kansai Paint Co., Ltd. |

|

10.9. Valspar Corporation (Acquired by Sherwin-Williams) |

|

10.10. RPM International Inc. |

|

10.11. Hempel A/S |

|

10.12. Axalta Coating Systems |

|

10.13. Clariant International Ltd. |

|

10.14. Benjamin Moore & Co. |

|

10.15. Berger Paints India Ltd. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Bio-Based Paints and Coatings Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Bio-Based Paints and Coatings Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Bio-Based Paints and Coatings Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA