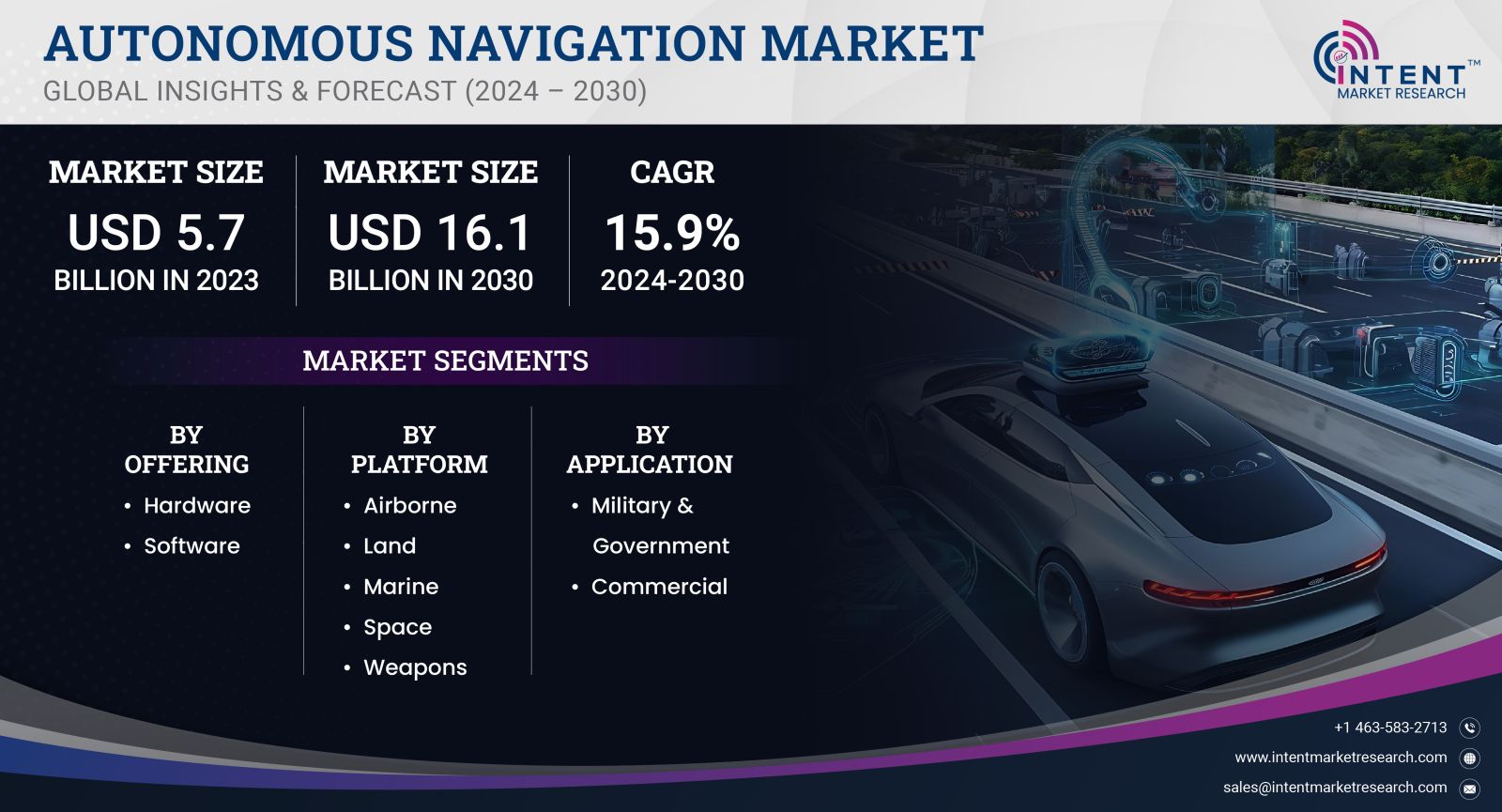

As per Intent Market Research, the Autonomous Navigation Market was valued at USD 5.7 billion in 2023-e and will surpass USD 16.1 billion by 2030; growing at a CAGR of 15.9% during 2024 - 2030.

The Autonomous Navigation Market is poised for significant growth as advancements in technology and increasing demand for automation across various industries drive its development. Autonomous navigation systems are designed to enable vehicles, drones, and robots to navigate without human intervention, utilizing a combination of sensors, artificial intelligence, and real-time data processing. This market encompasses various applications, including automotive, aerospace, marine, and industrial sectors, making it a multifaceted and dynamic industry. The rise in smart cities, coupled with the need for efficient logistics and supply chain management, is further propelling the adoption of autonomous navigation systems.

Automotive Segment is Largest Owing to Increasing Adoption of Autonomous Vehicles

The automotive segment of the Autonomous Navigation Market is the largest, primarily driven by the growing adoption of autonomous vehicles. As automotive manufacturers invest heavily in research and development, the implementation of autonomous driving features has become a competitive differentiator in the market. Key players are focusing on enhancing safety features, improving user experience, and reducing traffic congestion through advanced navigation systems.

The rise in consumer awareness regarding the benefits of autonomous vehicles, such as reduced travel time and increased safety, further fuels this growth. Additionally, regulatory support and initiatives promoting sustainable transportation solutions are encouraging manufacturers to integrate autonomous navigation technologies into their vehicles. As a result, the automotive segment is projected to maintain its dominance in the market, contributing significantly to the overall revenue growth of the Autonomous Navigation Market.

Aerospace Segment is Fastest Growing Owing to Innovations in Unmanned Aerial Vehicles

The aerospace segment is experiencing rapid growth, primarily due to innovations in unmanned aerial vehicles (UAVs). These technologies are revolutionizing the aerospace industry by enabling autonomous flight capabilities for applications such as cargo delivery, surveillance, and aerial photography. The increasing demand for UAVs in both commercial and military operations is driving the adoption of autonomous navigation systems.

Factors contributing to this segment's growth include advancements in battery technology, increased investment in drone technology, and the growing need for efficient air traffic management. Furthermore, regulatory frameworks are evolving to accommodate the expanding use of drones, thus enhancing their viability in various applications. This combination of factors positions the aerospace segment as the fastest-growing sub-segment within the Autonomous Navigation Market, with significant potential for innovation and development in the coming years.

Marine Segment is Largest Owing to Demand for Autonomous Shipping Solutions

The marine segment of the Autonomous Navigation Market is the largest, driven by the rising demand for autonomous shipping solutions. As the shipping industry seeks to optimize operations and reduce costs, autonomous vessels equipped with advanced navigation systems are becoming increasingly prevalent. These systems enhance safety, efficiency, and sustainability in maritime operations, making them attractive to shipping companies.

The ongoing investments in autonomous shipping technology, coupled with the need to address labor shortages in the maritime sector, further accelerate the growth of this segment. Moreover, the implementation of autonomous navigation solutions aids in reducing human error and improving route optimization. Consequently, the marine segment is anticipated to continue its dominance within the Autonomous Navigation Market, fueled by the industry's focus on innovation and efficiency.

Industrial Segment is Fastest Growing Owing to Robotics Integration

The industrial segment is witnessing rapid growth, largely attributed to the integration of autonomous navigation systems in robotics. Industries such as manufacturing, warehousing, and logistics are increasingly adopting autonomous mobile robots (AMRs) for tasks like material handling, assembly, and inventory management. The need for increased operational efficiency and reduced labor costs is driving this trend, making autonomous navigation a key component of modern industrial processes.

As businesses continue to automate their operations, the demand for reliable and efficient autonomous navigation solutions is expected to surge. Furthermore, advancements in sensor technology and artificial intelligence are enhancing the capabilities of industrial robots, allowing them to navigate complex environments with precision. This growth trajectory positions the industrial segment as the fastest-growing sub-segment within the Autonomous Navigation Market, reflecting the shift toward automation in various industrial applications.

Leading Region is North America Owing to Technological Advancements and Investment

The North American region is the leading market for autonomous navigation technologies, driven by technological advancements and significant investment in research and development. The presence of major automotive manufacturers, technology companies, and defense contractors in the region fosters an ecosystem conducive to innovation in autonomous navigation solutions. Additionally, government initiatives supporting the development of smart transportation systems further enhance the growth prospects in this region.

The rapid adoption of autonomous vehicles, UAVs, and robotics in North America underscores the region's pivotal role in the Autonomous Navigation Market. Furthermore, the increasing focus on improving transportation safety, reducing congestion, and enhancing supply chain efficiency positions North America as a crucial player in the global market landscape. As technology continues to evolve, North America is expected to maintain its leadership in autonomous navigation, contributing significantly to market growth.

Competitive Landscape and Leading Companies

The Autonomous Navigation Market is characterized by a competitive landscape featuring several key players who are leading the charge in innovation and development. Companies such as Waymo, Tesla, Boeing, and Lockheed Martin are at the forefront of technological advancements in autonomous navigation systems. These companies invest heavily in research and development to enhance their offerings and maintain a competitive edge.

The market is also witnessing collaborations and partnerships among industry stakeholders, fostering innovation and accelerating the development of autonomous navigation technologies. The competitive landscape is further shaped by the entry of new players and startups focusing on niche applications within the autonomous navigation space. As the market continues to evolve, companies that prioritize technological innovation, customer-centric solutions, and strategic collaborations will likely emerge as leaders in the Autonomous Navigation Market.

Report Objectives:

The report will help you answer some of the most critical questions in the Autonomous Navigation Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the autonomous navigation market?

- What is the size of the autonomous navigation market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 5.7 billion |

|

Forecasted Value (2030) |

USD 16.1 billion |

|

CAGR (2024-2030) |

15.9% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Autonomous Navigation Market By Solution (Hardware, Software), By Platform (Space, Airborne (Autonomous Drones, Autonomous Aircraft), Marine, Land, Weapons), By Application (Commercial, Military & Government) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Autonomous Navigation Market, by Offering (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Hardware |

|

4.1.1.Sensing System |

|

4.1.1.1.INS |

|

4.1.1.2.GNSS |

|

4.1.1.3.Radar |

|

4.1.1.4.Lidar |

|

4.1.1.5.Ultra Sonic Systems |

|

4.1.1.6.Cameras |

|

4.1.1.7.Others |

|

4.1.2.Processing Unit |

|

4.2.Software |

|

5.Autonomous Navigation Market, by Platform (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Airborne |

|

5.1.1.Autonomous Drone |

|

5.1.2.Autonomous Aircraft |

|

5.2.Land |

|

5.2.1.Autonomous Trains |

|

5.2.2.Autonomous Vehicle |

|

5.2.3.Autonomous Industrial Robots |

|

5.3.Marine |

|

5.3.1.Autonomous Underwater Vehicles |

|

5.3.2.Autonomous Ships |

|

5.3.3.Autonomous Surface Vehicles |

|

5.4.Space |

|

5.5.Weapons |

|

5.5.1.Guided Ammunition |

|

5.5.2.Guided Rockets |

|

5.5.3.Tactical Missiles |

|

5.5.4.Loitering Munition |

|

5.5.5.Torpedoes |

|

6.Autonomous Navigation Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Military & Government |

|

6.2.Commercial |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Autonomous Navigation Market, by Offering |

|

7.2.7.North America Autonomous Navigation Market, by Platform |

|

7.2.8.North America Autonomous Navigation Market, by Application |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Autonomous Navigation Market, by Offering |

|

7.3.1.2.US Autonomous Navigation Market, by Platform |

|

7.3.1.3.US Autonomous Navigation Market, by Application |

|

7.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.Honeywell |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Thales Group |

|

9.3.Northrop Grumman |

|

9.4.General Dynamics |

|

9.5.Trimble |

|

9.6.ABB |

|

9.7.L3Harris Technologies |

|

9.8.Rolls-Royce |

|

9.9.Raytheon Technologies |

|

9.10.Safran |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Autonomous Navigation Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to measure the impact of them on the autonomous navigation Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the autonomous navigation ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the autonomous navigation market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA