sales@intentmarketresearch.com

+1 463-583-2713

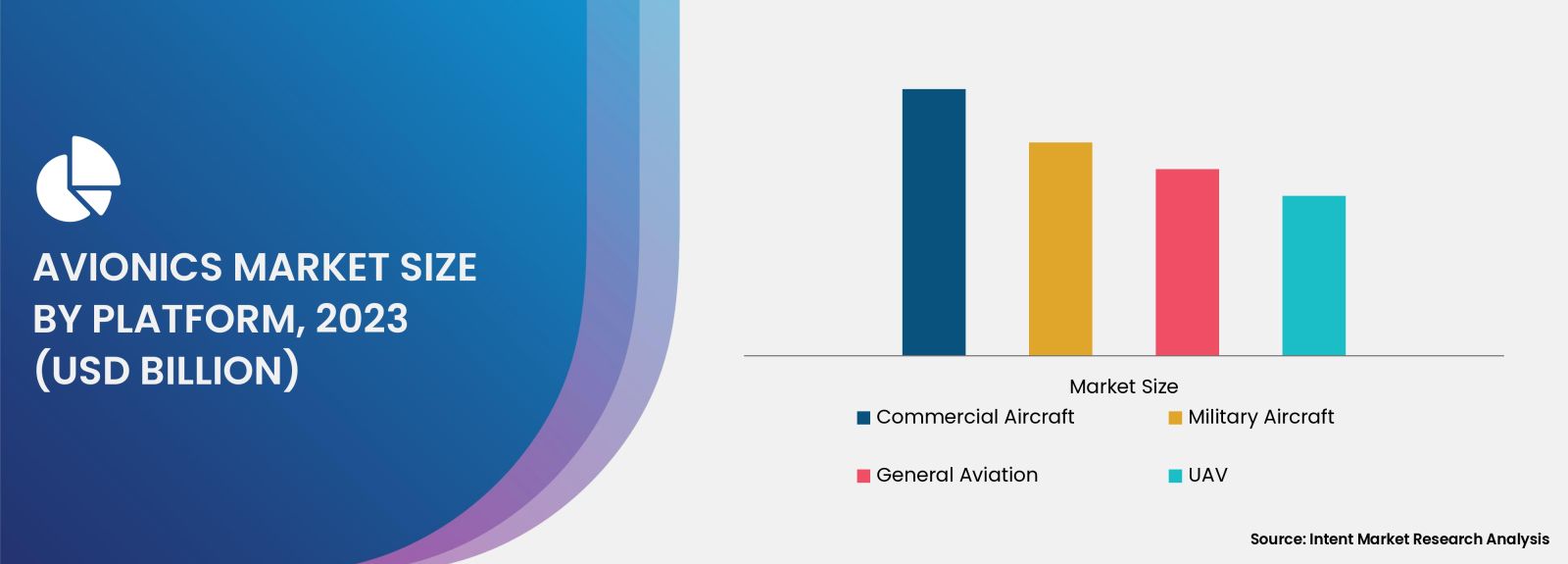

Avionics Market By Component (Flight Control Systems, Navigation Systems, Communication Systems, Surveillance Systems, Monitoring Systems, Display Systems), By Platform (Commercial Aircraft, Military Aircraft, General Aviation, Unmanned Aerial Vehicles (UAV)), By End User (OEM, Aftermarket), and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Avionics Market was valued at USD 52.1 billion in 2023 and will surpass USD 88.2 billion by 2030; growing at a CAGR of 7.8% during 2024 - 2030.

The avionics market, a crucial segment of the aerospace and defense industry, encompasses a wide range of electronic systems used in aircraft, spacecraft, and satellites. These systems are integral for navigation, communication, and monitoring functionalities, ensuring safe and efficient operations in modern aviation. The market is poised for significant growth, driven by advancements in technology, increasing air traffic, and rising demand for more sophisticated systems.

Communication Systems Segment is Largest Owing to Rising Demand for Enhanced Connectivity

The communication systems sub-segment holds a prominent position within the avionics market, driven by the increasing need for seamless communication in aviation operations. Communication systems enable real-time data transmission between aircraft and ground control, enhancing situational awareness and safety. The integration of advanced technologies, such as satellite communications (SATCOM) and very high frequency (VHF) radio systems, has significantly improved the reliability and efficiency of communication in aviation. The growing demand for in-flight connectivity services, particularly among commercial airlines, is further propelling the adoption of advanced communication systems.

Moreover, the rising need for safety and regulatory compliance has led to the incorporation of advanced communication systems in both commercial and military aircraft. The ongoing advancements in technology, such as the development of 5G networks and the Internet of Things (IoT), are set to revolutionize communication systems, enabling enhanced connectivity and data sharing capabilities. As a result, the communication systems segment is anticipated to continue its dominance in the avionics market, catering to the evolving needs of the aviation industry.

Flight Control Systems Segment is Fastest Growing Owing to Technological Advancements

The flight control systems sub-segment is emerging as the fastest-growing area within the avionics market, primarily due to technological advancements that enhance aircraft performance and safety. These systems play a crucial role in managing the flight of an aircraft, ensuring stability, maneuverability, and efficiency. The integration of fly-by-wire technology and autopilot systems has revolutionized flight control, reducing pilot workload and increasing operational safety. The increasing adoption of these technologies in both commercial and military aircraft is driving significant growth in this sub-segment.

Additionally, the push towards automation in aviation is leading to a greater emphasis on advanced flight control systems. The development of intelligent flight control systems that can adapt to changing flight conditions and assist pilots in critical situations is gaining traction. Furthermore, the emphasis on developing unmanned aerial vehicles (UAVs) is driving innovation in flight control technologies, further propelling the growth of this sub-segment. With these advancements, the flight control systems segment is poised for substantial growth, contributing significantly to the overall expansion of the avionics market.

Navigation Systems Segment is Largest Owing to Global Aviation Growth

Within the avionics market, the navigation systems sub-segment is the largest, reflecting the increasing reliance on advanced navigation technologies in aviation. Navigation systems, including Global Positioning System (GPS) and inertial navigation systems (INS), are essential for accurate positioning, route planning, and situational awareness. The growth of global air travel has amplified the demand for sophisticated navigation solutions that enhance the safety and efficiency of flights. As airlines strive to optimize routes and reduce fuel consumption, the integration of advanced navigation systems becomes paramount.

Moreover, the proliferation of smart airports and air traffic management systems is driving the adoption of advanced navigation technologies. The rise in air traffic congestion necessitates more efficient navigation systems to ensure smooth operations and timely arrivals. Innovations such as satellite-based augmentation systems (SBAS) and performance-based navigation (PBN) are setting new standards for navigation accuracy and reliability. As the aviation sector continues to expand, the navigation systems segment is expected to retain its position as the largest within the avionics market, fueled by ongoing technological advancements and the need for enhanced operational efficiency.

Surveillance Systems Segment is Fastest Growing Owing to Increased Safety Regulations

The surveillance systems sub-segment is recognized as the fastest-growing segment in the avionics market, primarily driven by the heightened focus on aviation safety and regulatory compliance. Surveillance systems, including Automatic Dependent Surveillance-Broadcast (ADS-B) and radar systems, play a critical role in monitoring aircraft positions, enhancing situational awareness, and ensuring safe separation between aircraft. The implementation of stringent safety regulations by aviation authorities worldwide is propelling the adoption of advanced surveillance systems across commercial and military fleets.

As the aviation industry faces increasing pressures to improve safety standards, the demand for sophisticated surveillance solutions is on the rise. The integration of next-generation technologies, such as ground-based surveillance systems and satellite-based surveillance, is revolutionizing the capabilities of surveillance systems, enabling real-time tracking and data sharing. Additionally, the growing emphasis on unmanned aerial systems (UAS) for various applications, including cargo delivery and surveillance, is further driving the demand for advanced surveillance technologies. Consequently, the surveillance systems segment is poised for robust growth, contributing significantly to the overall advancement of the avionics market.

Emerging Market for Unmanned Aerial Vehicles (UAVs) is Fastest Growing Segment

The market for unmanned aerial vehicles (UAVs), often referred to as drones, represents the fastest-growing segment within the avionics market. The proliferation of UAVs in various sectors, including military, commercial, and industrial applications, is driving unprecedented growth in this sub-segment. The versatility and cost-effectiveness of UAVs make them increasingly popular for tasks such as surveillance, cargo delivery, agriculture monitoring, and disaster response. The growing acceptance of UAVs in commercial airspace, coupled with advancements in autonomous technologies, is further fueling this growth.

Technological innovations, such as improved battery life, enhanced payload capacities, and advanced sensors, are transforming the capabilities of UAVs, making them more suitable for diverse applications. The integration of artificial intelligence (AI) and machine learning into UAV systems is enhancing their operational efficiency and decision-making capabilities. Moreover, regulatory frameworks are evolving to accommodate the integration of UAVs into national airspace systems, paving the way for broader adoption. As a result, the UAV market is anticipated to continue its rapid expansion, significantly influencing the overall dynamics of the avionics industry.

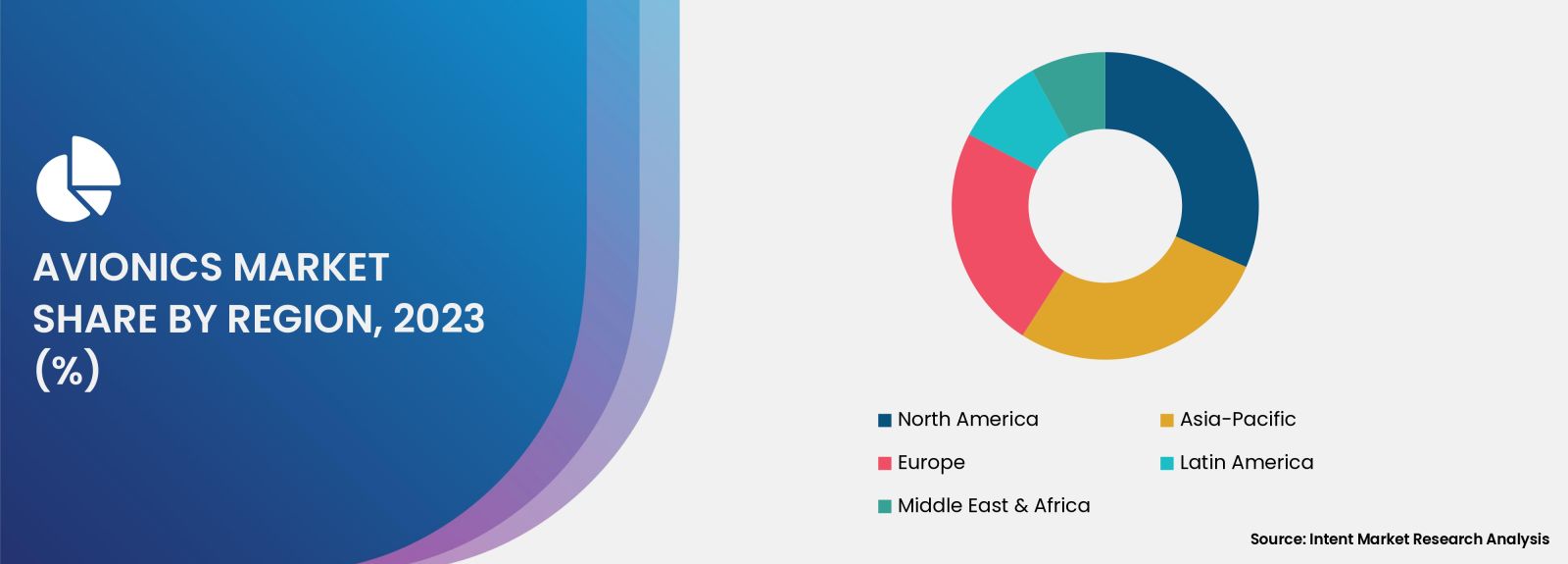

North America Region is Largest Owing to Established Aerospace Sector

The North America region stands out as the largest market for avionics, driven by the presence of a well-established aerospace sector and significant investments in aviation technologies. The United States, in particular, is home to major aircraft manufacturers, defense contractors, and aviation service providers, contributing to the region's dominance in the avionics market. The continuous advancements in avionics technologies, fueled by research and development initiatives, are enhancing the safety and efficiency of aviation operations across the region.

Moreover, the increasing demand for air travel and the modernization of aging aircraft fleets are driving the need for advanced avionics solutions in North America. The region's strong emphasis on regulatory compliance and safety standards further propels the adoption of cutting-edge avionics technologies. Additionally, the rise in military expenditures and defense contracts is fostering innovation and growth within the avionics market. With these factors at play, North America is expected to maintain its leading position in the avionics market throughout the forecast period.

Leading Companies and Competitive Landscape

The avionics market is characterized by a competitive landscape comprising several key players striving to gain a foothold in this dynamic industry. Prominent companies such as Honeywell International Inc., Rockwell Collins (now part of Collins Aerospace), Thales Group, and Garmin Ltd. are at the forefront, driving innovation and technological advancements in avionics systems. These companies are investing significantly in research and development to enhance their product offerings and stay ahead in the market.

The competitive landscape is marked by strategic collaborations, mergers and acquisitions, and partnerships aimed at expanding product portfolios and market reach. The emphasis on integrating advanced technologies, such as artificial intelligence, big data analytics, and the Internet of Things (IoT), is shaping the competitive dynamics of the market. As companies strive to meet the evolving needs of customers and adhere to stringent regulatory requirements, the avionics market is set for continued growth, driven by innovation and a commitment to enhancing aviation safety and efficiency

Report Objectives:

The report will help you answer some of the most critical questions in the Avionics Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Avionics Market?

- What is the size of the Avionics Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 52.1 billion |

|

Forecasted Value (2030) |

USD 88.2 billion |

|

CAGR (2024 – 2030) |

7.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Avionics Market By Component (Flight Control Systems, Navigation Systems, Communication Systems, Surveillance Systems, Monitoring Systems, Display Systems), By Platform (Commercial Aircraft, Military Aircraft, General Aviation, Unmanned Aerial Vehicles (UAV)), and By End User (OEM, Aftermarket) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Avionics Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Flight Control Systems |

|

4.1.1. Auto Pilot |

|

4.1.2. Fly-by-Wire Systems |

|

4.1.3. Flight Directors |

|

4.2. Navigation Systems |

|

4.2.1. Global Positioning Systems (GPS) |

|

4.2.2. Inertial Navigation Systems (INS) |

|

4.2.3. Radio Navigation Systems |

|

4.3. Communication Systems |

|

4.3.1. Airborne Radios |

|

4.3.2. SATCOM |

|

4.3.3. Data Links |

|

4.4. Surveillance Systems |

|

4.5. Monitoring Systems |

|

4.6. Display Systems |

|

4.7. Others |

|

5. Avionics Market, by Platform (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Commercial Aircraft |

|

5.1.1. Narrow-Body Aircraft |

|

5.1.2. Wide-Body Aircraft |

|

5.1.3. Regional Jets |

|

5.2. Military Aircraft |

|

5.2.1. Fighter Jets |

|

5.2.2. Transport Aircraft |

|

5.2.3. Surveillance & Reconnaissance Aircraft |

|

5.3. General Aviation |

|

5.3.1. Business Jets |

|

5.3.2. Light Aircraft |

|

5.3.3. Helicopters |

|

5.4. Unmanned Aerial Vehicles (UAV) |

|

6. Avionics Market, by End User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. OEM |

|

6.2. Aftermarket |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Avionics Market, by Component |

|

7.2.7. North America Avionics Market, by Platform |

|

7.2.8. North America Avionics Market, by End User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Avionics Market, by Component |

|

7.2.9.1.2. US Avionics Market, by Platform |

|

7.2.9.1.3. US Avionics Market, by End User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. BAE Systems |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Curtiss-Wright |

|

9.3. Elbit Systems |

|

9.4. Esterline Technologies |

|

9.5. Garmin |

|

9.6. General Electric |

|

9.7. Honeywell |

|

9.8. L3Harris |

|

9.9. Leonardo |

|

9.10. Mitsubishi |

|

9.11. Northrop Grumman |

|

9.12. RTX Corporation |

|

9.13. Saab |

|

9.14. Safran |

|

9.15. Thales |

|

10. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Avionics Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Avionics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Avionics ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Avionics Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats