The automotive radar market is poised for significant growth in the coming years, driven by the increasing demand for advanced driver assistance systems (ADAS) and the growing emphasis on vehicle safety. Automotive radar systems are essential for a range of applications, including adaptive cruise control, collision avoidance, blind spot detection, and parking assistance. As the automotive industry embraces automation and connectivity, radar technology has emerged as a critical component in enhancing vehicle performance and safety.

As per Intent Market Research, the Automotive Radar Market was valued at USD 6.2 billion in 2023 and will surpass USD 35.9 billion by 2030; growing at a CAGR of 28.4% during 2024 - 2030.

Short-Range Radar Segment is Fastest Growing Owing to Increasing Demand for Parking Assistance

The short-range radar segment is experiencing rapid growth, driven by the rising demand for parking assistance systems in vehicles. As urbanization increases and the number of vehicles on the road rises, the need for efficient parking solutions has become paramount. Short-range radars, typically operating at frequencies of 24 GHz, provide precise distance measurement and object detection capabilities, making them ideal for applications like parking sensors and low-speed collision avoidance systems. This segment's growth is further fueled by advancements in radar technology, allowing for more compact and cost-effective solutions that can be easily integrated into vehicles.

In addition, regulatory pressures regarding vehicle safety are propelling the adoption of short-range radar systems. Governments worldwide are implementing stricter safety standards, necessitating the inclusion of advanced driver assistance features in new vehicles. As a result, automakers are increasingly incorporating short-range radar technologies into their models, enhancing consumer safety and positioning themselves competitively in the market. This trend is expected to drive the short-range radar segment's growth, contributing significantly to the overall expansion of the automotive radar market.

Long-Range Radar Segment is Largest Owing to Growing Adoption in ADAS Applications

The long-range radar segment remains the largest in the automotive radar market, primarily due to its essential role in advanced driver assistance systems (ADAS). Operating typically in the frequency range of 76-81 GHz, long-range radars are designed to detect objects at significant distances, making them vital for applications such as adaptive cruise control and forward collision warning systems. As the automotive industry shifts towards autonomous driving and semi-autonomous vehicles, the demand for reliable long-range radar systems is escalating.

Furthermore, the integration of long-range radar systems is becoming standard in high-end vehicles, driven by consumer demand for enhanced safety and automation features. Automakers recognize the importance of these systems in meeting safety regulations and improving the overall driving experience. As a result, the long-range radar segment is expected to maintain its dominance in the automotive radar market, contributing to a substantial portion of the total market share as the industry progresses toward more automated driving solutions.

Frequency Modulated Continuous Wave (FMCW) Radar Segment is Fastest Growing Owing to Advanced Signal Processing Capabilities

The frequency-modulated continuous wave (FMCW) radar segment is rapidly growing, driven by its advanced signal processing capabilities and enhanced detection performance. FMCW radar systems utilize frequency modulation to provide accurate distance measurements and speed detection, making them ideal for a range of automotive applications, including adaptive cruise control and collision avoidance systems. The technology's ability to differentiate between multiple objects in real-time gives it a significant edge over traditional radar systems, facilitating safer and more reliable vehicle operation.

Moreover, the increasing complexity of driving environments, characterized by the presence of multiple vehicles and obstacles, necessitates advanced radar solutions like FMCW. This segment's growth is further supported by ongoing research and development efforts aimed at improving radar technology's performance and reducing costs. As automakers seek to enhance the capabilities of their vehicles and comply with safety regulations, the FMCW radar segment is expected to gain considerable traction, contributing to the overall growth of the automotive radar market.

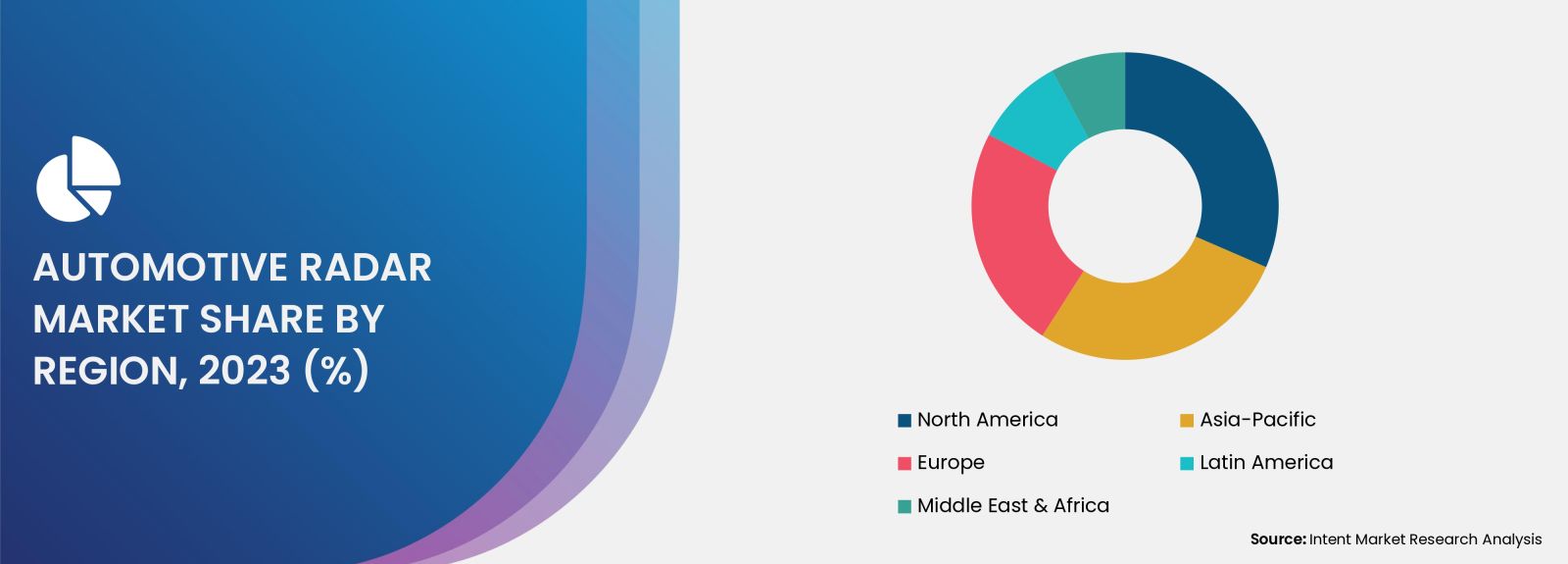

Automotive Radar Market in Asia Pacific Region is Fastest Growing Owing to Rising Production and Demand for Electric Vehicles

The Asia Pacific region is witnessing the fastest growth in the automotive radar market, driven by the increasing production and demand for electric vehicles (EVs) and advanced driver assistance systems (ADAS). Countries like China, Japan, and South Korea are at the forefront of EV production, with numerous manufacturers investing heavily in radar technologies to enhance vehicle safety and automation. The region's strong manufacturing capabilities, combined with government initiatives promoting EV adoption, create a conducive environment for the expansion of the automotive radar market.

Additionally, the growing awareness of road safety and the implementation of stringent safety regulations are propelling the demand for automotive radar systems in the Asia Pacific region. As consumers become more inclined toward vehicles equipped with advanced safety features, automakers are compelled to integrate radar technologies into their models. This trend is expected to result in substantial growth for the automotive radar market in the Asia Pacific region, making it a key player in the global landscape.

Competitive Landscape and Leading Companies

The automotive radar market is characterized by intense competition, with several key players dominating the landscape. Leading companies include Bosch, Continental AG, Denso Corporation, NXP Semiconductors, and Velodyne Lidar, among others. These firms are actively involved in research and development activities to enhance their radar technologies and meet the evolving demands of the automotive industry.

The competitive landscape is also shaped by strategic partnerships, collaborations, and mergers and acquisitions aimed at strengthening product portfolios and expanding market reach. As the automotive sector continues to embrace automation and connectivity, companies that can innovate and deliver advanced radar solutions will be well-positioned to capture significant market share. The focus on developing cost-effective, compact, and reliable radar systems will remain crucial as the industry evolves, ensuring that leading players stay competitive in the automotive radar market.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 6.2 billion |

|

Forecasted Value (2030) |

USD 35.9 billion |

|

CAGR (2024 – 2030) |

28.4% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Automotive Radar Market By Range (Short-Range Radar, Medium-Range Radar, Long-Range Radar), By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), By Frequency (24 GHz, 77 GHz), By Propulsion (ICE, Electric), By Application (Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS)) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Automotive Radar Market, by Range (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Short-Range Radar |

|

4.2. Medium-Range Radar |

|

4.3. Long-Range Radar |

|

5. Automotive Radar Market, by Vehicle Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Passenger Car |

|

5.2. Light Commercial Vehicle |

|

5.3. Heavy Commercial Vehicle |

|

6. Automotive Radar Market, by Frequency (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. 24 GHz |

|

6.2. 77 GHz |

|

7. Automotive Radar Market, by Propulsion (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. ICE |

|

7.2. Electric |

|

8. Automotive Radar Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Adaptive Cruise Control (ACC) |

|

8.2. Autonomous Emergency Braking (AEB) |

|

8.3. Blind Spot Detection (BSD) |

|

8.4. Forward Collision Warning System (FCWS) |

|

8.5. Others |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Automotive Radar Market, by Range |

|

9.2.7. North America Automotive Radar Market, by Vehicle Type |

|

9.2.8. North America Automotive Radar Market, by Frequency |

|

9.2.9. North America Automotive Radar Market, by Propulsion |

|

9.2.10. North America Automotive Radar Market, by Application |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Automotive Radar Market, by Range |

|

9.2.11.1.2. US Automotive Radar Market, by Vehicle Type |

|

9.2.11.1.3. US Automotive Radar Market, by Frequency |

|

9.2.11.1.4. US Automotive Radar Market, by Propulsion |

|

9.2.11.1.5. US Automotive Radar Market, by Application |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Aptiv |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Autoliv ASP Inc. |

|

11.3. Continental AG |

|

11.4. Denso Corporation |

|

11.5. NXP Semiconductors |

|

11.6. Robert Bosch GmbH |

|

11.7. Texas Instruments Incorporated |

|

11.8. Valeo |

|

11.9. Veoneer US Safety Systems, LLC. |

|

11.10. ZF Friedrichshafen AG |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Automotive Radar Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Automotive Radar Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Automotive Radar ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Automotive Radar Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA