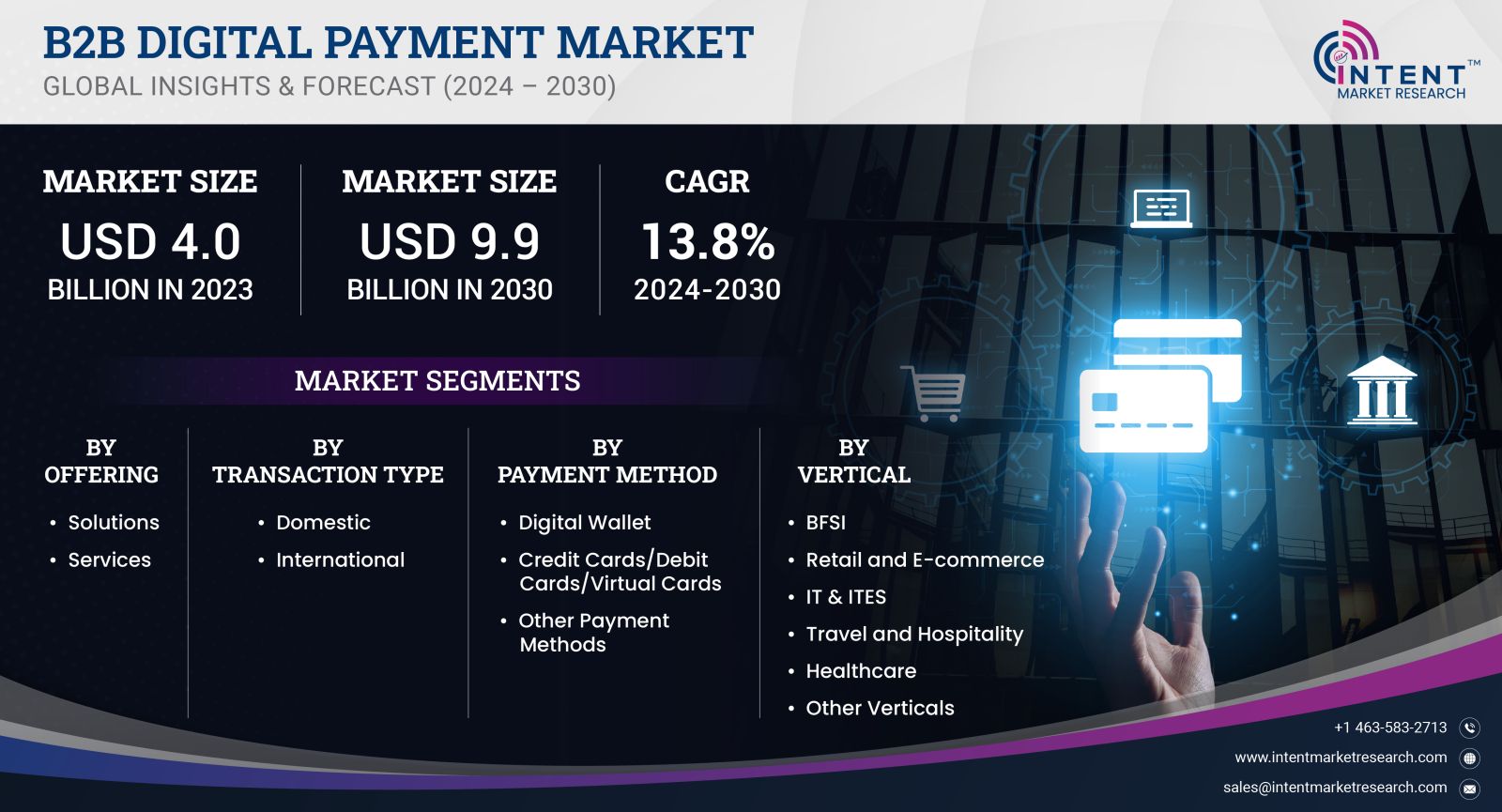

As per Intent Market Research, the B2B Digital Payment Market was valued at USD 4.0 billion in 2023-e and will surpass USD 9.9 billion by 2030; growing at a CAGR of 13.8% during 2024 - 2030.

The B2B digital payment market is witnessing unprecedented growth, fueled by the rapid digitization of financial transactions and the increasing adoption of electronic payment methods by businesses. As organizations strive for efficiency, cost-effectiveness, and enhanced security in their financial dealings, digital payment solutions have emerged as essential tools for streamlining operations.

The B2B digital payment ecosystem encompasses various segments, including payment processing solutions, gateways, and fraud detection tools. As these solutions become more sophisticated, they cater to the diverse needs of businesses across different sectors. Key drivers of growth in this market include the rising volume of cross-border transactions, increasing focus on improving cash flow management, and the necessity for compliance with regulatory frameworks. The evolution of technologies, such as blockchain and artificial intelligence, further enhances the appeal of digital payment solutions, making them integral to the operational strategies of modern enterprises.

Payment Processing Segment is Largest Owing to Increased Transaction Volumes

The payment processing segment is the largest within the B2B digital payment market, driven by the escalating volume of transactions processed electronically. Businesses are increasingly relying on digital platforms to handle payments efficiently, thereby reducing the time and resources spent on traditional payment methods. This segment encompasses various services, including payment gateways, point-of-sale systems, and merchant services, all of which facilitate seamless transactions between businesses. As organizations seek to enhance their operational efficiency and customer experience, payment processing solutions have become indispensable, contributing significantly to the overall market growth.

Moreover, the rise of e-commerce and digital marketplaces has significantly bolstered the payment processing segment. Businesses are leveraging these platforms to expand their reach and streamline payment operations. The integration of advanced technologies, such as mobile wallets and real-time payment systems, further enhances the appeal of payment processing solutions. This trend is expected to continue, with more businesses adopting digital payment systems to facilitate cross-border transactions and improve cash flow management. As a result, the payment processing segment is poised for sustained growth in the coming years.

Mobile Payments Segment is Fastest Growing Owing to Consumer Preference

The mobile payments segment is the fastest-growing segment within the B2B digital payment market, propelled by the increasing adoption of smartphones and mobile devices among businesses. As organizations recognize the importance of flexibility and convenience in their payment processes, mobile payment solutions are gaining traction. The ability to make transactions anytime and anywhere has transformed the way businesses manage their finances, leading to enhanced operational efficiency and improved customer experiences.

Furthermore, the COVID-19 pandemic accelerated the shift towards mobile payments as companies sought contactless solutions to reduce the risk of virus transmission. This shift has prompted businesses to invest in mobile payment technologies that enable secure transactions and improve customer engagement. The proliferation of mobile wallets and applications designed specifically for B2B transactions is expected to further drive growth in this segment. With consumers increasingly favoring mobile payment options, the mobile payments segment is set to witness exponential growth in the coming years.

E-invoicing Segment is Largest Owing to Streamlined Processes

The e-invoicing segment represents the largest subsegment within the B2B digital payment market, attributed to its ability to streamline invoicing and payment processes for businesses. E-invoicing allows organizations to generate, send, and manage invoices electronically, significantly reducing administrative burdens and minimizing errors associated with manual invoicing methods. This enhanced efficiency translates into faster payment cycles, improved cash flow management, and reduced operational costs, making e-invoicing an attractive option for businesses of all sizes.

In addition to operational efficiencies, e-invoicing solutions offer enhanced visibility and compliance, allowing organizations to track and manage their invoicing processes more effectively. This transparency is particularly crucial in industries subject to stringent regulatory requirements. As businesses increasingly recognize the benefits of e-invoicing in facilitating timely payments and maintaining accurate financial records, this segment is anticipated to sustain its leading position in the B2B digital payment market.

Cross-Border Payments Segment is Fastest Growing Owing to Globalization

The cross-border payments segment is the fastest-growing segment within the B2B digital payment market, driven by the increasing globalization of trade and commerce. As businesses expand their operations internationally, the demand for efficient cross-border payment solutions is surging. This segment encompasses various services, including currency exchange, remittances, and international payment gateways, all designed to facilitate seamless transactions across borders.

Advancements in technology, such as blockchain and distributed ledger systems, are revolutionizing cross-border payments by reducing transaction costs and settlement times. These innovations are enabling businesses to transact more efficiently with partners and suppliers worldwide, fostering greater collaboration and partnership opportunities. Additionally, regulatory changes and the emergence of fintech companies are further enhancing the competitive landscape of cross-border payments, propelling this segment to the forefront of the B2B digital payment market.

North America is the Largest Region Owing to Technological Advancements

North America is the largest region in the B2B digital payment market, primarily due to its robust technological infrastructure and early adoption of digital payment solutions. The region boasts a high concentration of fintech companies, innovative startups, and established financial institutions that are continuously developing and enhancing digital payment technologies. As businesses in North America increasingly recognize the importance of digitizing their payment processes, the demand for B2B digital payment solutions has surged, positioning the region as a leader in this market.

Additionally, the increasing volume of cross-border transactions and the growing preference for contactless payment methods have further fueled the growth of the B2B digital payment market in North America. The region's businesses are keen on leveraging advanced technologies, such as artificial intelligence and blockchain, to enhance their payment processes and improve overall operational efficiency. With the ongoing evolution of the digital payment landscape, North America is expected to maintain its leading position in the B2B digital payment market.

Competitive Landscape

The competitive landscape of the B2B digital payment market is characterized by the presence of several prominent players that are continually innovating and expanding their service offerings. Leading companies in this market include PayPal Holdings, Inc., Square, Inc., Stripe, Inc., Adyen N.V., and Mastercard Incorporated, among others. These companies are focusing on enhancing their digital payment solutions to cater to the evolving needs of businesses across various industries.

In addition to established players, the market is witnessing the emergence of fintech startups that are challenging traditional payment methods with innovative solutions. These companies are leveraging cutting-edge technologies, such as artificial intelligence and blockchain, to provide more efficient and secure payment options. The competitive landscape is also influenced by partnerships and collaborations between payment service providers and businesses seeking to enhance their digital payment capabilities. As the B2B digital payment market continues to evolve, companies must remain agile and responsive to market trends to maintain a competitive edge.

Report Objectives

The report will help you answer some of the most critical questions in the B2B Digital Payment Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the B2B digital payment market?

- What is the size of the B2B digital payment market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Middle East, and Rest of the World?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 4.0 billion |

|

Forecasted Value (2030) |

USD 9.9 billion |

|

CAGR (2024-2030) |

13.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Offering (Solutions, Services), By Payment Method (Credit Cards/Debit Cards/Virtual Cards, Digital Wallet), By Transaction Type (Domestic, International), By End-use Industry (BFSI, IT & Communication, Retail & E-commerce, Tourism) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.B2B Digital Payment Market, by Offering (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Solutions |

|

4.1.1.Billing and Accounting Management |

|

4.1.2.Payment Infrastructure |

|

4.1.3.Security, & Fraud Prevention Management |

|

4.2.Services |

|

5.B2B Digital Payment Market, by Transaction Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Domestic |

|

5.2.International |

|

6.B2B Digital Payment Market, by Payment Method (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Digital Wallet |

|

6.2.Credit Cards/Debit Cards/Virtual Cards |

|

6.3.Other Payment Methods |

|

7.B2B Digital Payment Market, by Vertical (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.BFSI |

|

7.2.Retail and E-commerce |

|

7.3.IT & ITES |

|

7.4.Travel and Hospitality |

|

7.5.Healthcare |

|

7.6.Media and Entertainment |

|

7.7.Transportation and Logistics |

|

7.8.Other Verticals |

|

8.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Regional Overview |

|

8.2.North America |

|

8.2.1.Regional Trends & Growth Drivers |

|

8.2.2.Barriers & Challenges |

|

8.2.3.Opportunities |

|

8.2.4.Factor Impact Analysis |

|

8.2.5.Technology Trends |

|

8.2.6.North America B2B Digital Payment Market, by Offering |

|

8.2.7.North America B2B Digital Payment Market, by Transaction Type |

|

8.2.8.North America B2B Digital Payment Market, by Payment Method |

|

8.2.9.North America B2B Digital Payment Market, by Vertical |

|

*Similar Segmentation will be provided at each regional level |

|

8.3.By Country |

|

8.3.1.US |

|

8.3.1.1.US B2B Digital Payment Market, by Offering (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.3.1.2.US B2B Digital Payment Market, by Transaction Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.3.1.3.US B2B Digital Payment Market, by Payment Method (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.3.1.4.US B2B Digital Payment Market, by Vertical (Market Size & Forecast: USD Billion, 2024 – 2030 |

|

8.3.2.Canada |

|

*Similar Segmentation will be provided at each regional and country level |

|

8.4.Europe |

|

8.5.APAC |

|

8.6.Latin America |

|

8.7.Middle East & Africa |

|

9.Competitive Landscape |

|

9.1.Overview of the Key Players |

|

9.2.Competitive Ecosystem |

|

9.2.1.Platform Manufacturers |

|

9.2.2.Subsystem Manufacturers |

|

9.2.3.Service Providers |

|

9.2.4.Software Providers |

|

9.3.Company Share Analysis |

|

9.4.Company Benchmarking Matrix |

|

9.4.1.Strategic Overview |

|

9.4.2.Product Innovations |

|

9.5.Start-up Ecosystem |

|

9.6.Strategic Competitive Insights/ Customer Imperatives |

|

9.7.ESG Matrix/ Sustainability Matrix |

|

9.8.Manufacturing Network |

|

9.8.1.Locations |

|

9.8.2.Supply Chain and Logistics |

|

9.8.3.Product Flexibility/Customization |

|

9.8.4.Digital Transformation and Connectivity |

|

9.8.5.Environmental and Regulatory Compliance |

|

9.9.Technology Readiness Level Matrix |

|

9.10.Technology Maturity Curve |

|

9.11.Buying Criteria |

|

10.Company Profiles |

|

10.1.PayPal |

|

10.1.1.Company Overview |

|

10.1.2.Company Financials |

|

10.1.3.Product/Service Portfolio |

|

10.1.4.Recent Developments |

|

10.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2.Fiserv |

|

10.3.Global Payments |

|

10.4.MasterCard |

|

10.5.BharatPe |

|

10.6.VISA |

|

10.7.ACI Worldwide |

|

10.8.Payoneer |

|

10.9.Block, Inc. |

|

10.10.Stripe |

|

11.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the B2B digital payment market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the B2B digital payment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the B2B digital payment ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the B2B digital payment market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA