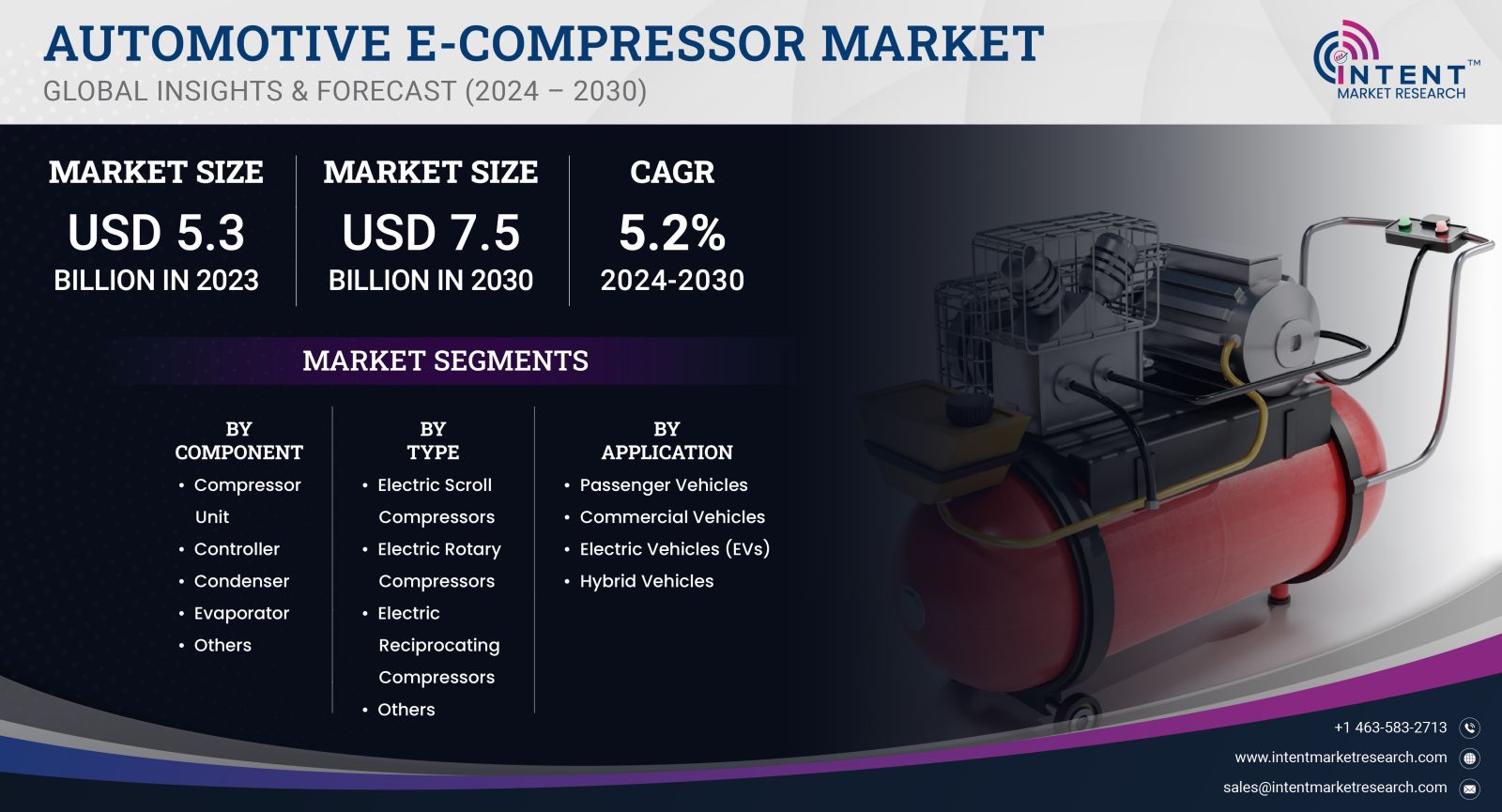

As per Intent Market Research, the Automotive E-Compressor Market was valued at USD 5.3 billion in 2023 and will surpass USD 7.5 billion by 2030; growing at a CAGR of 5.2% during 2024 - 2030, the market is expected to expand significantly, driven by regulatory support for electric vehicles and consumer demand for improved performance and lower emissions.

The Automotive E-Compressor Market is poised for substantial growth in the coming years, driven by advancements in electric vehicle technology and increasing demand for energy-efficient cooling systems. As the automotive industry shifts toward electrification and sustainability, e-compressors are becoming a vital component in electric and hybrid vehicles. These systems offer significant advantages over traditional mechanical compressors, including reduced weight, improved efficiency, and the ability to operate independently of the engine.

Electric Vehicle Segment is Largest Owing to Growing Adoption of Electric Vehicles

The electric vehicle (EV) segment represents the largest portion of the Automotive E-Compressor Market. As global awareness of climate change intensifies, manufacturers are increasingly investing in the production of electric vehicles to meet stringent emissions regulations. The integration of e-compressors in EVs allows for enhanced thermal management, crucial for maintaining optimal battery performance and extending vehicle range. E-compressors operate efficiently without relying on engine power, thus contributing to an overall reduction in energy consumption. The rising sales of electric vehicles, bolstered by government incentives and an expanding charging infrastructure, are propelling the demand for e-compressors in this segment.

Moreover, the rapid advancement of technology in the EV sector is enabling the development of more sophisticated e-compressors. These innovations are designed to cater to the specific thermal management needs of high-performance electric vehicles, which require robust and efficient cooling systems. As automakers prioritize performance, efficiency, and user experience, e-compressors are becoming an integral part of vehicle design. The focus on improving the range and efficiency of electric vehicles is expected to further boost the demand for e-compressors, solidifying this segment's dominance in the market.

Hybrid Vehicle Segment is Fastest Growing Owing to Increased Fuel Efficiency

The hybrid vehicle segment is currently the fastest-growing area within the Automotive E-Compressor Market. The growing need for improved fuel efficiency and reduced emissions has led many consumers and manufacturers to consider hybrid vehicles as a viable alternative to traditional combustion engine models. E-compressors play a crucial role in hybrid vehicles, providing efficient cooling systems that enhance both the internal combustion engine's and the electric motor's performance. By efficiently managing the vehicle's thermal requirements, e-compressors facilitate optimal operation and longevity of hybrid powertrains.

Furthermore, advancements in hybrid technology are driving innovation in e-compressors. The demand for lightweight, compact, and efficient cooling systems has prompted manufacturers to develop tailored e-compressor solutions specifically designed for hybrid applications. As automakers increasingly integrate e-compressors to enhance vehicle performance, the hybrid vehicle segment is expected to witness significant growth. This trend aligns with the rising consumer preference for greener alternatives, indicating a promising outlook for the e-compressor market in this segment.

Commercial Vehicle Segment is Largest Owing to Demand for Energy Efficiency

The commercial vehicle segment stands out as the largest contributor to the Automotive E-Compressor Market, fueled by the rising emphasis on energy efficiency and cost-effectiveness in fleet operations. Commercial vehicles, including trucks and buses, require robust cooling systems to maintain optimal performance in various driving conditions. The integration of e-compressors allows for better thermal management, ensuring that these vehicles operate efficiently while reducing fuel consumption and emissions.

Additionally, the increasing adoption of e-compressors in commercial vehicles is driven by the growing regulations aimed at minimizing environmental impact. As governments impose stricter emissions standards, manufacturers are compelled to adopt advanced technologies that can help meet these requirements. E-compressors not only provide energy-efficient cooling but also enable commercial vehicles to capitalize on hybrid or electric powertrains, further reducing their carbon footprint. This combination of regulatory pressures and the pursuit of operational efficiencies positions the commercial vehicle segment as a leader in the e-compressor market.

Aftermarket Segment is Fastest Growing Owing to Rising Vehicle Maintenance Needs

The aftermarket segment within the Automotive E-Compressor Market is witnessing rapid growth, primarily driven by the increasing emphasis on vehicle maintenance and upgrades. As vehicles age, the need for replacement and enhanced cooling systems becomes essential to maintain performance and efficiency. E-compressors are gaining traction in the aftermarket due to their ability to improve thermal management and energy efficiency compared to traditional compressors.

This growth is further supported by the rising trend of vehicle electrification, prompting owners of older vehicles to seek upgrades that enhance fuel efficiency and reduce emissions. As consumers become more environmentally conscious, the demand for aftermarket e-compressor installations is expected to rise. The expanding availability of e-compressors in the aftermarket sector presents a significant opportunity for manufacturers, as they cater to a growing base of consumers who prioritize sustainability and performance enhancements.

Asia-Pacific Region is Fastest Growing Owing to Rapid Electric Vehicle Adoption

The Asia-Pacific region is projected to be the fastest-growing market for automotive e-compressors, fueled by the rapid adoption of electric vehicles and supportive government policies promoting sustainable transportation. Countries such as China and India are at the forefront of this shift, investing heavily in electric vehicle infrastructure and incentives to stimulate consumer demand. As these nations strive to reduce their carbon footprints and tackle urban pollution, the need for efficient thermal management systems, including e-compressors, has become increasingly apparent.

Additionally, the presence of major automotive manufacturers in the Asia-Pacific region has accelerated the development and deployment of e-compressors in new vehicle models. The increasing focus on electric mobility and sustainable transportation solutions positions this region as a key player in the global e-compressor market. As investments in research and development continue to rise, the Asia-Pacific market is expected to witness significant growth, capturing a substantial share of the global automotive e-compressor market by 2030.

Competitive Landscape and Key Players

The Automotive E-Compressor Market is characterized by a competitive landscape that includes several key players focusing on innovation and market expansion. Leading companies such as Denso Corporation, Sanden Holdings Corporation, Valeo SA, Mahle GmbH, and Continental AG are at the forefront of technological advancements, developing high-performance e-compressors tailored to the evolving needs of the automotive industry.

These companies are investing in research and development to enhance the efficiency, reliability, and performance of e-compressors. Collaborations and strategic partnerships are also common, enabling manufacturers to leverage complementary technologies and expand their market reach. As the demand for electric and hybrid vehicles continues to grow, competition among these industry leaders is expected to intensify, driving further innovations in the Automotive E-Compressor Market.

Report Objectives:

The report will help you answer some of the most critical questions in the Automotive E-Compressor Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Automotive E-Compressor Market?

- What is the size of the Automotive E-Compressor Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 5.3 billion |

|

Forecasted Value (2030) |

USD 7.5 billion |

|

CAGR (2024 – 2030) |

5.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Automotive E-Compressor Market By Component (Compressor Unit, Controller, Condenser, Evaporator), By Type (Electric Scroll Compressors, Electric Rotary Compressors, Electric Reciprocating Compressors), and By Application (Passenger Vehicles, Commercial Vehicles, Electric Vehicles (EVs), Hybrid Vehicles) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Automotive E-Compressor Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Compressor Unit |

|

4.2. Controller |

|

4.3. Condenser |

|

4.4. Evaporator |

|

4.5. Others |

|

5. Automotive E-Compressor Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Electric Scroll Compressors |

|

5.2. Electric Rotary Compressors |

|

5.3. Electric Reciprocating Compressors |

|

5.4. Others |

|

6. Automotive E-Compressor Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Passenger Vehicles |

|

6.2. Commercial Vehicles |

|

6.3. Electric Vehicles (EVs) |

|

6.4. Hybrid Vehicles |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Automotive E-Compressor Market, by Component |

|

7.2.7. North America Automotive E-Compressor Market, by Type |

|

7.2.8. North America Automotive E-Compressor Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Automotive E-Compressor Market, by Component |

|

7.2.9.1.2. US Automotive E-Compressor Market, by Type |

|

7.2.9.1.3. US Automotive E-Compressor Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Aisin |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Bitzer |

|

9.3. Continental |

|

9.4. Denso |

|

9.5. Hanon Systems |

|

9.6. Mahle |

|

9.7. Mitsubishi Electric |

|

9.8. Panasonic |

|

9.9. Sanden |

|

9.10. Valeo |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Automotive E-Compressor Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Automotive E-Compressor Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Automotive E-Compressor ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Automotive E-Compressor Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA