sales@intentmarketresearch.com

+1 463-583-2713

Automotive Lighting Market By Product Type (Exterior Lighting, Interior Lighting), By Technology (Halogen Lights, Xenon (HID) Lights, LED Lights), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Trucks, Buses, Two-Wheelers), By Distribution Channel (OEM, Aftermarket), and By Region; Global Insights & Forecast (2024 – 2030)

The Automotive Lighting Market is poised for significant growth between 2024 and 2030, driven by increasing demand for advanced lighting technologies and growing automotive production globally.

As per Intent Market Research, the Automotive Lighting Market was valued at USD 24.8 billion in 2023 and will surpass USD 36.3 billion by 2030; growing at a CAGR of 5.6% during 2024 - 2030. Automotive lighting is a critical component in modern vehicles, not only enhancing safety and visibility but also playing a vital role in aesthetics and energy efficiency. With the rise of electric vehicles (EVs) and autonomous driving technologies, the demand for innovative and intelligent lighting solutions is expected to accelerate further.

.jpg)

Exterior Lighting Segment is Largest Due to LED Adoption

The exterior lighting segment represents the largest portion of the automotive lighting market. Exterior lighting includes headlights, taillights, and indicators, crucial for vehicle visibility and safety. The demand for exterior lighting has surged, driven by the widespread adoption of LED technology. LEDs are becoming the preferred choice among manufacturers due to their energy efficiency, longer lifespan, and improved brightness compared to traditional halogen or HID (High-Intensity Discharge) lights.

One of the largest subsegments within the exterior lighting sector is the headlight segment, where the transition to LED and adaptive headlights is notable. Adaptive headlights enhance driving safety by automatically adjusting the direction and intensity of light based on vehicle speed, steering, and weather conditions. This technology is increasingly integrated into mid-range and high-end vehicles, boosting the segment's growth. As automakers focus on energy-efficient, smart lighting systems, the demand for LED and adaptive headlights is expected to dominate this segment over the forecast period.

Interior Lighting Segment is Fastest Growing Due to Customization Trends

The interior lighting segment, though smaller than exterior lighting, is experiencing rapid growth, making it the fastest-growing segment. The shift towards enhanced in-car experiences, especially in luxury and premium vehicles, is driving demand for advanced interior lighting systems. Modern automotive interiors are increasingly designed with ambient lighting, which not only enhances aesthetics but also provides comfort and personalization options for drivers and passengers.

The ambient lighting subsegment is witnessing the highest growth in the interior lighting market. Consumers now expect their vehicle's interior lighting to be adjustable and tailored to different moods and environments. Features such as multi-color lighting, light sequences synced with vehicle performance, and voice-activated controls are becoming common in newer models. This focus on personalization and comfort is particularly prevalent in EVs and luxury cars, further fueling the growth of the ambient lighting subsegment.

Light Source Segment is Dominated by LED Technology

The automotive lighting market is segmented based on light sources, including halogen, HID, and LED lights. Among these, the LED light source segment remains the dominant one due to its superior performance, energy efficiency, and versatility. LED technology has transformed automotive lighting, providing brighter illumination while consuming less power, an essential feature for modern vehicles, especially electric and hybrid models.

One of the primary drivers for the growth of the LED subsegment is the increasing application of LED lights in all areas of automotive lighting, from headlights and taillights to interior and ambient lighting systems. LED lights' ability to offer various color temperatures and their compatibility with intelligent lighting systems make them an attractive option for automakers. Additionally, regulatory bodies across the globe are promoting the use of LED technology for its reduced environmental impact, further solidifying its position as the largest light source segment in the market.

Passenger Vehicle Segment Leads Due to Safety and Aesthetic Enhancements

The automotive lighting market is segmented into passenger vehicles and commercial vehicles, with the passenger vehicle segment leading in market share. This dominance can be attributed to the increasing production of passenger cars and the rising consumer demand for advanced lighting systems that enhance safety, comfort, and aesthetics. Modern passenger vehicles are equipped with adaptive headlights, fog lamps, and LED taillights, reflecting a trend towards integrating intelligent lighting solutions.

The adaptive lighting systems subsegment within passenger vehicles is the largest, driven by the growing focus on safety regulations and technological advancements. Adaptive lighting enhances visibility in various driving conditions, making it particularly valuable for passenger vehicles that operate in diverse environments. Automakers are incorporating these systems into mid-range and luxury cars, ensuring their continued market expansion as the demand for safety and comfort features grows.

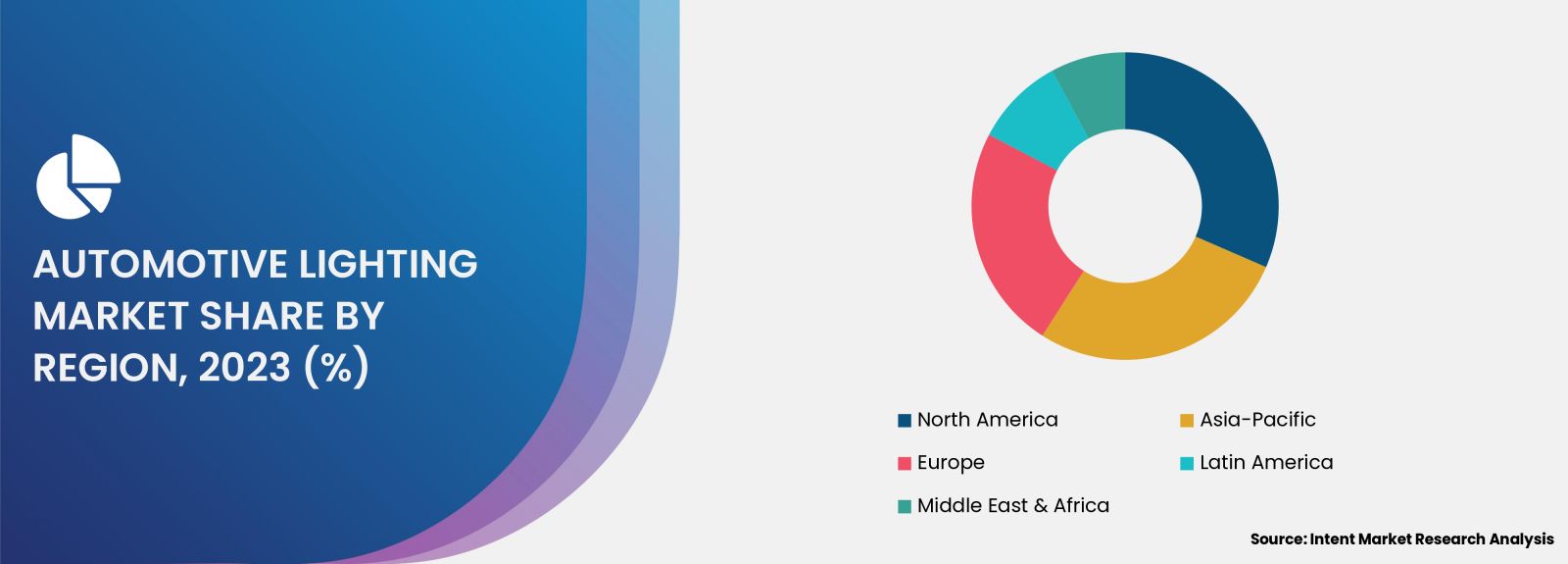

Asia-Pacific Region is the Fastest Growing Due to Rising Automotive Production

Geographically, the Asia-Pacific region is emerging as the fastest-growing market for automotive lighting, fueled by the rapid expansion of the automotive industry in countries such as China, India, and Japan. The region's automotive sector is witnessing substantial growth due to increasing vehicle production, rising disposable income levels, and favorable government policies supporting automotive manufacturing and innovation.

China, in particular, is a major player in the automotive lighting market, with a strong focus on developing advanced lighting systems for electric vehicles (EVs). The country’s push towards EV adoption and the presence of numerous automotive lighting manufacturers contribute to the segment's rapid growth. Similarly, India’s burgeoning automotive market and rising consumer preference for technologically advanced vehicles are expected to propel the Asia-Pacific region's growth rate throughout the forecast period.

Competitive Landscape Dominated by Innovation and Strategic Collaborations

The automotive lighting market is highly competitive, with leading companies such as Osram Continental, HELLA, Valeo, Koito Manufacturing Co., and Stanley Electric driving innovation and market expansion. These key players are continuously investing in R&D to develop advanced lighting technologies, such as matrix LED systems, laser lights, and adaptive driving beam (ADB) systems, to cater to evolving consumer demands and regulatory requirements.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 24.8 billion |

|

Forecasted Value (2030) |

USD 36.3 billion |

|

CAGR (2024 – 2030) |

5.6% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Automotive Lighting Market By Product Type (Exterior Lighting, Interior Lighting), By Technology (Halogen Lights, Xenon (HID) Lights, LED Lights), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Trucks, Buses, Two-Wheelers), and By Distribution Channel (OEM, Aftermarket) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Automotive Lighting Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Exterior Lighting |

|

4.1.1. Headlights |

|

4.1.2. Taillights |

|

4.1.3. Turn Signal Lights |

|

4.1.4. Daytime Running Lights (DRLs) |

|

4.1.5. Others |

|

4.2. Interior Lighting |

|

4.2.1. Ambient Lighting |

|

4.2.2. Dashboard Lighting |

|

4.2.3. Reading Lights |

|

4.2.4. Others |

|

5. Automotive Lighting Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Halogen Lights |

|

5.2. Xenon (HID) Lights |

|

5.3. LED Lights |

|

5.4. Others |

|

6. Automotive Lighting Market, by Vehicle Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Passenger Cars |

|

6.2. Light Commercial Vehicles |

|

6.3. Trucks |

|

6.4. Buses |

|

6.5. Two-Wheelers |

|

7. Automotive Lighting Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. OEM |

|

7.2. Aftermarket |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Automotive Lighting Market, by Product Type |

|

8.2.7. North America Automotive Lighting Market, by Technology |

|

8.2.8. North America Automotive Lighting Market, by Vehicle Type |

|

8.2.9. North America Automotive Lighting Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Automotive Lighting Market, by Product Type |

|

8.2.10.1.2. US Automotive Lighting Market, by Technology |

|

8.2.10.1.3. US Automotive Lighting Market, by Vehicle Type |

|

8.2.10.1.4. US Automotive Lighting Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Aisin Seiki |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Bosch |

|

10.3. General Electric |

|

10.4. Hella |

|

10.5. Infineon |

|

10.6. Koito Manufacturing |

|

10.7. Marelli |

|

10.8. Osram Licht |

|

10.9. Philips |

|

10.10. Stanley Electric |

|

10.11. Sylvania Lighting |

|

10.12. Valeo |

|

11. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Automotive Lighting Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Automotive Lighting Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Automotive Lighting ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Automotive Lighting Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats