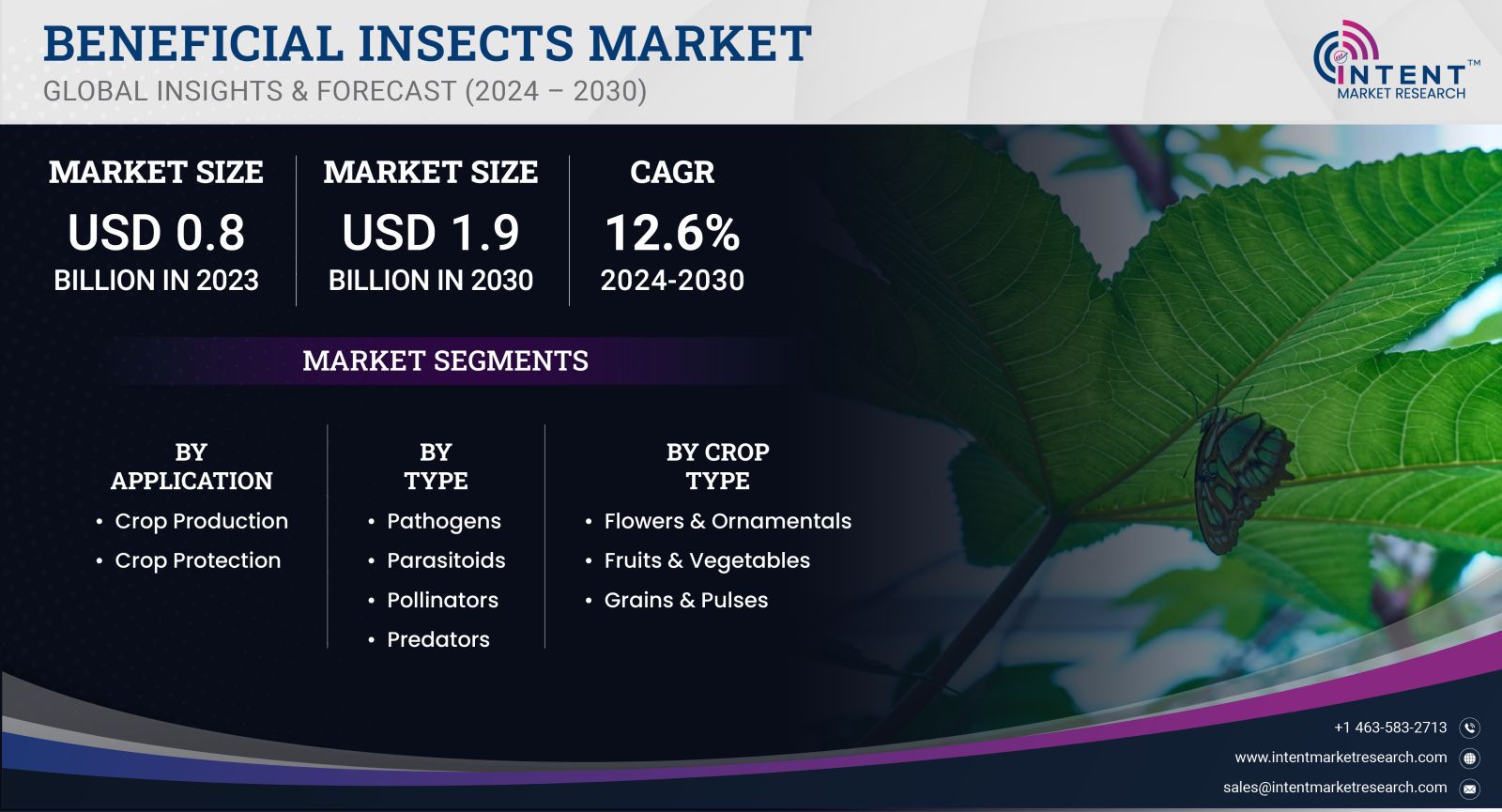

As per Intent Market Research, the Beneficial Insects Market is projected to grow from USD 0.8 billion in 2023 to USD 1.9 billion by 2030, registering a CAGR of 12.6% during the forecast period (2024–2030).

The adoption of beneficial insects not only helps in managing pest populations but also enhances soil health and crop yield, making them an integral part of sustainable agriculture. As farmers and agricultural stakeholders become more aware of the benefits of integrated pest management (IPM), the demand for beneficial insects is expected to rise, reshaping traditional farming practices and promoting ecological balance. This shift toward sustainable solutions is fostering innovation and investment in the beneficial insects market, creating opportunities for growth across various segments

Predatory Insects Segment is Largest Owing to Effectiveness in Pest Control

The predatory insects segment is the largest within the beneficial insects market, primarily due to their effectiveness in controlling pest populations. Predatory insects, such as ladybugs, lacewings, and predatory mites, are crucial in managing pest species that threaten crop health. Their ability to reproduce quickly and adapt to various environments makes them highly effective agents in integrated pest management strategies, appealing to both conventional and organic farmers.

Farmers are increasingly recognizing the economic and ecological advantages of using predatory insects to mitigate pest damage. By reducing the reliance on chemical pesticides, these insects contribute to a healthier ecosystem while also enhancing crop yield and quality. The growing awareness of sustainable farming practices is driving the adoption of predatory insects, solidifying their position as the largest segment in the beneficial insects market.

Pollinators Segment is Fastest Growing Owing to Rising Demand for Crop Pollination

The pollinators segment is the fastest growing in the beneficial insects market, driven by the increasing demand for crop pollination services. Pollinators, particularly honeybees and bumblebees, are essential for the production of numerous fruits, vegetables, and nuts. As global food production faces challenges from climate change and habitat loss, the need for reliable pollination services has become more critical, leading to a surge in the use of pollinators in agriculture.

The decline in natural pollinator populations has further amplified the need for managed pollination services. Farmers are increasingly investing in pollinator services to enhance crop yields and quality. This growing awareness of the role of pollinators in food production is propelling the rapid expansion of the pollinators segment, making it a key focus for stakeholders in the beneficial insects market.

Beneficial Nematodes Segment is Fastest Growing Owing to Soil Health Enhancement

The beneficial nematodes segment is also experiencing notable growth within the beneficial insects market, driven by their role in enhancing soil health and managing soil-borne pests. Beneficial nematodes are microscopic roundworms that parasitize and control various soil pests, such as root weevils and grubs. Their effectiveness in biological pest control and soil improvement makes them an attractive option for farmers seeking sustainable pest management solutions.

As the agricultural industry increasingly emphasizes soil health and sustainability, beneficial nematodes are gaining traction. They contribute to the reduction of chemical inputs while promoting a healthier soil ecosystem. This growing recognition of the importance of soil health in agriculture is driving the demand for beneficial nematodes, making them one of the fastest-growing segments in the beneficial insects market.

North America Region is Largest Owing to Advanced Agricultural Practices

The North America region is the largest market for beneficial insects, attributed to the advanced agricultural practices and increasing awareness of sustainable pest management. The United States and Canada are at the forefront of adopting integrated pest management strategies, where beneficial insects play a vital role. The presence of a large agricultural sector focused on both conventional and organic farming has fostered a favorable environment for the growth of the beneficial insects market.

Furthermore, government regulations promoting sustainable agriculture and reduced pesticide use are encouraging farmers to explore alternative pest management solutions, including beneficial insects. The significant investment in research and development of sustainable farming practices in North America is also contributing to the growth of the beneficial insects market in the region. As awareness continues to rise, North America is expected to maintain its status as the largest market for beneficial insects.

Competitive Landscape of Leading Companies

The beneficial insects market is characterized by a competitive landscape with several key players driving innovation and market growth. Leading companies in this sector include:

- Biobest Group: A pioneer in biological control, Biobest specializes in beneficial insects and offers a comprehensive range of solutions for pest management and pollination.

- Syngenta: A global leader in agriculture, Syngenta provides integrated solutions, including beneficial insects, to enhance crop productivity and sustainability.

- BASF: With a strong focus on sustainable agriculture, BASF develops and markets a variety of beneficial insects as part of its integrated pest management portfolio.

- Stoller USA: Stoller is committed to advancing agriculture through innovative biological products, including beneficial insects, that promote crop health and productivity.

- AgBiTech: Specializing in biological pest control, AgBiTech focuses on developing beneficial insects and microorganisms for sustainable agriculture.

- Koppert Biological Systems: Koppert is a global leader in biological pest control and pollination services, offering a wide range of beneficial insects tailored to various crops.

- Greenhouse Megastore: This company provides beneficial insects for greenhouse and hydroponic farmers, contributing to sustainable agricultural practices.

- BioWorks: BioWorks offers a comprehensive portfolio of beneficial insects and biopesticides to enhance pest management in organic and conventional farming.

- Nature’s Way: Focused on sustainable farming practices, Nature’s Way provides a variety of beneficial insects to support crop health and pest control.

- RHS Entomology: RHS Entomology specializes in beneficial insects and integrated pest management solutions tailored to the agricultural sector.

These companies are investing in research and development to enhance their offerings and expand their market presence. The competitive landscape is characterized by collaborations, partnerships, and strategic acquisitions aimed at improving the effectiveness of beneficial insects and meeting the evolving needs of farmers. As the market continues to grow, these leading players are well-positioned to capitalize on the increasing demand for sustainable agricultural solutions.

Report Objectives:

The report will help you answer some of the most critical questions in the beneficial insects market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the beneficial insects market?

- What is the size of the beneficial insects market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 0.8 billion |

|

Forecasted Value (2030) |

USD 1.9 billion |

|

CAGR (2024-2030) |

12.6% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Beneficial Insects Market By Application (Crop Production, Crop Protection), By Type (Pathogens, Predators, Parasitoids, Pollinators), By Crop Type (Fruits & Vegetables, Flowers & Ornamentals, and Grains & Pulses) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Beneficial Insects Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1.Crop Production |

|

4.2.Crop Protection |

|

5.Beneficial Insects Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1.Pathogens |

|

5.2.Parasitoids |

|

5.3.Pollinators |

|

5.4.Predators |

|

6.Beneficial Insects Market, by Crop Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1.Flowers & Ornamentals |

|

6.2.Fruits & Vegetables |

|

6.3.Grains & Pulses |

|

7.Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Beneficial Insects Market, by Application |

|

7.2.7.North America Beneficial Insects Market, by Type |

|

7.2.8.North America Beneficial Insects Market, by Crop Type |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Beneficial Insects Market, by Application |

|

7.3.1.2.US Beneficial Insects Market, by Type |

|

7.3.1.3.US Beneficial Insects Market, by Crop Type |

|

7.3.2.Canada |

|

7.3.3.Mexico |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1. Anatis Bioprotection |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Andermatt Biocontrol |

|

9.3.Biobest Group |

|

9.4.Applied Bio-nomics |

|

9.5.Koppert |

|

9.6.Fargro |

|

9.7.Bioline Agrosciences |

|

9.8.Arbico Organics |

|

9.9.Bionema |

|

9.10.Growliv Biologicals |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the beneficial insects market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to measure the impact of them on the beneficial insects market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the beneficial insects ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the beneficial insects market. These methods were also employed to estimate the size of various sub-segments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA