The Battery Thermal Management System (BTMS) Market is expected to witness substantial growth from 2024 to 2030, driven by the increasing adoption of electric vehicles (EVs) and the growing demand for efficient thermal management solutions in energy storage systems. As battery technology advances, maintaining optimal temperature conditions has become critical for improving battery lifespan, performance, and safety.

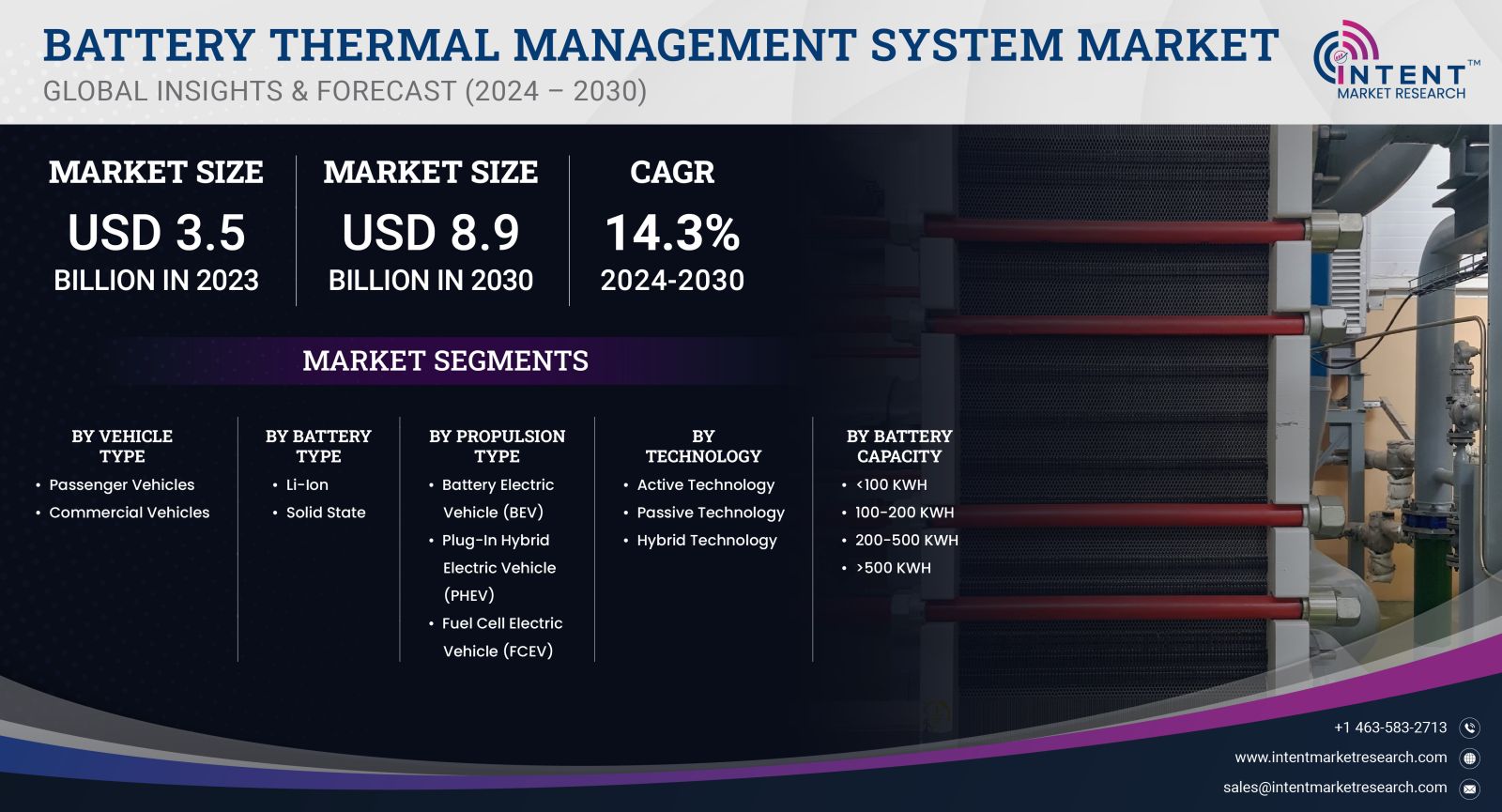

As per Intent Market Research, the Battery Thermal Management System Market was valued at USD 3.5 billion in 2023 and will surpass USD 8.9 billion by 2030; growing at a CAGR of 14.3% during 2024 - 2030.

EV Segment is Fastest Growing Owing to Rising Electric Vehicle Adoption

The Electric Vehicle (EV) segment is experiencing rapid growth within the BTMS market, primarily due to the increasing penetration of electric cars in global markets. As governments worldwide push for cleaner and more sustainable transportation solutions, automakers are investing heavily in battery technologies that require efficient thermal management systems to ensure safety and optimal performance.

Among the various types of EVs, battery electric vehicles (BEVs) represent the fastest-growing sub-segment, driven by government incentives, infrastructure development, and technological advancements. BEVs require advanced thermal management solutions to manage the heat generated during charging and discharging cycles, making BTMS essential for enhancing battery life and efficiency. The development of next-generation BEVs with longer ranges and faster charging capabilities further fuels demand for sophisticated battery thermal management technologies.

Air Cooling Segment is Largest Due to Cost Efficiency and Scalability

The air-cooling segment is the largest in the BTMS market, owing to its cost-effective and scalable solutions suitable for a wide range of applications, particularly in compact electric vehicles and smaller battery systems. Air cooling uses fans and ventilation systems to regulate battery temperature, offering a simpler and more economical approach compared to liquid or refrigerant-based systems.

In the air-cooling segment, passive air cooling, which leverages natural airflow without additional energy input, holds the largest market share. This sub-segment is widely used in low-power applications and smaller EV models where energy efficiency and affordability are prioritized. With the increasing demand for cost-efficient and reliable solutions in the electric two-wheeler and three-wheeler markets, passive air-cooling systems are expected to maintain their dominance in this segment.

Liquid Cooling Segment is Fastest Growing Due to High Efficiency and Performance

The liquid cooling segment is emerging as the fastest-growing segment within the BTMS market, driven by the demand for higher efficiency and superior temperature regulation capabilities. Liquid cooling systems, which circulate coolant to absorb and dissipate heat from battery cells, are becoming increasingly popular in high-performance EVs and energy storage systems requiring precise temperature control.

Among the liquid cooling systems, the direct liquid cooling sub-segment is seeing the most rapid growth due to its effectiveness in maintaining uniform temperatures across battery modules. This technology is particularly favored in premium electric vehicles and commercial EVs, where managing thermal loads efficiently is critical to performance. The expanding market for high-performance electric vehicles and heavy-duty transportation solutions is expected to further boost the adoption of direct liquid cooling systems.

Passenger Car Segment is Largest Due to High Electric Vehicle Sales

The passenger car segment holds the largest share in the BTMS market, primarily attributed to the surging sales of electric passenger vehicles globally. As automotive manufacturers increasingly focus on electrification strategies, battery thermal management has become an integral part of vehicle design, ensuring both safety and reliability.

Within this segment, compact and mid-sized electric cars are the largest sub-segment, reflecting the growing consumer preference for affordable and eco-friendly vehicles. The introduction of government incentives, coupled with advancements in battery technology, is enhancing the adoption of electric passenger cars, thereby driving the demand for efficient thermal management solutions tailored to these vehicle categories.

Lithium-Ion Battery Segment is Largest Due to Widespread Use in EVs

Lithium-ion batteries dominate the BTMS market as they are the most widely used energy storage technology in electric vehicles. Known for their high energy density and long cycle life, lithium-ion batteries require effective thermal management solutions to prevent overheating and degradation during operation.

The largest sub-segment within lithium-ion batteries is the NMC (Nickel Manganese Cobalt) chemistry, which offers a balanced performance in terms of energy density, safety, and cost. The increasing use of NMC batteries in electric cars and hybrid vehicles is driving demand for advanced BTMS solutions that can maintain optimal temperatures and improve battery longevity. With continuous R&D efforts aimed at enhancing battery efficiency and safety, the NMC sub-segment is expected to retain its leading position in the market.

Asia-Pacific Region is Fastest Growing Owing to Expanding Electric Vehicle Market

The Asia-Pacific region is the fastest-growing market for BTMS, fueled by the rapid expansion of the electric vehicle sector in countries like China, Japan, and South Korea. China, in particular, is the largest market for electric vehicles, with significant government support for EV adoption and infrastructure development. As a result, the demand for advanced battery thermal management solutions has surged, making Asia-Pacific a crucial market for BTMS providers.

Among the countries in this region, India is expected to show the highest growth rate during the forecast period. The Indian government’s initiatives to promote electric mobility, combined with the increasing focus of local manufacturers on developing affordable electric two-wheelers and compact cars, is propelling the demand for BTMS solutions. The development of new battery manufacturing facilities and the growth of the electric vehicle ecosystem are also contributing to the region's rapid expansion.

Competitive Landscape and Leading Companies

The BTMS market is highly competitive, with several key players actively investing in research and development to innovate and expand their product offerings. Leading companies in the market include Bosch, LG Chem, Valeo, MAHLE, and Gentherm. These companies are focusing on developing integrated thermal management solutions that combine cooling, heating, and energy management functionalities for optimal battery performance.

The competitive landscape is characterized by strategic collaborations, mergers, and acquisitions as companies aim to enhance their technological capabilities and market presence. The increasing trend of partnerships between automakers and BTMS providers highlights the growing emphasis on tailored solutions for specific EV models, ensuring both performance and safety standards are met.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 3.5 billion |

|

Forecasted Value (2030) |

USD 8.9 billion |

|

CAGR (2024 – 2030) |

14.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Battery Thermal Management System Market By Vehicle Type (Passenger, Commercial), By Battery Type (Li-Ion, Solid State), Propulsion Type (BEV, PHEV, FCEV), By Technology (Active Technology, Passive Technology, Hybrid Technology), By Battery Capacity (<100 KWH, 100-200 KWH, 200-500 KWH, >500 KWH) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Battery Thermal Management System Market, by Vehicle Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Passenger Vehicles |

|

4.2. Commercial Vehicles |

|

5. Battery Thermal Management System Market, by Battery Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Li-Ion |

|

5.2. Solid State |

|

6. Battery Thermal Management System Market, by Propulsion Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Battery Electric Vehicle (BEV) |

|

6.2. Plug-In Hybrid Electric Vehicle (PHEV) |

|

6.3. Fuel Cell Electric Vehicle (FCEV) |

|

7. Battery Thermal Management System Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Active Technology |

|

7.2. Passive Technology |

|

7.3. Hybrid Technology |

|

8. Battery Thermal Management System Market, by Battery Capacity (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. <100 KWH |

|

8.2. 100-200 KWH |

|

8.3. 200-500 KWH |

|

8.4. >500 KWH |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Battery Thermal Management System Market, by Vehicle Type |

|

9.2.7. North America Battery Thermal Management System Market, by Battery Type |

|

9.2.8. North America Battery Thermal Management System Market, by Propulsion Type |

|

9.2.9. North America Battery Thermal Management System Market, by Technology |

|

9.2.10. North America Battery Thermal Management System Market, by Battery Capacity |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Battery Thermal Management System Market, by Vehicle Type |

|

9.2.11.1.2. US Battery Thermal Management System Market, by Battery Type |

|

9.2.11.1.3. US Battery Thermal Management System Market, by Propulsion Type |

|

9.2.11.1.4. US Battery Thermal Management System Market, by Technology |

|

9.2.11.1.5. US Battery Thermal Management System Market, by Battery Capacity |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. 3M |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. ContiTech Deutschland GmbH |

|

11.3. Dana Incorporated |

|

11.4. GENTHERM |

|

11.5. Grayson Thermal Systems |

|

11.6. Hanon Systems |

|

11.7. MAHLE GmbH |

|

11.8. Robert Bosch |

|

11.9. Valeo |

|

11.10. VOSS Automotive |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Battery Thermal Management System Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Battery Thermal Management System Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Battery Thermal Management System ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Battery Thermal Management System Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA