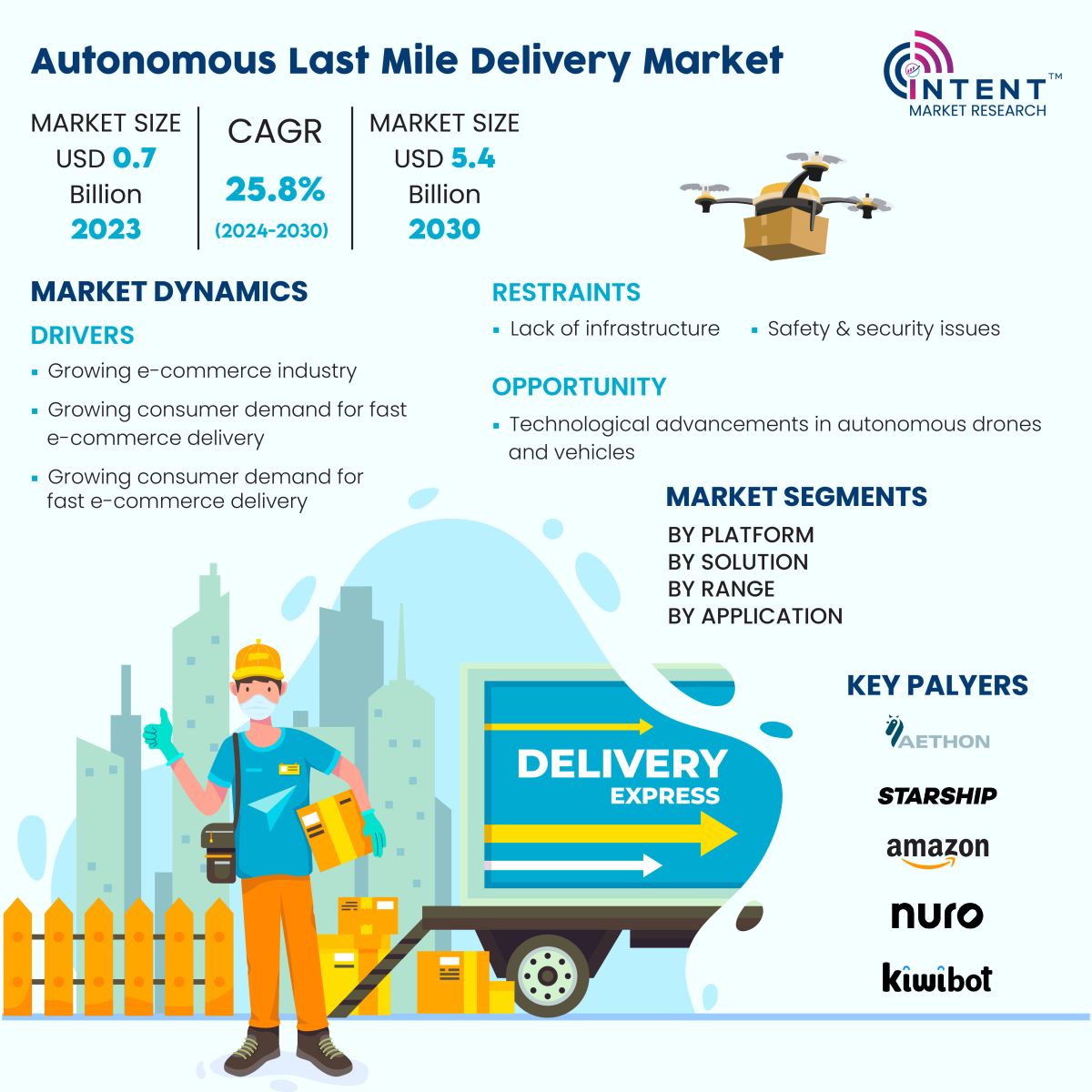

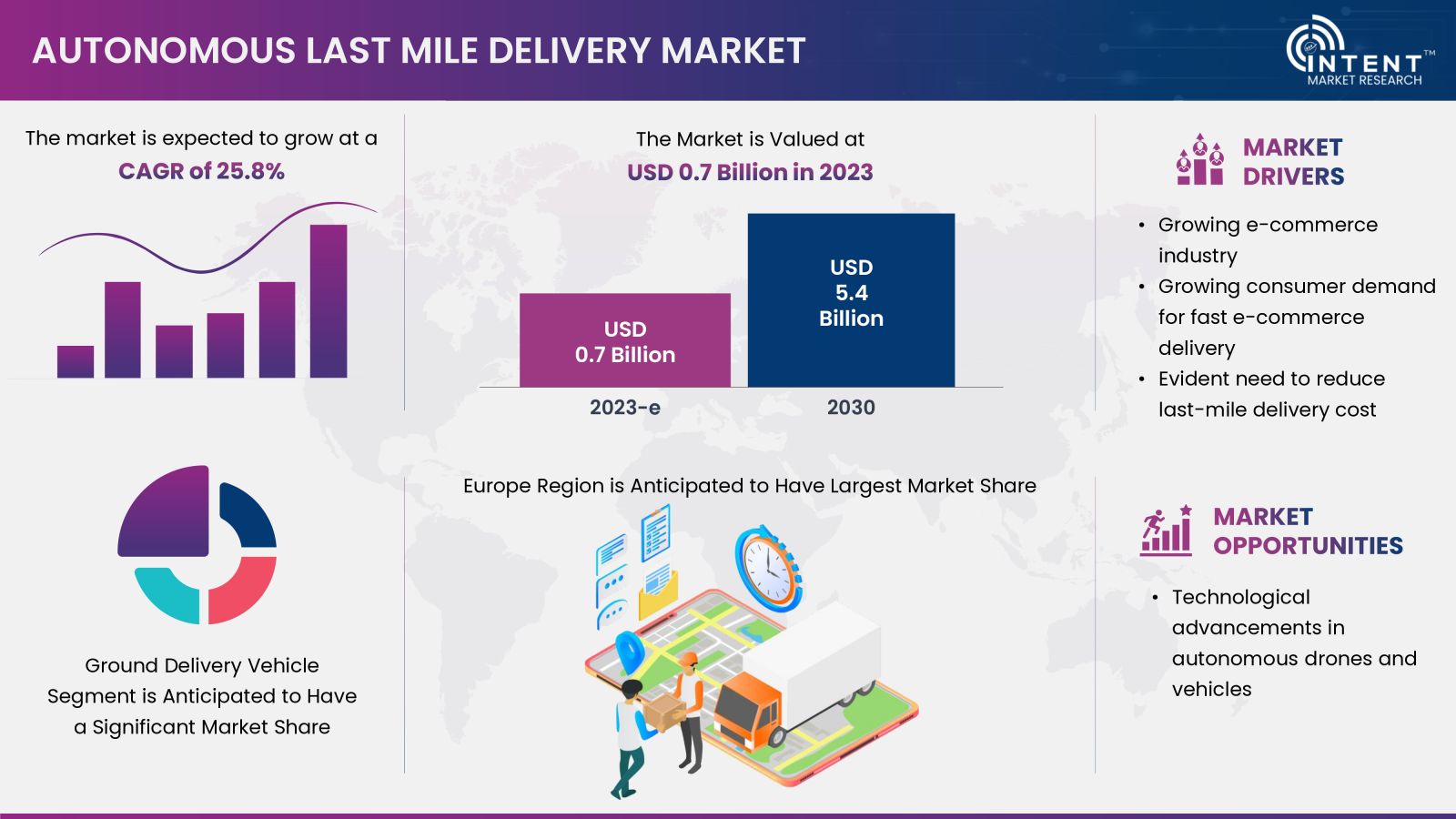

The Autonomous Last Mile Delivery Market is expected to grow from USD 0.7 billion in 2023-e to USD 5.4 billion by 2030, at a CAGR of 25.8% during the forecast period. The autonomous last-mile delivery market is a competitive market, the prominent players in the global market include Aethon, Alibaba, Amazon, KiwiBot, Matternet, Nuro, Pablo Air, Starship Technologies, Swoop Aero, Wing Aviation, Yiqing Innovation (Unity Drive Innovation), and Zipline. The growing e-commerce industry and rising consumer demand for fast e-commerce delivery are driving the market growth. Technological advancements in autonomous drones and vehicles are anticipated to provide significant growth opportunities for the autonomous last-mile delivery market.

Autonomous Last Mile Delivery Market Overview

Autonomous last-mile delivery denotes the final leg of the delivery process, during which a package travels from a transportation hub to its ultimate destination without any human involvement. Last-mile delivery services, although crucial, can be both expensive and intricate within retail logistics. They significantly influence the customer journey and overall consumer satisfaction. Key companies actively invest and partner to establish autonomous last-mile delivery technologies. Thus, there are significant growth opportunities in the autonomous last-mile delivery market.

Growing E-Commerce Industry is Driving the Market Growth

The growing adoption of 5G and smartphones has revolutionized the way consumers shop and e-commerce has emerged as a strong industry in the B2C as well as B2B landscape. An increasing number of businesses ranging from small businesses to multinational corporations, are utilizing e-commerce platforms to reach consumers worldwide. According to the US International Trade Administration, global B2C e-commerce revenue is expected to grow to USD 5.5 trillion by 2027 at a steady 14.4% CAGR. The leading sectors within the B2C e-commerce are consumer electronics, fashion, furniture, toys/hobby, health & pharmaceuticals, media & entertainment, beverages, and food. Thus, the growing e-commerce industry is driving the autonomous last-mile delivery market growth.

Segment Analysis

As Technology Continues to Evolve, There’s an Increasing Demand for Aerial Delivery Drones

Drone delivery services are revolutionizing the way goods are transported. As drone technology continues to evolve and regulations become more accommodating, aerial delivery drones are making deliveries more efficient, cost-effective, and environment-friendly. Several researches have shown that the last mile of package deliveries using drones uses less energy and creates fewer emissions than conventional means.

The logistics and transportation industry is among the industries that are actively adopting drones to enhance their last-mile delivery operations further. For instance, in October 2023, Amazon announced that it is anticipating to start drone delivery operations in Italy, the UK, and a 3rd location in the US by late 2024. Thus, aerial delivery drones are anticipated to grow at a significant rate.

Software Segment is Anticipated to be the Fastest Growing Segment Offering Improved Inspection & Monitoring in Autonomous Last Mile Delivery

There has been exponential growth in the commercial drone market in recent years owing to the rise in popularity and increasing applications. The ever-evolving automation is leading to a rise in adoption of the drones for commercial and industrial use. The software is used for inspection and monitoring of the drones. The drone companies are investing substantially in automation software recognizing the market's huge potential. For instance, in October 2023, Skyports Drone Services and RigiTech launched the Drone Delivery App in South Korea. Thus, the rising adoption of advanced analytics and growing investment in drone analytics solutions is driving the software segment.

Growing Acceptance Among the Public is Driving the Demand for Short Range (<20 km) automotive delivery vehicles

Most products and services in the autonomous last-mile delivery market are currently targeted towards short-range typically constrained to small city sectors, university campuses, and hospitals. A majority of autonomous delivery services are still in the testing phase and thereby constrained to short range. However, growing acceptance among the public and improving the technology of autonomous vehicles drive the demand for short-range autonomous last-mile delivery services.

Adoption of Food Delivery Bots is Driving the Demand from Food & Beverage Sector

The food delivery ecosystem has evolved tremendously with the introduction of user-friendly apps and tech-enabled driver networks. The use of autonomous food delivery bots is the next revolution happening in the food delivery ecosystem. The use of autonomous last-mile delivery vehicles in food & beverage is driven by increased efficiency, reduced cost, and 24/7 availability. There’s an increasing trend of adoption of food delivery bots in college campuses owing to the high acceptance of autonomous technologies among college students.

For instance, in February 2023, Grubhub and Starship Technologies introduced robot delivery via Starship’s fleet on the University of Notre Dame campus. In May 2023, Serve Robotics in partnership with Uber Eats announced the deployment of up to 2,000 more autonomous delivery robots and expansion to other cities across North America. Thus, the increasing trend of adoption of food delivery bots is driving the market growth.

Regional Analysis

North America Holds Largest Share in the Autonomous Last Mile Delivery Market

North America is among the early adopters of autonomous last-mile delivery services. The presence of key drone manufacturers as well as ground delivery vehicles is one of the core factors driving the market growth. The presence of key players such as Aethon, Amazon, Nuro, UPS Flight Forward, Wing Aviation, and Zipline, among others, in the region is driving the North America last-mile delivery market growth.

Moreover, increasing investments in the R&D, innovation, new product development as well as in mergers & acquisitions is driving the market growth. For instance, in March 2022, NVIDIA came into partnership with Serve Robotics, a sidewalk robot delivery company, and invested USD 10 million. Thus, the presence of key players in the region and increasing investments are driving market growth in the region.

Competitive Analysis

The Autonomous Last Mile Delivery Market is Highly Competitive with the Presence of Several Large, Medium & Small Players

Companies operating within the autonomous last-mile delivery market are primarily drone manufacturers and autonomous vehicle manufacturers, infrastructure developers, service providers, and software developers. The companies are expanding their product portfolios with the growing demand for delivery bots and drones. The autonomous last-mile delivery market is highly competitive with few big global players competing with an increasing number of startups entering the market. The key companies in the market are Aethon, Alibaba, Amazon, KiwiBot, Matternet, Nuro, Pablo Air, Starship Technologies, Swoop Aero, Wing Aviation, Yiqing Innovation (Unity Drive Innovation), and Zipline, among others.

Following are some key developments in the autonomous last-mile delivery market:

- In September 2023, Matternet received the US FAA Type Certification Amendment for its M2 drone delivery system.

- In January 2023, Starship Technologies and Grubhub launched food delivery robots at East Carolina University.

Autonomous Last Mile Delivery Market Coverage

The report provides key insights into the autonomous last-mile delivery market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players and the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 0.7 billion |

|

Forecast Revenue (2030) |

USD 5.4 billion |

|

CAGR (2024-2030) |

25.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Platform (Aerial Delivery Drones (Cargo Drones, Delivery Drones), Ground Delivery Vehicles (Delivery Bots, Self-Driving Vans, Trucks)), By Solution (Hardware, Software, Services, Infrastructure) Range (Short Range, Long Range) By Application (Logistics, Healthcare, Food & Beverage, Retail, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico), Middle East and Africa (Saudi Arabia, UAE, South Africa) |

|

Competitive Landscape |

Aethon, Alibaba, Amazon, KiwiBot, Matternet, Nuro, Pablo Air, Starship Technologies, Swoop Aero, Wing Aviation, Yiqing Innovation (Unity Drive Innovation), and Zipline |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Growing e-commerce industry |

|

4.1.2.Growing consumer demand for fast e-commerce delivery |

|

4.1.3.Evident needs to reduce last-mile delivery cost |

|

4.2.Market Growth Restraints |

|

4.2.1.Lack of infrastructure |

|

4.2.2.Safety & security issues |

|

4.3.Market Growth Opportunities |

|

4.3.1.Technological advancements in autonomous drones and vehicles |

|

4.4.Porter’s Five Forces |

|

4.5.PESTLE Analysis |

|

5.Market Outlook |

|

5.1.Supply Chain Analysis |

|

5.2.Regulatory Framework |

|

5.3.Technology Analysis |

|

5.4.Patent Analysis |

|

5.5.Venture Capital Investment Analysis |

|

6.Market Segment Outlook (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

6.1.Segment Synopsis |

|

6.2.By Platform |

|

6.2.1.Aerial Delivery Drone |

|

6.2.1.1.Cargo Drone |

|

6.2.1.2.Delivery Drone |

|

6.2.2.Ground Delivery Vehicle |

|

6.2.2.1.Delivery Bot |

|

6.2.2.2.Self-Driving Vans and Trucks |

|

6.3.By Solution |

|

6.3.1.Hardware |

|

6.3.2.Software |

|

6.3.3.Services |

|

6.3.4.Infrastructure |

|

6.4.By Range |

|

6.4.1.Short Range (<20 km) |

|

6.4.2.Long Range (>20 km) |

|

6.5.By Application |

|

6.5.1.Logistics |

|

6.5.2.Healthcare |

|

6.5.3.Food & Beverage |

|

6.5.4.Retail |

|

6.5.5.Others |

|

7.Regional Outlook (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America Autonomous Last Mile Delivery Market Outlook |

|

7.2.2.US |

|

7.2.2.1.US Autonomous Last Mile Delivery Market, By Platform |

|

7.2.2.1.1.US Autonomous Last Mile Delivery Market for Aerial Delivery Platform |

|

7.2.2.1.2.US Autonomous Last Mile Delivery Market for Ground Delivery Platform |

|

7.2.2.2.US Autonomous Last Mile Delivery Market, By Solution |

|

7.2.2.3.US Autonomous Last Mile Delivery Market, By Range |

|

7.2.2.4.US Autonomous Last Mile Delivery Market, By Application |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3.Canada |

|

7.3.Europe |

|

7.3.1.Europe Autonomous Last Mile Delivery Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Italy |

|

7.3.6.Spain |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific Autonomous Last Mile Delivery Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Middle East & Africa |

|

7.5.1.Middle East & Africa Autonomous Last Mile Delivery Market Outlook |

|

7.5.2.Saudi Arabia |

|

7.5.3.UAE |

|

7.5.4.South Africa |

|

7.6.Latin America |

|

7.6.1.Latin America Autonomous Last Mile Delivery Market Outlook |

|

7.6.2.Brazil |

|

7.6.3.Mexico |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Company Strategy Analysis |

|

8.3.Competitive Matrix |

|

9.Company Profiles |

|

9.1.Aethon |

|

9.1.1.Company Synopsis |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

*Note: All the companies in section 9.1 will cover the same sub-chapters as above. |

|

9.2.Alibaba |

|

9.3.Amazon |

|

9.4.KiwiBot |

|

9.5.Matternet |

|

9.6.Nuro |

|

9.7.PABLO AIR |

|

9.8.Starship Technologies |

|

9.9.Swoop Aero |

|

9.10. Wing Aviation |

|

9.11. Yiqing Innovation (Unity Drive Innovation) |

|

9.12. Zipline |

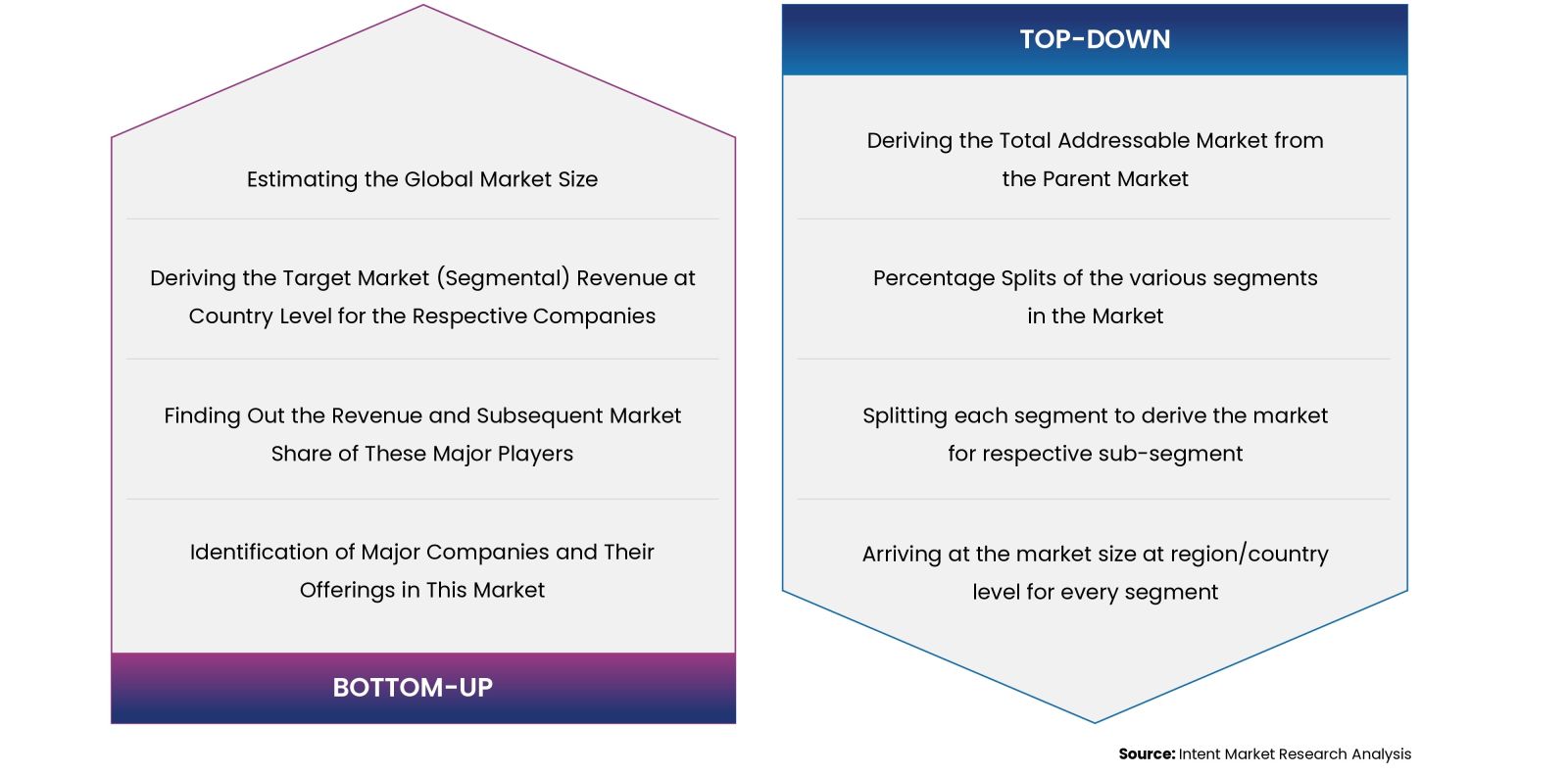

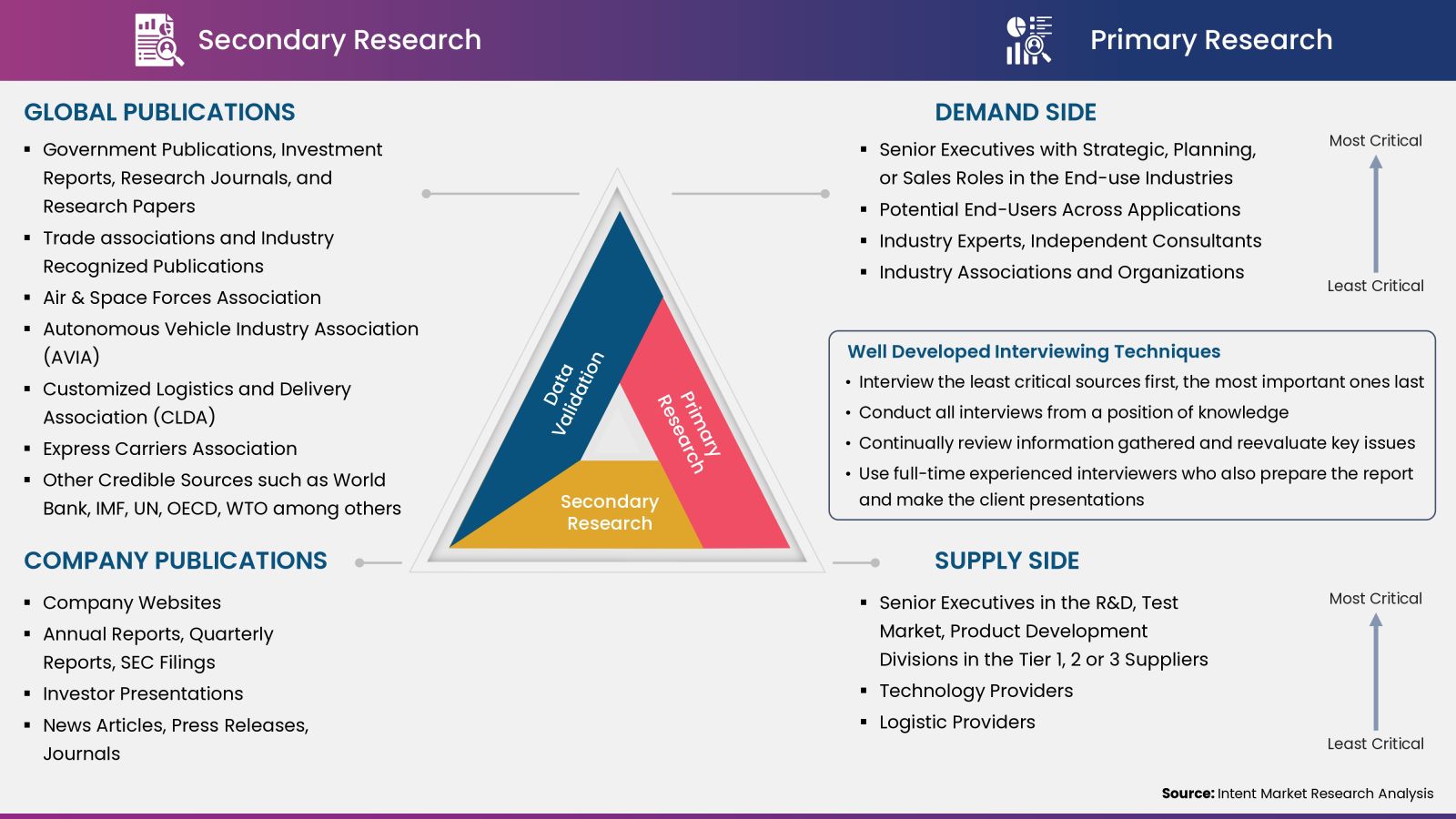

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.