As per Intent Market Research, the Automotive Lead Acid Battery Market was valued at USD 25.0 billion in 2023 and will surpass USD 36.9 billion by 2030; growing at a CAGR of 5.7% during 2024 - 2030.

The automotive lead acid battery market has seen continuous demand, driven by the need for reliable and efficient power storage solutions in vehicles. These batteries, primarily used for starting vehicles and powering electrical components, remain one of the most commonly utilized types due to their cost-effectiveness, reliability, and recycling potential. The market has been evolving with advancements in battery technology, meeting the growing demand in the automotive, commercial, and two-wheeler sectors. A transition towards eco-friendly, sustainable products and innovations in battery chemistry are shaping the future of this market.

The market is segmented based on application, type, technology, end-user, and sales channel. Among these segments, some sub-segments stand out due to their size or growth rate, reflecting key trends in the industry. Below, we explore the largest and fastest-growing sub-segments within each category, highlighting the evolving dynamics in the global automotive lead acid battery market.

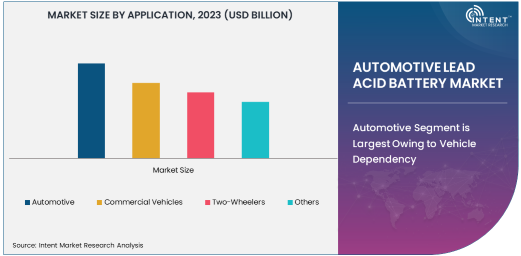

Automotive Segment is Largest Owing to Vehicle Dependency

The automotive segment is the largest in the global automotive lead acid battery market, primarily driven by the widespread use of these batteries in passenger cars, trucks, and SUVs. Lead acid batteries are extensively used in vehicles due to their affordability, longevity, and efficient energy storage capabilities. As global vehicle production continues to rise, especially in emerging markets, the demand for automotive batteries has surged.

Among the various vehicle categories, the light-duty vehicles (LDVs) segment is a major contributor to the automotive segment’s size. LDVs, which include sedans, SUVs, and compact cars, account for the largest share of lead acid battery usage. With the increasing production of vehicles, particularly in developing countries like China and India, the automotive lead acid battery market is poised to maintain its growth trajectory in the coming years.

VRLA Battery is Fastest Growing in Type Segment

The Valve Regulated Lead Acid (VRLA) battery is the fastest-growing sub-segment within the type category of automotive lead acid batteries. VRLA batteries, known for their sealed design and maintenance-free operation, offer superior performance compared to traditional flooded batteries. Their ability to withstand high discharge rates, combined with a longer lifespan and safety features, makes them particularly popular in modern automotive applications.

As vehicle manufacturers increasingly implement advanced power systems, the demand for VRLA batteries is expected to rise. Additionally, VRLA batteries are being used more frequently in the automotive sector's start-stop systems, further driving their growth. Their application in both traditional internal combustion engine (ICE) vehicles and electric vehicles (EVs) is fueling a robust expansion of VRLA battery adoption, positioning it as a key technology for the future of automotive energy storage.

Start-Stop Systems Technology is Fastest Growing in Technology Segment

Start-stop systems technology is the fastest-growing sub-segment in the automotive lead acid battery market. These systems, which automatically shut off and restart the engine when the vehicle is idling, are gaining popularity due to their ability to improve fuel efficiency and reduce emissions. This technology is increasingly becoming a standard feature in modern vehicles, driven by tightening regulations around fuel efficiency and carbon emissions.

The adoption of start-stop technology has led to higher demand for specialized lead acid batteries, particularly AGM and VRLA types, which are more suitable for the frequent charge-discharge cycles required by start-stop systems. With rising consumer awareness of environmental issues and automotive manufacturers' focus on sustainability, the start-stop system technology is expected to continue driving growth in the automotive lead acid battery sector.

OEMs End-User Segment is Largest Due to Vehicle Production

The OEM (Original Equipment Manufacturer) end-user segment is the largest in the automotive lead acid battery market. OEMs are responsible for the integration of lead acid batteries into newly manufactured vehicles, and they dominate the overall demand for these batteries. The growth of the OEM segment is closely tied to the increasing global production of vehicles, especially in emerging economies, where automotive sales are witnessing robust growth.

Additionally, OEMs prefer lead acid batteries for their cost-effectiveness and reliability, which makes them a primary choice for vehicle manufacturers. As automotive production continues to expand, the demand for lead acid batteries from OEMs is expected to remain strong, solidifying this segment’s dominance in the market.

Offline Sales Channel is Largest in the Market

The offline sales channel is the largest segment within the sales channel category for automotive lead acid batteries. Traditional brick-and-mortar retail stores, including auto parts shops and service centers, remain the most common place for consumers to purchase replacement batteries. The offline sales model benefits from established customer relationships, the ability to inspect products before purchase, and professional services for installation and battery maintenance.

Despite the increasing presence of online platforms, offline sales continue to dominate due to their immediate availability and the hands-on support provided by distributors. With many consumers preferring face-to-face interactions for such critical purchases, the offline channel remains integral to the automotive lead acid battery market, especially in markets with strong automotive repair and aftermarket sectors.

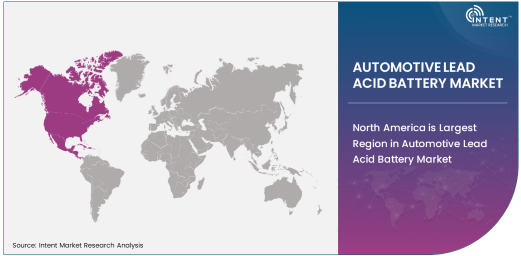

North America is Largest Region in Automotive Lead Acid Battery Market

North America is the largest region in the automotive lead acid battery market, driven by the high demand from the automotive industry in the U.S. and Canada. The region boasts a large fleet of vehicles, including light-duty cars, trucks, and commercial vehicles, all of which require lead acid batteries for both primary use and replacement. Additionally, North America is home to several prominent automotive manufacturers and a robust aftermarket sector that continues to drive battery sales.

In addition to a strong existing vehicle base, North America is witnessing growing adoption of start-stop technologies and hybrid vehicles, further boosting the demand for automotive lead acid batteries. With a well-established distribution network and significant investment in automotive manufacturing, North America is expected to maintain its position as the largest market for lead acid batteries.

Leading Companies and Competitive Landscape

The automotive lead acid battery market is highly competitive, with several key players dominating the global landscape. Companies like Exide Technologies, Johnson Controls (Clarios), and GS Yuasa are among the leading manufacturers, offering a range of high-quality batteries for automotive applications. These players focus on technological advancements, such as the development of VRLA and AGM batteries, to meet the evolving demands of the automotive industry.

In addition to these established players, there is increasing competition from emerging companies and regional manufacturers, particularly in Asia-Pacific, as the demand for automotive batteries grows. Market participants are also focusing on strategic partnerships, mergers, and acquisitions to enhance their product offerings, expand production capabilities, and strengthen their market positions. As the market continues to evolve, innovation in battery technology, sustainability efforts, and the adoption of new regulatory standards will shape the competitive landscape.

Recent Developments:

- Exide Technologies recently launched a new line of high-performance AGM lead-acid batteries designed for start-stop vehicle systems, offering improved durability and power efficiency.

- Johnson Controls (now part of Clarios) entered into a strategic partnership to enhance its battery production capabilities in Europe, focusing on sustainability and expanding its market share.

- East Penn Manufacturing announced a merger with a leading European battery distributor to strengthen its presence in the European automotive battery market.

- Saft Groupe S.A. received regulatory approval for the development of a new lead-acid battery manufacturing plant in the United States, aimed at reducing the supply chain for automotive battery producers.

- Amara Raja Batteries introduced a next-generation VRLA battery, incorporating advanced safety features and improved energy density, addressing increasing demand in electric vehicles

List of Leading Companies:

- Exide Technologies

- Johnson Controls International PLC

- GS Yuasa Corporation

- East Penn Manufacturing Company

- Stryten Energy

- Saft Groupe S.A.

- Camel Group Co. Ltd.

- Trojan Battery Company

- Panasonic Corporation

- Banner Batteries

- Luminous Power Technologies Pvt. Ltd.

- Amara Raja Batteries Ltd.

- Enersys Inc.

- FIAMM Energy Technology S.p.A

- Leoch International Technology Limited

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 25.0 Billion |

|

Forecasted Value (2030) |

USD 36.9 Billion |

|

CAGR (2024 – 2030) |

5.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Automotive Lead Acid Battery Market By Application (Automotive, Commercial Vehicles, Two-Wheelers), By Type (Flooded Lead Acid Battery, Valve Regulated Lead Acid Battery (VRLA), Gel Type Lead Acid Battery, Absorbent Glass Mat (AGM) Lead Acid Battery), By Technology (Start-Stop Systems, Non Start-Stop Systems), By End-User Industry (OEMs (Original Equipment Manufacturers), Aftermarket), By Sales Channel (Online Sales, Offline Sales) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Exide Technologies, Johnson Controls International PLC, GS Yuasa Corporation, East Penn Manufacturing Company, Stryten Energy, Saft Groupe S.A., Camel Group Co. Ltd., Trojan Battery Company, Panasonic Corporation, Banner Batteries, Luminous Power Technologies Pvt. Ltd., Amara Raja Batteries Ltd., Enersys Inc., FIAMM Energy Technology S.p.A, Leoch International Technology Limited |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Automotive Lead Acid Battery Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Automotive |

|

4.2. Commercial Vehicles |

|

4.3. Two-Wheelers |

|

4.4. Others |

|

5. Automotive Lead Acid Battery Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Flooded Lead Acid Battery |

|

5.2. Valve Regulated Lead Acid Battery (VRLA) |

|

5.3. Gel Type Lead Acid Battery |

|

5.4. Absorbent Glass Mat (AGM) Lead Acid Battery |

|

6. Automotive Lead Acid Battery Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Start-Stop Systems |

|

6.2. Non Start-Stop Systems |

|

7. Automotive Lead Acid Battery Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. OEMs (Original Equipment Manufacturers) |

|

7.2. Aftermarket |

|

8. Automotive Lead Acid Battery Market, by Sales Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Online Sales |

|

8.2. Offline Sales |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Automotive Lead Acid Battery Market, by Application |

|

9.2.7. North America Automotive Lead Acid Battery Market, by Type |

|

9.2.8. North America Automotive Lead Acid Battery Market, by Technology |

|

9.2.9. North America Automotive Lead Acid Battery Market, by End-User |

|

9.2.10. North America Automotive Lead Acid Battery Market, by Sales Channel |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Automotive Lead Acid Battery Market, by Application |

|

9.2.11.1.2. US Automotive Lead Acid Battery Market, by Type |

|

9.2.11.1.3. US Automotive Lead Acid Battery Market, by Technology |

|

9.2.11.1.4. US Automotive Lead Acid Battery Market, by End-User |

|

9.2.11.1.5. US Automotive Lead Acid Battery Market, by Sales Channel |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Exide Technologies |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Johnson Controls International PLC |

|

11.3. GS Yuasa Corporation |

|

11.4. East Penn Manufacturing Company |

|

11.5. Stryten Energy |

|

11.6. Saft Groupe S.A. |

|

11.7. Camel Group Co. Ltd. |

|

11.8. Trojan Battery Company |

|

11.9. Panasonic Corporation |

|

11.10. Banner Batteries |

|

11.11. Luminous Power Technologies Pvt. Ltd. |

|

11.12. Amara Raja Batteries Ltd. |

|

11.13. Enersys Inc. |

|

11.14. FIAMM Energy Technology S.p.A |

|

11.15. Leoch International Technology Limited |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Automotive Lead Acid Battery Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Automotive Lead Acid Battery Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Automotive Lead Acid Battery Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA