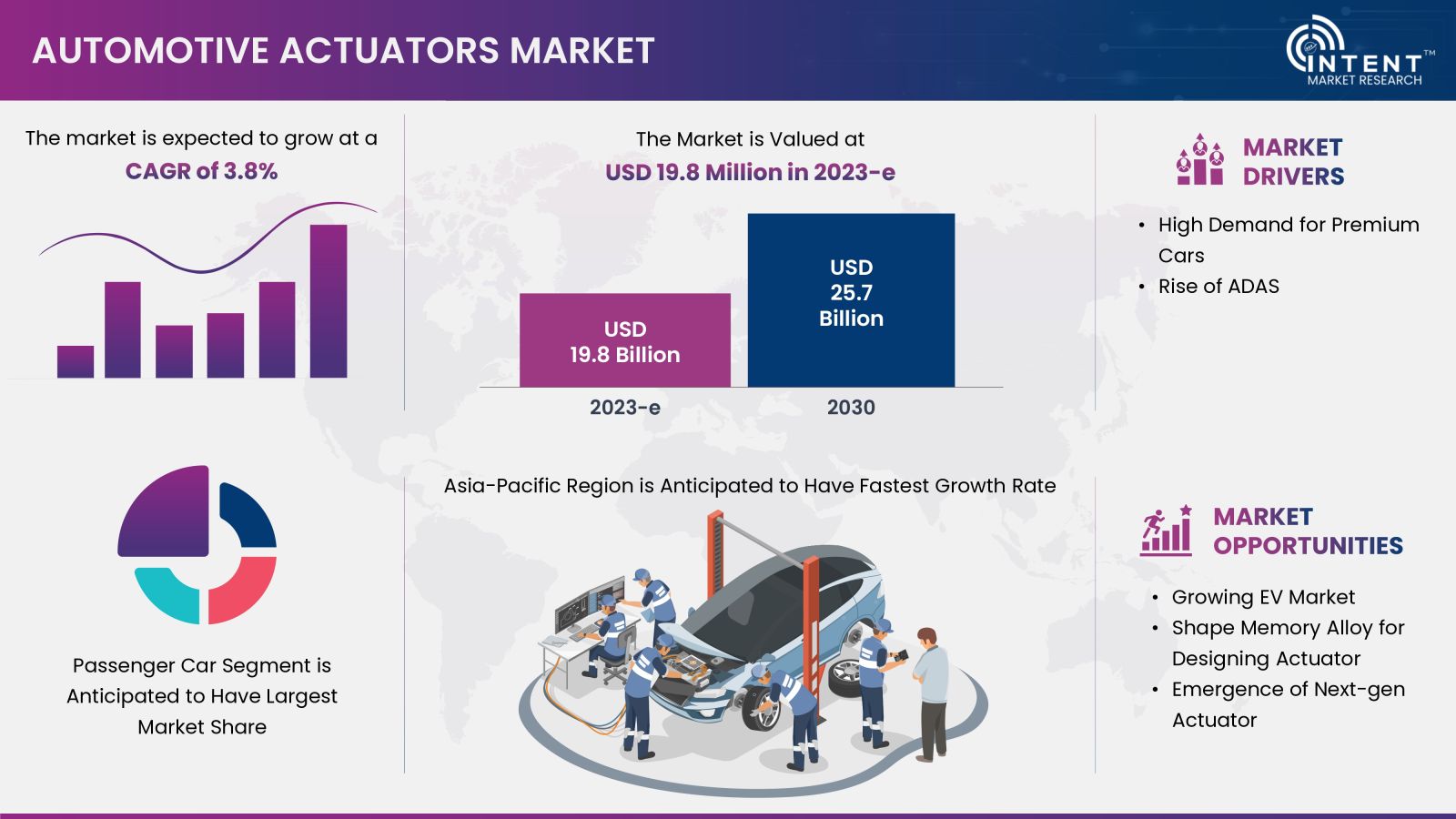

As per Intent Market Research, the global Automotive Actuators Market accounted for USD 19.8 billion in 2023-e and is projected to reach USD 25.7 billion by 2030, growing at a CAGR of 3.8% from 2024 to 2030.

The growth of this market is attributed to the high demand for premium cars having premium features such as panoramic sunroof, power windows, automated climate control, automated seat adjustment, etc. All these features have driven the demand for automotive actuators in recent years. However, the integration of actuators in premium cars into modern vehicles with other electronic systems is poised to be a major restraining factor for the market growth.

Contrarily, the explosive demand for electric vehicles is expected to offer several opportunities to the market stakeholders. Conversely, the market may face challenges in the coming years such as the need for lighter actuators with lower cost for EVs which are crucial for EV’s longer range. In 2022, over 10 million EVs were sold globally, and is expected to reach 14 million by the end of 2023.

Rise of ADAS offers Huge Opportunities for the Market Growth

Advanced Driver Assistance System (ADAS) is becoming the standard part of vehicle technology. It offers enhanced safety, accident prevention & automatic emergency braking, adaptive cruise control, etc. In ADAS, an actuator is used for translating electronic signals into physical actions to control various vehicle functions. Thus, helps in reducing the risk of vehicle accidents. Considering the high impact of ADAS, many countries have ruled the mandatory use of ADAS in vehicles. Europe started the mandatory use of ADAS in new cars by 2022.

Stringent safety regulations and standards imposed by governments and automotive safety organizations worldwide have encouraged automakers to integrate advanced safety features, driving the demand for ADAS technologies and, consequently, actuators.

Consumers are increasingly prioritizing safety and convenience features in their vehicles, which has led to the adoption of ADAS technologies. This, in turn, boosts the market for actuators that enable these functionalities. Ongoing advancements in sensor technologies, artificial intelligence, and connectivity have contributed to the development and improvement of ADAS features. As these systems become more sophisticated, actuators play a vital role in ensuring precise and reliable control.

The development of autonomous driving technologies relies heavily on ADAS components. As the automotive industry moves towards higher levels of autonomy, the demand for advanced actuators capable of handling complex tasks is expected to increase.

Key Findings of the Automotive Actuators Market Study

Passenger Vehicles Segment Expected to Grow With the Significant CAGR from 2024 To 2030

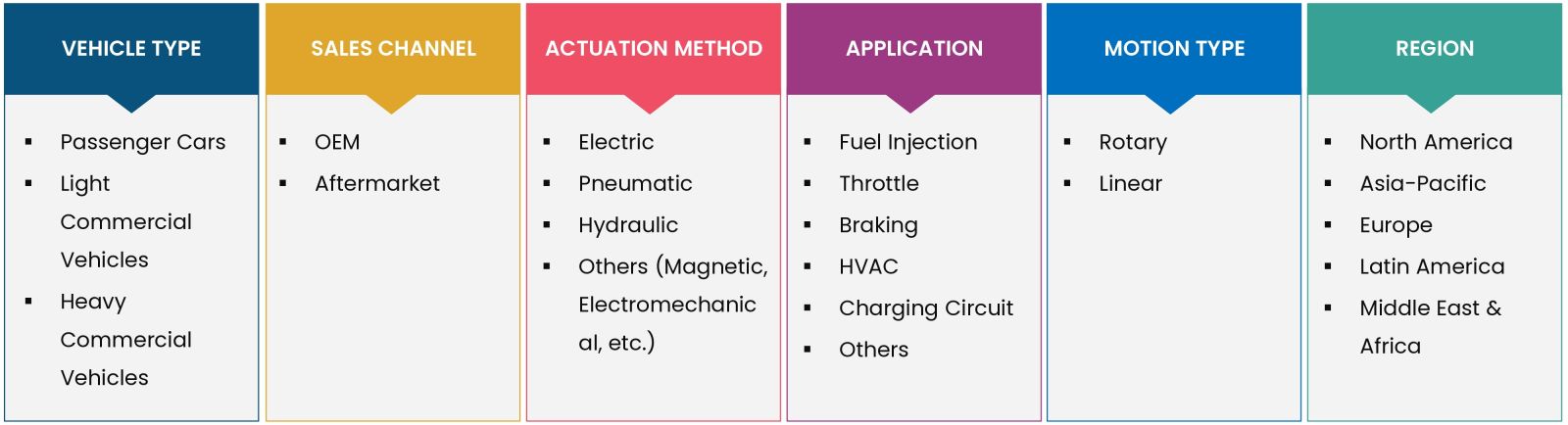

The automotive actuators market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. In 2023, the passenger vehicles segment recorded a significant share of the market. The high demand for passenger cars has driven the automotive actuators market from the passenger cars segment. With the expected boom of EVs in the coming years, the passenger cars segment is expected to record a significant growth during the forecast period.

OEM Expected to Register the Higher CAGR

Original equipment manufacturers (OEMs) are heavily investing in R&D of automotive actuators. OEMs have launched smart & intelligent actuators with higher efficiency, lighter weight and compact size. It is estimated that, the OEM segment will register the higher CAGR during the forecast period.

Electric Actuators are in High Demand

Based on actuation method, the automotive actuators market is segmented into: electric, pneumatic, hydraulic, other methods such as magnetic, electromechanical, etc. Electric actuators offers highest precision control positioning, high level of accuracy, energy efficiency, quick re-programming, instant feedback on diagnostics and vehicle maintenance, less noisy than other actuators, and no fluid leakage. These advantages promotes the demand of electric actuators in automotive industry.

Charging Circuit to Record High Growth

The growing electric vehicle market, and the integration of ADAS, and vehicle telematics is expected to influence the demands of charging circuit actuator in the coming years. However, actuator for fuel injection expected to decline considering the expected decline in demand for gasoline vehicles in coming years.

Linear Motion to Continue its Growth Trajectory

Automotive actuators are classified into two types based on motion type, linear and rotary. Compared to rotary motion, vehicle has larger number of linear motion applications. Linear motion actuators offer advantages such as precision, reliability, and the ability to automate linear movement in various applications, making them versatile components in the automotive industry. Linear actuators are utilized in power seats to enable adjustments in the position and tilt of car seats. It is also used to control the linear movement of trunks and hoods in some vehicles. This has promoted linear motion segment to witness higher growth over the forecast period.

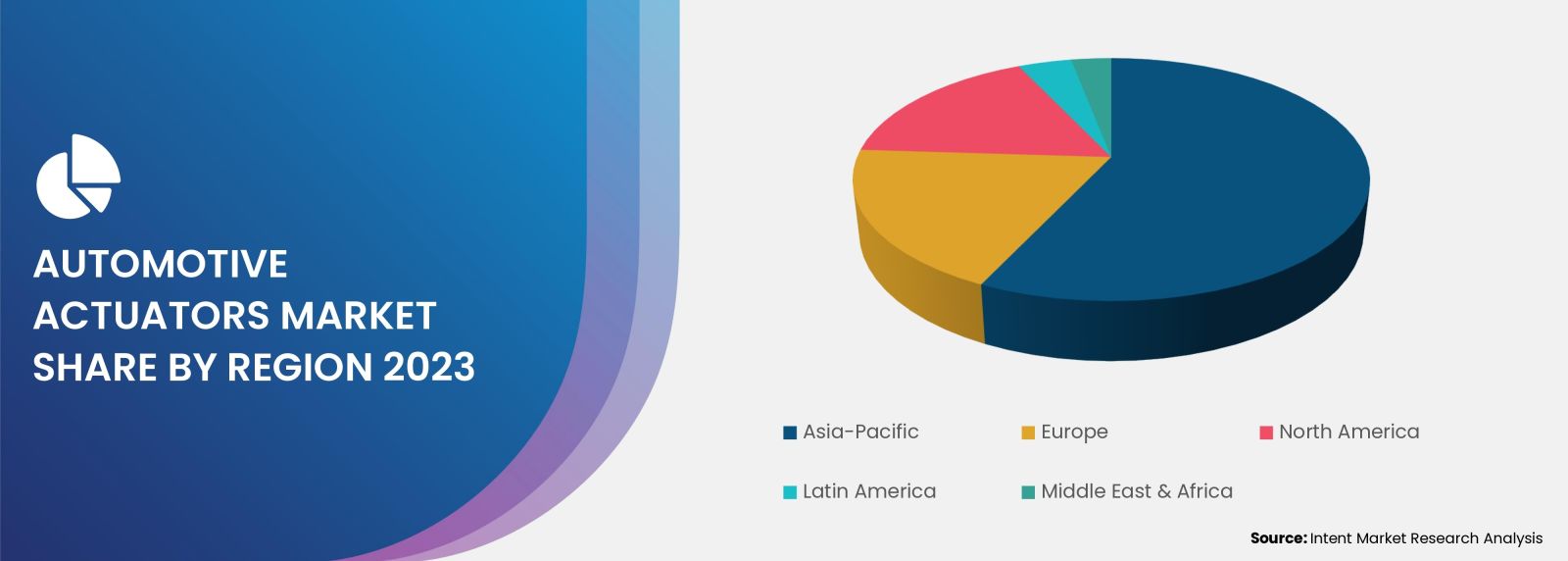

China Fuels the Asia-Pacific Growth

Geographically, Asia-Pacific holds the largest share of the global automotive actuators market. This large share of the Asia-Pacific region is fueled by China’s dominance in the automotive industry. China is the biggest producer of vehicles in the world, with over 26 million vehicles were sold in 2021. With the boom of electric vehicle, the share of China is further expected to improve in coming years. Additionally, India, and Japan are the major markets of automobile sales in the region. In 2022, India ranked 3rd and Japan 4th largest vehicle market in the world. Such high demand of automobiles from the regional countries expected to continue in coming years as well. Thereby, driving the automotive actuators market.

Key players operating in the global automotive actuators market are BorgWarner, Bosch, Continental, Denso, EFI Automotive, Hitachi, Johnson Electric, MAHLE, Mitsubishi Electric, NIDEC, among others.

Key market players have started adopting several strategies to tap major market share . For instance, in September 2023, Marelli, a leading global suppliers to the automotive sector, headquartered in Japan has launched its new range of multipurpose smart actuators for electric cars. This new smart actuator comes with features such as light-weight, super-compact, on-board diagnostics, cyber-security, and offers simple customization and installation within the vehicle.

Automotive Actuators Market Coverage

The report provides key insights into the automotive actuators market, and it focuses on technological developments, trends, and initiatives taken by the government and private players. It delves into market drivers, restraints, opportunities, and challenges that are impacting the market growth. It analyses key players as well as the competitive landscape within the global market.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 19.8 billion |

|

Forecast Revenue (2030) |

USD 25.7 billion |

|

CAGR (2024-2030) |

3.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Automotive Actuators Market By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Heavy Commercial Vehicles); By Sales Channel (OEM, Aftermarket); By Actuation Method (Electric, Pneumatic, Hydraulic, Other (Magnetic, Electromechanical)); By Application (Fuel Injection, Throttle, Braking, HVAC, Charging Circuit, Other); By Motion Type (Rotary, Linear) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America and Middle East & Africa |

|

Competitive Landscape |

BorgWarner, Bosch, Continental, Denso, EFI Automotive, Hitachi, Johnson Electric, MAHLE, Mitsubishi Electric, NIDEC, among others |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Key Stakeholders of the Market |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.2.Data Collection |

|

2.3.Market Assessment |

|

2.4.Assumptions & Limitations for the Study |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Drivers |

|

4.1.1.High Demand for Premium Cars |

|

4.1.2.Rise of ADAS |

|

4.2.Restraints |

|

4.2.1.Complexity in Integration |

|

4.3.Opportunities |

|

4.3.1.Growing EV Market |

|

4.4.Threats or Challenges |

|

4.4.1.Need of Light-weight Actuator |

|

4.5.Trends |

|

4.5.1.Shape Memory Alloy (SMA) for Designing Actuator |

|

4.5.2.Emergence of Next-Gen Actuator |

|

4.6.PORTER’S Five Forces Analysis |

|

4.7.PESTLE Analysis |

|

4.8.Case Studies |

|

5.Market Outlook |

|

5.1.Market Size by Vehicle Type |

|

5.2.Market Size by Sales Channel |

|

5.3.Market Size by Actuation Method |

|

5.4.Market Size by Application |

|

5.5.Market Size by Motion Type |

|

5.6.Market Size by Geography |

|

6.Market Size by Vehicle Type, (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

6.1.Passenger Cars |

|

6.2.Light Commercial Vehicles |

|

6.3.Heavy Commercial Vehicles |

|

7.Market Size by Sales Channel, (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

7.1.OEM |

|

7.2.Aftermarket |

|

8.Market Size by Actuation Method, (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

8.1.Electric |

|

8.2.Pneumatic |

|

8.3.Hydraulic |

|

8.4.Others (Magnetic, Electromechanical, etc.) |

|

9.Market Size by Application, (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

9.1.Fuel Injection |

|

9.2.Throttle |

|

9.3.Braking |

|

9.4.HVAC |

|

9.5.Charging Circuit |

|

9.6.Others |

|

10.Market Size by Motion Type, (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

10.1. Rotary |

|

10.2. Linear |

|

11.Regional Outlook (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

11.1. North America |

|

11.1.1. U.S. |

|

11.1.1.1. US Market Outlook by Vehicle Type |

|

11.1.1.2. US Market Outlook by Sales Channel |

|

11.1.1.3. US Market Outlook by Actuation Method |

|

11.1.1.4. US Market Outlook by Application |

|

11.1.1.5. US Market Outlook by Motion Type |

|

Note: Similar Cross-segmentation for each country will be covered as shown above |

|

11.1.2. Canada |

|

11.2. Asia-Pacific |

|

11.2.1. China |

|

11.2.2. Japan |

|

11.2.3. South Korea |

|

11.2.4. India |

|

11.2.5. Rest of APAC |

|

11.3. Europe |

|

11.3.1. U.K. |

|

11.3.2. Germany |

|

11.3.3. France |

|

11.3.4. Italy |

|

11.3.5. Rest of Europe |

|

11.4. Latin America |

|

11.5. Middle East & Africa |

|

12.Competitive Landscape |

|

12.1. Market Share Analysis |

|

12.2. Key Market Growth Strategies |

|

12.3. Company Strategy Analysis |

|

12.4. Competitive Benchmarking |

|

13.Company Profile |

|

13.1. Bosch |

|

13.2. BorgWarner |

|

13.3. Continental |

|

13.4. Denso |

|

13.5. Mitsubishi Electric |

|

13.6. Johnson Electric |

|

13.7. Nidec |

|

13.8. Hitachi |

|

13.9. Mahle |

|

13.10. EFI Automotive |

|

14.Appendix |

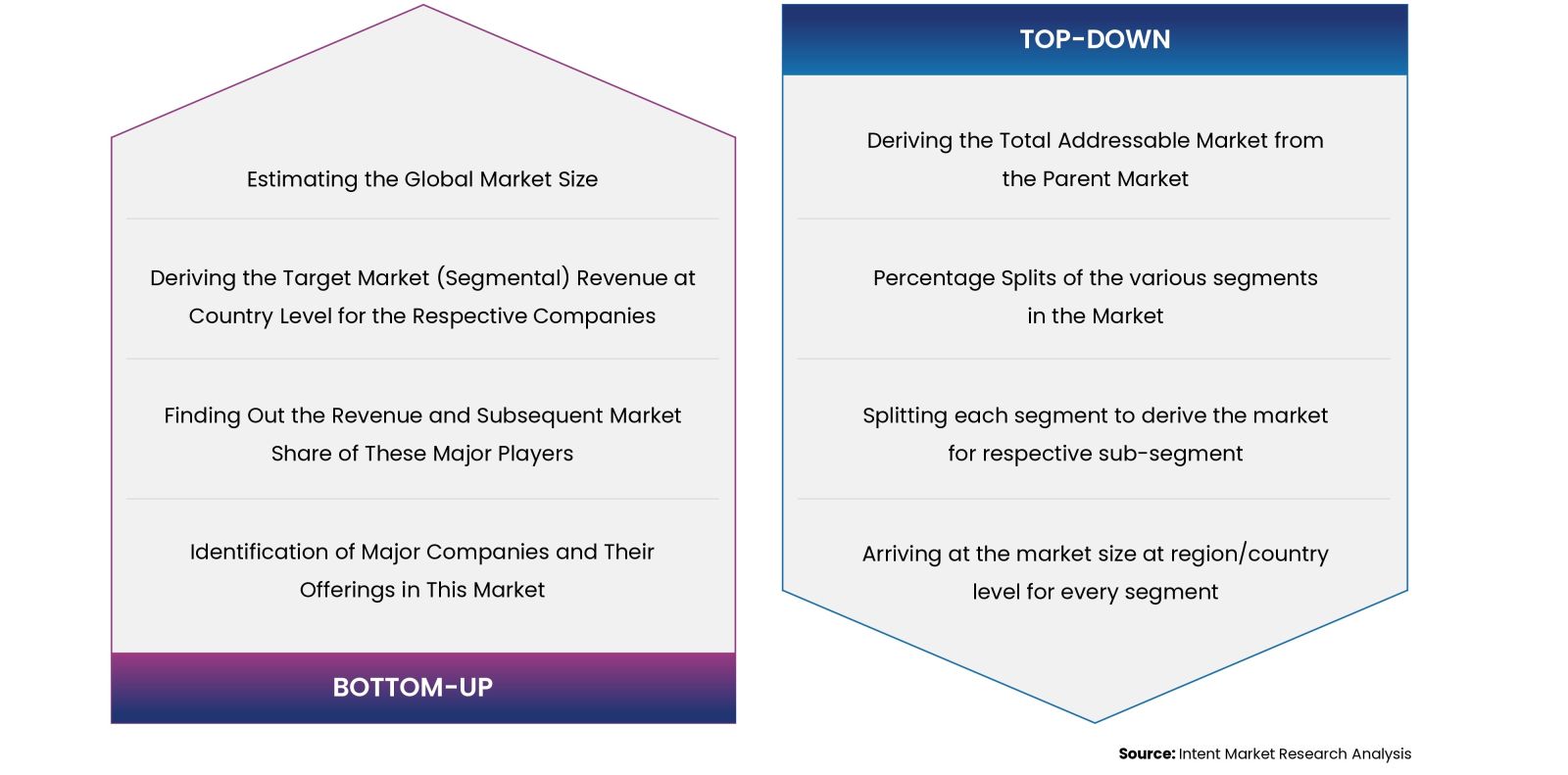

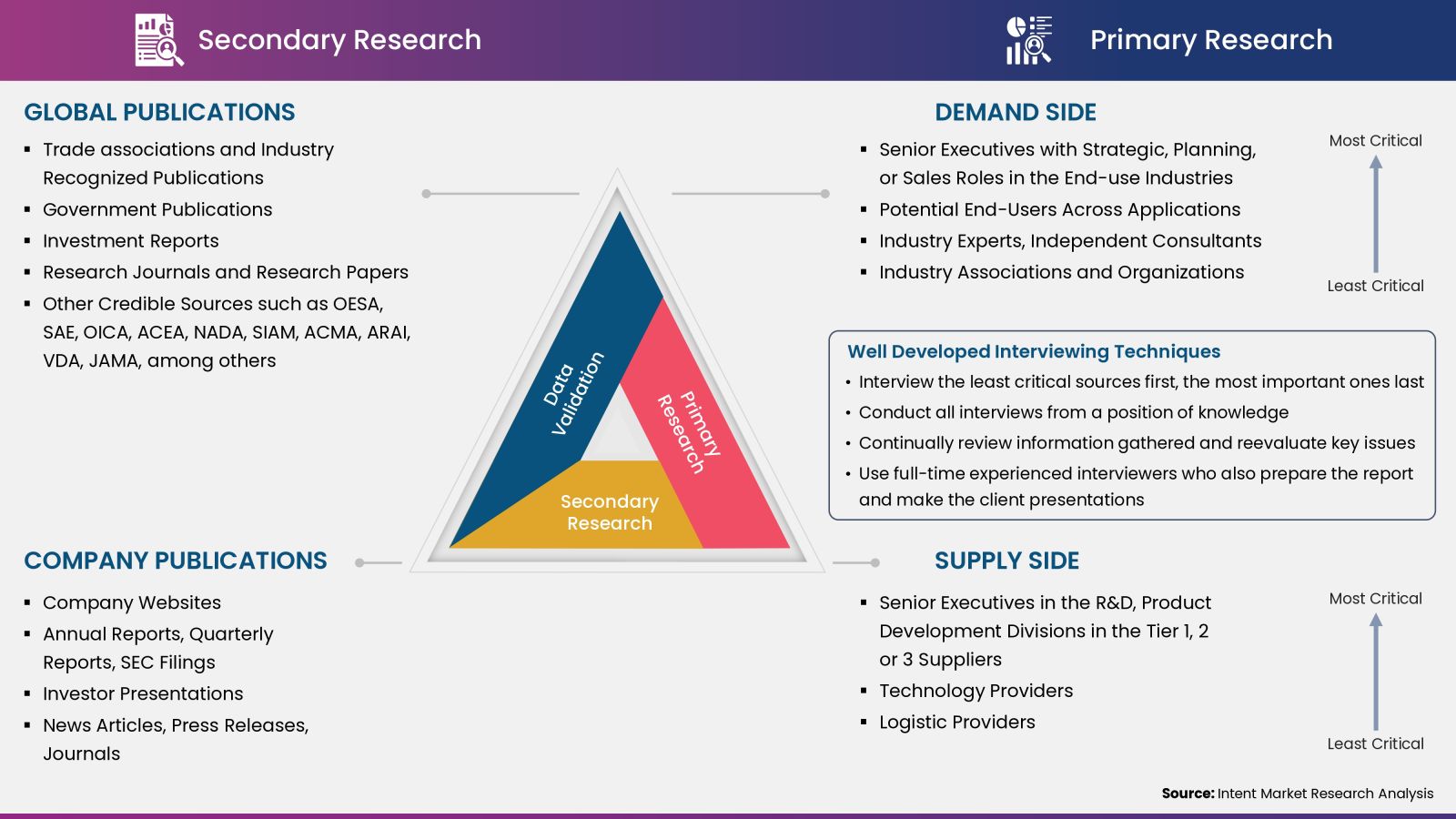

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analysed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.