As per Intent Market Research, the Betaine Market was valued at USD 4.9 billion in 2023 and will surpass USD 6.9 billion by 2030; growing at a CAGR of 5.2% during 2024 - 2030.

The Betaine market has seen robust growth due to its diverse range of applications across various industries, including pharmaceuticals, food and beverages, animal feed, and personal care. Betaine, a naturally occurring compound derived from sugar beets, is widely used for its beneficial properties in promoting health and enhancing the quality of products in these industries. It is well-known for its ability to improve hydration, support liver function, and act as an osmolyte that protects cells from stress. As consumer awareness around health and wellness grows, the demand for Betaine has expanded, particularly in functional foods and nutritional supplements.

In addition to its use in health-related applications, Betaine plays a key role in personal care and cosmetic formulations due to its moisturizing, conditioning, and soothing properties. This wide applicability across different sectors positions Betaine as an essential ingredient in both consumer products and industrial applications. The growth of the global personal care and nutraceutical industries, alongside increased demand for high-quality animal feed and supplements, further drives the market for Betaine, creating new opportunities for manufacturers and suppliers.

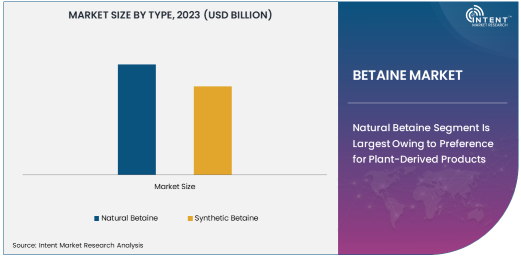

Natural Betaine Segment Is Largest Owing to Preference for Plant-Derived Products

The natural Betaine segment is the largest within the market, driven by growing consumer preference for plant-derived and organic ingredients. Natural Betaine is primarily derived from sugar beets, and its natural origin makes it highly appealing in sectors such as pharmaceuticals, food and beverages, and personal care, where consumers are increasingly focused on plant-based, sustainable, and clean-label products. As consumers become more conscientious about the ingredients in the products they consume and use, the demand for natural Betaine continues to rise, particularly in food and personal care products that emphasize wellness and sustainability.

In the pharmaceutical sector, natural Betaine is used in various formulations, including those targeting liver health, cardiovascular health, and digestive issues. Its status as a naturally sourced compound enhances its appeal to health-conscious consumers who prefer products made from plant-based ingredients. The rise of organic and clean-label trends in food and beverages, particularly among consumers seeking functional and natural ingredients, has significantly contributed to the dominance of the natural Betaine segment in the market.

Synthetic Betaine Segment Is Fastest Growing Owing to Cost-Effectiveness and Versatility

The synthetic Betaine segment is the fastest-growing in the Betaine market, driven by its cost-effectiveness and versatility. Synthetic Betaine, which is chemically produced, offers a more affordable alternative to natural Betaine, making it an attractive option for large-scale industrial applications. It is widely used in animal feed and personal care products, where cost considerations play a significant role. In the animal feed sector, synthetic Betaine is commonly included to improve the nutritional profile of feed, particularly in poultry and livestock farming, helping to enhance growth rates and feed efficiency.

The growth of synthetic Betaine is also supported by its versatility in a range of formulations, particularly in cosmetics and personal care products, where it is used as a conditioning agent, surfactant, and moisturizer. Its ability to be produced in large quantities at a lower cost compared to natural Betaine makes it an increasingly popular choice for manufacturers looking to meet growing demand while maintaining profitability. As industries such as animal nutrition and personal care continue to expand, the synthetic Betaine segment is expected to experience rapid growth in the coming years.

Food & Beverages End-Use Segment Is Largest Owing to Rising Demand for Functional Foods

The food and beverages end-use segment is the largest in the Betaine market, fueled by the growing demand for functional foods and beverages that support overall health and wellness. Betaine is increasingly being included in a variety of food products, such as energy drinks, functional snacks, and supplements, due to its ability to improve hydration, support liver function, and enhance physical performance. As consumers become more aware of the health benefits of specific nutrients and ingredients, Betaine has gained traction as a functional ingredient in foods aimed at promoting digestion, heart health, and overall well-being.

In addition, the growing trend toward clean-label and natural food products has led to an increase in the incorporation of Betaine, especially natural Betaine derived from sugar beets, into food formulations. This demand is further accelerated by the increasing interest in sports nutrition and dietary supplements, where Betaine is recognized for its ability to support muscle endurance and improve athletic performance. The food and beverages segment is expected to continue dominating the Betaine market, driven by these health and wellness trends.

Pharmaceuticals End-Use Segment Is Fastest Growing Owing to Growing Health Consciousness

The pharmaceuticals end-use segment is the fastest-growing in the Betaine market, driven by rising health consciousness and increasing demand for natural ingredients in pharmaceutical products. Betaine is widely used in the pharmaceutical industry for its potential health benefits, particularly in liver health, metabolic disorders, and as a treatment for conditions like homocystinuria. As the global population ages and awareness of chronic diseases such as liver disease increases, the demand for Betaine in pharmaceutical formulations is expected to continue to grow.

Moreover, Betaine’s ability to support healthy metabolism and improve cardiovascular health positions it as an attractive ingredient in dietary supplements. The rising prevalence of lifestyle diseases, combined with consumer preference for supplements that improve overall well-being, fuels the demand for Betaine-based products in the pharmaceutical sector. As more clinical studies validate the therapeutic benefits of Betaine, its role in pharmaceutical formulations will continue to expand, contributing to the growth of this segment.

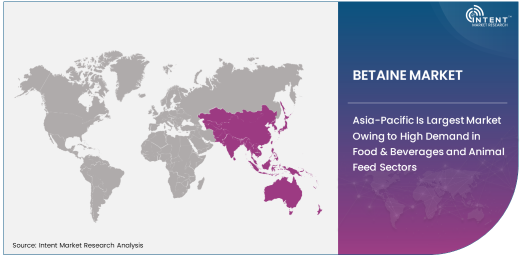

Asia-Pacific Is Largest Market Owing to High Demand in Food & Beverages and Animal Feed Sectors

The Asia-Pacific region is the largest market for Betaine, driven by its significant demand in the food and beverages and animal feed sectors. The region is home to some of the world’s largest agricultural economies, where Betaine plays an important role in improving animal nutrition and boosting the productivity of livestock farming. In addition, as the demand for functional foods and nutritional supplements increases in countries like China and India, Betaine has become a key ingredient in products aimed at supporting health, hydration, and athletic performance.

Asia-Pacific’s large and rapidly growing population, combined with increasing disposable incomes and changing dietary habits, has contributed to the strong demand for Betaine in the food and beverages sector. As the region continues to industrialize and urbanize, there is also a growing focus on improving livestock production, further boosting the market for Betaine in animal feed. The Asia-Pacific region is expected to continue to lead the Betaine market due to these ongoing trends and its position as a major hub for both food and agricultural production.

Competitive Landscape

The Betaine market is competitive, with key players including BASF, DuPont, Evonik Industries, and Associated British Foods, dominating the market due to their extensive product portfolios and strong market presence. These companies offer a wide range of Betaine products, catering to various end-use industries such as pharmaceuticals, food and beverages, and animal feed. Their focus on innovation, sustainability, and expanding production capacities has allowed them to maintain leadership in the market.

In addition to these global players, several regional manufacturers also play a crucial role in meeting local demand, particularly in the Asia-Pacific and European markets. Companies are increasingly focusing on the development of sustainable and eco-friendly Betaine production methods to align with the growing demand for clean-label and natural ingredients. With continued research into the health benefits of Betaine and the expansion of applications across diverse sectors, the competitive landscape is expected to evolve, with companies striving to gain market share through strategic acquisitions, partnerships, and product innovations.

Recent Developments:

- In November 2024, Evonik Industries AG expanded its production of natural betaine to meet the increasing demand in the food and beverage industry.

- In October 2024, Solvay SA launched a new betaine-based ingredient for the personal care market, focusing on moisturizing and anti-aging benefits.

- In September 2024, DuPont de Nemours, Inc. announced the acquisition of a betaine manufacturing plant to strengthen its position in animal feed production.

- In August 2024, Stepan Company introduced a new line of betaine-based surfactants for industrial detergent applications.

- In July 2024, BASF SE unveiled a new sustainable betaine production method aimed at reducing environmental impact.

List of Leading Companies:

- Evonik Industries AG

- Solvay SA

- DuPont de Nemours, Inc.

- Associated British Foods (ABF)

- Stepan Company

- Alfa Aesar (Thermo Fisher Scientific)

- KAO Corporation

- BASF SE

- Sunchemical Corporation

- The Chemical Company

- ICL Group

- Nouryon (AkzoNobel)

- Sasol Limited

- PPG Industries, Inc.

- AkzoNobel N.V.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 4.9 billion |

|

Forecasted Value (2030) |

USD 6.9 billion |

|

CAGR (2024 – 2030) |

5.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Betaine Market By Type (Natural Betaine, Synthetic Betaine), By End Use (Pharmaceuticals, Food & Beverages, Animal Feed, Personal Care & Cosmetics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Evonik Industries AG, Solvay SA, DuPont de Nemours, Inc., Associated British Foods (ABF), Stepan Company, Alfa Aesar (Thermo Fisher Scientific), KAO Corporation, BASF SE, Sunchemical Corporation, The Chemical Company, ICL Group, Nouryon (AkzoNobel), Sasol Limited, PPG Industries, Inc., AkzoNobel N.V. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Betaine Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Natural Betaine |

|

4.2. Synthetic Betaine |

|

5. Betaine Market, by End Use (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Pharmaceuticals |

|

5.2. Food & Beverages |

|

5.3. Animal Feed |

|

5.4. Personal Care & Cosmetics |

|

5.5. Others |

|

6. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Regional Overview |

|

6.2. North America |

|

6.2.1. Regional Trends & Growth Drivers |

|

6.2.2. Barriers & Challenges |

|

6.2.3. Opportunities |

|

6.2.4. Factor Impact Analysis |

|

6.2.5. Technology Trends |

|

6.2.6. North America Betaine Market, by Type |

|

6.2.7. North America Betaine Market, by End Use |

|

6.2.8. By Country |

|

6.2.8.1. US |

|

6.2.8.1.1. US Betaine Market, by Type |

|

6.2.8.1.2. US Betaine Market, by End Use |

|

6.2.8.2. Canada |

|

6.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

6.3. Europe |

|

6.4. Asia-Pacific |

|

6.5. Latin America |

|

6.6. Middle East & Africa |

|

7. Competitive Landscape |

|

7.1. Overview of the Key Players |

|

7.2. Competitive Ecosystem |

|

7.2.1. Level of Fragmentation |

|

7.2.2. Market Consolidation |

|

7.2.3. Product Innovation |

|

7.3. Company Share Analysis |

|

7.4. Company Benchmarking Matrix |

|

7.4.1. Strategic Overview |

|

7.4.2. Product Innovations |

|

7.5. Start-up Ecosystem |

|

7.6. Strategic Competitive Insights/ Customer Imperatives |

|

7.7. ESG Matrix/ Sustainability Matrix |

|

7.8. Manufacturing Network |

|

7.8.1. Locations |

|

7.8.2. Supply Chain and Logistics |

|

7.8.3. Product Flexibility/Customization |

|

7.8.4. Digital Transformation and Connectivity |

|

7.8.5. Environmental and Regulatory Compliance |

|

7.9. Technology Readiness Level Matrix |

|

7.10. Technology Maturity Curve |

|

7.11. Buying Criteria |

|

8. Company Profiles |

|

8.1. Evonik Industries AG |

|

8.1.1. Company Overview |

|

8.1.2. Company Financials |

|

8.1.3. Product/Service Portfolio |

|

8.1.4. Recent Developments |

|

8.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2. Solvay SA |

|

8.3. DuPont de Nemours, Inc. |

|

8.4. Associated British Foods (ABF) |

|

8.5. Stepan Company |

|

8.6. Alfa Aesar (Thermo Fisher Scientific) |

|

8.7. KAO Corporation |

|

8.8. BASF SE |

|

8.9. Sunchemical Corporation |

|

8.10. The Chemical Company |

|

8.11. ICL Group |

|

8.12. Nouryon (AkzoNobel) |

|

8.13. Sasol Limited |

|

8.14. PPG Industries, Inc. |

|

8.15. AkzoNobel N.V. |

|

9. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Betaine Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Betaine Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Betaine Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA