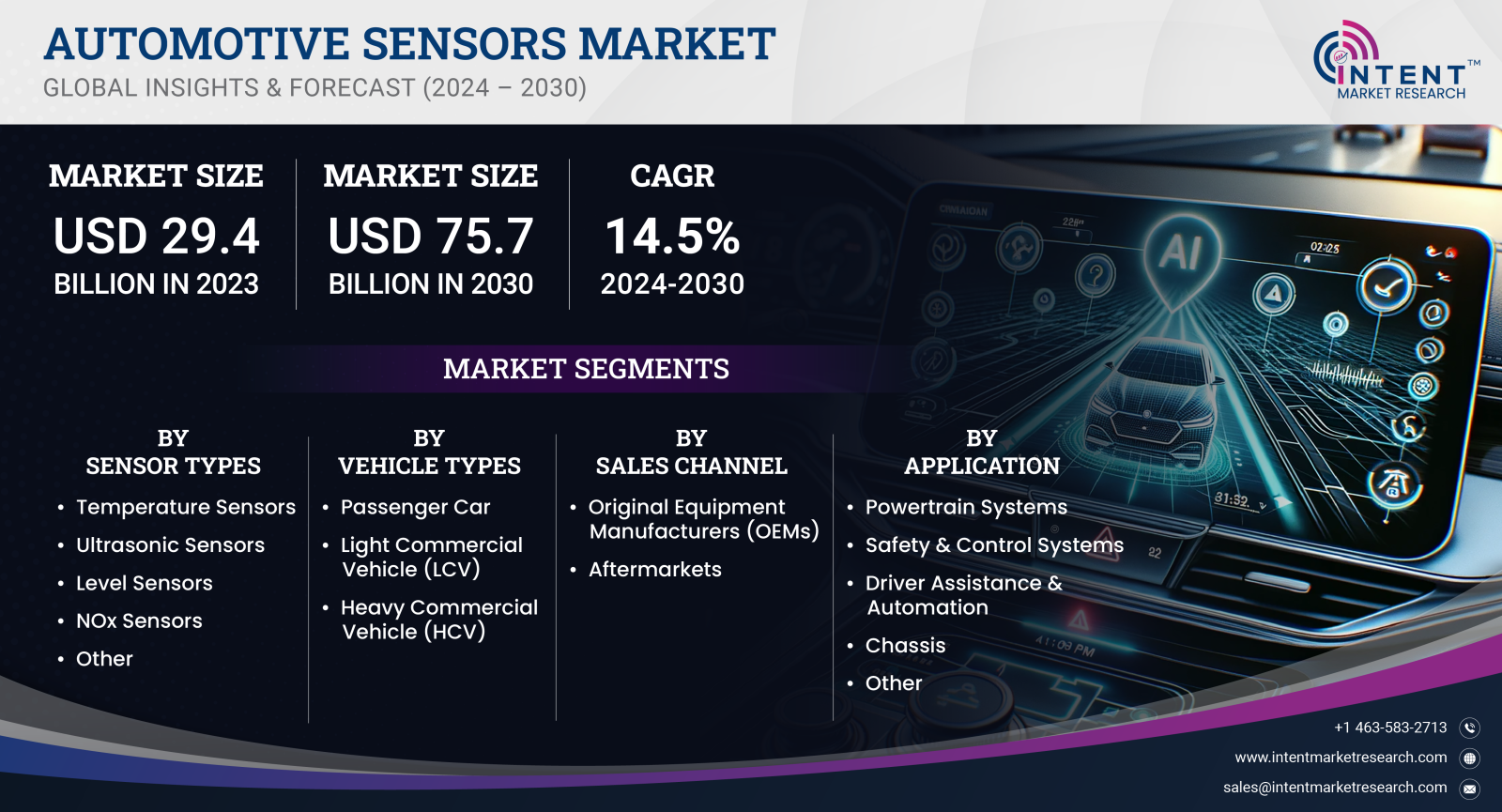

As per Intent Market Research, the Automotive Sensors Market was valued at USD 29.4 billion in 2023-e and will surpass USD 75.7 billion by 2030; growing at a CAGR of 14.5% during 2024 - 2030.

The automotive sensors market has gained significant momentum over the past decade, driven by the rapid evolution of vehicle technologies and the growing demand for safety, comfort, and fuel efficiency. Automotive sensors are vital components in modern vehicles, enabling advanced driver assistance systems (ADAS), autonomous driving, and enhanced performance monitoring. These sensors collect crucial data, which is used to optimize various vehicle functions such as engine performance, emissions control, and vehicle stability, contributing to the development of smarter and safer vehicles.

With the base year of 2024, the market is forecast to expand significantly, driven by stringent government regulations on emissions and safety, as well as the rising adoption of electric vehicles (EVs) and autonomous driving technologies.

Pressure Sensors Segment is Largest Owing to Regulatory Compliance

The pressure sensors segment holds the largest share in the automotive sensors market, largely due to the critical role these sensors play in ensuring regulatory compliance, particularly with regard to emissions and safety standards. Pressure sensors are widely used in engine control, tire pressure monitoring systems (TPMS), and fuel systems to optimize vehicle performance and reduce emissions. These sensors help maintain engine efficiency by monitoring and regulating air-fuel mixtures and exhaust gases, which is essential in meeting increasingly stringent emissions regulations worldwide.

Additionally, the growing demand for safer vehicles has spurred the integration of pressure sensors in braking systems and airbags, enhancing vehicle safety features. With governments enforcing more stringent safety and emissions standards, the need for pressure sensors will continue to rise, maintaining the segment’s dominant position in the automotive sensors market. This trend is especially prevalent in the production of electric and hybrid vehicles, where pressure sensors are essential for managing battery performance and thermal systems.

Radar Sensors Segment is Fastest Growing Owing to Autonomous Driving

The radar sensors segment is the fastest-growing in the automotive sensors market, driven by the rapid development of autonomous driving technologies and advanced driver assistance systems (ADAS). Radar sensors are critical components of ADAS, enabling functions such as adaptive cruise control, collision avoidance, and blind-spot detection. These sensors provide precise information about the distance, speed, and direction of objects around the vehicle, ensuring safe navigation in various driving environments.

As automakers push towards higher levels of vehicle autonomy, the demand for radar sensors is expected to grow exponentially. The increasing consumer preference for vehicles equipped with safety features like automatic emergency braking (AEB) and lane-keeping assist is further fueling the adoption of radar sensors. With autonomous vehicles projected to become a mainstream reality in the coming years, radar sensors are set to play an essential role in driving the future of mobility, making this segment the fastest growing in the automotive sensors market.

Temperature Sensors Segment is Largest Owing to Rising Demand for EVs

Temperature sensors account for a significant portion of the automotive sensors market, especially due to the rising demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs). These sensors monitor and regulate the temperature of critical vehicle components, including the engine, exhaust systems, and battery packs, ensuring optimal performance and preventing overheating. In EVs, temperature sensors play a crucial role in maintaining battery health and efficiency by monitoring thermal conditions within the battery management system (BMS).

Moreover, with the global shift towards electrification in the automotive sector, temperature sensors have become indispensable in ensuring vehicle safety and longevity. Automakers are increasingly incorporating temperature sensors to optimize energy consumption, enhance vehicle efficiency, and extend the lifecycle of vehicle components. As the electric vehicle market continues to expand, the temperature sensors segment is expected to maintain its prominence, particularly in EV production and battery management applications.

Proximity Sensors Segment is Fastest Growing Owing to Parking Assistance

The proximity sensors segment is emerging as the fastest-growing area within the automotive sensors market, primarily due to the rising adoption of parking assistance and obstacle detection technologies. These sensors detect the presence of nearby objects and help drivers navigate tight spaces, enhancing convenience and reducing the risk of collisions during parking. The growing demand for features like automated parking and rearview assistance in both luxury and mid-range vehicles is driving the rapid growth of this segment.

Furthermore, the integration of proximity sensors with ADAS functionalities, such as lane-change assistance and cross-traffic alert, is further accelerating their adoption. As urbanization leads to more congested roads and limited parking spaces, proximity sensors are becoming increasingly essential for ensuring driver convenience and safety. With automakers focusing on improving user experiences and vehicle safety, the proximity sensors segment is expected to witness substantial growth in the coming years.

Fastest Growing Region: Asia-Pacific

The Asia-Pacific region is expected to witness the fastest growth in the automotive sensors market, driven by the expanding automotive industry, rising disposable incomes, and increasing adoption of electric and autonomous vehicles. Countries like China, Japan, and South Korea are at the forefront of this growth, with China emerging as a global leader in electric vehicle production and sales. The region's growing automotive manufacturing base, coupled with government initiatives promoting the adoption of EVs and advanced safety systems, is contributing to the rapid expansion of the automotive sensors market.

In addition to government incentives and policies aimed at reducing carbon emissions, the increasing demand for vehicles equipped with advanced driver assistance systems (ADAS) is driving the demand for automotive sensors in the region. As automakers in the Asia-Pacific continue to invest in the development of smart and connected vehicles, the region is set to become a key player in the global automotive sensors market, further enhancing its growth prospects through the forecast period.

Competitive Landscape

The competitive landscape of the automotive sensors market is highly dynamic, with both established companies and new entrants vying for market share. The market is dominated by key players that have a strong presence in sensor technologies, including advancements in ADAS, autonomous driving, and electric vehicle applications. Leading companies are focusing on strategic partnerships, mergers, and acquisitions to expand their product portfolios and strengthen their market position.

Top 10 Companies in the Automotive Sensors Market:

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Infineon Technologies AG

- Delphi Technologies (BorgWarner)

- NXP Semiconductors

- Sensata Technologies

- Texas Instruments Incorporated

- Valeo S.A.

- ZF Friedrichshafen AG

These companies are leading the charge in developing advanced automotive sensors that cater to the growing demands for vehicle safety, efficiency, and automation. The competitive landscape is marked by continuous innovations, with market leaders focusing on enhancing sensor precision, reliability, and integration with emerging automotive technologies. Additionally, increased investments in research and development, particularly in areas such as artificial intelligence (AI) and machine learning for vehicle automation, are expected to further intensify competition in the market.

Report Objectives

The report will help you answer some of the most critical questions in the Automotive Sensors Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the automotive sensors market?

- What is the size of the automotive sensors market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Middle East, and Rest of the World?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 29.4 billion |

|

Forecasted Value (2030) |

USD 75.7 billion |

|

CAGR (2024-2030) |

14.5% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Automotive Sensors Market By Sales Channel (OEM, Aftermarket), By Sensors Type (Temperature, Pressure, Oxygen, Position, Speed, Inertial, Image, Level, Chemical Sensors), By Vehicle Type (Passenger Car, LCV, HCV), By Application (Powertrain, Driver Assistance & Automation, Exhaust Systems, Safety & Control Systems, Telematics Systems, Body Electronics) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2. Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3. Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4. Automotive Sensors Market, by Sensor Types (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Temperature Sensors |

|

4.2.Ultrasonic Sensors |

|

4.3.Level Sensors |

|

4.4.NOx Sensors |

|

4.5.Inertial Sensors |

|

4.6.Speed Sensors |

|

4.7.Position Sensors |

|

4.8.Current Sensors |

|

4.9.Oxygen Sensors |

|

4.10.Chemical Sensors |

|

4.11.Radar Sensors |

|

4.12.Pressure Sensors |

|

4.13.LiDAR Sensors |

|

4.14.Image Sensors |

|

4.15.Other Sensor Types |

|

5. Automotive Sensors Market, by Vehicle Types (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Passenger Car |

|

5.2.Light Commercial Vehicle (LCV) |

|

5.3.Heavy Commercial Vehicle (HCV) |

|

6. Automotive Sensors Market, by Sales Channel (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Original Equipment Manufacturers (OEMs) |

|

6.2.Aftermarkets |

|

7. Automotive Sensors Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Powertrain Systems |

|

7.2.Safety & Control Systems |

|

7.3.Driver Assistance & Automation |

|

7.4.Chassis |

|

7.5.Vehicle Body Electronics |

|

7.6.Telematics Systems |

|

7.7.Exhaust Systems |

|

7.8.Other Applications |

|

8. Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Regional Overview |

|

8.2.North America |

|

8.2.1.Regional Trends & Growth Drivers |

|

8.2.2.Barriers & Challenges |

|

8.2.3.Opportunities |

|

8.2.4.Factor Impact Analysis |

|

8.2.5.Technology Trends |

|

8.2.6.North America Automotive Sensors Market, by Sensor Types |

|

8.2.7.North America Automotive Sensors Market, by Vehicle Types |

|

8.2.8.North America Automotive Sensors Market, by Sales Channel |

|

8.2.9.North America Automotive Sensors Market, by Application |

|

*Similar Segmentation will be provided at each regional level |

|

8.3.By Country |

|

8.3.1.US |

|

8.3.1.1.US Automotive Sensors Market, by Sensor Types |

|

8.3.1.2.US Automotive Sensors Market, by Vehicle Types |

|

8.3.1.3.US Automotive Sensors Market, by Sales Channel |

|

8.3.1.4.US Automotive Sensors Market, by Application |

|

8.3.2.Canada |

|

*Similar Segmentation will be provided at each regional and country level |

|

8.4.Europe |

|

8.5.APAC |

|

8.6.Latin America |

|

8.7.Middle East & Africa |

|

9. Competitive Landscape |

|

9.1.Overview of the Key Players |

|

9.2.Competitive Ecosystem |

|

9.2.1.Platform Manufacturers |

|

9.2.2.Subsystem Manufacturers |

|

9.2.3.Service Providers |

|

9.2.4.Software Providers |

|

9.3.Company Share Analysis |

|

9.4.Company Benchmarking Matrix |

|

9.4.1.Strategic Overview |

|

9.4.2.Product Innovations |

|

9.5.Start-up Ecosystem |

|

9.6.Strategic Competitive Insights/ Customer Imperatives |

|

9.7.ESG Matrix/ Sustainability Matrix |

|

9.8.Manufacturing Network |

|

9.8.1.Locations |

|

9.8.2.Supply Chain and Logistics |

|

9.8.3.Product Flexibility/Customization |

|

9.8.4.Digital Transformation and Connectivity |

|

9.8.5.Environmental and Regulatory Compliance |

|

9.9.Technology Readiness Level Matrix |

|

9.10.Technology Maturity Curve |

|

9.11.Buying Criteria |

|

10.Company Profiles |

|

10.1.Robert Bosch |

|

10.1.1.Company Overview |

|

10.1.2.Company Financials |

|

10.1.3.Product/Service Portfolio |

|

10.1.4.Recent Developments |

|

10.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2.ON Semiconductor |

|

10.3.TE Connectivity |

|

10.4.Continental |

|

10.5.Infineon Technologies |

|

10.6.Omnivision |

|

10.7.Denso |

|

10.8.Panasonic |

|

10.9.Allegro Microsystems |

|

10.10.NXP Semiconductors |

|

11.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the automotive sensors market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the automotive sensors Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the automotive sensors ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the automotive sensors market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA