As per Intent Market Research, the Automotive Oil Recycling Market was valued at USD 44.4 billion in 2023 and will surpass USD 66.2 billion by 2030; growing at a CAGR of 5.9% during 2024 - 2030.

The automotive oil recycling market is poised for substantial growth as the need for sustainable and eco-friendly solutions in the automotive industry continues to rise. As vehicles use large amounts of oil and fluids throughout their lifecycle, the proper disposal and recycling of automotive oils is critical for both environmental protection and resource conservation. Recycled oils, including engine oils, transmission fluids, and hydraulic oils, offer a cost-effective alternative to virgin oils while also reducing environmental pollution. With increasing awareness of the benefits of recycling, coupled with government regulations pushing for greener practices, the automotive oil recycling market is experiencing significant demand across various segments.

In this report, we will explore the largest and fastest-growing sub-segments within the key segments of the automotive oil recycling market, highlighting trends in applications, oil types, recycling processes, end-user industries, and sales channels. The growing adoption of recycling technologies, the shift towards sustainable solutions, and the increasing global focus on waste management practices are driving these shifts. Below, we dive into the most important sub-segments within each category.

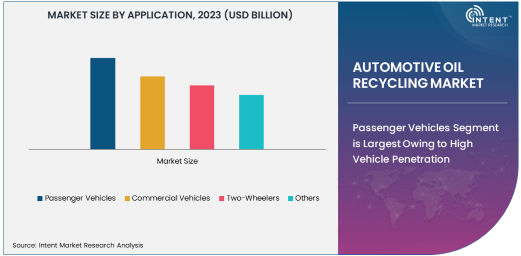

Passenger Vehicles Segment is Largest Owing to High Vehicle Penetration

The passenger vehicle segment holds the largest share in the automotive oil recycling market, largely driven by the vast number of passenger cars on the road globally. With millions of vehicles requiring regular oil changes, the demand for recycled engine oil, hydraulic fluid, and transmission fluid is continually rising. Passenger vehicles typically use the highest volume of oils, particularly engine oils, which contribute to the majority of oil recycling efforts. As consumer awareness of sustainability increases, car owners are becoming more conscious of the benefits of using recycled oils, further boosting the segment's growth.

This segment’s dominance is also a result of extensive infrastructure supporting recycling processes for passenger vehicles. The widespread availability of oil recycling centers and the ease of collecting used oil from vehicles make it highly efficient to recycle oils in this segment. OEMs and aftermarket service providers are actively promoting the use of re-refined engine oils and fluids in passenger vehicles, positioning this segment as the key driver in the automotive oil recycling market.

Engine Oil Segment is Largest Due to High Usage and Relevance

Engine oil holds the largest share within the oil type category in the automotive oil recycling market. It is the most commonly used automotive fluid, with vehicles requiring frequent oil changes. Given its widespread usage across passenger cars, commercial vehicles, and two-wheelers, engine oil accounts for the majority of recycled oils globally. Engine oils undergo high-temperature operation and degradation, leading to frequent disposal and recycling, creating a large volume of used oil that must be processed.

The large-scale consumption of engine oil, coupled with advancements in re-refining technologies, positions engine oil as the largest segment in the automotive oil recycling market. Recycled engine oil, often used in new automotive applications or industrial machinery, significantly reduces the reliance on virgin oil production, thus contributing to environmental sustainability. As more consumers and manufacturers turn towards eco-friendly alternatives, the engine oil segment will continue to dominate the recycling efforts in the automotive sector.

Re-refining Process is Fastest Growing Owing to Advanced Technologies

The re-refining process is the fastest-growing segment in the automotive oil recycling market, driven by advancements in purification and filtration technologies that restore used oils to a quality comparable to new oils. This process removes contaminants from used oils, such as metals, dirt, and moisture, to produce high-quality base oils. The re-refining process has become increasingly popular due to its environmental benefits, as it reduces the need for virgin oils and minimizes waste. Furthermore, the demand for high-performance oils in various automotive and industrial applications is fueling the expansion of re-refining operations.

The re-refining process not only ensures the safe recycling of oils but also provides an economically viable solution for consumers and businesses. As the automotive industry continues to focus on reducing waste and carbon footprints, the demand for re-refined oils is set to grow rapidly. This segment is expected to lead the market as technological innovations make the process more efficient and cost-effective, while also meeting the rigorous performance standards of automotive manufacturers.

Aftermarket Segment is Largest in End-User Industry Due to Increasing Consumer Awareness

The aftermarket segment is the largest in the automotive oil recycling market due to the increasing number of consumers opting for oil changes, fluid replacement, and maintenance services after the original warranty period of their vehicles ends. As vehicles age, their owners are more likely to use recycled oils and fluids, particularly in markets where environmental concerns and sustainability are prioritized. The aftermarket segment benefits from rising awareness about eco-friendly practices and the availability of recycled oils that offer similar performance to new oils at a lower cost.

Additionally, the growing number of independent repair shops and service centers that offer recycling services is contributing to the expansion of the aftermarket segment. These service providers not only offer used oil collection but also supply recycled oils, catering to the needs of both individual consumers and fleet operators. The aftermarket segment’s continuous growth reflects the broader shift towards sustainability in automotive maintenance.

Offline Sales Channel is Largest Due to Established Service Networks

Offline sales remain the largest channel in the automotive oil recycling market due to the established service infrastructure and direct customer interaction. Many consumers prefer to purchase recycled oils and fluids from local service centers, auto repair shops, and dealerships, where they can also receive installation or oil change services. These offline sales channels benefit from consumer trust, convenience, and the opportunity for professional advice on the right type of recycled oil for different vehicle models.

Additionally, offline sales are driven by the strong presence of automotive maintenance service networks and a wide distribution of oil recycling centers globally. Although online sales channels are growing, particularly for consumers seeking convenience, offline channels continue to dominate the market due to their long-standing presence in the automotive service industry.

Asia-Pacific is Fastest Growing Region in Automotive Oil Recycling Market

The Asia-Pacific region is the fastest-growing market for automotive oil recycling, driven by rapid industrialization, increasing vehicle ownership, and growing environmental awareness in countries such as China, India, and Japan. The region has seen a significant rise in the number of vehicles, leading to greater demand for oil recycling services. Additionally, strict environmental regulations in countries like Japan and China are encouraging the adoption of oil recycling technologies and practices, further boosting market growth.

The presence of a large automotive manufacturing base in Asia-Pacific also plays a crucial role in the growth of the recycling market. As vehicle production continues to expand and the automotive aftermarket grows, the demand for recycled oils in this region is expected to increase substantially, making it the fastest-growing region in the automotive oil recycling market.

Leading Companies and Competitive Landscape

The automotive oil recycling market is highly competitive, with several leading players shaping the industry. Companies such as Clean Harbors, Inc., Valvoline Inc., and ExxonMobil Corporation dominate the market by offering a wide range of re-refined oils and recycling solutions. These companies focus on product innovation and technological advancements, developing more efficient recycling processes and expanding their market presence across regions.

In addition to these large companies, smaller firms and regional players also contribute to the competitive landscape, especially in emerging markets. The market is characterized by strategic partnerships, acquisitions, and technology development aimed at improving the efficiency of the recycling process. As sustainability becomes an increasingly critical focus for the automotive sector, leading companies will continue to invest in environmentally friendly technologies to meet consumer demand and comply with stricter regulations. The competitive landscape will evolve with a greater emphasis on the adoption of eco-friendly solutions and the development of advanced recycling technologies

Recent Developments:

- Clean Harbors, Inc. announced the expansion of its oil recycling facilities in North America, increasing its capacity for re-refining used automotive oils to meet rising demand for sustainable automotive fluid solutions.

- Valvoline Inc. launched a new line of eco-friendly motor oils made from 100% re-refined oils, demonstrating its commitment to sustainable practices in automotive oil production and recycling.

- ExxonMobil Corporation recently secured regulatory approval for its new oil recycling technology aimed at enhancing the purification process, making it more efficient and reducing environmental impact.

- Shell Global Solutions acquired a leading waste oil recycling company to expand its presence in the automotive oil recycling market, focusing on advanced re-refining technologies for both engine and transmission fluids.

- Sinopec Limited partnered with an international technology firm to develop a new recycling process aimed at improving the quality of re-refined motor oils, reducing costs, and increasing the overall adoption of recycled oils in the automotive sector

List of Leading Companies:

- Clean Harbors, Inc.

- Valvoline Inc.

- Shell Global Solutions

- ExxonMobil Corporation

- Sinopec Limited

- Chevron Corporation

- Re-refined Oil Company, Inc.

- PetroChoice

- Safety-Kleen Systems, Inc.

- National Oilwell Varco, Inc.

- Dow Chemical Company

- Castrol Ltd.

- Quaker Chemical Corporation

- Royal Dutch Shell PLC

- BP Global

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 44.4 Billion |

|

Forecasted Value (2030) |

USD 66.2 Billion |

|

CAGR (2024 – 2030) |

5.9% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Automotive Oil Recycling Market By Application (Passenger Vehicles, Commercial Vehicles, Two-Wheelers), By Oil Type (Engine Oil, Transmission Fluid, Hydraulic Oil, Brake Fluid,), By Recycling Process (Re-refining, Reconditioning, Blending), By End-User Industry (OEMs, Aftermarket), By Sales Channel (Online Sales, Offline Sales) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Clean Harbors, Inc., Valvoline Inc., Shell Global Solutions, ExxonMobil Corporation, Sinopec Limited, Chevron Corporation, Re-refined Oil Company, Inc., PetroChoice, Safety-Kleen Systems, Inc., National Oilwell Varco, Inc., Dow Chemical Company, Castrol Ltd., Quaker Chemical Corporation, Royal Dutch Shell PLC, BP Global |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Automotive Oil Recycling Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Passenger Vehicles |

|

4.2. Commercial Vehicles |

|

4.3. Two-Wheelers |

|

4.4. Others |

|

5. Automotive Oil Recycling Market, by Oil Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Engine Oil |

|

5.2. Transmission Fluid |

|

5.3. Hydraulic Oil |

|

5.4. Brake Fluid |

|

5.5. Other Automotive Oils |

|

6. Automotive Oil Recycling Market, by Recycling Process (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Re-refining |

|

6.2. Reconditioning |

|

6.3. Blending |

|

6.4. Others |

|

7. Automotive Oil Recycling Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. OEMs (Original Equipment Manufacturers) |

|

7.2. Aftermarket |

|

8. Automotive Oil Recycling Market, by Sales Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Online Sales |

|

8.2. Offline Sales |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Automotive Oil Recycling Market, by Application |

|

9.2.7. North America Automotive Oil Recycling Market, by Oil Type |

|

9.2.8. North America Automotive Oil Recycling Market, by Recycling Process |

|

9.2.9. North America Automotive Oil Recycling Market, by End-User Industry |

|

9.2.10. North America Automotive Oil Recycling Market, by |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Automotive Oil Recycling Market, by Application |

|

9.2.11.1.2. US Automotive Oil Recycling Market, by Oil Type |

|

9.2.11.1.3. US Automotive Oil Recycling Market, by Recycling Process |

|

9.2.11.1.4. US Automotive Oil Recycling Market, by End-User Industry |

|

9.2.11.1.5. US Automotive Oil Recycling Market, by |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Clean Harbors, Inc. |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Valvoline Inc. |

|

11.3. Shell Global Solutions |

|

11.4. ExxonMobil Corporation |

|

11.5. Sinopec Limited |

|

11.6. Chevron Corporation |

|

11.7. Re-refined Oil Company, Inc. |

|

11.8. PetroChoice |

|

11.9. Safety-Kleen Systems, Inc. |

|

11.10. National Oilwell Varco, Inc. |

|

11.11. Dow Chemical Company |

|

11.12. Castrol Ltd. |

|

11.13. Quaker Chemical Corporation |

|

11.14. Royal Dutch Shell PLC |

|

11.15. BP Global |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Automotive Oil Recycling Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Automotive Oil Recycling Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Automotive Oil Recycling Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA