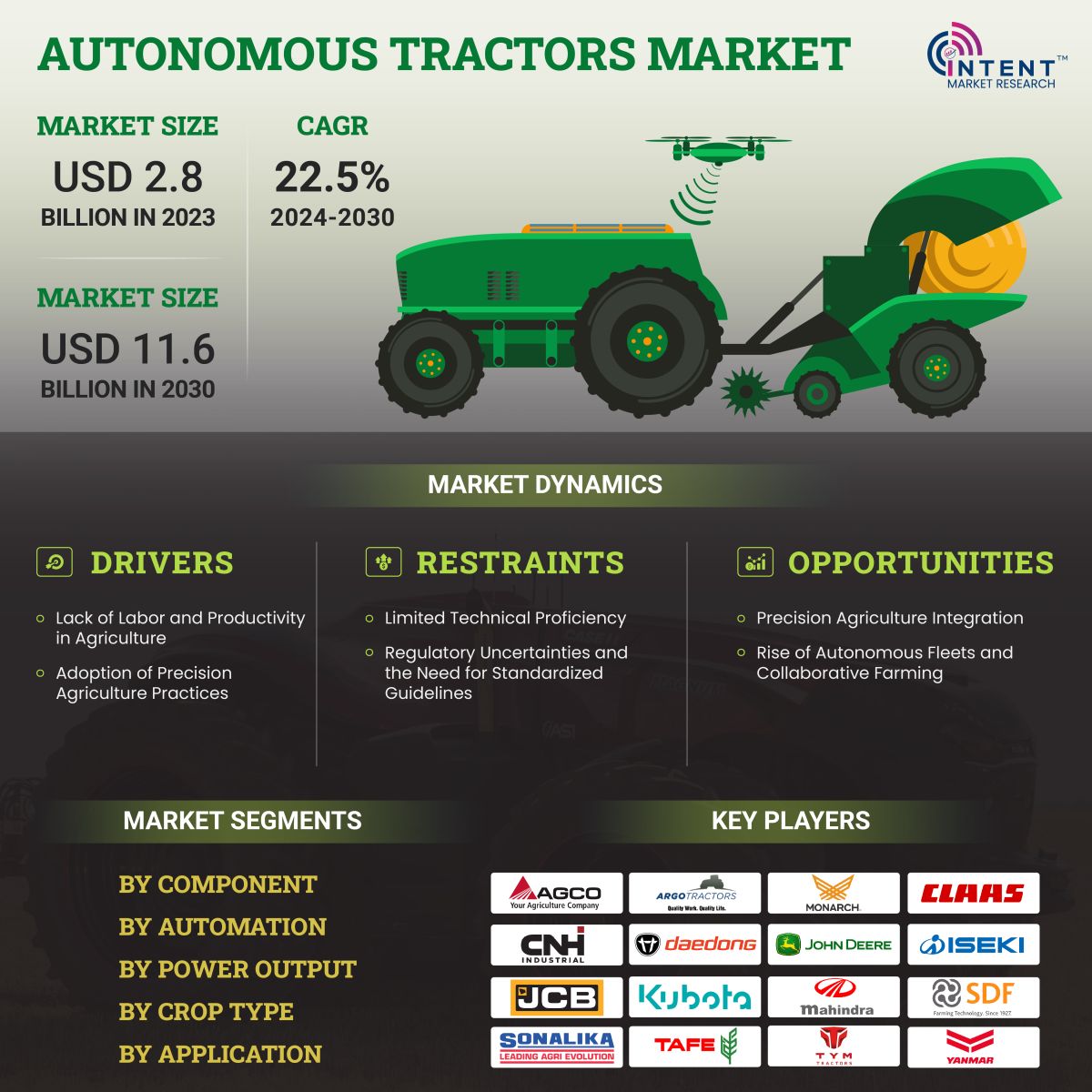

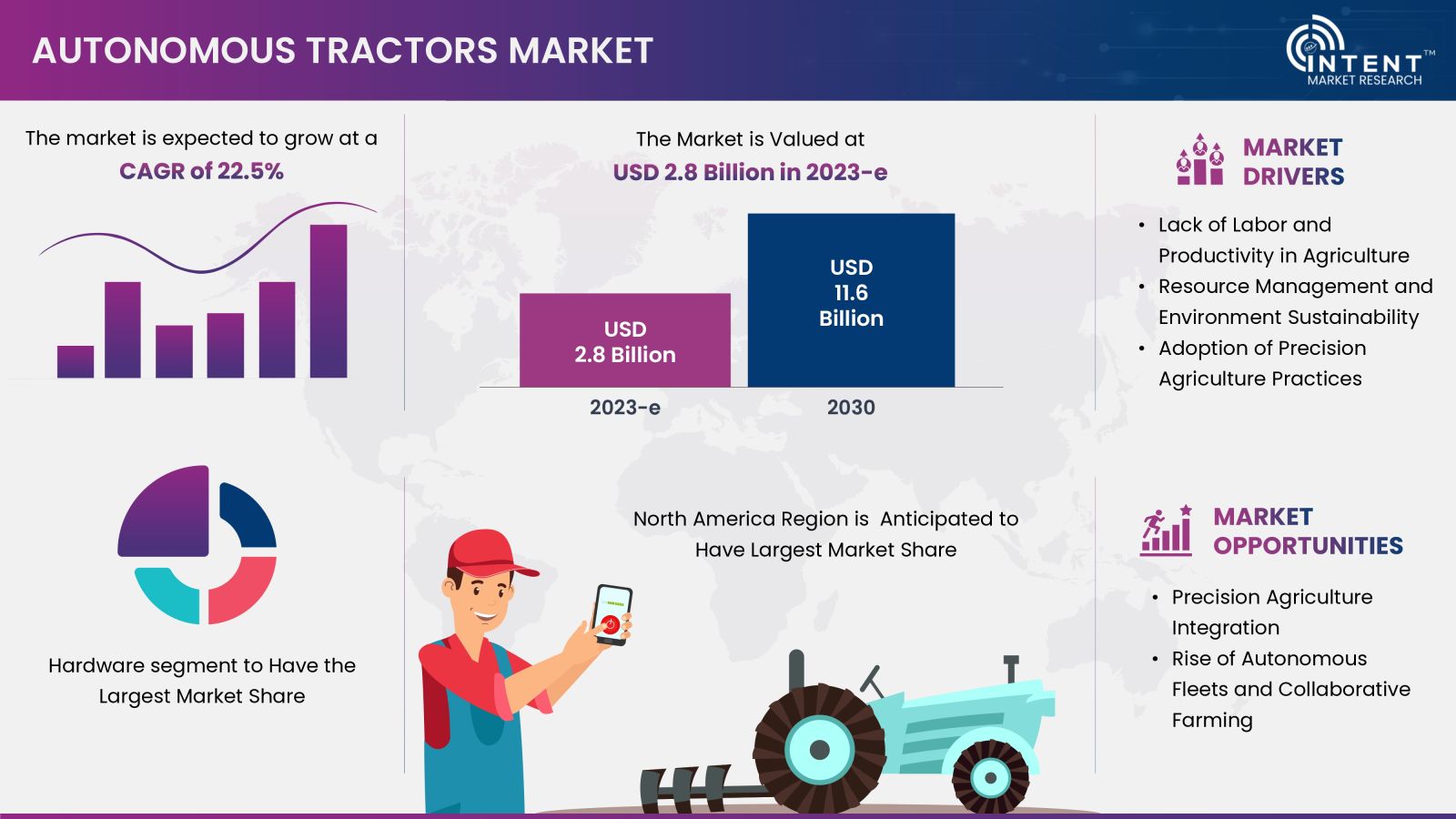

According to Intent Market Research, the Autonomous Tractors Market is expected to grow from USD 2.8 billion in 2023-e at a CAGR of 22.5% to touch USD 11.6 billion by 2030. Autonomous tractors is a competitive market, the prominent players in the global market include AGCO, Argo Tractors, Monarch Tractors, CLAAS, CNH, Daedong, Deere & Company, Iseki, JCB, Kubota, Mahindra, SDF, Sonalika, TAFE, TYM, and Yanmar. The advent of mechanization, technological advancements in the agriculture sector, and encouraging government initiatives are fueling the growth of autonomous tractors market.

Within the agricultural machinery industry, the autonomous tractors market is centered around cutting-edge technologies such as artificial intelligence, sensors, and GPS, which are defining a new and revolutionary field where tractors can operate on their own. Advanced sensor technologies, such as LiDAR and cameras, are gaining traction as a means of improving the accuracy of autonomous tractors.

Key Findings of the Autonomous Tractors Market Study

Lack of Labor and Productivity in Agriculture will Drive the Market

The lack of labour is posing problems for the agriculture sector, especially in areas where traditional farming methods necessitate a large amount of manual labour. An alternative is provided by autonomous tractors which lessen the need for manual labour by automating a variety of jobs such as planting, harvesting, and weeding. Autonomous tractors increase agricultural productivity by utilizing cutting-edge technologies such as GPS navigation and sensors. They can cultivate, harvest, and plant with precision, minimizing human error and maximizing resource use.

Limited Technical Proficiency among Farmers is Hindering the Use of Autonomous Tractors

The complicated technologies integrated into autonomous tractors may be difficult for farmers to comprehend and adjust to. Implementation of education, training and user-friendly interface initiatives can equip farmers with the skills they need to handle these cutting-edge agricultural technologies with greater confidence and competence. The problem of low technical proficiency must be addressed in order to increase the acceptance and practical application of autonomous tractors in the agricultural industry.

Autonomous Tractors Market is Anticipated to Witness Growth Primarily Driven by the Hardware Segment

Hardware innovations have significantly fueled the growth of the autonomous tractors market by elevating their capabilities, dependability, and safety. These technological advancements increased the attractiveness of autonomous tractors to farmers and agricultural businesses. Autonomous tractors are experiencing improved agricultural productivity, decreased downtime, and increased efficiency.

With the use of camera and vision technologies the tractor can monitor its environment in real time allowing it to detect obstacles, navigate through challenging terrain and make informed decisions. The adoption of autonomous tractors is anticipated to soar as the market realizes the revolutionary impact of camera/vision systems on agricultural practices driving the growth of the overall market.

Growing Use of Precision Agriculture Techniques and the Need for Efficiency is Driving the Demand for Fully-Autonomous Tractors

Growing adoption of precision agriculture techniques, and technological advancements in the farming industry to improve efficiency, the fully autonomous tractors market is expected to witness significant growth. In January 2023, Deere & Company created and later sold a fully autonomous tractor that was intended for large-scale farming. These tractors, equipped with advanced technologies, precisely execute tasks like planting and harvesting, optimizing resource utilization. As agriculture evolves towards more sustainable and tech-driven practices, the rise in demand for fully-autonomous tractors reflects a strategic shift to meet the contemporary challenges of modern farming.

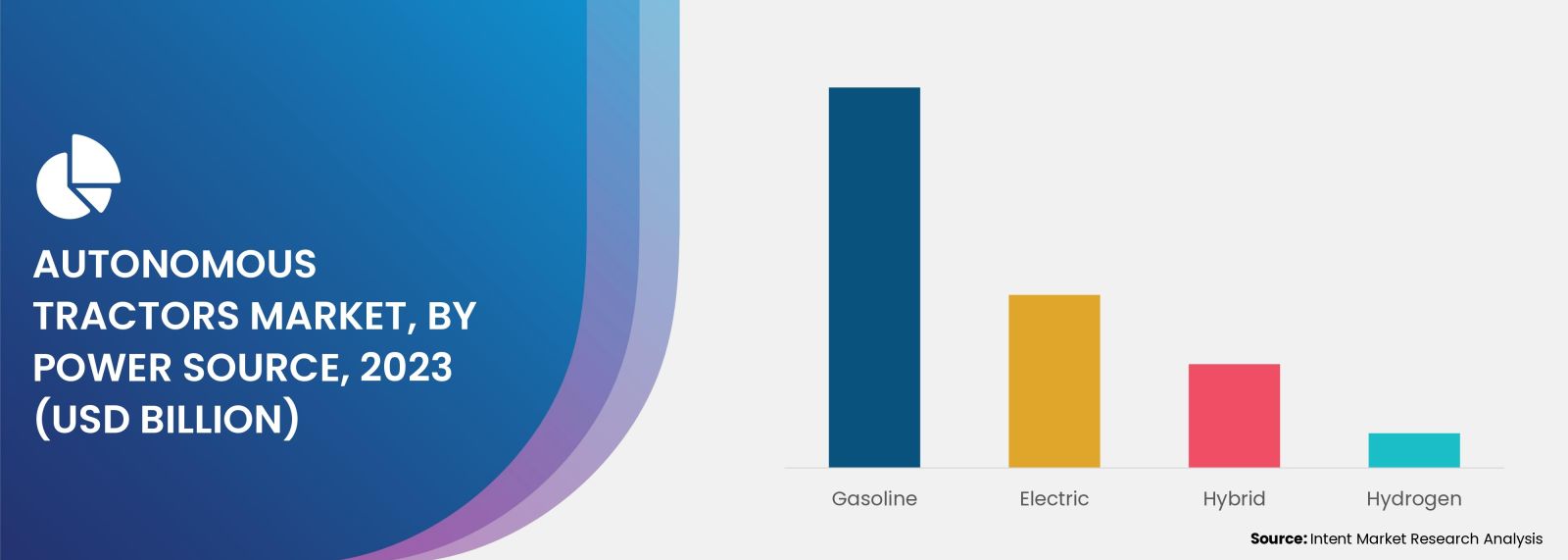

Gasoline-Powered Autonomous Tractors Offers Increased Mobility and Reduce Dependence on Traditional Fuels

Gasoline-powered autonomous tractors are contributing significantly to the growth of the autonomous tractors market. These tractors leverage gasoline engines, offering flexibility and cost-effectiveness compared to traditional diesel models. Gasoline-powered autonomous tractors are becoming catalysts for market growth due to their versatility and efficiency. These tractors offer increased mobility, allowing them to navigate diverse agricultural landscapes seamlessly. By reducing reliance on traditional fuels, they present a unique and sustainable solution, aligning with the evolving needs of modern farming practices.

The 31-100 HP Category Fuels Autonomous Tractors Market Growth, Delivering Versatile Power for Enhanced Agricultural Efficiency and Widespread Adoption

The 31–100 HP category held the largest market share in 2023 as many of the current autonomous tractor models are designed for smaller-scale farming operations and have power outputs falling within this range. This power range strikes a balance, catering to a broad spectrum of farming operations such as plowing, planting, harvesting, and hauling with versatile capabilities. From precision tasks to handling varied terrains, these tractors offer the efficiency needed for modern agriculture. Their adaptability is a key driver, spurring widespread adoption and transforming farming practices.

Fruits & Vegetables within the Crop Type Segment is Driving Market Growth

Fruits & vegetables consumption is rising quickly with the world population growth. In fruit and vegetable farming, the use of autonomous tractors promotes sustainable practices by enhancing precision and efficiency in various tasks. With the ability to be programmed to follow predetermined patterns, these vehicles can reduce soil compaction and prevent needless crop damage.

Farmers Gain Increased Flexibility in Managing Tillage Operations with Autonomous Tractors

The adoption of autonomous tractors in tillage processes is a key driver in the transformative growth of the agricultural machinery market. Tillage procedures are revolutionized by autonomous tractors equipped with cutting-edge technology such as GPS, sensors, and automated control systems. These tractors have a high degree of accuracy and consistency when performing tasks such as harrowing, seedbed preparation, and ploughing. With their accurate control autonomous tractors improve soil conditions, guarantee consistent seed placement, and increase crop yields.

North America is Poised for Significant Market Growth in the Forecast Period

The market for autonomous tractors in North America is large due to technological advancements and sophisticated farming methods. Encouraging policies and incentives from the government promote the use of autonomous tractors in North America and create an atmosphere that is conducive to agricultural technology advancements. Large-scale farming operations in North America make a compelling case for independent solutions, including autonomous machinery, data-driven analytics, and smart farming technologies.

Key players such as AGCO, Argo Tractors, Monarch Tractor, CLAAS, CNH, Daedong, Deere & Company, Iseki, JCB, Kubota, Mahindra, SDF, Sonalika, TAFE, TYM, and Yanmar. Major market players have started adopting strategies such as new product launches and innovation to improve their market share. For instance, in February 2023, four new compact tractor models were added to the lineup by Kubota Tractor Corporation. The LX3520 and LX4020 are the first two models in the new LX20 Series, which the company announced. Additionally, it is launching the L2502 and L4802 to further expand its well-liked L02 Series.

Autonomous Tractors Market Coverage

The report provides key insights into the autonomous tractors market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 2.8 billion |

|

Forecast Revenue (2030) |

USD 11.6 billion |

|

CAGR (2024-2030) |

22.5% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

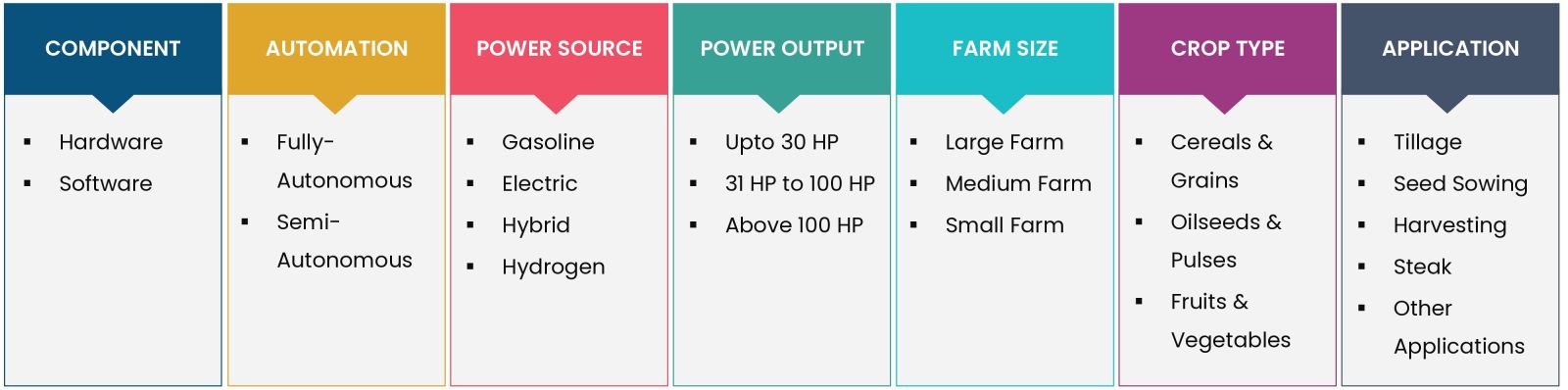

By Component (Hardware (Camera Vision Systems, Hand-held Devices, GPS Receivers, Sensors, Controllers, Actuators, Others), Software (Guidance Software, Monitoring and Control Software)), By Automation (Fully-Autonomous, Semi-Autonomous); By Power Source (Gasoline, Electric, Hybrid, Hydrogen); By Power Output (Up to 30 HP, 31 HP to 100 HP, Above 100 HP); By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses); By Application (Tillage, Seed-Sowing, Harvesting, Steak, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

AGCO, Argo Tractors, Monarch Tractors, CLAAS, CNH, Daedong, Deere & Company, Iseki, JCB, Kubota, Mahindra, SDF, Sonalika, TAFE, TYM and Yanmar. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Lack of Labor and Productivity in Agriculture |

|

4.1.2.Resource Management and Environmental Sustainability |

|

4.1.3.Adoption of Precision Agriculture Practices |

|

4.2.Market Growth Restraints |

|

4.2.1.Limited Technical Proficiency |

|

4.2.2.Regulatory Uncertainties and the Need for Standardized Guidelines |

|

4.3.Market Growth Opportunities |

|

4.3.1.Precision Agriculture Integration |

|

4.3.2.Rise of Autonomous Fleets and Collaborative Farming |

|

5.Market Outlook |

|

5.1.Supply Chain Analysis |

|

5.2.Technology Trends |

|

5.3.Patent Analysis |

|

5.4.PORTER’S Five Forces Analysis |

|

5.5.PESTLE Analysis |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Segment Synopsis |

|

6.2.By Component |

|

6.2.1.By Hardware |

|

6.2.1.1.Camera Vision Systems |

|

6.2.1.2.Hand-held Devices |

|

6.2.1.3.GPS Receivers |

|

6.2.1.4.Sensors |

|

6.2.1.5.Controllers |

|

6.2.1.6.Actuators |

|

6.2.2.By Software |

|

6.2.2.1.Guidance Software |

|

6.2.2.2.Monitoring and Control Software |

|

6.3.By Automation |

|

6.3.1.Fully-Autonomous |

|

6.3.2.Semi-Autonomous |

|

6.4.By Power Source |

|

6.4.1.Gasoline |

|

6.4.2.Electric |

|

6.4.3.Hybrid |

|

6.4.4.Hydrogen |

|

6.5.By Power Output |

|

6.5.1.Upto 30 HP |

|

6.5.2.31HP-100 HP |

|

6.5.3.Above 100 HP |

|

6.6.By Crop Type |

|

6.6.1.Cereals & Grains |

|

6.6.2.Fruits & Vegetables |

|

6.6.3.Oilseeds & Pulses |

|

6.7.By Application |

|

6.7.1.Tillage |

|

6.7.2.Seed-Sowing |

|

6.7.3.Harvesting |

|

6.7.4.Steak |

|

6.7.5.Others |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America Autonomous Tractors Market Outlook |

|

7.2.2.US |

|

7.2.2.1.US Autonomous Tractors Market, By Component |

|

7.2.2.2.US Autonomous Tractors Market, By Automation |

|

7.2.2.3.US Autonomous Tractors Market, By Power Source |

|

7.2.2.4.US Autonomous Tractors Market, By Power Output |

|

7.2.2.5.US Autonomous Tractors Market, By Crop Type |

|

7.2.2.6.US Autonomous Tractors Market, By Application |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3.Canada |

|

7.2.4.Mexico |

|

7.3.Europe |

|

7.3.1.Europe Autonomous Tractors Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Spain |

|

7.3.6.Italy |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific Autonomous Tractors Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Latin America |

|

7.5.1.Latin America Autonomous Tractors Market Outlook |

|

7.5.2.Brazil |

|

7.5.3.Argentina |

|

7.6.Middle East & Africa |

|

7.6.1.Middle East & Africa Autonomous Tractors Market Outlook |

|

7.6.2.Saudi Arabia |

|

7.6.3.UAE |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Company Strategy Analysis |

|

8.3.Competitive Matrix |

|

9.Company Profiles |

|

9.1.Autonomous Tractors Companies |

|

9.1.1.AGCO |

|

9.1.1.1. Company Synopsis |

|

9.1.1.2. Company Financials |

|

9.1.1.3. Product/Service Portfolio |

|

9.1.1.4. Recent Developments |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.1.2.Argo Tractors |

|

9.1.3.CLAAS |

|

9.1.4.CNH |

|

9.1.5.Daedong |

|

9.1.6.Deere & Company |

|

9.1.7.Iseki |

|

9.1.8.JCB |

|

9.1.9.Kubota |

|

9.1.10. Mahindra |

|

9.1.11. Monarch Tractors |

|

9.1.12. SDF |

|

9.1.13. Sonalika |

|

9.1.14. TAFE |

|

9.1.15. TYM |

|

9.1.16. Yanmar |

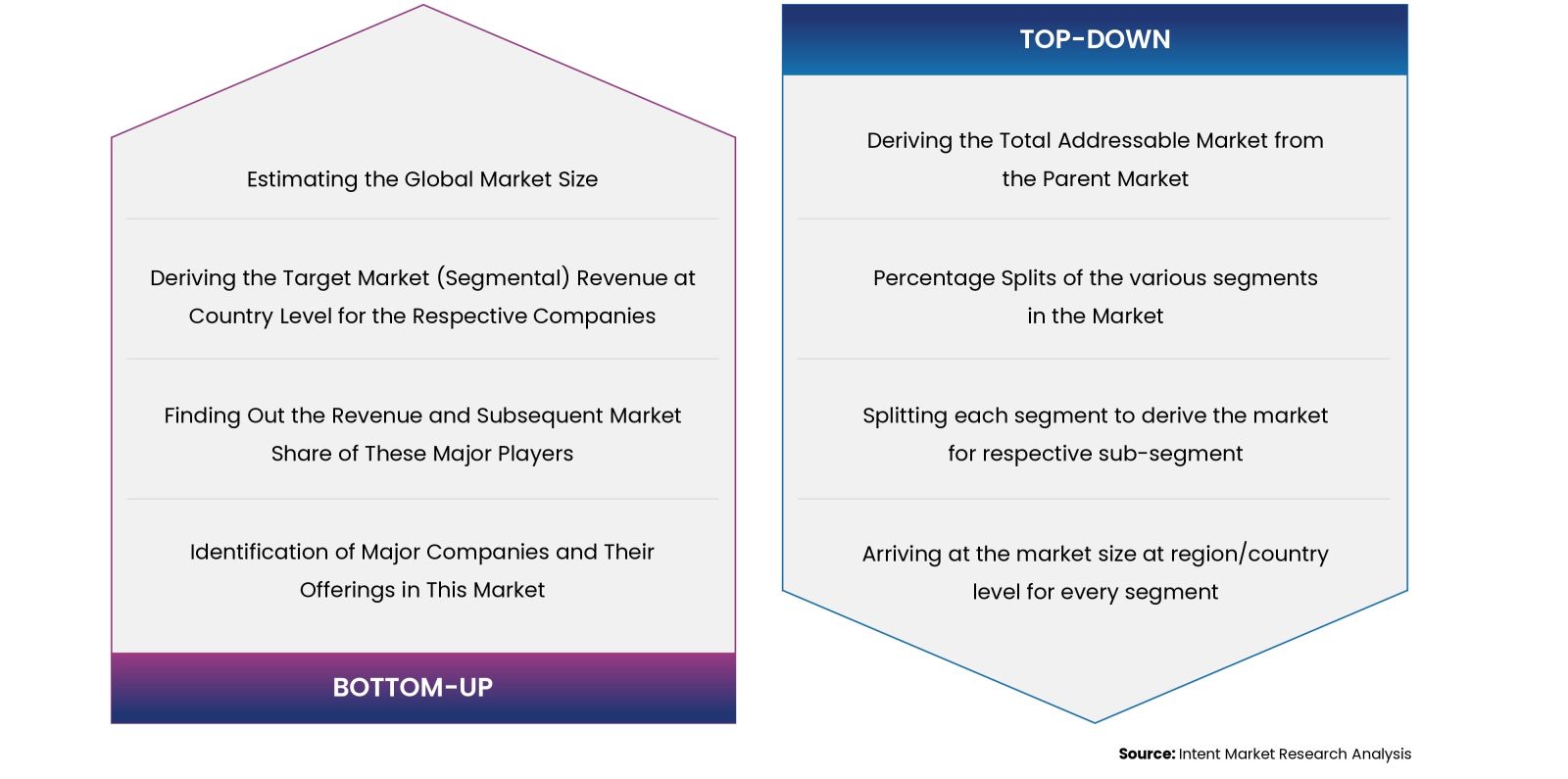

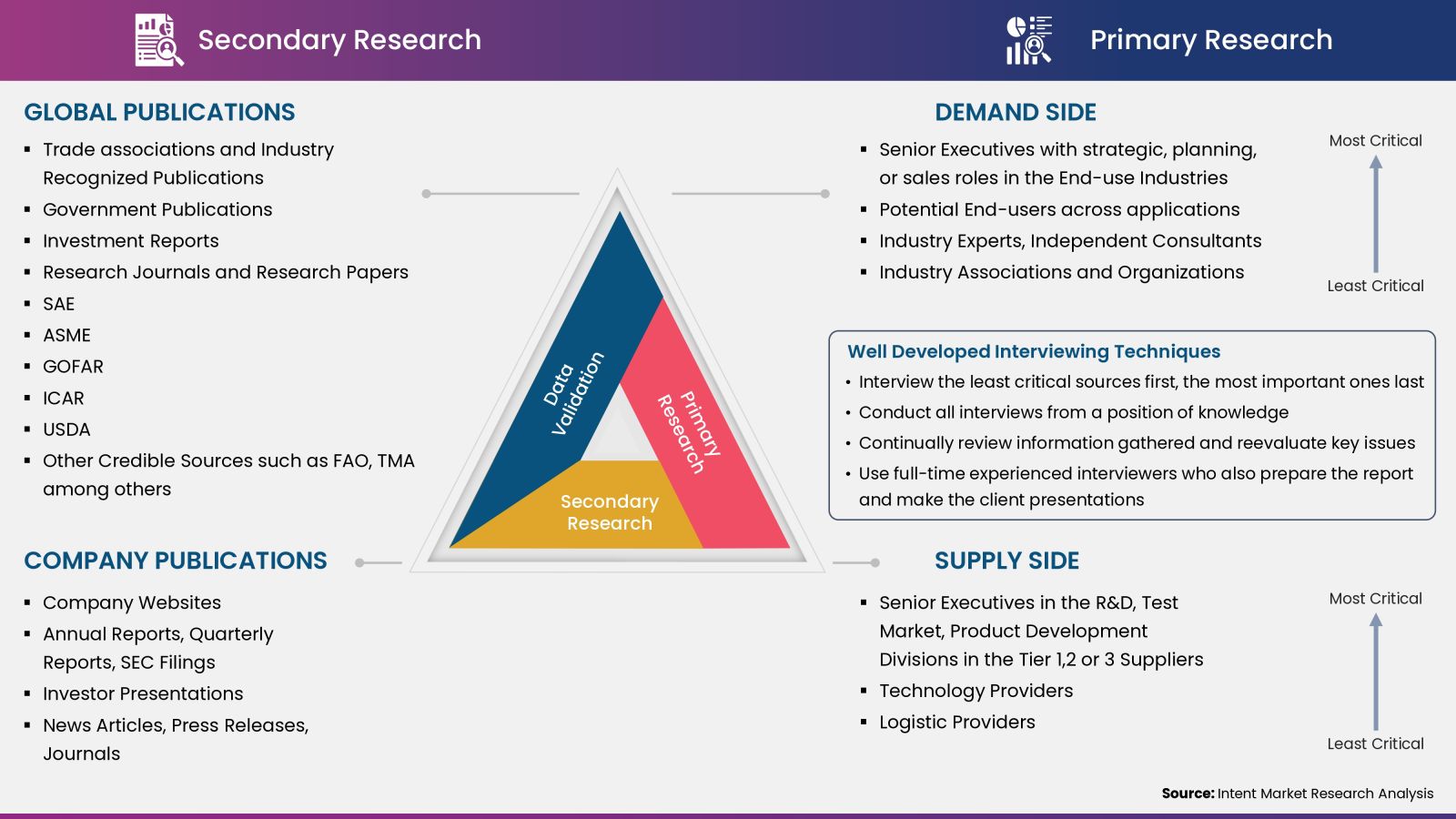

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.