As per Intent Market Research, the Automated Endoscopy Reprocessors Market was valued at USD 413.3 million in 2024-e and will surpass USD 744.5 million by 2030; growing at a CAGR of 10.3% during 2025 - 2030.

The automated endoscopy reprocessors market is witnessing significant growth due to the increasing demand for advanced medical technologies and the rising focus on reducing healthcare-associated infections (HAIs). Automated endoscopy reprocessors are used to clean and disinfect endoscopes after each procedure, ensuring that these instruments are free from contaminants before being reused. This is particularly critical in medical fields like gastrointestinal, urological, and pulmonary endoscopy, where the risk of infection is high. The growing emphasis on patient safety, combined with stricter infection control regulations, has made automated reprocessing a standard practice in healthcare facilities worldwide.

As healthcare systems increasingly shift towards automation to improve efficiency and patient outcomes, the adoption of automated endoscopy reprocessors is gaining momentum. These devices offer several advantages, such as minimizing the risk of cross-contamination, reducing the reliance on manual labor, and improving the consistency and speed of the reprocessing cycle. With endoscopes being used more frequently in diagnostic and therapeutic procedures, automated reprocessors are becoming essential in ensuring optimal cleaning and disinfection between procedures, thereby enhancing operational workflows in hospitals, ambulatory surgical centers, and diagnostic laboratories.

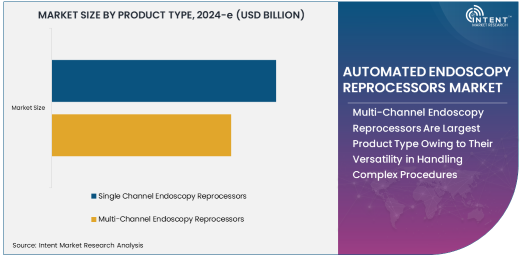

Multi-Channel Endoscopy Reprocessors Are Largest Product Type Owing to Their Versatility in Handling Complex Procedures

Multi-channel endoscopy reprocessors are the largest product type in the automated endoscopy reprocessors market, owing to their versatility and ability to handle a wide range of complex endoscopic procedures. These reprocessors are designed to clean and disinfect endoscopes with multiple channels, such as those used in gastrointestinal, urological, and pulmonary endoscopies, where different parts of the endoscope need to be cleaned separately. The ability to effectively clean multiple channels ensures that the devices are safe for reuse in procedures that require the use of various diagnostic tools or treatments.

Multi-channel endoscopy reprocessors are especially critical in settings where complex procedures are performed regularly, such as in hospitals and ambulatory surgical centers. Their high efficiency in reprocessing endoscopes helps healthcare providers minimize downtime, maintain a steady flow of procedures, and meet stringent infection control standards. This combination of versatility, high throughput, and regulatory compliance has made multi-channel endoscopy reprocessors the dominant product type in the market.

Single Channel Endoscopy Reprocessors Are Fastest Growing Product Type Owing to the Simplicity and Cost-Effectiveness for Routine Procedures

Single-channel endoscopy reprocessors are the fastest-growing product type in the automated endoscopy reprocessors market, driven by their simplicity and cost-effectiveness in handling routine endoscopic procedures. These devices are designed to clean and disinfect single-channel endoscopes, which are commonly used in more straightforward diagnostic procedures, such as those in gastroenterology or pulmonology. Single-channel reprocessors offer a more affordable solution for healthcare facilities with less complex procedures, especially in smaller or outpatient settings.

The growing adoption of single-channel endoscopy reprocessors is particularly evident in diagnostic laboratories and ambulatory surgical centers, where the volume of routine procedures is high but the complexity of the equipment is lower. The affordability and ease of use of single-channel reprocessors make them an attractive option for healthcare providers looking to streamline their endoscope reprocessing without compromising on safety or efficiency. As a result, single-channel reprocessors are expected to continue driving growth in the market, particularly in regions where cost-conscious healthcare systems are prevalent.

Gastrointestinal Endoscopy Is Largest Application Owing to High Volume of Diagnostic and Therapeutic Procedures

Gastrointestinal endoscopy is the largest application segment in the automated endoscopy reprocessors market, driven by the high volume of diagnostic and therapeutic procedures performed in this area. Gastrointestinal endoscopes are used for a wide range of procedures, including colonoscopies, gastroscopies, and other diagnostic evaluations of the digestive tract. Given the prevalence of gastrointestinal diseases and the importance of early detection, the demand for gastrointestinal endoscopy procedures is substantial, leading to a significant need for automated reprocessing solutions.

The use of gastrointestinal endoscopes is expected to continue growing as the global incidence of gastrointestinal disorders rises, including conditions like colorectal cancer, inflammatory bowel disease (IBD), and gastroesophageal reflux disease (GERD). As a result, the demand for automated endoscopy reprocessors tailored to gastrointestinal applications is expected to remain high, with hospitals and ambulatory surgical centers being the key end-users in this segment.

Urological Endoscopy Is Fastest Growing Application Owing to Increased Focus on Urological Disorders

Urological endoscopy is the fastest-growing application in the automated endoscopy reprocessors market, driven by the increasing prevalence of urological disorders and the growing use of endoscopic procedures in urology. Urological endoscopes are used for procedures such as cystoscopies, ureteroscopy, and biopsies, which are crucial for diagnosing and treating conditions like urinary tract infections, bladder cancer, and kidney stones. As the demand for minimally invasive urological procedures rises, so does the need for efficient and effective reprocessing of urological endoscopes.

The rise in the incidence of urological disorders, coupled with the growing preference for minimally invasive surgical techniques, has led to a surge in the adoption of urological endoscopy. Healthcare providers are increasingly relying on automated endoscopy reprocessors to ensure that these delicate instruments are properly cleaned and disinfected, minimizing the risk of infection and cross-contamination. As urological procedures become more prevalent, the demand for automated endoscopy reprocessors in this segment is expected to continue its rapid growth.

Ambulatory Surgical Centers Are Fastest Growing End-User Industry Owing to Increasing Adoption of Minimally Invasive Procedures

Ambulatory surgical centers (ASCs) are the fastest-growing end-user industry in the automated endoscopy reprocessors market, driven by the increasing adoption of minimally invasive procedures. ASCs often perform a wide range of endoscopic procedures, including gastrointestinal and urological procedures, but with shorter recovery times and lower costs compared to traditional hospitals. The growing preference for outpatient surgeries has resulted in a higher volume of endoscopic procedures being performed in these centers.

Automated endoscopy reprocessors play a crucial role in ensuring that ASCs maintain high standards of infection control while optimizing workflow and reducing operational costs. As ASCs continue to expand their capabilities and perform more complex endoscopic procedures, the demand for automated reprocessing solutions is expected to grow rapidly in this sector.

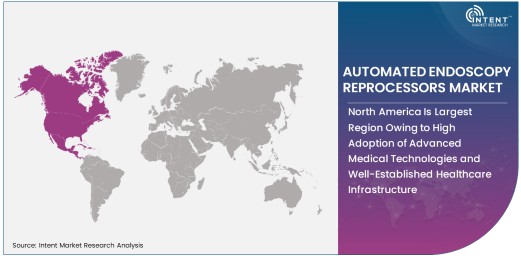

North America Is Largest Region Owing to High Adoption of Advanced Medical Technologies and Well-Established Healthcare Infrastructure

North America is the largest region in the automated endoscopy reprocessors market, owing to the high adoption of advanced medical technologies and the region's well-established healthcare infrastructure. The United States, in particular, is a major contributor to the growth of this market, driven by the increasing demand for minimally invasive procedures and the need for efficient, safe reprocessing of endoscopic instruments. Healthcare providers in North America are early adopters of automation technologies, including endoscopy reprocessors, as they focus on improving patient outcomes, reducing operational costs, and meeting stringent regulatory requirements.

As North America's healthcare system continues to invest in innovative technologies to enhance patient care and operational efficiency, the demand for automated endoscopy reprocessors is expected to remain strong. Additionally, the region's focus on reducing healthcare-associated infections and improving infection control practices further supports the growth of this market.

Leading Companies and Competitive Landscape

The automated endoscopy reprocessors market is competitive, with several key players offering advanced solutions to meet the growing demand for endoscope cleaning and disinfection. Leading companies in the market include Getinge AB, Olympus Corporation, Steris Corporation, Cantel Medical, and Medivators Inc. These companies offer a variety of automated endoscopy reprocessors, including models designed for single-channel and multi-channel endoscopes, as well as solutions tailored to specific endoscopic applications.

The competitive landscape is shaped by ongoing innovations in automation technology, with companies focusing on improving the efficiency, reliability, and ease of use of their reprocessing systems. Key trends in the market include the development of more compact and user-friendly devices, the integration of data management systems for tracking and monitoring reprocessing cycles, and the incorporation of advanced disinfection technologies to enhance patient safety. As demand for automated endoscopy reprocessing solutions continues to grow, these companies are expected to remain at the forefront of innovation and competition in the market.

Recent Developments:

- In December 2024, STERIS Corporation launched an advanced multi-channel automated endoscopy reprocessor featuring enhanced disinfecting technology for improved infection control.

- In November 2024, Getinge AB introduced a new range of single-channel endoscope reprocessors designed to minimize maintenance downtime and increase processing speed.

- In October 2024, Olympus Corporation announced a partnership with a leading healthcare provider to integrate its automated endoscope reprocessing systems into their facilities.

- In September 2024, Medivators Inc. unveiled a new software solution to monitor and track the cleaning process in real time for automated endoscopy reprocessors.

- In August 2024, Cantel Medical Corporation expanded its portfolio with a new high-capacity endoscope reprocessor for large healthcare systems and hospitals.

List of Leading Companies:

- Getinge AB

- Pentax Medical

- Olympus Corporation

- Medivators Inc.

- Hoya Corporation

- CISA S.p.A.

- Endo-Technik GmbH

- Wassenburg Medical

- KIRBY Lester LLC

- Becton Dickinson and Company

- Belimed Inc.

- 3M Healthcare

- Cantel Medical Corporation

- Federal Equipment Company

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 413.3 million |

|

Forecasted Value (2030) |

USD 744.5 million |

|

CAGR (2025 – 2030) |

10.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Automated Endoscopy Reprocessors Market By Product Type (Single Channel Endoscopy Reprocessors, Multi-Channel Endoscopy Reprocessors), By Application (Gastrointestinal Endoscopy, Urological Endoscopy, Pulmonary Endoscopy), By End-User Industry (Hospitals, Ambulatory Surgical Centers, Diagnostic Laboratories) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

STERIS Corporation, Getinge AB, Pentax Medical, Olympus Corporation, Medivators Inc., Hoya Corporation, CISA S.p.A., Endo-Technik GmbH, Wassenburg Medical, KIRBY Lester LLC, Becton Dickinson and Company, Belimed Inc., 3M Healthcare, Cantel Medical Corporation, Federal Equipment Company |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Automated Endoscopy Reprocessors Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Single Channel Endoscopy Reprocessors |

|

4.2. Multi-Channel Endoscopy Reprocessors |

|

5. Automated Endoscopy Reprocessors Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Gastrointestinal Endoscopy |

|

5.2. Urological Endoscopy |

|

5.3. Pulmonary Endoscopy |

|

6. Automated Endoscopy Reprocessors Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Ambulatory Surgical Centers |

|

6.3. Diagnostic Laboratories |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Automated Endoscopy Reprocessors Market, by Product Type |

|

7.2.7. North America Automated Endoscopy Reprocessors Market, by Application |

|

7.2.8. North America Automated Endoscopy Reprocessors Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Automated Endoscopy Reprocessors Market, by Product Type |

|

7.2.9.1.2. US Automated Endoscopy Reprocessors Market, by Application |

|

7.2.9.1.3. US Automated Endoscopy Reprocessors Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. STERIS Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Getinge AB |

|

9.3. Pentax Medical |

|

9.4. Olympus Corporation |

|

9.5. Medivators Inc. |

|

9.6. Hoya Corporation |

|

9.7. CISA S.p.A. |

|

9.8. Endo-Technik GmbH |

|

9.9. Wassenburg Medical |

|

9.10. KIRBY Lester LLC |

|

9.11. Becton Dickinson and Company |

|

9.12. Belimed Inc. |

|

9.13. 3M Healthcare |

|

9.14. Cantel Medical Corporation |

|

9.15. Federal Equipment Company |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Automated Endoscopy Reprocessors Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Automated Endoscopy Reprocessors Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Automated Endoscopy Reprocessors Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA