As per Intent Market Research, the Beta Catenin Market was valued at USD 52.7 million in 2023 and will surpass USD 159.5 million by 2030; growing at a CAGR of 17.2% during 2024 - 2030.

The Beta Catenin market is an emerging segment within the life sciences and biotechnology industries, primarily driven by the critical role of Beta Catenin in various cellular processes, including cell adhesion, signal transduction, and regulation of gene expression. Beta Catenin is a multifunctional protein that serves as a central component in the Wnt signaling pathway, which plays a pivotal role in embryogenesis, cell differentiation, and tissue homeostasis. With its relevance in various cellular mechanisms, Beta Catenin is increasingly being explored in drug discovery, diagnostics, and cancer research, where its dysregulation has been linked to various diseases, particularly cancers. The growing focus on precision medicine, coupled with advancements in genetic research and biotechnology, has significantly contributed to the growth of this market.

Furthermore, Beta Catenin’s potential in various therapeutic applications, including its involvement in immune response modulation and tumor progression, ensures continued interest from both research institutions and pharmaceutical companies. As the understanding of Beta Catenin's biological functions deepens, the market for Beta Catenin-based products and solutions is expected to expand, driven by rising demand for more effective therapeutic interventions and diagnostic tools.

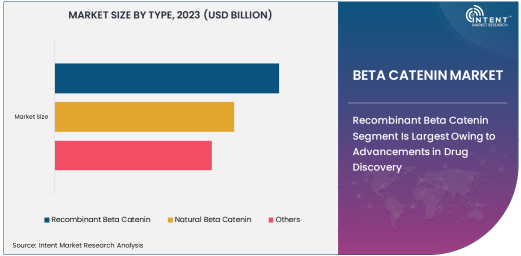

Recombinant Beta Catenin Segment Is Largest Owing to Advancements in Drug Discovery

The recombinant Beta Catenin segment holds the largest share in the market, largely driven by its widespread application in drug discovery and development. Recombinant Beta Catenin is produced through genetic engineering techniques, allowing for high-purity, functional protein that is crucial for investigating Beta Catenin’s role in various diseases, particularly cancer and genetic disorders. The ability to generate recombinant Beta Catenin in the laboratory has opened up new avenues for drug screening and therapeutic interventions, with pharmaceutical companies increasingly leveraging recombinant Beta Catenin in the development of targeted therapies.

Moreover, recombinant Beta Catenin is an essential tool for understanding the molecular mechanisms of Beta Catenin-related diseases, such as colorectal cancer, and for developing small molecules or biologics aimed at modulating its activity. The large-scale production and availability of recombinant Beta Catenin are expected to continue driving its dominance in the market as the pharmaceutical industry seeks novel approaches to cancer and other complex diseases. The growing demand for targeted therapies and precision medicine further supports the expansion of the recombinant Beta Catenin segment.

Drug Discovery & Development Application Segment Is Fastest Growing Owing to Increased Focus on Targeted Therapies

The drug discovery and development application segment is the fastest-growing within the Beta Catenin market, primarily due to the increasing focus on targeted therapies and personalized medicine. Beta Catenin’s pivotal role in the Wnt signaling pathway has made it an important target for drug discovery, particularly in the treatment of cancers and other diseases associated with the dysregulation of Beta Catenin. Research efforts are intensifying to develop inhibitors or modulators of Beta Catenin signaling as potential therapeutic agents for various types of cancer, including colorectal, liver, and breast cancer.

The rise of precision medicine, which aims to tailor treatments to the individual genetic profile of patients, further accelerates the demand for Beta Catenin-based drug discovery tools. The market for Beta Catenin in drug development is expected to expand rapidly as more pharmaceutical companies invest in the exploration of Beta Catenin modulation as a therapeutic strategy, fostering the growth of this segment. Furthermore, advancements in screening technologies and increased funding for cancer research will continue to support the development of novel Beta Catenin-targeted therapies.

Pharmaceuticals End-Use Segment Is Largest Owing to Growing Cancer Research Initiatives

The pharmaceuticals end-use segment is the largest within the Beta Catenin market, driven by the significant demand for Beta Catenin-based products in drug discovery and therapeutic applications. Pharmaceutical companies are at the forefront of utilizing Beta Catenin in their research and development efforts, particularly in the development of novel cancer treatments. The critical role of Beta Catenin in the Wnt signaling pathway, which is frequently implicated in tumorigenesis, has made it a key target for cancer drug discovery, particularly for colorectal cancer and other solid tumors.

As the global cancer burden rises, pharmaceutical companies are increasingly focused on developing therapies that target Beta Catenin’s molecular mechanisms. The growing pipeline of Beta Catenin inhibitors and modulators in clinical trials further fuels the demand for Beta Catenin in pharmaceutical applications. This trend is expected to continue as the pharmaceutical industry intensifies its efforts to find more effective treatments for cancer and other Beta Catenin-related diseases.

Research Institutes Segment Is Fastest Growing Owing to Increased Funding for Cancer and Genetic Research

The research institutes end-use segment is the fastest-growing segment in the Beta Catenin market, driven by the rising funding for cancer research and genetic studies. Research institutions are major contributors to the advancement of Beta Catenin-based therapies, particularly in the fields of oncology and genetic disorders. As the understanding of Beta Catenin’s biological functions expands, research institutions are focusing on its potential as a therapeutic target and its role in diseases like cancer, Alzheimer’s, and diabetes.

The surge in research funding, especially in cancer immunotherapy and regenerative medicine, has spurred the demand for Beta Catenin in these research applications. The growing number of clinical trials targeting Beta Catenin and the increasing collaboration between academic institutions and pharmaceutical companies are key factors driving the research institutes segment. As research efforts intensify, the demand for Beta Catenin-based tools and models for preclinical and clinical studies will continue to rise, making this segment a significant growth driver.

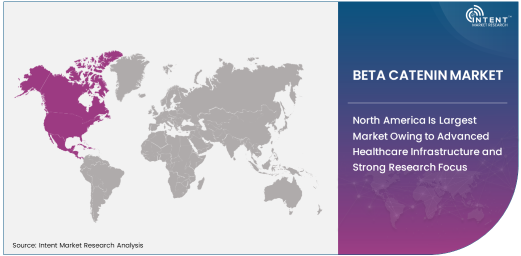

North America Is Largest Market Owing to Advanced Healthcare Infrastructure and Strong Research Focus

North America is the largest market for Beta Catenin-based products, primarily due to the region’s advanced healthcare infrastructure, well-established pharmaceutical industry, and significant research efforts in cancer and genetic disorders. The United States, in particular, is home to numerous leading pharmaceutical companies, research institutions, and biotechnology firms that are heavily invested in Beta Catenin research and drug development. The growing focus on precision medicine, coupled with significant investments in cancer research, further drives the demand for Beta Catenin in the region.

Additionally, North America’s regulatory framework supports the development and commercialization of new therapeutics and diagnostic tools, making it an attractive market for Beta Catenin-based innovations. As the demand for targeted therapies and cancer treatments continues to rise, North America is expected to remain the dominant market for Beta Catenin.

Competitive Landscape

The Beta Catenin market is competitive, with a number of global and regional players involved in the production and development of Beta Catenin-based products. Key players in the market include Thermo Fisher Scientific, Sigma-Aldrich, Bio-Techne, and Abcam, which are focused on offering high-quality recombinant Beta Catenin products for drug discovery, diagnostics, and research applications. These companies leverage their expertise in biotechnology and life sciences to provide researchers and pharmaceutical companies with the tools needed to explore Beta Catenin’s therapeutic potential.

Smaller players and emerging biotech firms are also gaining traction in the market, offering innovative solutions and targeted products for specific applications, such as cancer drug development. The competitive landscape is characterized by continuous research and development, collaborations, and partnerships aimed at advancing Beta Catenin-based therapies and diagnostics. As the market for Beta Catenin expands, competition is expected to intensify, with companies focusing on improving the efficiency of their production processes and expanding their portfolios to meet the growing demand from research institutions, pharmaceutical companies, and healthcare providers.

Recent Developments:

- In November 2024, Thermo Fisher Scientific Inc. launched a new range of beta catenin antibodies for cancer research applications.

- In October 2024, Bio-Techne Corporation introduced a new beta catenin signaling pathway inhibitor for cancer therapeutics.

- In September 2024, Merck Group expanded its beta catenin-related product offerings to support neurological disorder research.

- In August 2024, Roche Diagnostics partnered with a biotech firm to develop advanced diagnostic tools targeting beta catenin in cancer detection.

- In July 2024, Abcam Plc announced the release of a new recombinant beta catenin protein for research purposes.

List of Leading Companies:

- Thermo Fisher Scientific Inc.

- Bio-Techne Corporation

- Abcam Plc

- Merck Group

- Roche Diagnostics

- Sigma-Aldrich (Merck)

- PerkinElmer, Inc.

- Agilent Technologies

- Abnova Corporation

- Cell Signaling Technology, Inc.

- Santa Cruz Biotechnology, Inc.

- New England Biolabs

- Enzo Life Sciences, Inc.

- Becton, Dickinson and Company

- Bioworld Biotechnology

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 52.7 million |

|

Forecasted Value (2030) |

USD 159.5 million |

|

CAGR (2024 – 2030) |

17.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Beta Catenin Market By Type (Recombinant Beta Catenin, Natural Beta Catenin), By Application (Drug Discovery & Development, Diagnostic Tools), By End Use (Pharmaceuticals, Research Institutes, Healthcare Providers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Thermo Fisher Scientific Inc., Bio-Techne Corporation, Abcam Plc, Merck Group, Roche Diagnostics, Sigma-Aldrich (Merck), PerkinElmer, Inc., Agilent Technologies, Abnova Corporation, Cell Signaling Technology, Inc., Santa Cruz Biotechnology, Inc., New England Biolabs, Enzo Life Sciences, Inc., Becton, Dickinson and Company, Bioworld Biotechnology |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Beta Catenin Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Recombinant Beta Catenin |

|

4.2. Natural Beta Catenin |

|

4.3. Others |

|

5. Beta Catenin Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Drug Discovery & Development |

|

5.2. Diagnostic Tools |

|

5.3. Others |

|

6. Beta Catenin Market, by End Use (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Pharmaceuticals |

|

6.2. Research Institutes |

|

6.3. Healthcare Providers |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Beta Catenin Market, by Type |

|

7.2.7. North America Beta Catenin Market, by Application |

|

7.2.8. North America Beta Catenin Market, by End Use |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Beta Catenin Market, by Type |

|

7.2.9.1.2. US Beta Catenin Market, by Application |

|

7.2.9.1.3. US Beta Catenin Market, by End Use |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Thermo Fisher Scientific Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Bio-Techne Corporation |

|

9.3. Abcam Plc |

|

9.4. Merck Group |

|

9.5. Roche Diagnostics |

|

9.6. Sigma-Aldrich (Merck) |

|

9.7. PerkinElmer, Inc. |

|

9.8. Agilent Technologies |

|

9.9. Abnova Corporation |

|

9.10. Cell Signaling Technology, Inc. |

|

9.11. Santa Cruz Biotechnology, Inc. |

|

9.12. New England Biolabs |

|

9.13. Enzo Life Sciences, Inc. |

|

9.14. Becton, Dickinson and Company |

|

9.15. Bioworld Biotechnology |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Beta Catenin Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Beta Catenin Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Beta Catenin Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA