The Automotive Fuel Cell Market is witnessing transformative growth driven by the global shift towards sustainable transportation solutions. Fuel cell vehicles (FCVs) are emerging as a viable alternative to conventional internal combustion engines, promising lower emissions and enhanced energy efficiency. As the automotive industry pivots towards electric mobility, the fuel cell sector has gained traction, benefiting from technological advancements, supportive government policies, and rising consumer awareness of environmental issues.

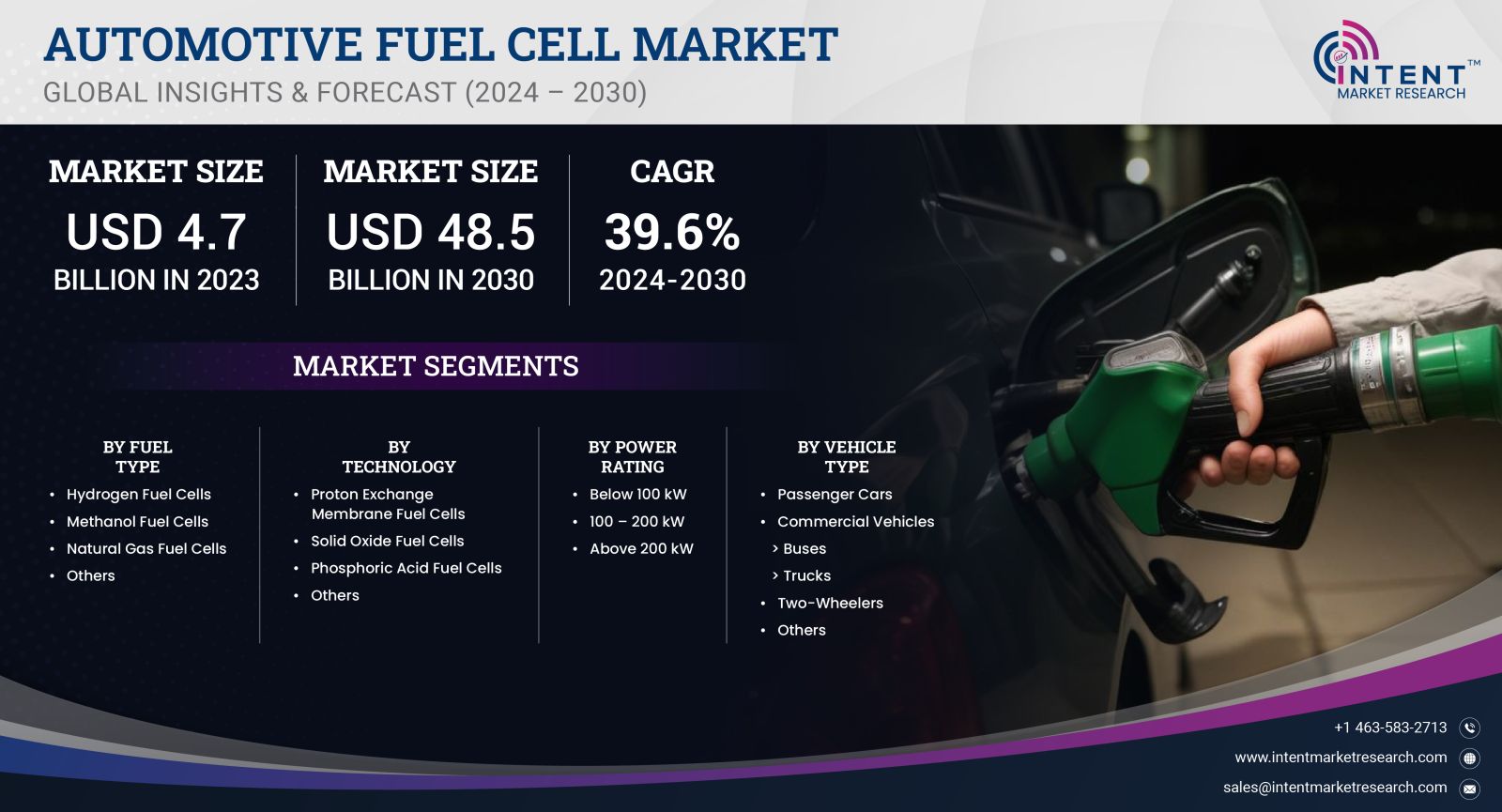

As per Intent Market Research, the Automotive Fuel Cell Market was valued at USD 4.7 billion in 2023 and will surpass USD 48.5 billion by 2030; growing at a CAGR of 39.6% during 2024 - 2030, the market is expected to grow significantly, driven by the increasing demand for clean and efficient transportation solutions.

As we look towards the future, the market is poised for expansion across various segments, including passenger vehicles, commercial vehicles, and other applications. Each of these segments is experiencing growth, but certain subsegments stand out due to unique dynamics and emerging trends. This report delves into the key subsegments of the automotive fuel cell market, highlighting their significance and potential for growth in the coming years.

Passenger Vehicles Segment is Largest Owing to Increasing Adoption of Fuel Cell Technology

The passenger vehicle segment remains the largest within the automotive fuel cell market, driven by increasing adoption of fuel cell technology among consumers and automakers. The growing emphasis on reducing greenhouse gas emissions and achieving energy independence has propelled manufacturers to explore innovative solutions such as fuel cell electric vehicles (FCEVs). Major automotive players are investing heavily in research and development to enhance the performance, range, and cost-effectiveness of FCEVs. The infrastructure for hydrogen refueling is also expanding, making these vehicles more accessible to consumers.

With several government initiatives promoting zero-emission vehicles, the demand for fuel cell passenger vehicles is expected to continue rising. Notable manufacturers like Toyota and Honda have already launched successful FCEV models, capturing consumer interest and paving the way for future developments in this segment. As advancements in fuel cell technology and infrastructure progress, the passenger vehicle segment is likely to retain its position as the largest contributor to the automotive fuel cell market.

Commercial Vehicles Segment is Fastest Growing Owing to Demand for Sustainable Logistics

The commercial vehicles segment is recognized as the fastest-growing segment within the automotive fuel cell market. This rapid growth can be attributed to the increasing demand for sustainable logistics solutions and the need to reduce the carbon footprint of freight transportation. With stricter emissions regulations and growing awareness of environmental impacts, fleet operators are seeking alternative fuel solutions that can provide long-range capabilities and rapid refueling times, both of which are key advantages of fuel cell technology.

Several major logistics companies are piloting fuel cell trucks, showcasing their potential in long-haul applications. The development of hydrogen refueling infrastructure is also gaining momentum, facilitating the adoption of fuel cell commercial vehicles. Companies like Nikola and Hyundai are leading the charge in this area, developing innovative solutions to meet the demands of the commercial transportation sector. As a result, the commercial vehicle segment is set to witness substantial growth, bolstered by advancements in technology and the urgent need for eco-friendly logistics solutions.

Bus Segment is Largest Owing to Urbanization and Public Transport Needs

Among the various applications of fuel cell technology, the bus segment stands out as the largest contributor to the automotive fuel cell market. The increasing urbanization and rising demand for efficient public transport solutions have led municipalities worldwide to explore cleaner alternatives to traditional diesel buses. Fuel cell buses offer significant advantages, including lower emissions, quieter operation, and longer ranges, making them an attractive option for city transport systems.

Government initiatives aimed at reducing air pollution in urban areas are further driving the adoption of fuel cell buses. Many cities have begun transitioning their public transport fleets to fuel cell technology, resulting in a surge of orders for fuel cell buses from manufacturers. Major players such as Ballard Power Systems and New Flyer are at the forefront of this movement, delivering advanced fuel cell systems that meet the needs of modern public transportation. As cities strive for sustainability, the bus segment is expected to maintain its status as the largest application for fuel cell technology.

Hydrogen Refueling Infrastructure Segment is Fastest Growing Owing to Strategic Investments

The hydrogen refueling infrastructure segment is identified as the fastest-growing component within the automotive fuel cell market. As the adoption of fuel cell vehicles accelerates, the need for a robust hydrogen refueling network becomes increasingly critical. Strategic investments from both public and private sectors are being directed towards developing refueling stations to support the growing fleet of fuel cell vehicles.

Several countries are implementing policies to promote hydrogen infrastructure development, recognizing its role in facilitating the transition to a hydrogen-based economy. Companies like Air Products and Linde are spearheading initiatives to establish comprehensive hydrogen refueling networks across key markets. With the increasing collaboration between governments, industry stakeholders, and research institutions, the hydrogen refueling infrastructure segment is poised for rapid expansion, enabling the widespread adoption of fuel cell vehicles.

North America Region is Largest Owing to Advanced Infrastructure and Investment

North America emerges as the largest region in the automotive fuel cell market, primarily driven by advanced infrastructure and significant investments in fuel cell technology. The United States, in particular, has established itself as a leader in fuel cell research and development, supported by government initiatives aimed at promoting clean energy solutions. Major automotive manufacturers, including Toyota and General Motors, are actively involved in the fuel cell market, contributing to technological advancements and market growth.

The presence of a well-developed hydrogen refueling infrastructure further solidifies North America’s position as a dominant player in the automotive fuel cell market. Collaborative efforts between industry and government have led to the establishment of numerous hydrogen refueling stations, facilitating the adoption of fuel cell vehicles across the region. As the demand for sustainable transportation continues to rise, North America is expected to maintain its leadership position, driving innovations in the automotive fuel cell sector.

Leading Companies and Competitive Landscape

The automotive fuel cell market is characterized by a competitive landscape with several key players at the forefront. Leading companies such as Toyota, Honda, Ballard Power Systems, Hyundai, and Nikola are driving innovation and market expansion through their investments in research and development. These companies are not only enhancing fuel cell technology but also establishing strategic partnerships to strengthen their market position.

The competitive landscape is marked by a focus on technological advancements, cost reductions, and the establishment of hydrogen refueling infrastructure. Collaborations between automotive manufacturers, energy providers, and government agencies are fostering an ecosystem conducive to the growth of the fuel cell market. As the industry evolves, players are expected to adapt to changing market dynamics, with a strong emphasis on sustainability and efficiency. The race for leadership in the automotive fuel cell market will intensify as more companies recognize the potential of hydrogen as a clean energy solution for the future.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 4.7 billion |

|

Forecasted Value (2030) |

USD 48.5 billion |

|

CAGR (2024 – 2030) |

39.6% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Automotive Fuel Cell Market By Fuel Type (Hydrogen Fuel Cells, Methanol Fuel Cells, Natural Gas Fuel Cells, Others), By Technology (Proton Exchange Membrane Fuel Cells, Solid Oxide Fuel Cells, Phosphoric Acid Fuel Cells, Others), By Power Rating (Below 100 kW, 100 – 200 kW, Above 200 kW), By Vehicle Type (Passenger Cars, Commercial Vehicles {Buses, Trucks}, Two-Wheelers, Others) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and Rest of Asia Pacific), Latin America (Brazil, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Automotive Fuel Cell Market, by Fuel Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Hydrogen Fuel Cells |

|

4.2. Methanol Fuel Cells |

|

4.3. Natural Gas Fuel Cells |

|

4.4. Others |

|

5. Automotive Fuel Cell Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Proton Exchange Membrane Fuel Cells |

|

5.2. Solid Oxide Fuel Cells |

|

5.3. Phosphoric Acid Fuel Cells |

|

5.4. Others |

|

6. Automotive Fuel Cell Market, by Power Rating (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Below 100 kW |

|

6.2. 100 – 200 kW |

|

6.3. Above 200 kW |

|

7. Automotive Fuel Cell Market, by Vehicle Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Passenger Cars |

|

7.2. Commercial Vehicles |

|

7.2.1. Buses |

|

7.2.2. Trucks |

|

7.3. Two-Wheelers |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Automotive Fuel Cell Market, by Fuel Type |

|

8.2.7. North America Automotive Fuel Cell Market, by Technology |

|

8.2.8. North America Automotive Fuel Cell Market, by Power Rating |

|

8.2.9. North America Automotive Fuel Cell Market, by Vehicle Type |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Automotive Fuel Cell Market, by Fuel Type |

|

8.2.10.1.2. US Automotive Fuel Cell Market, by Technology |

|

8.2.10.1.3. US Automotive Fuel Cell Market, by Power Rating |

|

8.2.10.1.4. US Automotive Fuel Cell Market, by Vehicle Type |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. AVL |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Ballard Power Systems |

|

10.3. ElringKlinger |

|

10.4. Horizon Fuel Cell Technologies |

|

10.5. Hyundai Motor Company |

|

10.6. Intelligent Energy |

|

10.7. Nedstack Fuel Cell Technology |

|

10.8. Nuvera Fuel Cells |

|

10.9. Plug Power |

|

10.10. PowerCell Sweden |

|

10.11. Pragma Industries |

|

10.12. Umicore |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Automotive Fuel Cell Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to measure the impact of them on the Automotive Fuel Cell Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across Automotive Fuel Cell ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the Automotive Fuel Cell Market. These methods were also employed to estimate the size of various sub segments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

.jpg)