As per Intent Market Research, the Beta Cyfluthrin Market was valued at USD 261.3 million in 2023 and will surpass USD 395.1 million by 2030; growing at a CAGR of 6.1% during 2024 - 2030.

The Beta Cyfluthrin market is experiencing significant growth due to its effectiveness as a pyrethroid insecticide used in various sectors, including agriculture, household, and commercial applications. Beta Cyfluthrin is widely recognized for its fast-acting properties and its ability to control a broad spectrum of pests, including those that affect crops, livestock, and structures. Its use is essential in pest management practices, particularly in regions with high agricultural activity and urban pest concerns. As the global demand for pesticides rises, particularly due to increasing pest resistance to traditional insecticides, Beta Cyfluthrin continues to gain popularity as a preferred solution in both commercial and residential pest control.

The growing need for sustainable agriculture, coupled with increasing awareness about the importance of pest control in maintaining crop health and food security, has contributed to Beta Cyfluthrin’s expanding application. Additionally, innovations in formulation and the development of more targeted pest control methods are helping to drive demand. As regulatory bodies focus more on environmental impact, there is an increasing emphasis on products like Beta Cyfluthrin that offer effective pest control while being more environmentally friendly compared to older pesticide formulations.

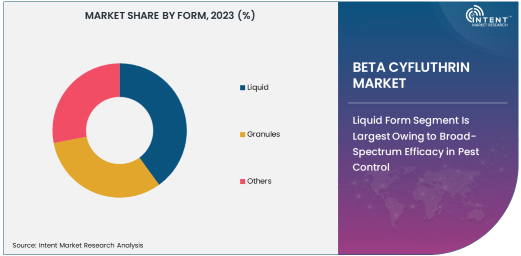

Liquid Form Segment Is Largest Owing to Broad-Spectrum Efficacy in Pest Control

The liquid form of Beta Cyfluthrin dominates the market due to its versatility and ease of application across different sectors. Liquid formulations are preferred in agricultural settings for the large-scale control of pests on crops, as they allow for efficient distribution via spraying or irrigation systems. The ability to cover a large area quickly and effectively, combined with its rapid action against a wide range of pests, makes liquid Beta Cyfluthrin the preferred choice for farmers and pest control professionals. Additionally, liquid formulations are easily absorbed by both plants and animals, enhancing their effectiveness in pest management.

In household and commercial applications, liquid Beta Cyfluthrin products are also commonly used in sprays and concentrates, providing effective pest control in residential homes, warehouses, and industrial settings. The liquid form ensures targeted and immediate pest control, which is essential for maintaining health and safety standards in homes and businesses. Given these benefits, the liquid segment is expected to remain the largest and most dominant in the Beta Cyfluthrin market.

Agriculture Application Segment Is Fastest Growing Owing to Rising Demand for Crop Protection

The agriculture application segment is the fastest-growing in the Beta Cyfluthrin market, driven by the increasing need for effective pest control solutions in crop protection. Agriculture is a primary sector that relies heavily on insecticides to prevent crop damage from pests, which can significantly affect yield and quality. With global food demand rising due to population growth and climate change-related challenges, farmers are under pressure to ensure high-quality, pest-free crops. Beta Cyfluthrin, with its broad-spectrum efficacy against various pests, has emerged as a crucial tool in agricultural pest management.

Moreover, the shift towards sustainable farming practices, which prioritize minimal environmental impact while maximizing crop protection, has increased the adoption of Beta Cyfluthrin in organic and conventional farming. As more farmers adopt integrated pest management (IPM) strategies that combine chemical, biological, and mechanical pest control methods, the use of Beta Cyfluthrin in agriculture is expected to continue to rise, making it the fastest-growing application segment.

Wholesale Distribution Channel Is Largest Due to Bulk Purchases and Widespread Access

The wholesale distribution channel is the largest within the Beta Cyfluthrin market, particularly in the agricultural and commercial pest control sectors. Wholesale distributors play a key role in ensuring bulk purchases of Beta Cyfluthrin for large-scale agricultural operations, pest control companies, and retailers. They provide a direct route for customers to access the product at competitive prices, making them the preferred distribution method for businesses and large farms that require significant quantities of insecticides.

Additionally, wholesale distributors offer convenience and competitive pricing, allowing for better accessibility and availability of Beta Cyfluthrin products in multiple regions. This makes wholesale distribution the dominant channel in the market, as it supports both large and small businesses with the required volumes of the insecticide.

Online Retail Channel Is Fastest Growing Owing to Increasing Consumer Access and Convenience

The online retail channel is the fastest-growing segment in the Beta Cyfluthrin market, driven by increasing consumer preference for the convenience of online shopping and the growing e-commerce industry. Consumers are increasingly turning to online platforms to purchase pest control products due to the ease of comparing prices, reading reviews, and having products delivered directly to their homes. Online retailers, such as Amazon and specialized e-commerce sites, offer a variety of Beta Cyfluthrin products, catering to both residential customers and small businesses.

Additionally, online retail platforms provide a more direct way for manufacturers and suppliers to reach end-users, bypassing traditional brick-and-mortar stores. With the growing focus on home gardening, pest control, and DIY solutions, the online retail segment is expected to continue expanding rapidly as more consumers choose to purchase Beta Cyfluthrin products online for home and garden use.

North America Is Largest Market Owing to High Agricultural Output and Pest Control Demand

North America is the largest market for Beta Cyfluthrin, driven by its well-established agricultural industry and high demand for pest control products in both residential and commercial sectors. The United States, in particular, is a significant consumer of Beta Cyfluthrin in agriculture, with its vast farmland requiring effective pest management solutions to protect crops such as corn, soybeans, and wheat. Additionally, urban areas in North America have high demand for pest control in homes and commercial spaces, where Beta Cyfluthrin is used to address infestations of common pests such as ants, cockroaches, and termites.

Furthermore, the region’s focus on sustainable agriculture and integrated pest management practices contributes to the ongoing demand for Beta Cyfluthrin. With a well-developed regulatory framework and robust distribution channels, North America remains the largest and most mature market for Beta Cyfluthrin, and it is expected to maintain this position due to continued growth in both agricultural and commercial pest control applications.

Competitive Landscape

The Beta Cyfluthrin market is highly competitive, with a mix of global and regional players focused on providing effective pest control solutions. Key companies operating in the market include Syngenta, Bayer CropScience, BASF, and FMC Corporation. These companies dominate the market by offering a broad range of insecticides and formulations, including Beta Cyfluthrin, targeting different pest control needs across agriculture, household, and commercial sectors.

In addition to large multinational companies, several regional manufacturers also contribute to the market, focusing on cost-effective production methods and meeting the specific demands of local markets. The competitive landscape is characterized by ongoing innovation in formulation, distribution strategies, and pricing, as companies seek to gain market share in a rapidly evolving pest control industry. As the market continues to grow, companies are likely to focus on expanding their product portfolios, enhancing sustainability practices, and developing more targeted solutions to meet the diverse needs of consumers.

Recent Developments:

- In November 2024, Bayer AG announced a new beta cyfluthrin-based formulation for improved pest control in agriculture.

- In October 2024, Syngenta AG launched a new household pest control product using beta cyfluthrin for indoor use.

- In September 2024, BASF SE introduced a beta cyfluthrin-based insecticide solution for industrial applications.

- In August 2024, FMC Corporation expanded its beta cyfluthrin production capacity to meet growing demand for agricultural pest control.

- In July 2024, Corteva Agriscience received regulatory approval for a beta cyfluthrin-based product in crop protection.

List of Leading Companies:

- Bayer AG

- Syngenta AG

- BASF SE

- Corteva Agriscience

- FMC Corporation

- Sumitomo Chemical Co., Ltd.

- Adama Agricultural Solutions Ltd.

- UPL Limited

- Nufarm Limited

- The Dow Chemical Company

- Mitsui Chemicals Agro, Inc.

- Arysta LifeScience

- Cheminova A/S

- Helena Chemical Company

- Mahindra Agribusiness

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 261.3 million |

|

Forecasted Value (2030) |

USD 395.1 million |

|

CAGR (2024 – 2030) |

6.1% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Beta Cyfluthrin Market By Form (Liquid, Granules), By Application (Agriculture, Household, Commercial & Industrial), By Distribution Channel (Online Retail, Wholesale Distribution, Direct Sales) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Bayer AG, Syngenta AG, BASF SE, Corteva Agriscience, FMC Corporation, Sumitomo Chemical Co., Ltd., Adama Agricultural Solutions Ltd., UPL Limited, Nufarm Limited, The Dow Chemical Company, Mitsui Chemicals Agro, Inc., Arysta LifeScience, Cheminova A/S, Helena Chemical Company, Mahindra Agribusiness |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Beta Cyfluthrin Market, by Form (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Liquid |

|

4.2. Granules |

|

4.3. Others |

|

5. Beta Cyfluthrin Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Agriculture |

|

5.2. Household |

|

5.3. Commercial & Industrial |

|

5.4. Others |

|

6. Beta Cyfluthrin Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Online Retail |

|

6.2. Wholesale Distribution |

|

6.3. Direct Sales |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Beta Cyfluthrin Market, by Form |

|

7.2.7. North America Beta Cyfluthrin Market, by Application |

|

7.2.8. North America Beta Cyfluthrin Market, by Distribution Channel |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Beta Cyfluthrin Market, by Form |

|

7.2.9.1.2. US Beta Cyfluthrin Market, by Application |

|

7.2.9.1.3. US Beta Cyfluthrin Market, by Distribution Channel |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Bayer AG |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Syngenta AG |

|

9.3. BASF SE |

|

9.4. Corteva Agriscience |

|

9.5. FMC Corporation |

|

9.6. Sumitomo Chemical Co., Ltd. |

|

9.7. Adama Agricultural Solutions Ltd. |

|

9.8. UPL Limited |

|

9.9. Nufarm Limited |

|

9.10. The Dow Chemical Company |

|

9.11. Mitsui Chemicals Agro, Inc. |

|

9.12. Arysta LifeScience |

|

9.13. Cheminova A/S |

|

9.14. Helena Chemical Company |

|

9.15. Mahindra Agribusiness |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Beta Cyfluthrin Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Beta Cyfluthrin Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Beta Cyfluthrin Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA