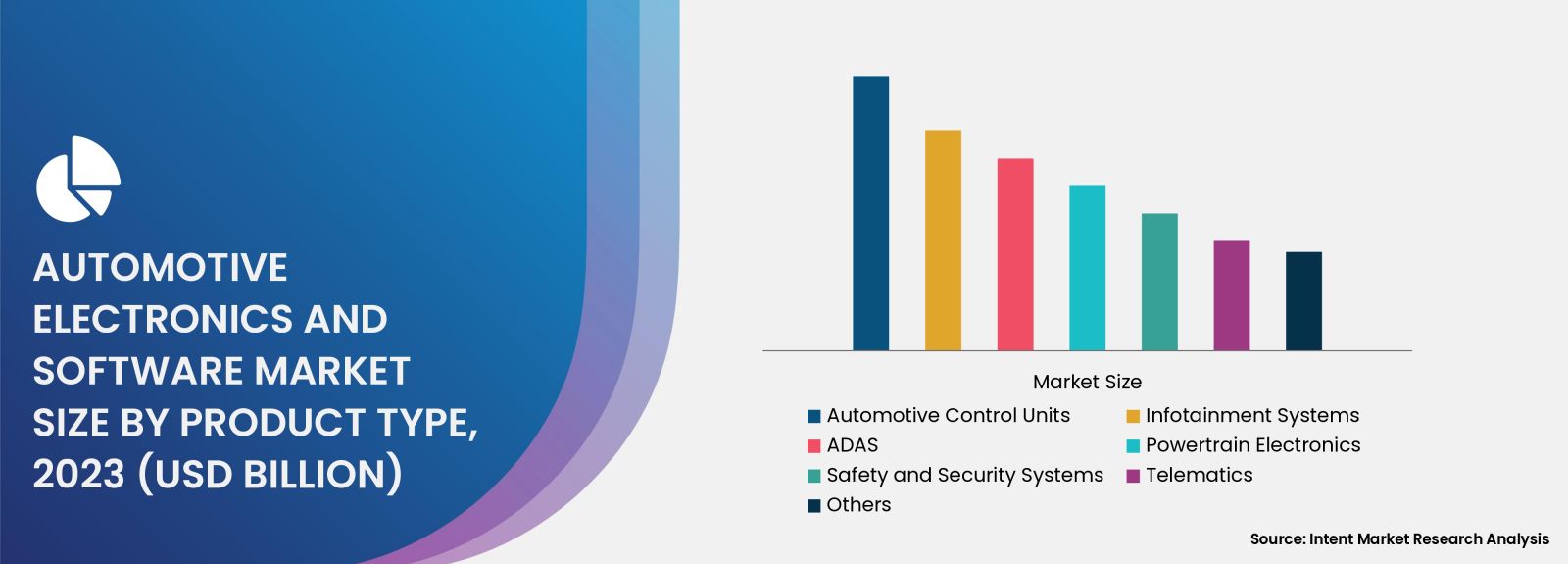

As per Intent Market Research, the Automotive Electronics and Software Market was valued at USD 286.3 billion in 2023 and will surpass USD 398.6 billion by 2030; growing at a CAGR of 4.8% during 2024 - 2030, driven by the rising demand for advanced safety features, connectivity solutions, and the increasing electrification of vehicles. The growing consumer preference for electric vehicles (EVs) and hybrid models, alongside regulatory measures pushing for reduced emissions, are major factors influencing this growth. As automakers and tech firms continue to innovate, integrating artificial intelligence (AI), Internet of Things (IoT), and autonomous driving technologies, the automotive electronics and software industry is set to become an integral part of the automotive ecosystem.

Powertrain Electronics Segment is Largest Owing to Electrification of Vehicles

Powertrain electronics represent the largest segment within the automotive electronics market. This growth is driven by the electrification of vehicles and the shift towards cleaner and more efficient propulsion systems. The demand for advanced powertrain systems such as electric drive modules, battery management systems, and hybrid control systems is increasing as automakers invest heavily in EV development. These components are essential for enhancing vehicle efficiency, performance, and compliance with environmental regulations. As the EV market grows, so does the demand for sophisticated powertrain electronics, positioning this segment as the largest contributor.

Within the powertrain electronics segment, the battery management system (BMS) subsegment is particularly dominant. BMS technology is crucial for monitoring the health, performance, and safety of vehicle batteries, ensuring optimal power output and longevity. With the automotive industry's shift toward electric and hybrid models, manufacturers are investing significantly in R&D to enhance the capabilities of these systems. The BMS subsegment is not only central to the adoption of EVs but also offers opportunities for innovation, such as integrating AI to predict battery life cycles and improve overall vehicle performance.

ADAS Segment is Fastest Growing Owing to Safety Regulations and Demand for Autonomous Vehicles

The Advanced Driver Assistance Systems (ADAS) segment is the fastest growing, fueled by the automotive industry's focus on safety and autonomous driving. With global regulatory bodies mandating safety features like lane departure warnings, adaptive cruise control, and automated braking systems, the integration of ADAS technologies has become essential for automotive manufacturers. Consumers are increasingly opting for vehicles equipped with advanced safety systems, contributing to the growth of this segment.

The autonomous emergency braking (AEB) subsegment is the fastest-growing within ADAS, propelled by stringent safety regulations and consumer demand for enhanced safety features. AEB systems detect potential collisions and automatically apply the brakes, reducing the risk of accidents. As regulatory agencies worldwide make AEB mandatory in new vehicles, automotive manufacturers are focusing on developing and integrating these systems, contributing significantly to the ADAS segment's rapid growth. Additionally, the integration of AI and sensor technology in AEB systems is transforming how vehicles respond to dynamic road conditions, offering a safer driving experience.

Infotainment and Connectivity Segment is Largest Owing to Consumer Demand for Enhanced Driving Experience

The infotainment and connectivity segment holds a significant share of the automotive electronics market due to increasing consumer demand for an enhanced and connected driving experience. Automakers are incorporating advanced infotainment systems that offer features like voice recognition, navigation, smartphone integration, and cloud-based services. This trend is further supported by the growth of connected car technologies, where vehicles are integrated with IoT solutions to provide real-time information and entertainment.

The largest subsegment within this category is the telematics system. Telematics combines telecommunications and informatics, offering a comprehensive solution for vehicle monitoring, navigation, and communication. The rising consumer preference for real-time vehicle diagnostics, emergency services, and seamless connectivity has propelled the demand for telematics systems. Automakers and tech companies are collaborating to develop more sophisticated telematics solutions that integrate with other vehicle systems, making this subsegment the most influential in the infotainment and connectivity space.

Body Electronics Segment is Fastest Growing Owing to Advancements in Comfort and Convenience Features

Body electronics is emerging as a rapidly growing segment, as automakers prioritize enhancing comfort and convenience for consumers. This segment includes components like lighting systems, climate control, keyless entry, and seat adjustment mechanisms. The growing trend of luxury vehicles equipped with high-end comfort features is a significant factor contributing to the segment's expansion.

The fastest-growing subsegment within body electronics is the intelligent lighting system. These systems enhance visibility, safety, and aesthetics, offering features like adaptive headlights and ambient lighting. With increasing adoption of LED technology and innovations like matrix lighting, the market for intelligent lighting systems is expanding rapidly. Automakers are leveraging these technologies not only to improve safety but also to offer customizable in-cabin experiences, aligning with consumer preferences for personalization.

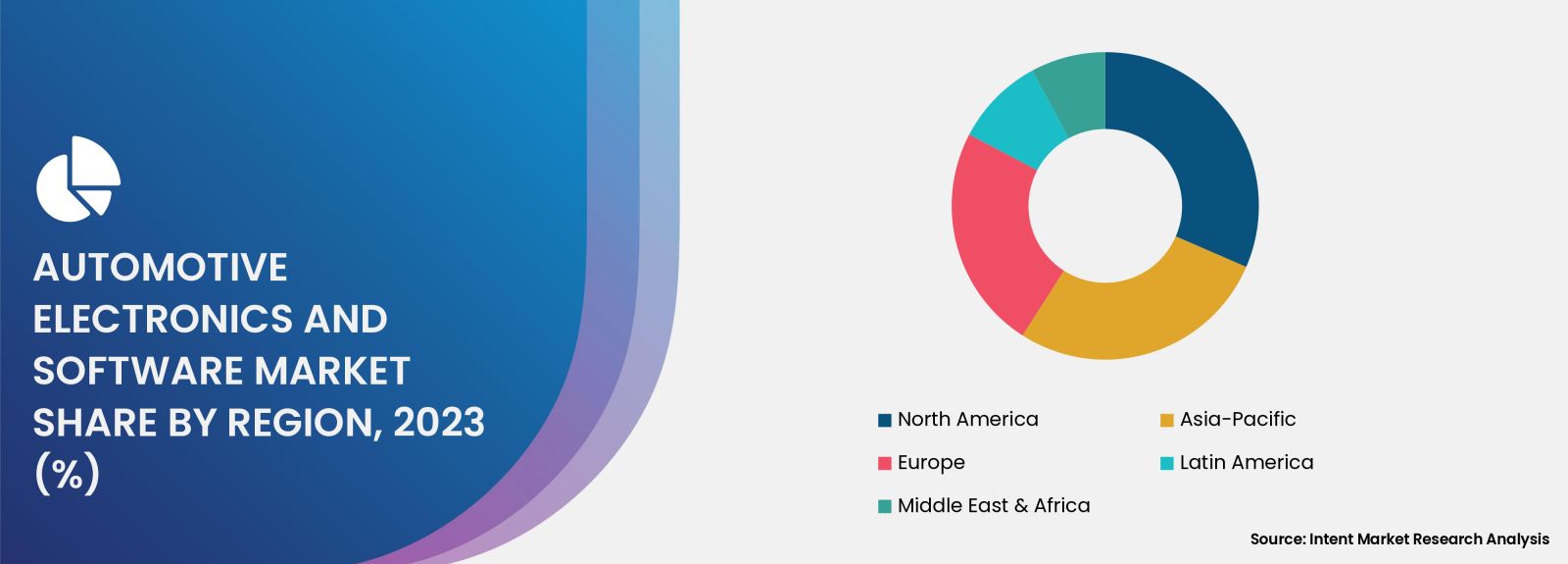

Fastest Growing Region: Asia-Pacific Owing to Expansion of EV Market

The Asia-Pacific region is the fastest-growing market for automotive electronics and software, primarily due to the rapid expansion of the electric vehicle market. Countries like China, Japan, and South Korea are leading in EV adoption, supported by government initiatives, subsidies, and investments in charging infrastructure. These factors, coupled with the presence of major automotive and electronics manufacturers, make Asia-Pacific a hub for automotive electronics development.

China, in particular, is a focal point for growth as it accelerates the adoption of connected and autonomous vehicles. The country’s emphasis on smart city initiatives and 5G technology is driving demand for advanced automotive software solutions. Additionally, Japanese and South Korean manufacturers are investing heavily in R&D to develop cutting-edge ADAS, infotainment, and powertrain solutions, further boosting the region's market growth.

Competitive Landscape: Dominance of Established Players and Rise of New Entrants

The automotive electronics and software market is highly competitive, with established players like Bosch, Continental AG, Denso Corporation, and Aptiv PLC dominating the landscape. These companies are investing heavily in research and development to enhance their product offerings and maintain their market position. Collaborations between automakers and tech firms are also common, aiming to integrate advanced software and AI-driven solutions into vehicles.

New entrants and startups are also gaining traction, particularly in the EV and autonomous driving sectors. These companies are focusing on niche technologies, such as AI for autonomous systems and next-generation infotainment platforms, challenging the dominance of traditional players. The competitive landscape is further shaped by strategic partnerships, mergers and acquisitions, and regional expansions, as companies strive to innovate and capture market share in this rapidly evolving industry.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 286.3 billion |

|

Forecasted Value (2030) |

USD 398.6 billion |

|

CAGR (2024 – 2030) |

4.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Automotive Electronics and Software Market By Component (Hardware, Software & Services), By Product Type (Automotive Control Units, Infotainment Systems, ADAS, Powertrain Electronics, Safety and Security Systems, Telematics), By Vehicle Type (Passenger Cars, LCVs, HCVs, 2 & 3 Wheelers), and By Propulsion Type (ICE, EV, Hybrid Vehicles) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Automotive Electronics and Software Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Hardware |

|

4.1.1. Microcontrollers |

|

4.1.2. Sensors |

|

4.1.3. Connectors |

|

4.1.4. Circuit Boards |

|

4.1.5. Others |

|

4.2. Software & Services |

|

4.2.1. Operating Systems |

|

4.2.2. Application Software |

|

4.2.3. Middleware |

|

4.2.4. Development Tools |

|

4.2.5. Others |

|

5. Automotive Electronics and Software Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Automotive Control Units |

|

5.1.1. Engine Control Units (ECUs) |

|

5.1.2. Transmission Control Units (TCUs) |

|

5.1.3. Body Control Modules (BCMs) |

|

5.1.4. Chassis Control Modules |

|

5.1.5. Others |

|

5.2. Infotainment Systems |

|

5.2.1. Audio Systems |

|

5.2.2. Navigation Systems |

|

5.2.3. Connected Car Technologies |

|

5.2.4. Others |

|

5.3. Advanced Driver Assistance Systems (ADAS) |

|

5.3.1. Adaptive Cruise Control |

|

5.3.2. Parking Assistance Systems |

|

5.3.3. Others |

|

5.4. Powertrain Electronics |

|

5.4.1. Electric Power Steering |

|

5.4.2. Battery Management Systems |

|

5.4.3. Others |

|

5.5. Safety and Security Systems |

|

5.5.1. Airbag Control Systems |

|

5.5.2. Anti-lock Braking Systems (ABS) |

|

5.5.3. Vehicle Tracking Systems |

|

5.5.4. Others |

|

5.6. Telematics |

|

5.7. Others |

|

6. Automotive Electronics and Software Market, by Vehicle Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Passenger Cars |

|

6.2. Light Commercial Vehicles (LCVs) |

|

6.3. Heavy Commercial Vehicles (HCVs) |

|

6.4. 2 & 3 Wheelers |

|

7. Automotive Electronics and Software Market, by Propulsion Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Internal Combustion Engine (ICE) |

|

7.2. Electric Vehicles (EVs) |

|

7.3. Hybrid Vehicles |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Automotive Electronics and Software Market, by Component |

|

8.2.7. North America Automotive Electronics and Software Market, by Product Type |

|

8.2.8. North America Automotive Electronics and Software Market, by Vehicle Type |

|

8.2.9. North America Automotive Electronics and Software Market, by Propulsion Type |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Automotive Electronics and Software Market, by Component |

|

8.2.10.1.2. US Automotive Electronics and Software Market, by Product Type |

|

8.2.10.1.3. US Automotive Electronics and Software Market, by Vehicle Type |

|

8.2.10.1.4. US Automotive Electronics and Software Market, by Propulsion Type |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Aptiv |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Bosch |

|

10.3. Continental |

|

10.4. Delphi |

|

10.5. Denso |

|

10.6. Harman |

|

10.7. Infineon |

|

10.8. Magna |

|

10.9. NXP Semiconductors |

|

10.10. Qualcomm |

|

10.11. Renesas |

|

10.12. STMicroelectronics |

|

10.13. Texas Instruments |

|

10.14. Veoneer |

|

10.15. ZF Friedrichshafen |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Automotive Electronics and Software Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Automotive Electronics and Software Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Automotive Electronics and Software ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Automotive Electronics and Software Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA