As per Intent Market Research, the Automated Document Inserter Market was valued at USD 411.7 million in 2024-e and will surpass USD 883.1 million by 2030; growing at a CAGR of 13.6% during 2025 - 2030.

The automated document inserter market is seeing strong growth as businesses and organizations increasingly seek to improve efficiency and reduce costs in document processing. Automated document inserters are designed to streamline the process of inserting documents, such as bills, catalogs, and promotional materials, into envelopes, which is a critical step in direct mail and billing operations. These systems are capable of processing high volumes of documents quickly and accurately, significantly improving throughput and reducing the chances of human error. With a growing need for speed, accuracy, and cost efficiency in mail processing, the adoption of automated document inserters has become crucial across various industries.

The market is being driven by the increasing need for businesses to manage large-scale mailing operations, particularly in industries like BFSI, retail, and e-commerce, where high volumes of transactional and promotional documents are regularly processed. Automated document inserters help these sectors improve operational efficiency by automating manual tasks and ensuring that documents are processed in a timely and secure manner. With the rapid advancements in automation technology, these systems are becoming more sophisticated, offering features like inline and offline integration, enhanced security protocols, and customization options to meet the specific needs of various industries.

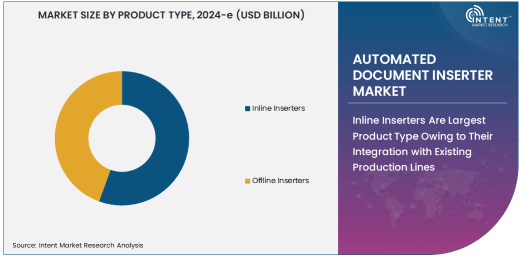

Inline Inserters Are Largest Product Type Owing to Their Integration with Existing Production Lines

Inline inserters are the largest product type in the automated document inserter market, owing to their seamless integration with existing production lines in industries that require high-volume document processing. Inline inserters are designed to operate directly within the document production workflow, automatically inserting documents into envelopes as part of a continuous process. This integration eliminates the need for separate manual handling, which not only improves efficiency but also reduces labor costs and the risk of errors.

The widespread use of inline inserters in industries like BFSI, retail, and e-commerce is a key factor driving their dominance in the market. These sectors often deal with large amounts of transactional documents, such as bills and invoices, as well as promotional materials, which must be processed quickly and accurately. Inline inserters are highly effective in automating this process, allowing businesses to meet high-volume demands while maintaining a high level of accuracy and speed. As businesses continue to streamline their operations and embrace automation, inline inserters are expected to remain the dominant product type in the automated document inserter market.

Offline Inserters Are Fastest Growing Product Type Owing to Their Flexibility and Versatility

Offline inserters are the fastest-growing product type in the automated document inserter market, driven by their flexibility and versatility in handling a wide range of document types and sizes. Unlike inline inserters, which are integrated into existing production lines, offline inserters operate independently and are ideal for businesses that need to process smaller batches of documents or documents that do not require continuous handling. These systems can be used for a variety of applications, such as billing, catalogs, and promotional mailings, and can be easily adapted to different business requirements.

Offline inserters are particularly appealing to smaller businesses and those with fluctuating document processing needs. They offer a more affordable and customizable option compared to inline inserters, making them an attractive choice for industries like retail, e-commerce, and government, where document volume may vary. As the demand for flexible and cost-effective document processing solutions increases, offline inserters are becoming a key growth segment in the market.

BFSI Is Largest End-User Industry Owing to High Volume of Transactional Documents

The BFSI (banking, financial services, and insurance) industry is the largest end-user industry in the automated document inserter market, owing to the high volume of transactional documents that require accurate and timely processing. BFSI organizations regularly process large numbers of documents, including bills, invoices, account statements, and loan documents, all of which need to be inserted into envelopes for mailing. Automated document inserters are essential tools for these organizations, as they help to reduce manual labor, minimize errors, and ensure compliance with data security regulations.

The need for high-speed, high-volume document processing in the BFSI sector has driven the widespread adoption of automated document inserters. These devices are particularly useful in ensuring that transactional documents are processed efficiently, allowing BFSI organizations to focus on other aspects of their operations, such as customer service and regulatory compliance. As the BFSI sector continues to expand and digitize, the demand for automated document inserters is expected to remain strong.

Retail and E-commerce Are Fastest Growing End-User Industries Owing to Increased Direct Mail and Catalog Requirements

Retail and e-commerce industries are the fastest-growing end-user industries in the automated document inserter market, driven by the increased use of direct mail and catalogs to engage customers. Both industries rely heavily on printed promotional materials and invoices, which need to be efficiently processed and mailed to large numbers of customers. Automated document inserters provide these industries with an efficient solution for handling high volumes of promotional mailings, catalogs, and billing documents.

As online shopping continues to grow and retailers expand their direct marketing efforts, the demand for automated document inserters in the retail and e-commerce sectors is increasing. These industries require solutions that can handle a variety of document types and sizes while maintaining accuracy and speed. Automated document inserters offer the flexibility needed to accommodate this demand, making them a key tool for retailers and e-commerce businesses seeking to improve customer engagement and operational efficiency.

North America Is Largest Region Owing to Advanced Automation Adoption and Strong Infrastructure

North America is the largest region in the automated document inserter market, owing to the high adoption of automation technologies and the region's well-established infrastructure for document processing. The United States, in particular, is a key market, with numerous BFSI, retail, and e-commerce organizations utilizing automated document inserters to streamline their mailing operations. The region’s advanced technological landscape, along with the increasing demand for operational efficiency and cost reduction, has led to widespread adoption of automated document inserters.

In addition to the BFSI and retail sectors, government agencies and public sector organizations in North America also rely on automated document inserters to handle large volumes of documents efficiently. With continuous advancements in automation technology and the growing need for businesses to optimize document processing, North America is expected to remain the largest market for automated document inserters in the coming years.

Leading Companies and Competitive Landscape

The automated document inserter market is competitive, with several key players offering a range of products designed to meet the needs of different industries. Leading companies in the market include Pitney Bowes, Neopost, Kern (Kern AG), Bowe Systec, and Quadient. These companies offer a variety of inline and offline inserters, with features such as high-speed processing, customizable configurations, and integration with other document management solutions.

The competitive landscape is shaped by continuous innovations in automation technology, with companies focusing on improving the performance, flexibility, and ease of use of their inserter systems. Key trends in the market include the development of more energy-efficient and environmentally friendly devices, as well as the integration of data security features to ensure compliance with privacy regulations. Strategic partnerships and acquisitions are also common as companies seek to expand their product offerings and reach new customer segments. As the demand for efficient document processing continues to grow, the market is expected to see ongoing competition and innovation.

Recent Developments:

- In December 2024, Pitney Bowes Inc. launched an upgraded version of its automated document inserter with enhanced capabilities for personalized direct mail campaigns.

- In November 2024, Neopost Group introduced a new offline document inserter that offers higher throughput and better integration with customer relationship management systems.

- In October 2024, Xerox Corporation expanded its portfolio of automated document inserters by adding a high-speed model designed for large-volume billing applications.

- In September 2024, Bell and Howell unveiled a new document inserter optimized for e-commerce and catalog distribution with advanced sorting capabilities.

- In August 2024, Canon Inc. introduced a next-generation inline document inserter that integrates with cloud-based solutions for seamless document tracking and analytics.

List of Leading Companies:

- Pitney Bowes Inc.

- Neopost Group

- Xerox Corporation

- Bowe Systec GmbH

- OMRON Corporation

- Bell and Howell

- Canon Inc.

- Secap, Inc.

- FP Mailing Solutions

- Kern AG

- Jabil Inc.

- SIEMENS AG

- Toshiba Corporation

- Keyence Corporation

- Standard Register

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 411.7 million |

|

Forecasted Value (2030) |

USD 883.1 million |

|

CAGR (2025 – 2030) |

13.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Automated Document Inserter Market By Product Type (Inline Inserters, Offline Inserters), By End-User Industry (BFSI, Retail, E-commerce, Government and Public Sector), By Application (Direct Mail, Billing and Invoices, Catalogs and Promotions) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Pitney Bowes Inc., Neopost Group, Xerox Corporation, Bowe Systec GmbH, OMRON Corporation, Bell and Howell, Canon Inc., Secap, Inc., FP Mailing Solutions, Kern AG, Jabil Inc., SIEMENS AG, Toshiba Corporation, Keyence Corporation, Standard Register |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Automated Document Inserter Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Inline Inserters |

|

4.1.1. Single-Track Inserters |

|

4.1.2. Multi-Track Inserters |

|

4.2. Offline Inserters |

|

5. Automated Document Inserter Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. BFSI |

|

5.2. Retail |

|

5.3. E-commerce |

|

5.4. Government and Public Sector |

|

6. Automated Document Inserter Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Direct Mail |

|

6.2. Billing and Invoices |

|

6.3. Catalogs and Promotions |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Automated Document Inserter Market, by Product Type |

|

7.2.7. North America Automated Document Inserter Market, by End-User Industry |

|

7.2.8. North America Automated Document Inserter Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Automated Document Inserter Market, by Product Type |

|

7.2.9.1.2. US Automated Document Inserter Market, by End-User Industry |

|

7.2.9.1.3. US Automated Document Inserter Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Pitney Bowes Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Neopost Group |

|

9.3. Xerox Corporation |

|

9.4. Bowe Systec GmbH |

|

9.5. OMRON Corporation |

|

9.6. Bell and Howell |

|

9.7. Canon Inc. |

|

9.8. Secap, Inc. |

|

9.9. FP Mailing Solutions |

|

9.10. Kern AG |

|

9.11. Jabil Inc. |

|

9.12. SIEMENS AG |

|

9.13. Toshiba Corporation |

|

9.14. Keyence Corporation |

|

9.15. Standard Register |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Automated Document Inserter Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Automated Document Inserter Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Automated Document Inserter Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA